The Research HUB: How To Manage Risk - A Primer

A Primer On Risk Management

Hey everyone,

I have asked my good friends at Mythic’s Substack to write another article on risk management. I’ve received a lot of requests for additional articles on risk management and the guys at Mythic Market Research are true experts in this domain. I would encourage all of you to subscribe to their work and read their last guest article:

Risk Management Process By Mythic Market Research:

For every trade, regardless of the asset class, strategy, or holding period, one crucial question needs answering: how much? The response to this question can determine the fate of a trader. As traders, we must create a decision tree to optimize our position size to achieve our specific objectives or mandates. This post highlights essential concepts to help us make better decisions regarding position sizing.

Before we delve into the methods we use to evaluate risk appropriately, having a friendly conversation about risk and what that word means to you is vital.

The Truth

When constructing models, it's lazy to presume the level of risk that we, as traders, feel comfortable with. However, the truth is that unless an individual has given some thought to what risk signifies to them, it's plausible that they may not be accepting the risk they believe they are taking. Generally speaking, we overestimate our risk.

When constructing or testing models, it's simple to overlook the variables related to determining how much risk is acceptable. Within the trading community, the commonly suggested amount is 1-2% per trade. It may seem wise to adopt this risk per trade as a "default" guideline for speculation, but it's essential to recognize that personal risk tolerance varies significantly between individuals. What may be acceptable for one person may not be suitable for another.

I strive to take risks that align with the model, statistics, and my beliefs. I must balance being comfortable and pushing myself outside my comfort zone to improve as a trader. However, taking too much risk or straying too far outside my comfort zone can lead to dysfunction and self-sabotage.

“Most traders have absolutely no concept of what it means to be a risk-taker in the way a successful trader thinks about risk. The best traders not only take the risk, they have also learned to accept and embrace that risk. There is a huge psychological gap between assuming you are a risk-taker because you put on trades and fully accepting the risks inherent in each trade. When you fully accept the risks, it will have profound implications on your bottom-line performance.”

Mark Douglas (Author of Trading in the Zone)

If you're unwilling to accept the risks, you're setting yourself up for disappointment. Your consistency will be affected, causing you to stop trading to avoid further pain. You may also start searching for ways to reduce losses, which could ultimately derail any progress you've made.

At Mythic, we value the relationship between traders and risk. As a trader, you must acknowledge the risks to achieve your goals. Trusting your strategy and process is crucial to profiting from the markets. Confidence develops through surviving drawdowns and unexpected events, experiencing daily PnL swings, and achieving high watermarks despite the wiggles and jiggles of portfolio NAV.

Developing a Position-Sizing Decision Tree

Consideration 1: Your Objectives

This step is simple: you must search for the answers and choose a specific target to aim for.

Some things to consider when determining your objective:

Is this a Personal Account or a Client Account?

What is this money for?

When do you need the money?

What is the distribution schedule?

Consideration 2: Starting Account Balance (Principle) and Strategy Asset Allocation

When starting to trade, it's essential to consider your initial account balance. This amount determines how much you're willing to risk. As you continue trading, you'll likely have separate funds for trading and personal expenses. You may also have multiple accounts and strategies, which you'll need to decide whether to treat as one or keep separate. Additionally, you may gain access to margin and leveraged trading, allowing you to hold less capital in your brokerage account. While it may seem trivial, properly managing your account balance is crucial for success in trading.

Some things to consider when determining your starting balance and asset allocation:

Do you have multiple brokerage accounts?

Do you have access to margin?

Do you run various strategies?

What is your asset allocation across strategies?

What are your strategies' correlations to one another?

Do you rebalance your portfolio?

Consideration 3: Drawdown Limits

Most of the time, portfolios are in drawdown. There are very brief moments of making new equity highs. Drawdown limits are the guardrails of a portfolio. There are four drawdowns I would like to mention:

Drawdowns on your starting balance/principle.

Drawdowns above starting balance/principle.

Open Profit Drawdowns

Closed Trade Drawdowns

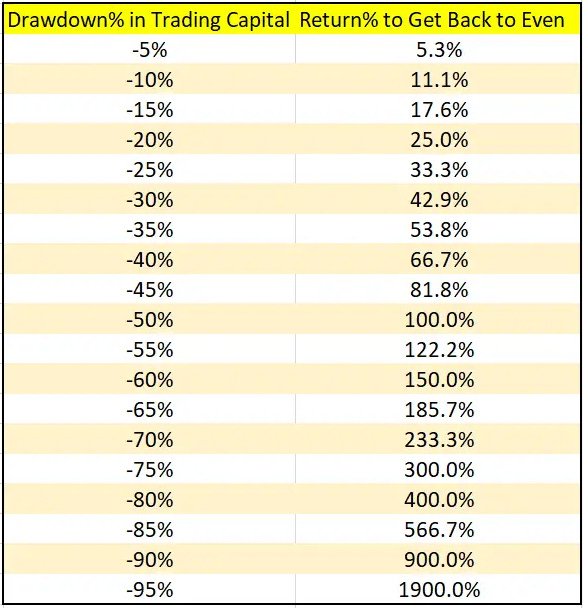

Also, we don’t want to dig such a giant hole where it hurts our mental game or is too large to recover. See the chart below from New Trader U:

Some things to consider when determining your drawdown limits:

What is the acceptable drawdown on the initial starting balance?

What is the acceptable drawdown on NAV greater than the starting balance?

When do you reset your initial starting balance?

