Trades: Alpha Report

Energy Complex

We continue to be in a regime where some assets (equities) are in a positive momentum regime and other assets (bonds) remain in a mean reversion regime. The energy complex has an important role within this framework as well.

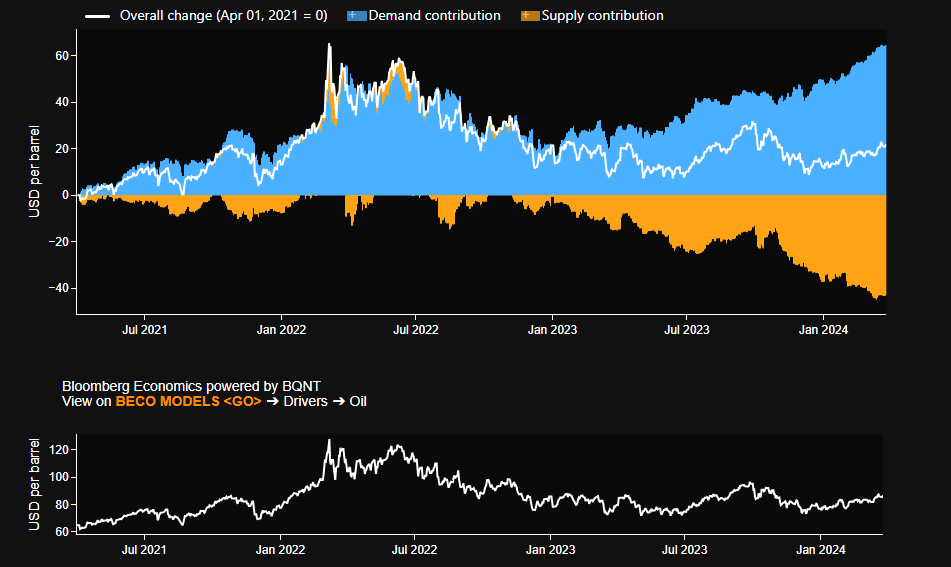

Supply and demand factors in the crude market continue to move to the opposite extreme seen during the 2022 invasion:

There is now additional focus on CL and BRN since it has been a positive performer YTD:

The dynamics surrounding the short-term inflection point are laid out in the alpha report below: (see previous alpha report here: Link)

Also, please review the macro report that was written which can be found here:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.