Think Clearly:

If you have been following me for any period of time you know that I NEVER blindly hold a view. I ALWAYS redundancy plan and set up a clear logic/signal process for every thesis I lay out. If things change tomorrow, I simply change my trades and continue on. I have no problem being long or short ANYTHING.

My goal as a trader is to bat singles until I can find a home run trade. I do not subscribe to any schools of thought and only focus on absolute returns. Why do I do this? Because I love the challenge and difficulty of competing against the best and winning.

I say this at the outset as a reminder that Capital Flows is not about any single thesis around an asset. It is about having a foundation to approach the market as a high-level adaptive participant who has the desire to win.

This is why I have written an entire suite of educational primers: every book and paper you will ever need on macro is here

And have the daily Macro Regime Tracker with systematic models I use (link). The majority of these are free because I know what it’s like to have ZERO help and have to find my way in markets.

With this in mind, I want to cover 3 foundational insights for this macro regime and HOW to use them in the macro thesis I have laid out.

Macro Context:

I laid out the macro framework for everything here:

And explained it in a video here:

(The only way we can move to the higher level alpha is if you understand the context for WHY I am saying things so just read everything on the Substack and you’ll understand WHERE we are).

Insight #1: Risk Flows

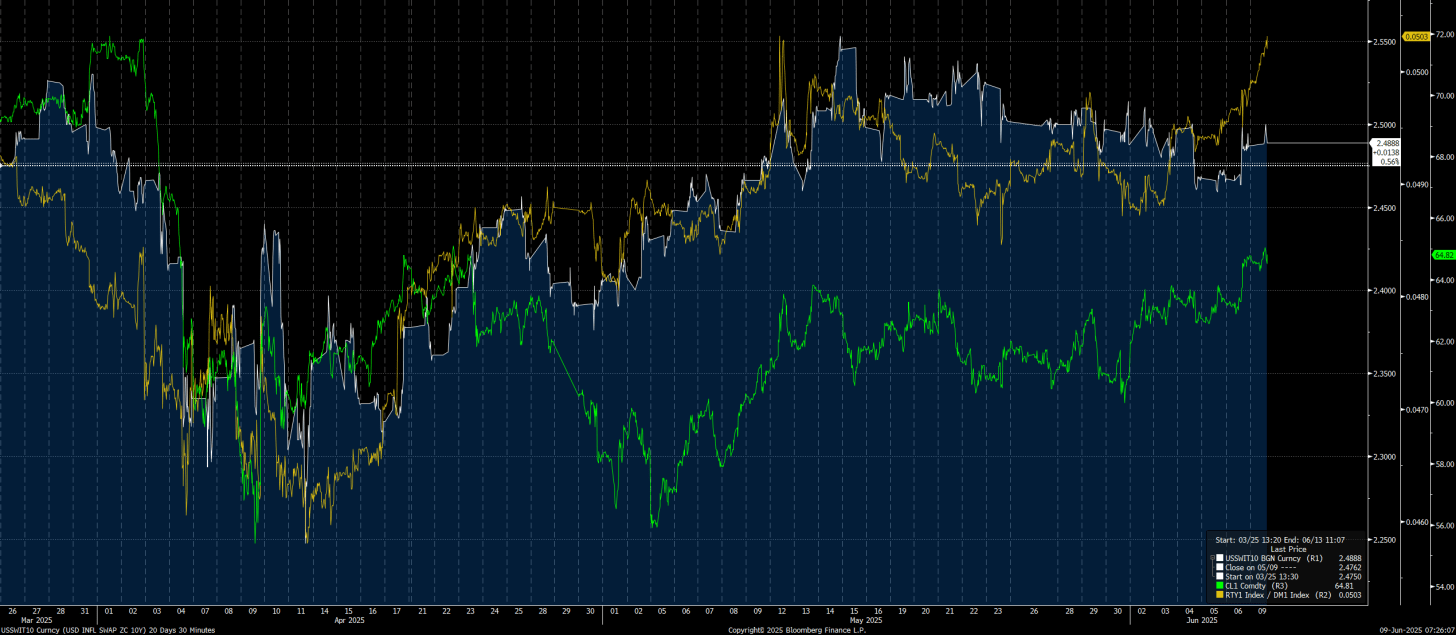

Risk Flows are directly linked with inflation expectations and the bond market. The chart below shows 10-year inflation swaps (white), the RTY/YM ratio (reflecting capital moving out the risk curve to buy riskier small caps in yellow), and crude (green). The main idea here is that capital moves out the risk curve because the amount of money in the system is greater than the price of that money (interest rates). So when more money is in the system without the Fed getting ahead of it, capital systematically moves out the risk curve (see explanation here: LINK).

