Week Ahead, Liquidity, And Macro Livestream

The largest changes having the biggest impact

Week Ahead and Macro Liquidity

“All money that is anywhere has to come from somewhere”

That is a fundamental presupposition for HOW the flows of capital function in the system.

When I dont understand WHY something is happening in markets, I always start by breaking down all of the sources and destinations of liquidity. When you map these, you can see how capital flows between different assets.

Here is the thing that confuses people, though: the flows of capital are never evenly distributed through time. This is where the historic phrase, “There are decades where nothing happens; and there are weeks where decades happen,” comes from.

We are in a short period of time where decades are happening.

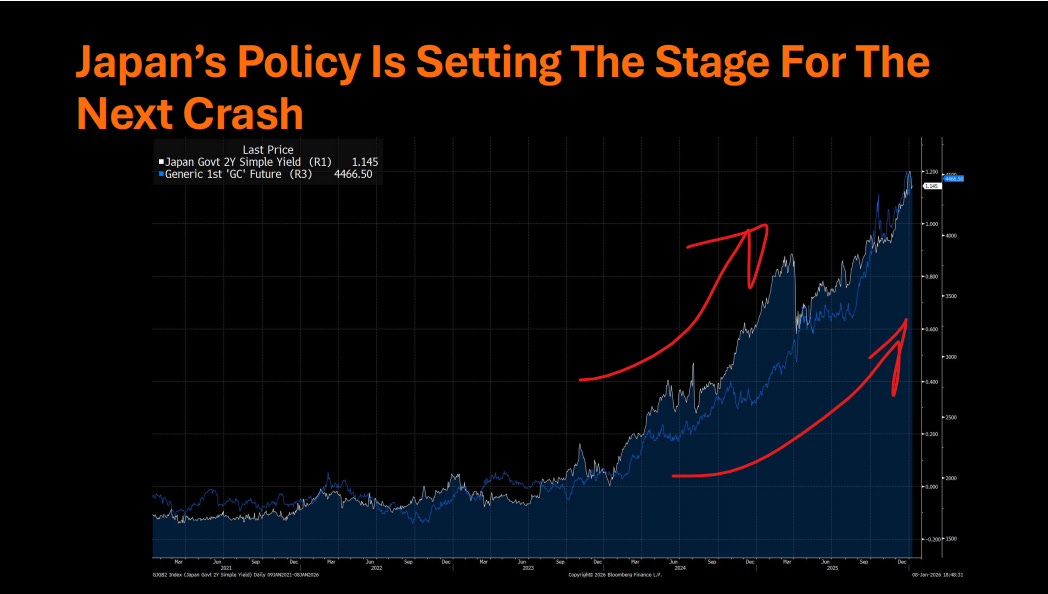

I want to draw your attention to a very specific SOURCE of liquidity that is shifting the amount of global liquidity int he system, JAPAN.

