Week Ahead: Views on Bonds and Equities

Also covering what I read this weekend

Hey everyone,

This will be an important article because it will lay out the catalysts for bonds in Q4. Here are the main things we will cover today:

Reading this weekend

Views on Bonds

Views on Equities and Gold

Correlation and Consolidation

What is the Yen up to?

Reading this weekend:

There are three things I do every weekend.

Go to church

Go for a hike

Go to a coffee shop and read

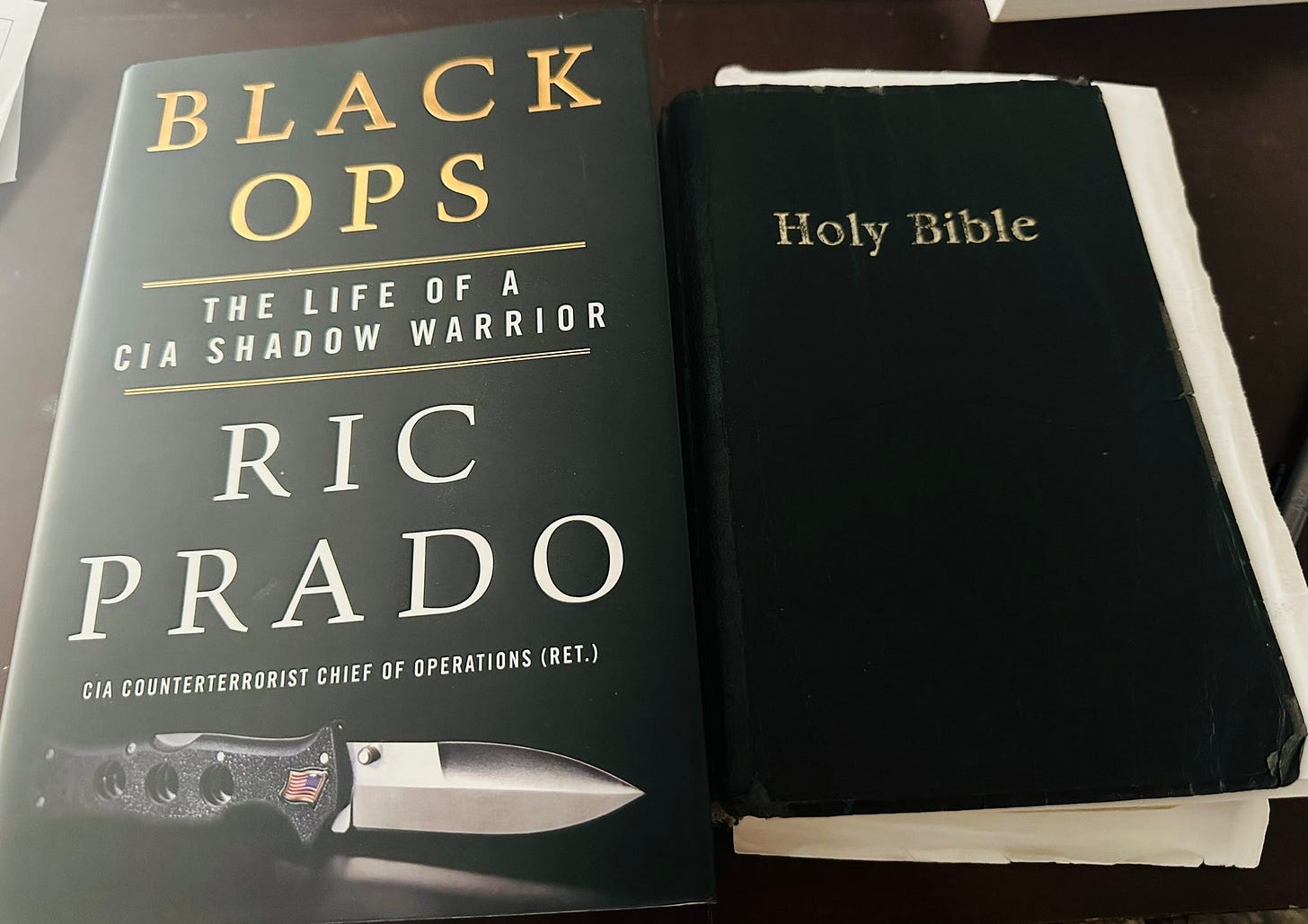

I shared this picture on Twitter recently of the new book I am reading. The Black Ops Book was the one I was reading this weekend:

The Intelligence field is incredibly interesting because it is similar to markets. In fact, it is directly connected to markets. Information is everything!

When I think about a country, it is never just in terms of its financial markets. A country is made up of many complex yet interconnected moving parts (see this article for a breakdown). There are economics, politics, religions, geography, and many other things that exert causal force in a country. It is actually very interesting because most people coming from one of these fields are baffled by how people act in other fields. For example, people who come from economic analysis might think it is absolutely absurd that individuals spend so much time and money on religious activities. It might make no sense. This is especially difficult during military campaigns where a religious ideology is the motivator of war as opposed to some economic interest.

The Black Ops book above is a story about an operative who works across multiple continents as a true intelligence practitioner and risk taker. I have said this before, if you want to understand risk management, go talk to someone actually taking risks in the real world where there is real chaos. I know markets are connected to the real world but sometimes people forget that there are actual things happening on the other side of their spreadsheets.

Views on Bonds:

Along with reading some good books, I have been giving a lot of thought to where we are with bonds. We just sold off a lot and are waiting for the issuance to take place in Q4.

I have laid out my views on bonds in these reports: link, link, and link

I am going to update my bond views but there is a little nuance to it:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.