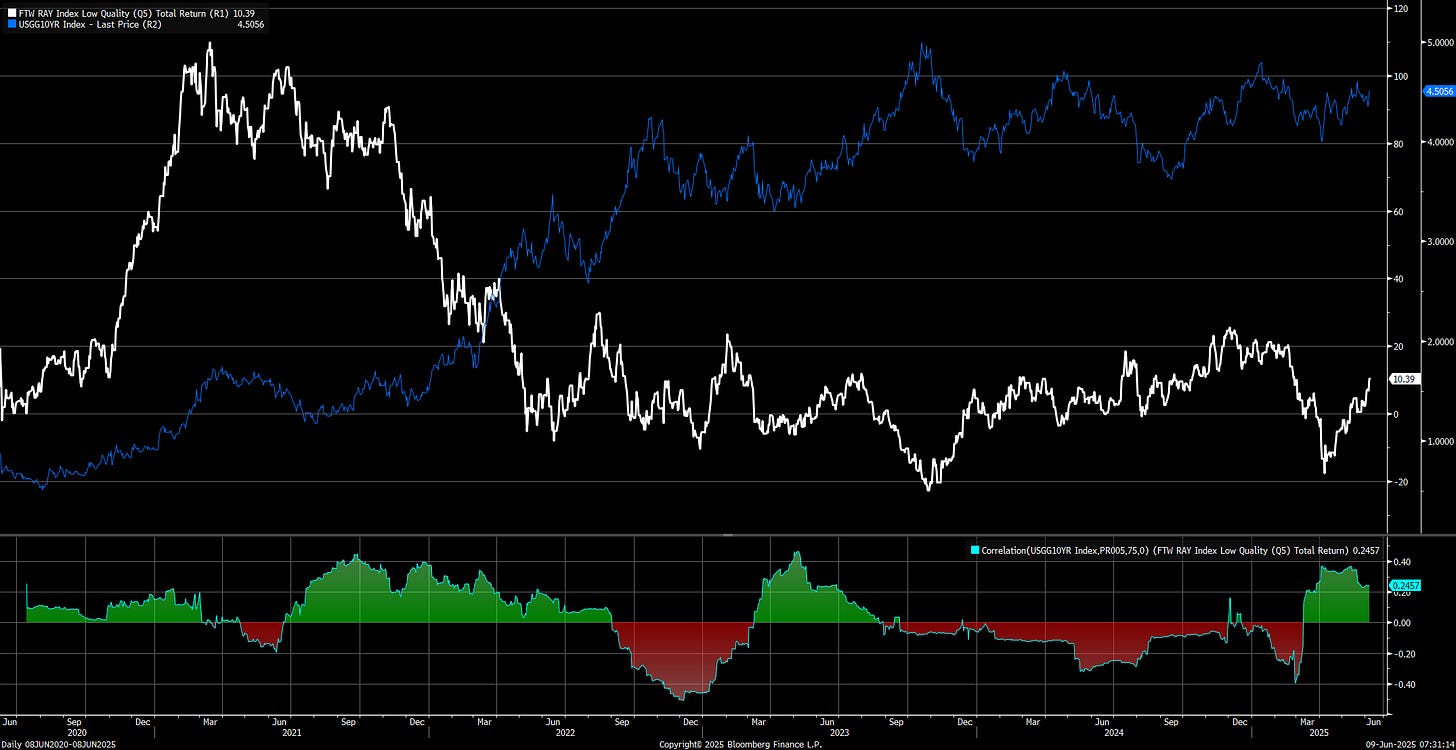

This is WHY watching the correlation between low quality stocks (white) and interest rates (blue) is key. You will notice that in 2021, there was a positive correlation. Once this correlation flipped negative, it began to signal a shift and this is one of the reasons things like ARKK topped in 2021. You will notice that we are back in this positive correlation regime at the same time low-quality stocks are rallying from their lows.

The implication? All of these flows are connected. This is why market tops and bottoms are ALWAYS linked with the fixed-income market. There is no such thing as regime shifts in macro that are siloed. My view is that risk assets are moving higher, HOWEVER, if this begins to change, it will almost certainly be reflected in how correlations and cross-sectional momentum shift. Cross-sectional momentum and changing correlations ALWAYS occur at macro-inflection points. (if this doesn’t make sense read the primers and feed this into chatgpt).

Insight #2: Crypto

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.