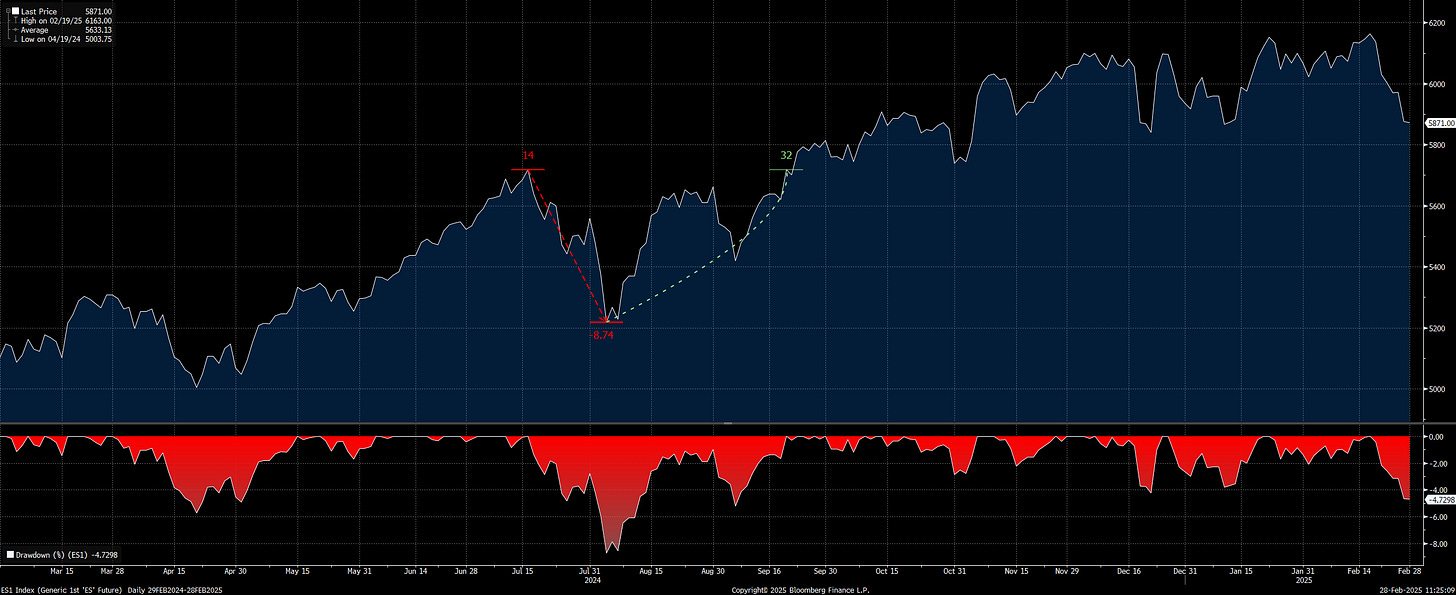

Zooming out:

We are less than 5% down from all-time highs in ES, and the fear people are feeling is palpable.