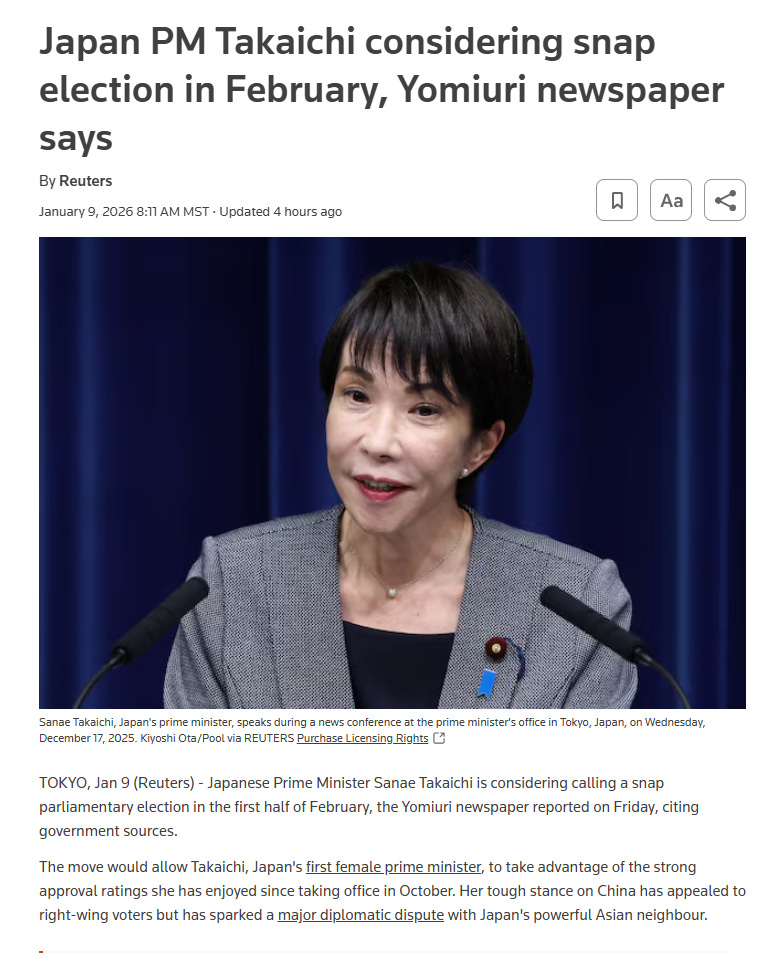

I put out a short note for paid subscribers yesterday explaining how Japan is one of the main drivers of liquidity as opposed to the labor market print: It was the fiscal news out of Japan, not NFP, that was driving flows.

Why does this matter? Because the SOURCE of liquidity explains short-term divergences like this, where the Nikkei is holding its bid as ES pulls back marginally on an intraday basis.

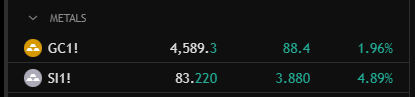

Does it begin to make more sense why gold and silver are up right now during the overnight session during this divergence? The liquidity is coming from Japan, which is bidding for gold and silver. This was one of the main drivers I explained in the livestream last week (Full slide deck and recording: LINK)

Until China stops its trade war, Japan stops its fiscal spending, or the Fed stops cutting, gold and silver are likely to continue melting up. Will there be pull-backs and positioning unwinds? Sure, but the larger structural drivers are always going to be the signal amid the noise.

Gold and Silver Are Front-Running a Major Shift

If you want to understand these structural forces, I’ll be doing a live session tomorrow at 3:30 p.m. Eastern, starting 30 minutes before the U.S. cash close. I’ll walk through the structural drivers behind gold and silver, why this melt‑up is happening, and exactly how to manage position risk during pullbacks or when price looks “overbought.” If you want a clear, actionable playbook instead of guessing at headlines, join the livestream via the link in this note.

Week Ahead

On top of the livestream, here are all the catalysts I am watching this week, and I will walk you through them in real-time in the chat function here on Substack.

Week Ahead (Mon Jan 12 to Fri Jan 16)

This week is shaped by two things: (1) the US inflation/growth stack (CPI, retail sales/PPI, claims/soft data), and (2) US Treasury auctions plus a dense run of bank earnings. If markets are already leaning one way (rates/risk), this is the kind of week that can either validate the narrative or force a rethink or repricing.

The core macro pulse

US CPI (Tue) is the anchor print for rates, USD, and FI duration. A clean downside surprise will see release more real-rate pressure and supports risk assets. A sticky print re-prices the front end and drags long-duration.

US retail sales + PPI (Wed), retail sales is the a growth check, PPI helps validate (or undermine) the CPI impulse.

Claims + regional surveys(Thu) are the cross-currents with labour cooling vs resilience

Monday, Jan 12

APAC

India CPI

EMEA

Euro-area Sentix investor confidence

ECB’s Guindos and Villeroy

Americas

Fed’s Williams, Bostic and Barkin

US 3- and 10-year note auctions

Tuesday, Jan 13

APAC

Japan trade balance and current account balance

Australia Westpac consumer confidence

EMEA

ECB’s Kocher

Americas

US CPI

US new home sales

ADP weekly employment change

NFIB small business optimism

Federal budget balance

Canada building permits

Fed’s Musalem and Barkin

US 30-year bond auction

EIA short term energy outlook report

JPMorgan earnings

Wednesday, Jan 14

APAC

China trade balance

EMEA

ECB’s Guindos

BOE’s Taylor and Ramsden

OPEC monthly oil market report

Americas

US retail sales

US PPI

US current account balance

US existing home sales

US business inventories

Fed Beige Book

Fed’s Miran, Williams, Kashkari, Paulson and Bostic

Bank of America, Wells Fargo and Citigroup earnings

Thursday, Jan 15

APAC

Japan PPI

TSMC earnings

EMEA

Euro-area industrial production and trade balance

Germany GDP 2025

France CPI (final)

UK monthly GDP, industrial production and trade balance

BOE bank liabilities and credit conditions surveys

Americas

US jobless claims

US import price index

Empire manufacturing

Philadelphia Fed business outlook

TIC flows

Canada manufacturing sales

Brazil retail sales

Fed’s Bostic and Barkin

Goldman Sachs and Morgan Stanley earnings

Friday, Jan 16

EMEA

Germany CPI (final)

Americas

US industrial production

NAHB housing market index

Canada housing starts

Brazil FGV inflation

Fed’s Jefferson

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Awesome CAP just what im after deeper understanding of Gold and Silver Thanks