Week Ahead: Set For GDP and ES Trade

Think in weekly and daily mindset

I want to lay out three things in this article:

How the data and catalysts this week set up for GDP expectations

How the ES trade is developing

How to quantify returns on a daily and weekly basis for macro views

But first, we interrupt this program for a meme:

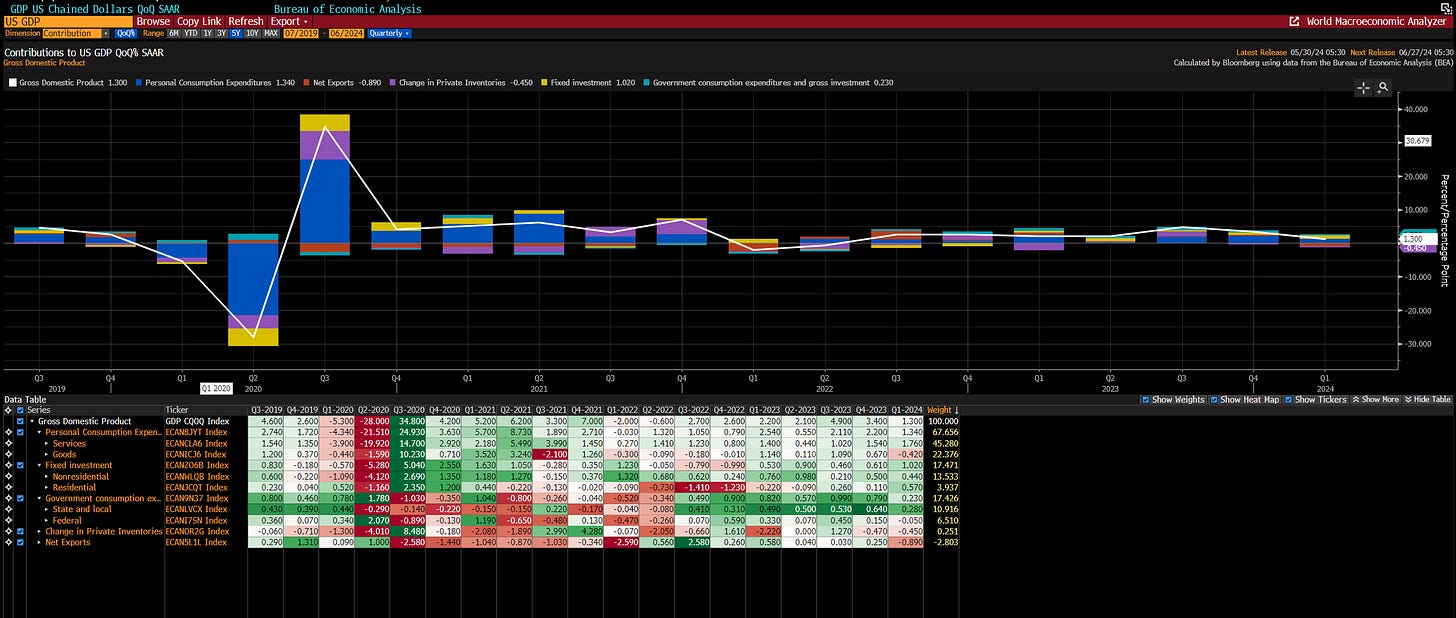

Data:

We have retail sales, industrial production, housing data, the S&P PMIs, and home prices this week. (side note, literally no one cares about the conference board data. All the macro doomers use it and no one cares). The main way you need to think about these data prints is not that they will necessarily move markets a ton but that they feed into how GDP is being nowcast.

Remember, GDP has each of these line items that connect to various parts of the economy.

Nowcasts like the Atlanta Fed GDP nowcast will take the monthly datapoints and attempt to triangulate the GDP print:

We have data this week that typically has a higher sensitivity to rates. If industrial production and housing data come out strong, it is functionally indicating that rates are still not restrictive enough to drag things into a negative growth regime.

As a reminder, housing data has decelerated from its 2021 extreme but remains resilient:

Look how elevated building permits are right now. It is important to quantify both the LEVEL and rate of change in economic data.

Here is the long-term chart. Again, could we be heading lower? Maybe. The direction is dependent on home affordability which is dependent on incomes and mortgage rates. The mortgage rate side is directly connected to the Fed’s decision.

Mortgage delinquencies are still so suppressed that even if we had a reply of 2008, it would take over a year for us to begin seeing a pervasive impact on other sectors.

These dynamics frame how growth is likely to play out in 2024. We have the GDP release the following week with PCE. This will provide further confirmation that growth is fine. My view is that real growth remains positive through 2024 (aka no recession).

I broke down how these tensions contextualize the risk-reward for interest rates in this report:

ES Trade:

Now let’s talk about the long ES trade I originally shared:

We have had multiple weeks of positive returns on a weekly basis:

We remain skewed to the upside but we had some short-term profit talking post CPI and FOMC. We are unlikely to have a weekly close below the 5400 level:

The main risk to watch for is how implied correlation shifts as breadth shifts. We have seen such a significant fall in implied correlations for months.

be careful because we might have a little bit of a vol shock as premiums in the vol complex shift around. VVIX has been rising and implied correlations are likely to rise marginally.

These are position shifts which are still important to monitor and manage risk around. The macro regime is skewing equities to the upside though.

Bottom line: I AM HOLDING THE LONG ES TRADE. I will write an article on here when I close the position.

I will be expanding more on these dynamics for paid subscribers this week.

Daily and Weekly Returns:

I want to cover some important points for thinking about positioning and trading macro that are critical to understand from an execution perspective.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.