Macro Report/Insights: Comprehensive Macro Report

People are getting the recession narrative completely wrong

Hey everyone,

I always like taking time away to write longer form macro reports framing how I trade for the next couple of months. The last macro report really hit the nail on the head with how bond price action would play out through the month of August:

I talked about the importance of BOTH the path and destination in price action for bonds. The forward curve was pricing imminent drops in inflation which was unlikely due to where GDP was running. The result? Bonds would likely move down over the month of August:

The result:

I didn’t think we would necessarily think we would break to new highs in the macro report but then updated my views:

Now that was all last month………

In this macro report, I am going to update these views.

Topics I will be covering today:

Structural Growth Situation

Cyclical reacceleration

Timing of Recession

Impact of Macro Regime On Asset Classes

Quick Into Thought:

The more time I spend interpreting markets and trading, the more I realize why some traders completely isolate themselves from social media and financial news. It is absolutely insane to me how much noise is out there.

Part of it has to do with my mental predisposition to forming ideas. I don’t have my best ideas collaborating with people. I have them when I am alone and reading a book. One of the most influential stories to me is of how Nick Roditi trades. See this tweet thread on it:

https://twitter.com/Globalflows/status/1646907973690888193

At the end of the day, it is up to you. Your gains, losses, and trading destiny rest in your hands.

(As noted in the last macro report, all future macro reports will be available exclusively to paid Subscribers. I will continue writing them every month and appreciate all the support).

Structural Growth Situation:

I have been giving a lot of thought to the longer-term growth situation because we have had such a historic rise in FED hikes without the economy falling apart. Remember in 2020 when people believed that if the FED hiked then the entire world would fall apart?

We have still yet to experience the full-time lag of monetary policy but it is significant that the longer-term contribution to GDP has been trending in opposite directions. If we look at goods and services as a percentage of overall GDP we can see services have been on a 70-year uptrend:

Why does this matter? Services are functionally labor which means there is less leverage connected to their activity. Goods can actually function as collateral for leverage whereas services don’t typically use large amounts of leverage.

This dynamic frames the situation with both the nature of inflation and the effectiveness of rate hikes to bring down inflation. Notice that the primary driver of inflation is services:

If we look at the effectiveness of rate hikes, we can see that they have had an impact on the cyclical sectors of the economy but not on services thus far. The two largest components of GDP are consumption and investment. Investment is explicitly and directly impacted by rate hikes. Investment has clearly decelerated on a YoY basis due to the rate hikes while consumption has remained positive.

The issue I see with the majority of the macro views out there is that they view the cyclical sectors in the economy as “leaders” or “predictors” of the rest of the economy. This is fundamentally incorrect in my opinion. Cyclical sectors of the economy simply have a higher sensitivity to rate hikes. When cyclical components decelerate, it can drag on the consumption and the service side of the economy. This drag doesn’t always take place though.

What is the logic?

Recession = cyclical sectors in negative territory but cyclical sectors in negative territory don’t = recession.

What I am saying is that if you call for a recession every time the investment portion of GDP decelerates, you would be wrong a decent amount of the time. This is where ideas such as “housing is the business cycle” fall apart.

2008 really ingrained presuppositions into a lot of macro strategists so that every time they see a deceleration in building permits, they begin to say a recession is imminent even though building permits are only a single data print.

Now do I think recession is completely off the table? NO! But making these distinctions is incredibly important for analyzing the PATH and DESTINATION for GDP.

At every step of the way we have been watching for the labor market to fall apart as cyclical components in the economy decelerated over the past year and it hasn’t happened yet.