Never

Yearly

Quarterly

Consideration 4: Portfolio Construction

A portfolio reflects a trader's perspective on the world, markets, and personal psychology. Each portfolio is distinct, and building one is similar to playing with Legos. Numerous pieces are available to construct the final product.

Some things to consider when determining portfolio construction:

What is the Correlation between Trading strategies?

What are the average and maximum number of positions in the portfolio at one time?

What is the average holding period for each strategy?

What is the maximum allowed exposure to each asset class?

What is your maximum allowed Portfolio Heat (If all your positions hit their stops simultaneously)?

What is your standard/base unit of risk? Different strategies deserve different units of risk.

25 bps

50 bps

1%

Consideration 5: Strategy Expectancy and Standard Deviation of Returns

For benchmarking trading systems, two essential strategy metrics are Dr. Van Tharp's SQN and Jack Schwager's Gain-to-Pain ratio. These metrics enable traders to compare their strategies and determine the appropriate position size based on returns relative to risk.

Some things to consider when determining strategy expectancy and standard deviations of returns:

How many trades per year do your strategies generate for the entire portfolio and individually?

What is the expectancy for each strategy?

What is the standard deviation of returns for each strategy?

Run a Monte Carlo analysis to set a range of expectations for your portfolio and each individual strategy.

How do you change your position sizing when your equity curve exceeds expectations on the upside and downside?

Consideration 6: Market Money

A portion of trading profits can be set aside as risk capital for future trades, known as market money. Setting aside market money allows risk scaling with good trading performance with as little risk to the principle as possible.

Some things to consider when determining how to apply the markets money concept:

What percentage of my profits do I want to set aside for risk capital?

What percentage of that pool gets added to my standard units?

What are my max units per trade?

Consideration 7: Correlation Adjustments

It's essential to remember that past correlations can only provide a limited perspective when analyzing the relationship between market models. The truth is that model correlations tend to fluctuate as market conditions change. Two models may have a strong correlation at one point, but later on, they may exhibit a weak correlation. By keeping track of the ongoing correlations of your strategies, you can ensure that you stay in line with current market situations and avoid taking on too much risk.

When managing a portfolio, it's essential to consider the correlation between strategies and their impact on returns and drawdowns. A portfolio with strongly negative correlations may result in lower returns, increased volatility, and drawdowns. On the other hand, a portfolio with strongly positive correlations may experience significantly more volatility. When models display high correlation, it's crucial to consider trading frequency and trade overlap. When building a portfolio, having a comprehensive understanding of each strategy's return drivers and how they extract market profits will help when conducting a correlation analysis.

Some things to consider when considering strategy and asset correlations:

What are the factors of each strategy, and why and how do they extract returns?

What are the correlations between strategies, and the range of correlation based on a rolling basis?

What is your portfolio correlation to Stocks, Bonds, Commodities, and USD?

Simple Position Sizing Strategy for One System:

Starting balance: $1,000,000

Drawdown on the Starting Balance: 5%

Allowable Max Drawdown Above Starting Balance: 15%

Max Portfolio Heat: 10%

Based on Monte Carlo simulations and understanding strategy losing streaks, strategy SQN, and Sortino:

Starting risk per trade: 0.40% (1 Unit of Risk)

Market Money

PnL greater than 10% on the account risk: 0.80% (2 Units of Risk per Position)

PnL greater than 15% on the account risk: 1.20% (3 Units of Risk per Position)

Max Units of Portfolio Risk: 25 Units

Position Sizing Strategy Examples

With this simple position sizing strategy, let's run through some examples of trades and scenarios.

SPY Example: 0.40% Risk with $100k Account

Let’s assume this is a brand-new portfolio with a starting allocation of $100,000. On 4/13/2023, our trend system generated a long signal. Our entry price was $410.74; our stop was $387.74. Since we just started this program and have not met the higher watermark thresholds of 10% or 15%, we risk 0.40% (1 Unit), equating to 17 SPY shares. This is a notional value of $6982.58, or 6.98% of our portfolio.

TLT Example: 0.80% Risk with $112.5k Account

Let’s assume we are up 12.5% for the year, and our portfolio value is now of $112,500. On 4/05/2023, our trend system generated a long signal. Our entry price was $106.60; our stop was $99.68. Since we have a PnL greater than 10% on the portfolio, we risk 0.80% (2 Units), equating to 130 TLT shares. This is a notional value of $13,858, or 12.3% of our portfolio.

GLD Example: 1.20% Risk with $150k Account

Let’s assume we are up 50% for the year, and our portfolio value is now of $150,000. On 3/14/2023, our trend system generated a long signal. Our entry price was $178.99; our stop was $167.77. Since we have a PnL greater than 15% on the portfolio, we risk 1.20% (4 Units), equating to 35 GLD shares. This is a notional value of $6,264.65, or 4.17% of our portfolio.

In these three examples, you’re able to see:

Risk doesn’t equal notional values

The distance between entry and stop significantly impacts notional position size! More volatility = smaller size.

We can scale our risk per trade with our performance. Reward good performance!

This simple example should provide a basic outline to develop your position-sizing strategy. The percent risks stated in the sample are not recommendations and must be determined based on your trading strategy analysis. Mythic Market Research offers consulting services if you want professional help with position-sizing strategies and algorithmic development. Thank you for reading our primer on position sizing; you can DM us on X @MythMkt or email me at grant@mythicmarketresearch.com

I love good risk management and articles that dive into are a joy to read! This was definitely one of the best pieces on risk management I’ve seen in Substack. Great job Mythic Markets and thank you Capital Flows for introducing me to Mythic Markets research back when they launched their Substack!