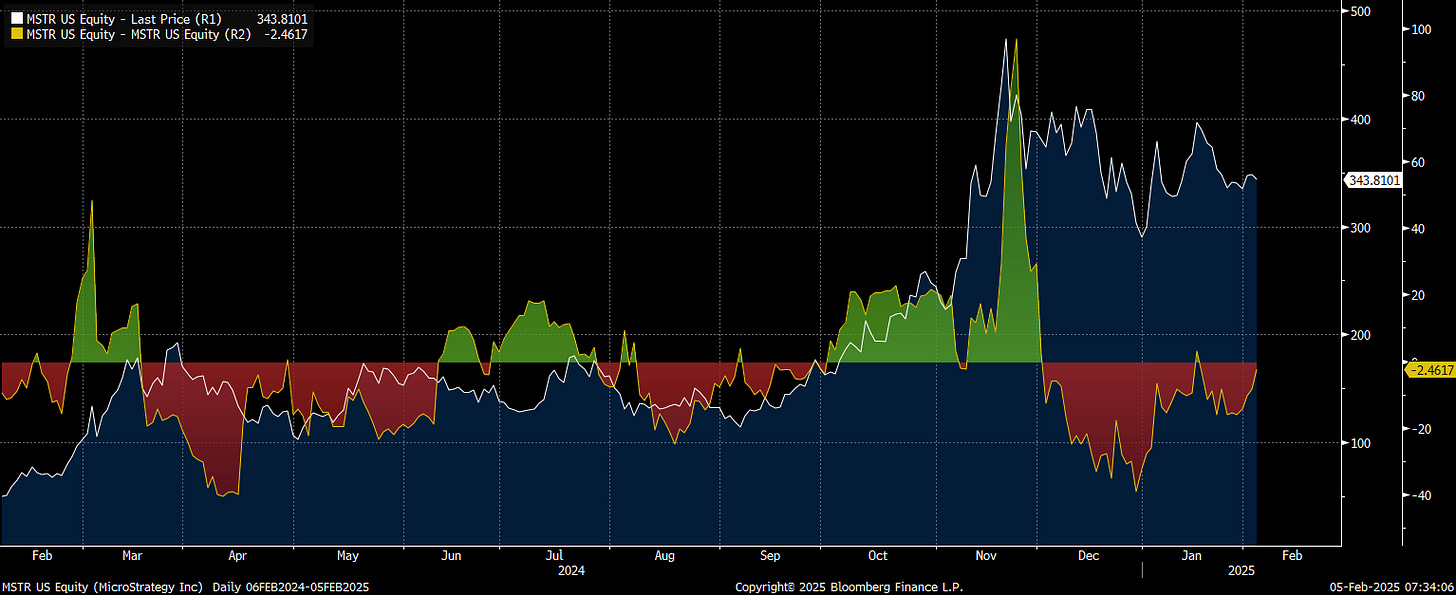

After months of Bitcoin and MSTR traders getting absolutely destroyed, we are approaching a short-term inflection point in positioning. You will notice that implied volatility premiums blew out when MSTR hit its high at the end of last year. Since this time, we have been trading in a range as implied vol premiums turn negative.

If you are trying to understand positioning premiums, check out this primer:

As we progress through the next 90 days, we are likely to move HIGHER as the complacent positioning turns into traders chasing again.

Total call open interest minus total put open interest (green) is already pushing higher which is likely to fuel a gamma squeeze if there is any marginal push-up in Bitcoin.

Once call vs put volume makes a spike, we are likely to be off to the races.

I will be tracking this trade and others in real-time for paid subscribers (this will be added to the spreadsheet, which I will update at the close). I am also in the process of writing the next comprehensive macro report that systematically breaks down all of the moving variables for the macro regime and explains WHERE we are going.

This is the part where things are about to get fun:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Why MSTR, specifically? Why not just long BTC some multiple 2X BTC future?

Hey Cap! Where do you see USDJPY landing?