Alpha Report: ES Trade, Interest Rates, and Positioning Unwind

When chaos provides oppurtunity to those who can think clearly

Hello everyone,

In today’s world, everyone has access to the same data and information. In the past, there were more limitations around getting information or paying for data. Ever since this has changed, the highest premium in markets is given to those who can INTERPRET the data correctly.

In a recent podcast, I even went over several of these free resources on the CME website:

Data in today’s world is priced at the highest speed ever seen in history. Unless you have a latency edge (aka an advantage in speed like the HFT space), the only way to generate alpha is by having the highest quality interpretation of all relevant information. Once you establish the correct interpretation of the data, you must time your actions correctly in order to establish a position that has a different time preference or risk tolerance than the market.

Check out this resource for more on this:

In this report, I am going to cover the following:

The big picture macro regime

How the macro regime connects with imminent catalysts

The drivers behind equities and how to analyze them for the next trade

If you didn’t catch the macro podcast I did on generating exceptional returns, I would encourage you to check it out here:

The big picture macro regime:

I have been very explicit about my views on underlying growth and inflation. Fundamentally, a recession has been a low probability all year and it continues to be a low probability.

I have laid out these tensions in the following reports:

The key is managing the existing tensions. We remain in a Goldilocks regime where growth is positive and showing resilience to the level of interest rates. Additionally, inflation is decelerating which is putting less upward pressure on interest rates. As a result, we have entered the beginning of a cutting cycle where the Fed is cutting rates into positive growth.

If interest rates are the price of money and growth represents the underlying cash flows of assets, then rate cuts into positive growth are incredibly supportive for broad-risk assets. This is why we have seen a 16% rally in the S&P500 YTD.

The primary source of volatility in the interest rate space has been pricing the SPEED of rate cuts as opposed to if they will happen or not. The Fed has already been incredibly clear on this dynamic.

Michael W. Green has done a great job at laying out the dynamics we currently have with inflation. Fundamentally, inflation is significantly below the Fed Funds rate reflecting how the Fed is erroring on the side of caution:

This spread between Fed Funds and inflation is directly connected to how the forward curve is pricing the future path of the Fed’s actions. As we move through inflation data releases and FOMC meetings, the market continually shifts its expectations as information moves across the spectrum of uncertainty to certainty.

This contextualizes the macro catalysts we have over the next two weeks and directly connects to the price action of ES.

How the macro regime connects with imminent catalysts:

There are 3 primary macro catalysts over the next two weeks that will be critical for running trades in equities, interest rates, metals and fx.

