Trades: Alpha Report and Week Ahead

Alpha generation

There continues to be a prevailing bias among market participants to focus too closely on the words of the Fed and not understand the macro mechanics of the system. There is no alpha in knowing Fed Speak incredibly well because it’s already priced in!

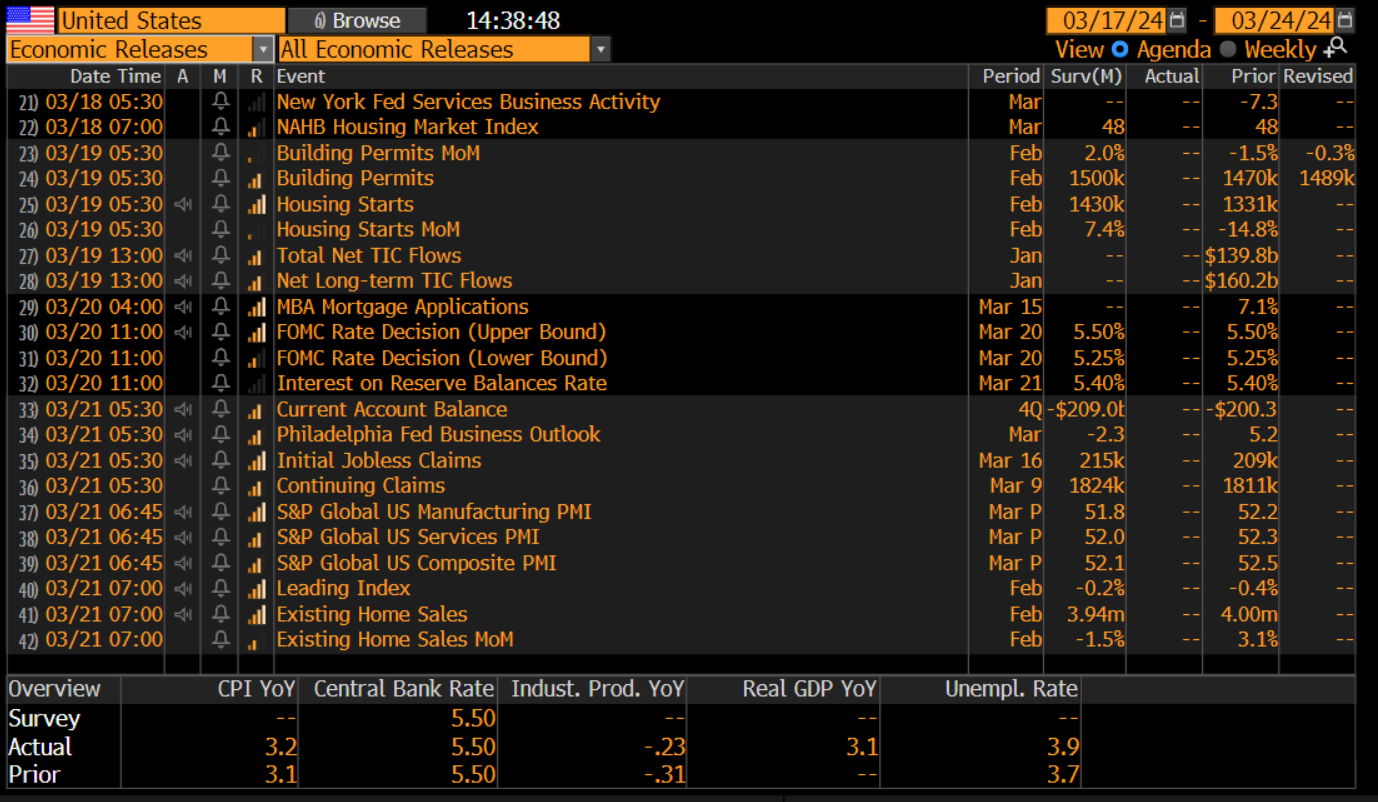

The primary event for the week is FOMC. This will function as a short-term clearing event to wash out weak money and allow active managers to unwind hedges.

The BoJ and BoE also make rate decisions this week:

The most recent marginal acceleration in inflation has already been priced into markets as reflected by FF contracts and inflation swaps. Crude is moving in lockstep with this:

Let me say that the opportunity for actively extracting macro alpha is huge right now, especially in bonds! It is already clear what has happened and what is priced in. The question is, how does this skew the path dependency moving forward? See the two recent alpha reports I wrote here:

Alpha Trades #1: Link (No paywall)

Alpha Trades #2: Link

(Please read these previous reports for context!)

Alpha Trade Report for this week is below:

Keep an eye on the chat and article publication this week because I will be sharing how the macro thesis is playing out in real time. Remember, this game is about adapting on the fly, not getting glued to a deterministic view of the future.