Trades: Updates

Steepener

“Clear thinker” is a better compliment than smart

-Naval

In the information age with infinite leverage, your ability to think clearly and have decisive judgment is the only way to achieve success. Hard work is a prerequisite to build this judgement but the ultimate decision is a result of clear thinking that grows out of the soil of hard work.

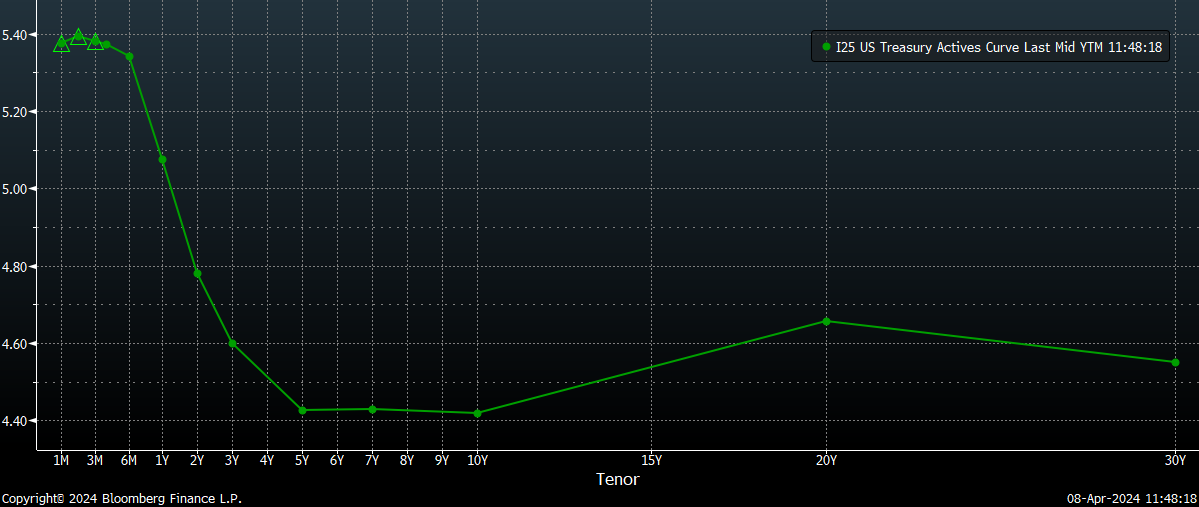

One of the key things I want to focus on today is how the shape of the yield curve is dynamically changing. If you are new, check out the bond primer I did here:

Also check out Citrini’s recent articles as well:

Main idea: when the curve is inverted (long-end rates lower than short-end rates), banks and institutions are not incentivized to take on additional duration risk relative to the short end.

Think about it like this, if I can “T-bill n chill” in the short end getting paid 5.50%, why would I buy TLT when it’s yielding 100bps less?

The short-end pricing and long-term NGDP conditions account for changes in the shape of the curve across various durations. Prometheus Research and I did a whole conversation on how this functions in the term premia discussion:

Where are we now?

The 2s10s curve has steepened marginally since March but on a long-term basis, it remains in a range. On the other hand, the 3m2s curve has steepened significantly since January:

It is divergences in these curves that are critical to connect to tensions in the bond market:

What will cause a durable rally in bonds? We need to see persistence in a bull steepening for duration to have a sustainable rally. What causes this? it is the collocation of the Fed cutting rates AND nominal GDP conditions deteriorating considerably.

YoY nominal GDP is running at 5.9%:

And we have headline CPI ticking up marginally due to the rallying in crude prices:

On top of this, NFP just came in above expectations. Not a recession!

Bonds remain in a mean reversion range where alpha opportunity exists in taking the other side of market extremes into market catalysts. Within this, betting on the steepener continues to have a high-risk reward.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.