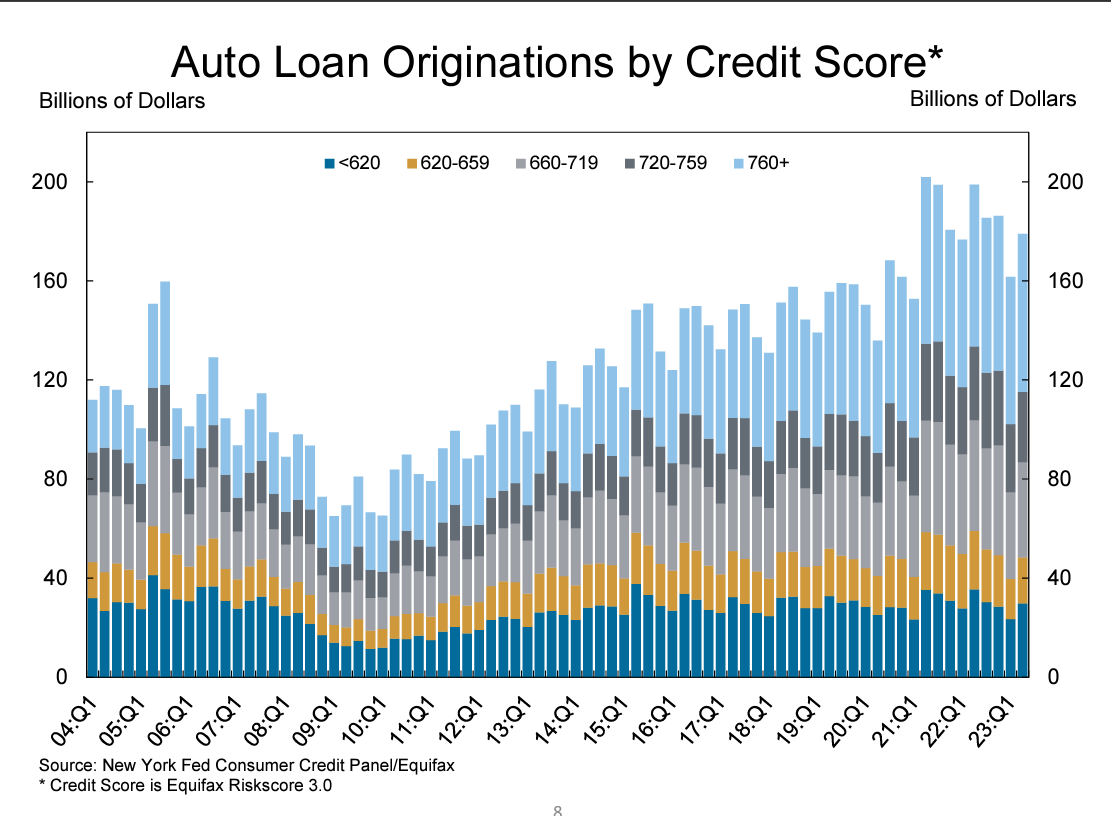

The question you should be thinking about the most right now is WHEN will the FED hikes begin to feed into rising delinquencies?

So what is the credit situation?

Total outstanding debt has risen a lot during the low-interest rate environment and has just recently slowed. The majority of debt is concentrated in mortgages (link to charts):

This is a key chart for the quality of the consumer balance sheet compared to 2008:

Delinquencies remain incredibly low right now:

While delinquencies as a whole are low, transitions are beginning to tick up marginally. However, remember, we need to see this begin to transition into enough of an impact to cause layoffs. We are still not seeing that transition.

We are seeing this across all ages:

Big picture, mortgages are the primary place the consumer has exposure to leverage. When we review the real estate situation, it is directly connected to the cyclical components of the economy and how the market is pricing growth expectations. This brings us to the current state of GDP.

Cyclical reacceleration:

Rate hikes have clearly caused housing unaffordability to increase:

Since so many existing homes are locked in at low mortgage rates, existing home sales continue to decelerate:

However, new home sales continue to accelerate from the October low:

NAHB housing index has accelerated from its low and is currently hovering in between continued acceleration or deceleration:

Mortgage applications are down due to higher interest rates:

Housing supply has accelerated from the COVID lows. When this overlapped with the contraction in credit due to higher rates, prices fell marginally. (white is the new housing supply and blue is the existing housing supply):

The most recent reacceleration in growth and decrease in supply has caused home prices to have multiple months of reacceleration:

This dynamic with housing is part of the reason we have seen a reacceleration in growth expectations. Notice that during the 2022 hiking cycle, we had real GDP turn negative for a quarter. This was primarily due to the cyclical components of GDP decelerating. However, notice, the Atlanta nowcast is accelerating considerably: (chart is nominal GDP in blue, real GDP in orange and the Atlanta nowcast in white)

Notice that residential investment was a net drag on GDP during 2022. This has now flipped and is a net positive for GDP:

This is part of the reason we have seen such a significant rally in equities. The cyclical components of the economy have and are continuing to reaccelerate. This overlapped with a considerable liquidity injection by the treasury issuing bills.

Notice cyclical equity sectors such as housing and industrials have made new highs as this occurs:

All of this brings us to the question, where is growth going from here? Have we entered a new growth rate cycle? The answer is no. Recession is likely the destination because it is the only thing that can “reset” inflation via delinquencies and a deterioration of the labor market. This is not the primary question though. The question is about the path and probable timing of the recession.

This brings us to the WHEN of recession.

Timing of Recession:

Is a recession imminent within the next 1-3 months? Is 3-6 months out? Or is it in the farther future, 8-12 months?

There are several principles to consider when analyzing the path and timing element:

The growth, inflation and liquidity cycle typically exemplify a logical progression of specific events that create the preconditions for the next event (see this previous article on this dynamic: link). On top of this, the path isn’t always clear in the way in which we progress through the economic cycle. This is why timing risk is so important.

Time in the economic cycle does not function in a linear fashion. Typically, we have very smooth progressions without significant tails until a recession takes place. A recession usually exhibits nonlinear moves in data points such as the labor market. This is what makes timing a recession so difficult.

When we think about a recession, it is consecutive prints of negative real GDP along with other economic metrics deteriorating. However, unless there is an exogenous shock like COVID, real GDP needs to decelerate from its current position to reach a negative print. When growth is elevated as it is now, it will either take longer for us to move into negative territory OR some type of additional force to increase the speed. We are not seeing a specific force to increase the speed at this time (I am watching this closely though!).

Finally, in terms of signals from “sentiment” or positioning, these don’t necessarily impact the actual outcome or probability of a recession taking place. For example, the fact that the FED previously used the word “recession” in their rhetoric during 2022 and has since then taken it out doesn't have any predictability on the probability of an actual recession. Secondly, positioning can but doesn’t always have an impact on the actual probability of a recession. For example, consensus and market positioning have been expecting a recession moving in 2023 for months now. This hasn’t been realized which is one of the reasons bonds have sold off. While this does likely bring us closer to the actual event of a recession since rates are rallying higher, positioning doesn’t necessarily have to be significantly offside for an official recession to take place. For example, 2022 rate hikes and the bear market was one of the most expected events ever and they still took place!

Current Situation:

When we look at the current situation, the preconditions set up dynamics for a contraction in growth due to the signals we have seen. However, we are NOT seeing the signals that would indicate the beginning of a recession. We see the preconditions for a contraction in growth but not the signals indicating the beginning of one. Let’s walk through these.

First, we continue to see negative real corporate profits which puts downward pressure on output and thereby pressure on the labor market:

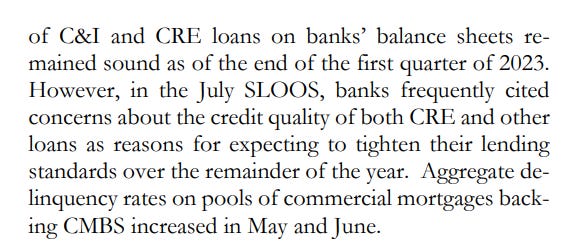

Credit conditions are clearly very restrictive and likely to remain there for a prolonged period of time. Real rates are at highs:

The senior officer loan survey continues to indicate tight credit conditions:

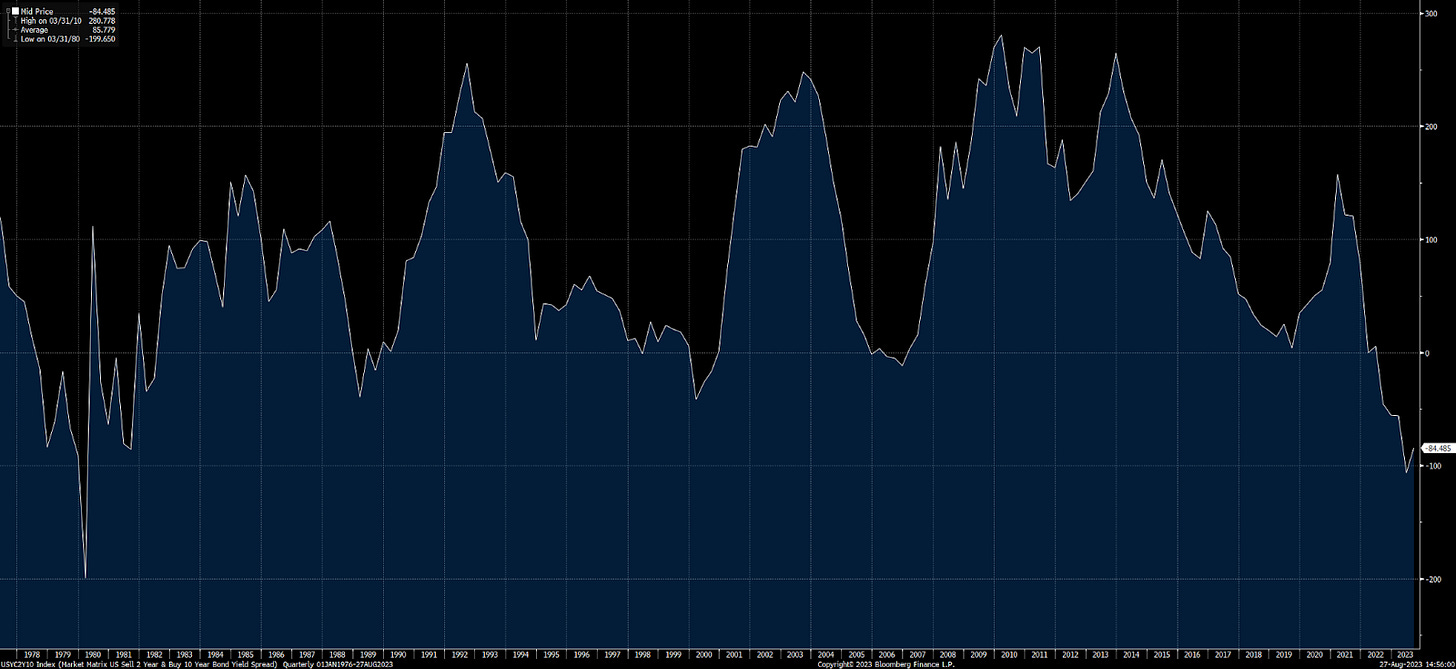

And the deep inversion of the yield curve continues to reflect the tight stance of the FED:

Initial claims have ticked up off their lows but remain in a range for the past 3 months:

Given the current stance of monetary policy and credit conditions, a contraction in growth is likely. However, this will be from the elevated level we are currently experiencing after this reacceleration in the cyclical components of the economy.

Additionally, we are likely to see a contraction in liquidity into the end of the year as the treasury issues longer-duration bonds as opposed to bills. This is likely to continue putting upward pressure on the long end of rates from a supply perspective.

Preconditions vs Signals:

All of these dynamics create the preconditions for a recession but we have not seen the start of the recession yet and are unlikely to moving into the end of the year. For the beginning of a recession, we need to see the following signals: growth data coming out below expectations, the labor market specifically showing clear signs of deterioration, the yield curve having a bull steepening, a negative stock-bond correlation with the dollar rallying, and credit risk expanding. We are seeing the opposite of all of these signals right now.

