Trades: Alpha Report

Updates and new trades

Please see the previous alpha report here:

Bonds were overextended into the CPI print this week due to the pricing of the forward curve and term premia dynamics. This was noted in the chat:

The surprise was only marginal as core continued to decelerate on a YoY basis

Please see notes in the previous alpha report on semiconductors but implied vol did decrease today post-CPI print. For durability in a semis rally, implied vol must decelerate from here, or else selling comparable to Friday will continue to occur:

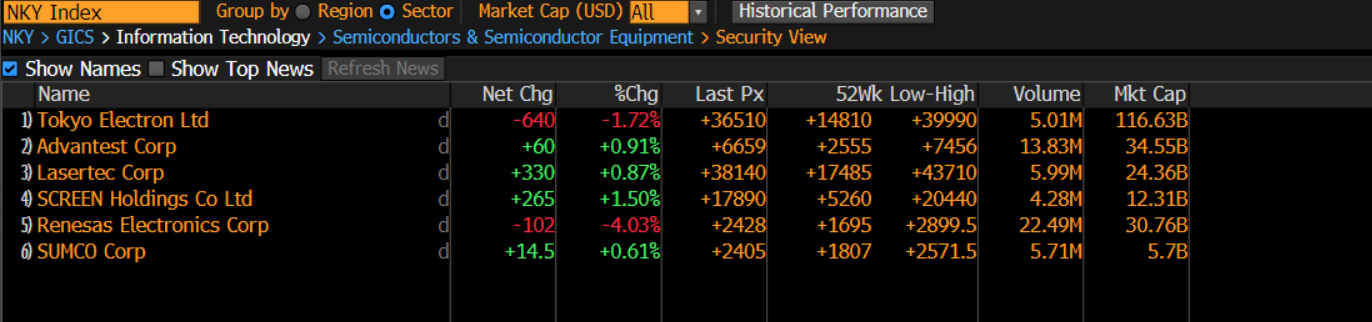

Continue to watch semi-stocks in the Nikkei during the Asia session because they are still leading US session price action.

The most recent inflation print will likely cause positioning to over extrapolate expectations surrounding cuts this year. The Fed is more likely to push back the TIMING of rate cuts before shifting to LESS cuts:

I have laid out these tensions, the specific signals to watch and how they impact assets in the alpha report below. The report also contains an updated CL analysis and new commodity trades:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.