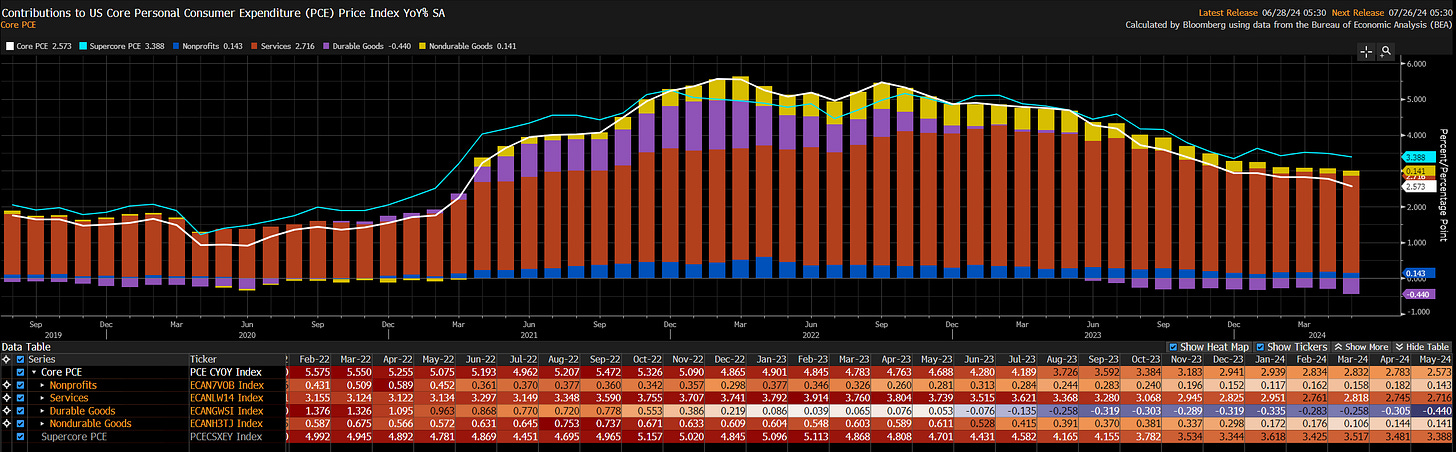

PCE data on 7/26

FOMC on 7/31

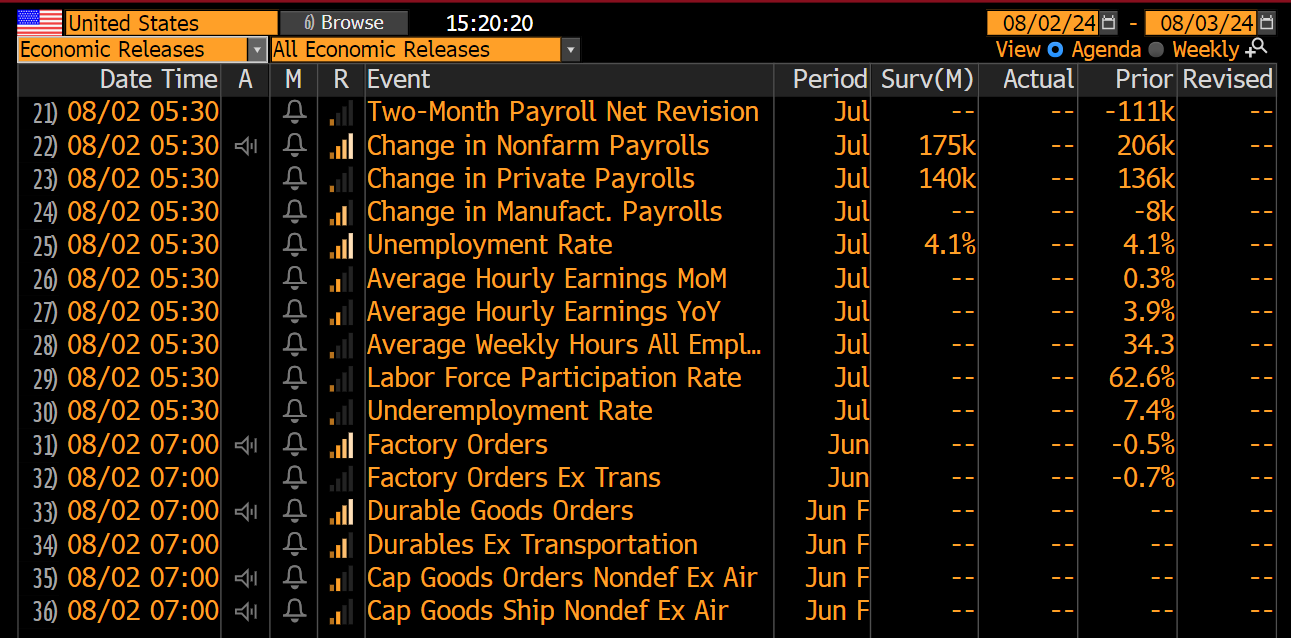

NFP on 8/2

These are important for several reasons. First, if PCE continues to decelerate by 10bps increments, this is going to keep the path of inflation skewed to the downside. If we extrapolate the speed of a dataset, we can ascertain WHEN it will arrive at a specific target. If we continue decelerating at the rate that consensus expects, we will hit the 2% target for some time at the beginning of 2025.

The Fed is clearly targeting Core CPI which is at 3.27%. However, as Michael W. Green pointed out, that inflation is not evenly distributed through the economy. There are clearly specific sectors in outright disinflation.

The goods portion of core PCE is already in outright contraction. This is really something we need to hold in tension right now.

