Trade: Closing Gold Trade (For Now)

Risk Premias

Hey everyone,

First, I noted that I opened a gold long at the lows (link and link):

We are now at $1943. I am closing it here because we are pretty overbought. I will be looking for other opportunities to get long but when such a large move takes place, you need to take a gain.

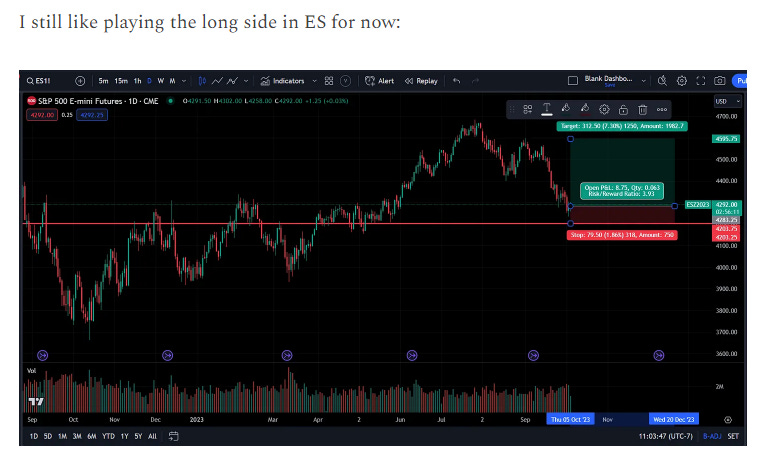

Second, I noted the ES bullish view (link)

We have moved up from the original R:R.

Here are my thoughts: I don’t want to take any unneeded weekend risk right now. We haven’t had any geopolitical volatility in a while and it’s so easy for some news to come out that causes outsized moves in risk assets. For now, FLAT ES view. I will after futures open this weekend.

Key observations:

This small tick-up in oil along with such a strong bid in gold during a strong dollar indicates the geopolitical risk premia is exerting itself a little more before the weekend:

People were focused on the CPI print this past week but that wasn’t the main event. It was duration issuance. See my original article here on this tension:

The CPI print moved positioning around a little but it was later in the day during the treasury auction that really moved things:

This is what dragged down ES marginally due to the bear steepener

Final chart I found incredibly helpful: We have seen the demand side move in lockstep with the macro growth situation but supply dynamics are beginning to exert their force again on energy prices.

Conclusion:

All of these moving parts in macro are in a constant state of flux in terms of their movement and causal impact. The way to get a grasp of them is to understand each of them individually and be in a constant state of interpreting them correctly. This framework of thinking applies to any domain. You could be running a shipping company or local business, it’s the same thing.

Those who have an eye for what is actually taking place will always be paid a premium.

Thanks for reading!