The bond market continues to sell off on labor market data, credit risk remains in its range, the yield curve had a bear steepener over the past month and now is likely to flatten, there is a very reasonable probability we have another rate hike before the end of the year, the stock-bond correlation is currently positive and the most recent pullback in equities is due to duration risk as opposed to earnings revisions, and finally, both real and nominal growth is reasonably elevated right now.

Bottom line, we are not seeing conclusive signals that an imminent recession is about to take place in the next 1-3 months. Obviously, this could change at any time which is why we need to manage the timing risk!

The FED?

I have been spending a lot of time thinking about this timing risk in connection with the FED. We are clearly at an extreme in terms of hawkish sentiment from the FED:

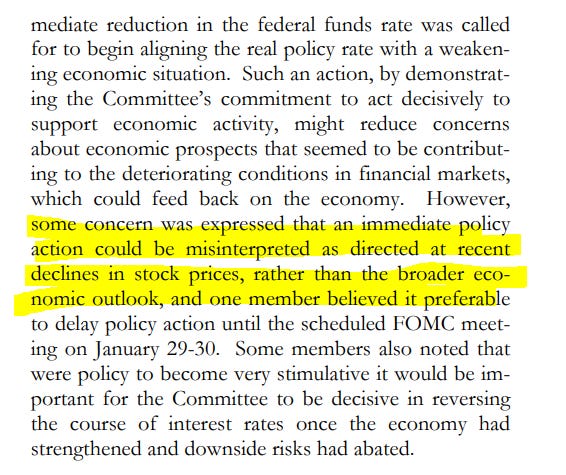

The interesting thing to me is the discontinuity of the 2007-2008 period. I was going through the FED statements and FED minutes from October of 2007 which was the peak in SPX.

Notice how much focus they give to credit conditions and the risks in housing:

https://www.federalreserve.gov/fomc/minutes/20070918.htm#august10

Now notice the language in January of 2008:

https://www.federalreserve.gov/newsevents/pressreleases/monetary20080130a.htm

January 2008 FOMC minutes:

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20080130.pdf

Most recent Fed minutes: July 2023

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20230726.pdf

In my mind, I view an almost night-and-day difference between the FOMC minutes of October 2007 and today’s FOMC minutes. The minutes of 2007 provided considerable focus on the risks that existed in the housing sector and credit markets. There is a significant discontinuity in the credit stress, inflation, and liquidity dynamics taking place today.

I draw attention to this because I continue to believe this: link

Could economic data begin deteriorating in September and we move into a much higher probability of rate cuts? Sure. But this goes back to the timing risk and their respective signals.

No one can claim a monopoly on timing the economy and market. I simply want to understand all the component parts and their respective signals incredibly well so that I can adapt on the fly.

Impact of Macro Regime On Asset Classes:

So what is the risk-reward of bonds from here?

We are clearly at this key technical level in the 10 year after the bear steepener:

The bear steepener was a key driver in the sell off in equities over the past month:

There are two things I am thinking about for bonds into the end of the year:

Is there another hike on the table?

How will the long end digest the new supply if the growth situation doesn’t deteriorate enough?

The market is now pricing a 43% probability of a hike in November. If we get a hike in November AND Powell clearly indicates he doesn’t plan to cut in Q1 of 2024, the 2-year yield still has upside:

This dynamic of an additional rate hike and the pricing out of cuts in Q1 of 2024 depends on how growth and inflation data come out in the next couple of months. At this point, I wouldn’t be leveraged long ZT until we have clarity on this.

I will also be watching how the market is digesting the issuance on the long end:

Conclusion:

These are the scenarios and tensions we have into the end of the year.

Over the next month, I will be sharing how I view the risk-reward of bonds within this framework as we move through the data releases. Remember, we want to identify how the market is pricing information as it moves across the spectrum of uncertainty to certainty.

There might be a couple more tactical trades shorting bonds but I am very wary of the timing tension I noted above.

Above all, stay nimble in the maze of markets!

Thanks for reading!

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Hell yeah great analysis we all gonna eat