Worldview, AI, and Economics

The difficulty of quantifying the past

The Problem In Macro:

I have learned that some of the most important drivers in macro are incredibly difficult to quantify in a backtest. Many market professionals in today’s environment will assert that if you can’t quantify the drivers of a variable and backtest it, then it has zero relevance for markets. If you go down the extreme route, you end up only using timeseries momentum to make your decisions and reject all other sources of information, such as fundamentals, news headlines, and narratives.

This type of thinking is really an outflow of the extreme scientific approach that the modern world has developed. Everything becomes about observable facts, testable hypotheses, and quantitative rigor (which has a very important place!). We are experiencing the final frontier of this in many ways as AI brings extreme precision and efficiency to language and numbers.

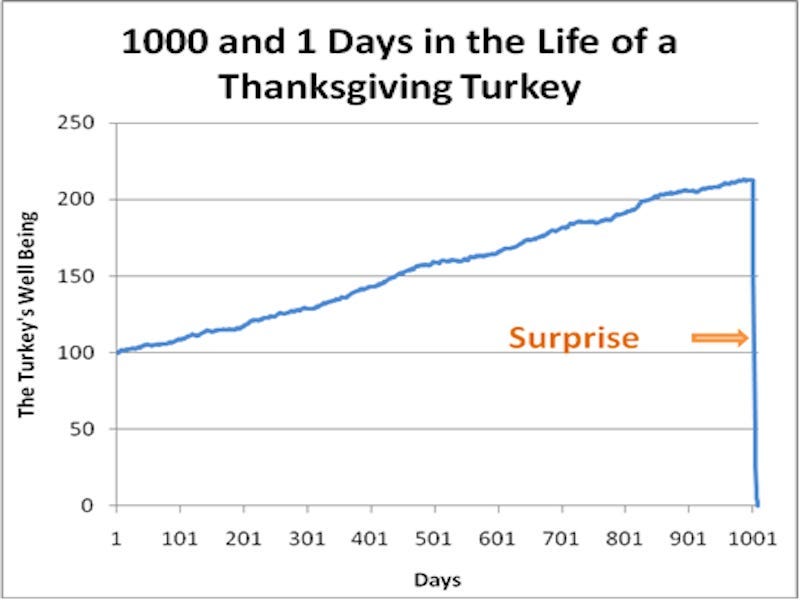

But here is the problem: no one seems to care about how UNSEEN elements and QUALITATIVE variables play an important role as we interact with a complex world. When we only address observable and seen elements of a system, we begin to think less about risk and become more complacent, which causes what Taleb calls “the turkey problem.”

So, how should we think about BOTH the seen and the unseen?

The foundational quote is from Bastiat’s 1850 essay "That Which is Seen, and That Which is Not Seen":

“In the economic sphere an act, a habit, an institution, a law gives birth not only to an effect, but to a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen. The good economist takes into account both the effect that can be seen and those effects that must be foreseen. The bad economist confines himself to the visible effect.”

Henry Hazlitt, in his book Economics in One Lesson, popularized Bastiat’s insight:

“The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups.”

A Path Forward:

In truth, every single moment of time in macro is 100% unique. The quants are constantly trying to find the commonality in the characteristics and extract returns in so much as they have continuity with the historical sample set. There are always idiosyncratic factors that are completely new, though, and these require greater imagination because they are typically UNSEEN. (Link for paper)

So, how do we tangibly connect these elements and moving parts? This occurs through having BOTH the quantitative rigor and the untangibly “IT FACTOR” that can imagine the unseen and how it will interact with the statistical factors that are seen.

You will notice that as soon as liquidity begins to dry up, people begin to think about risk differently. When you are able to just stop yourself out of a position, you have the luxury of not needing to think about how risk actually works. The excessive liquidity we have experienced in the US has been one of the greatest catalysts of innovation in history but it has also created complacency about how risk actually functions.

The days of pit traders are over, and now traders are typically spending most of their time in front of a computer screen instead of screaming across the room for a fill. All of these changes have their own unique sets of tradeoffs, where we have yet to see the full consequences (good and bad).

Today’s World:

What I will say is that today’s world has never been so interdependent and nonlinear. When you create the type of infrastructure the modern world now has, you are effectively embedding leverage into the system. Young individuals can become millionaires in short periods of time because they are completely locked in and using all the tools at their disposal.

Institutionalism is actually becoming one of the biggest risks because the greatest talent can easily access permissionless leverage through code and media. I would not be surprised if going to college becomes a shameful route of “selling out” because people couldn’t cut it, locking into AI for a few months.

But you know my stance from the very beginning of this Substack. Education and learning are for those who truly want it. The genie has been let out of the bottle, and it is impossible to put it back. The speed of change is accelerating, your ability to think clearly about the world (seen and unseen) is becoming your greatest asset.

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”