Please reference my views on the short end and duration here for more on these tensions:

A continual decrease in inflation AT THIS SPEED, will contextualize the rhetoric by the Fed in this months meeting.

There are two main things to be thinking about for this Fed meeting:

How many rate cuts will be this year?

How does the number of cuts this year set the preconditions for cuts in 2025?

As we move through the inflation print this week and FOMC the following week, watch the SOFR contract for this year AND 2025. The 2025 December SOFR contract is pricing a 3.710% Fed Funds rate:

This brings us to the growth question and the NFP print following FOMC. All of us know that a large portion of jobs are from the government right now and the unemployment rate ticked up to 4.10%. This print will tell us HOW MUCH growth is changing in connection with inflation decelerating:

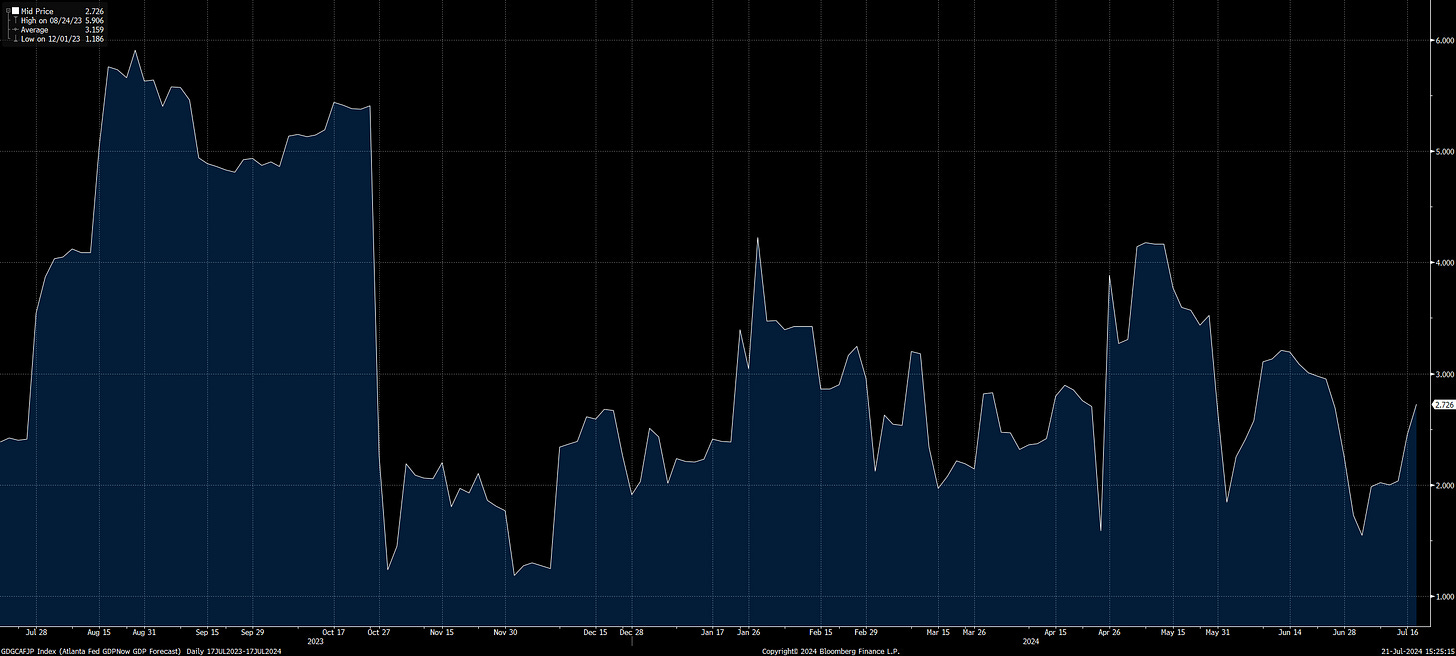

We know growth has surprised to the downside recently:

However, the Atlanta Fed GDP-nowcast is accelerating.

Understanding the macro regime and tensions frame WHY equities have sold off from their highs and WHERE they are going from here.

The drivers behind equities and how to analyze them for the next trade

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.