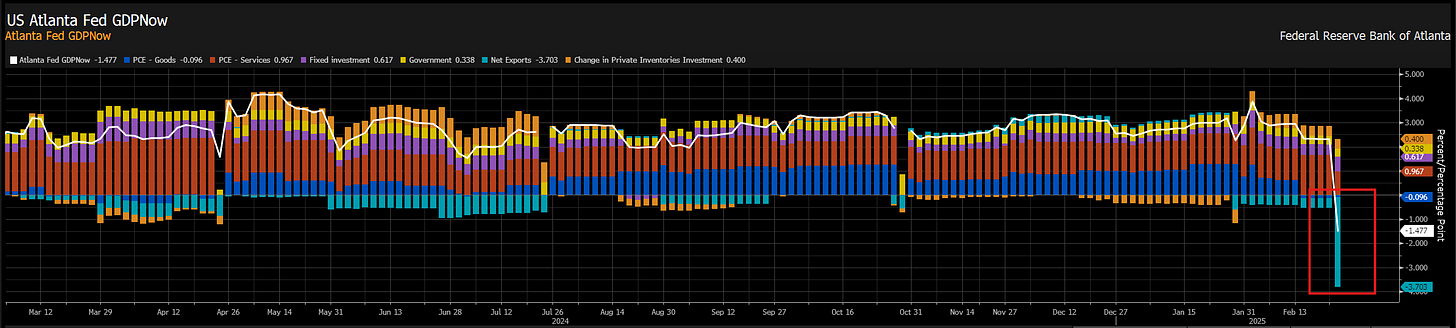

On top of this, consensus in the market is increasingly focused on the Atlanta Fed GDP nowcast that went negative:

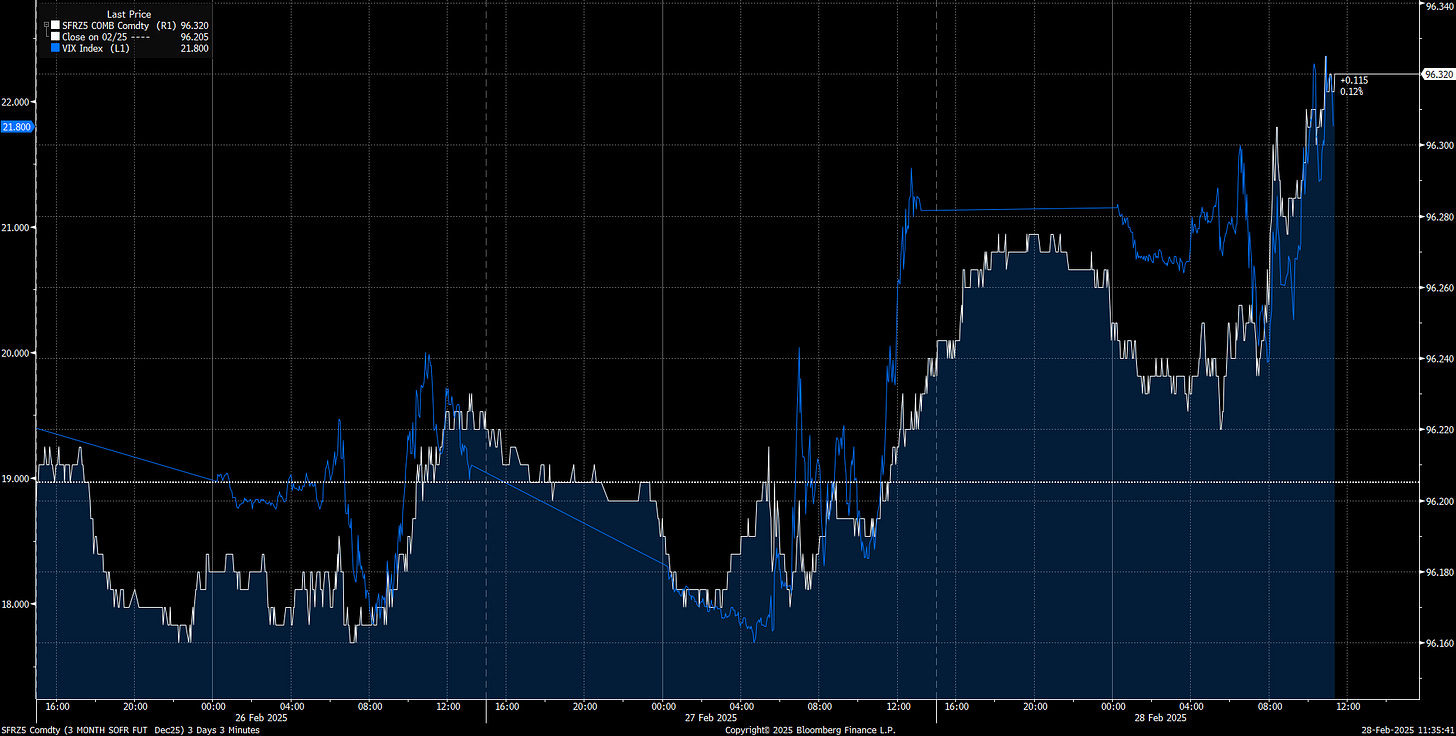

The combination of the positioning unwind, weaker tech earnings, and more aggressive rate cuts for 2025 has caused the VIX and Z5 SOFR contract to move in lockstep. In other words, the pullback in equities is being directly linked with aggressiveness in cuts for this year.

This is taking place in the context of elevated inflation expectations (inflation swaps in white) and still low levels of credit spreads.

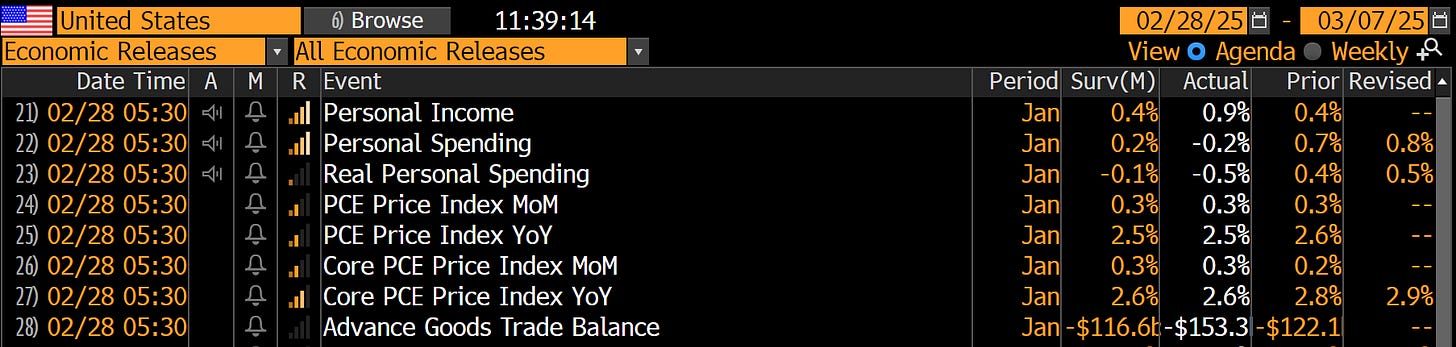

You will notice that on the print this morning, headline and core came out in line with expectations, functionally flat from the last print:

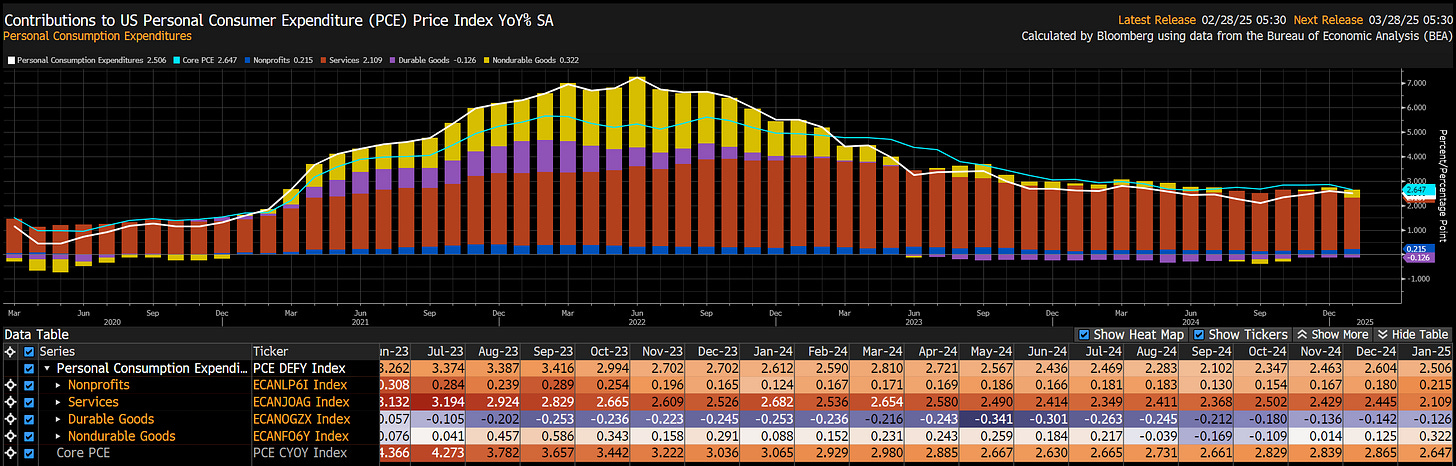

Notice that the services line item decelerated as the goods line item accelerated:

This, in connection with the trade balance data, frames the actual context for bonds.

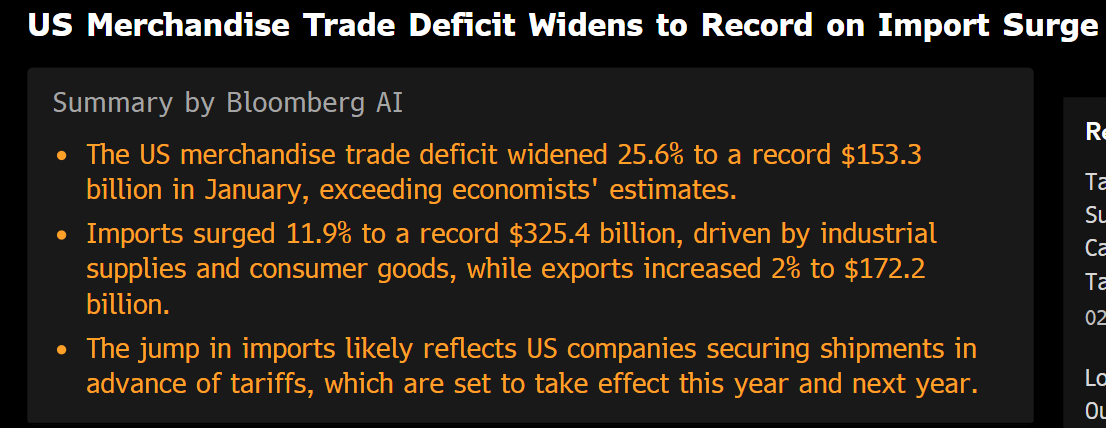

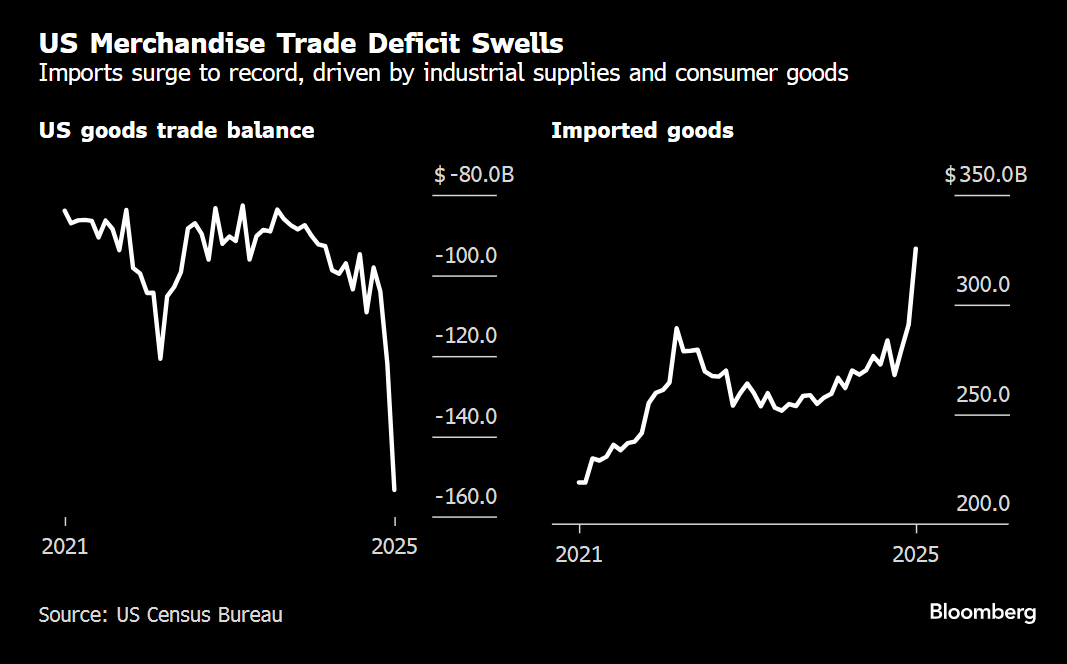

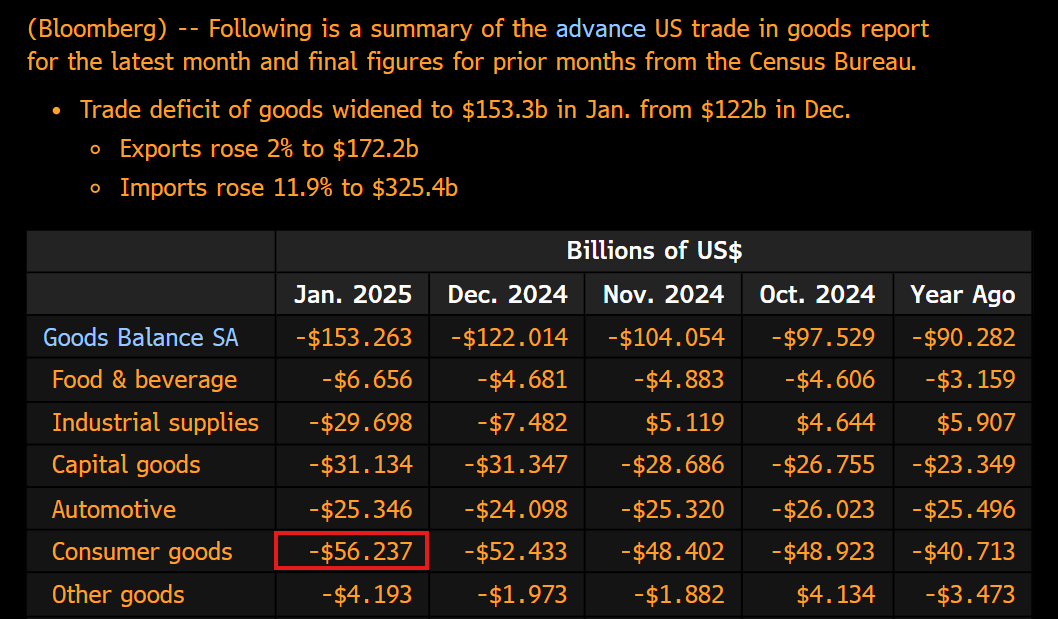

Notice that imports made a massive surge:

This is primarily from the goods line item. This is directly connected to the goods inflation line item in the PCE print. The connection between the import data and PCE is important because it shows HOW companies are reacting to the tariff news and explains the compression of time we are in right now.

While consumption weakened marginally, we have not entered a recession. People are conflating a short-term tariff move with a negative contraction in GDP:

This context frames the risk reward in assets we are goingg to dig into a bit more.

Trade Write-Up:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.