Alpha Report: Positioning Into Labor Market Data

How high is recession risk vs inflation risk?

Alpha Report: Positioning Into Labor Market Data

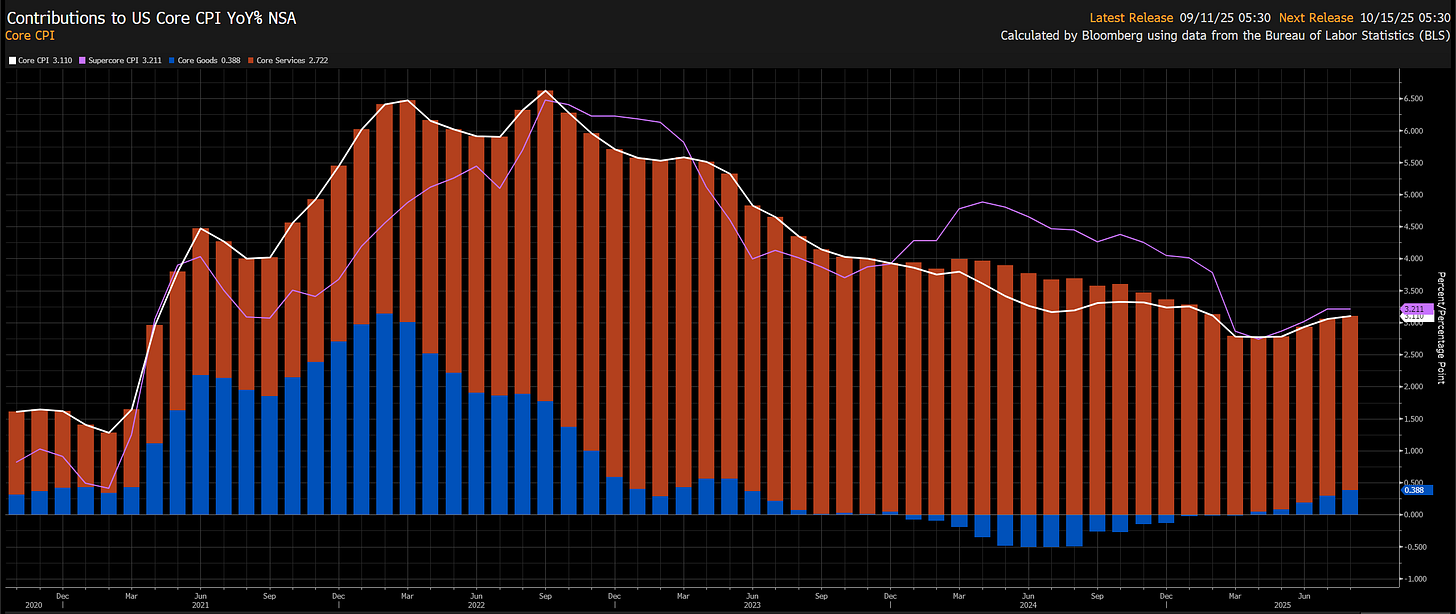

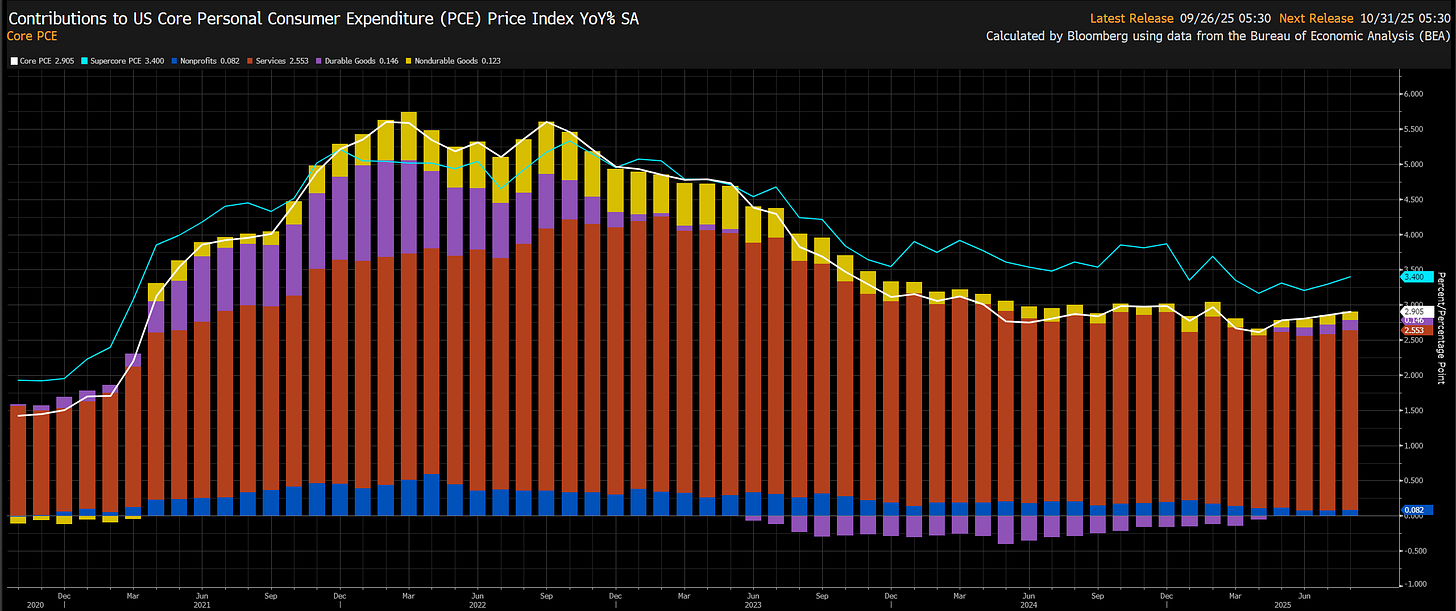

Over the last two weeks, CPI and PCE data showed inflation coming in flat but still holding above the 2% level. This matters because we are not accelerating like in 2022, nor are we decelerating like in 2023. Inflation is functionally flat. At the same time, it remains above the Fed’s 2% target. Just as we reach this stage of resilient inflation above 2%, the Fed has chosen to cut rates and lean heavily on growth rhetoric in its forward guidance to justify the move.

This is WHY the labor market data is important this week. When the Fed shifted its emphasis at Jackson Hole to supporting growth instead of making progress on inflation, it began to increase the amount of money in the system as real rates fell.

If the Fed allows real rates to fall into positive growth, it systematically pushes capital out the risk curve: (chart is 2-year real rates):

The main idea is that we continue to be in an accommodative territory for equities to rally. My view for this week is we are likely to push higher and remain ABOVE the FOMC levels/intraweek lows from last week:

This is why I ran the ES long for paid subscribers last week when we were at the 6670 level:

The macro regime for these labor market prints is directly linked with the global imbalances I laid out in this report:

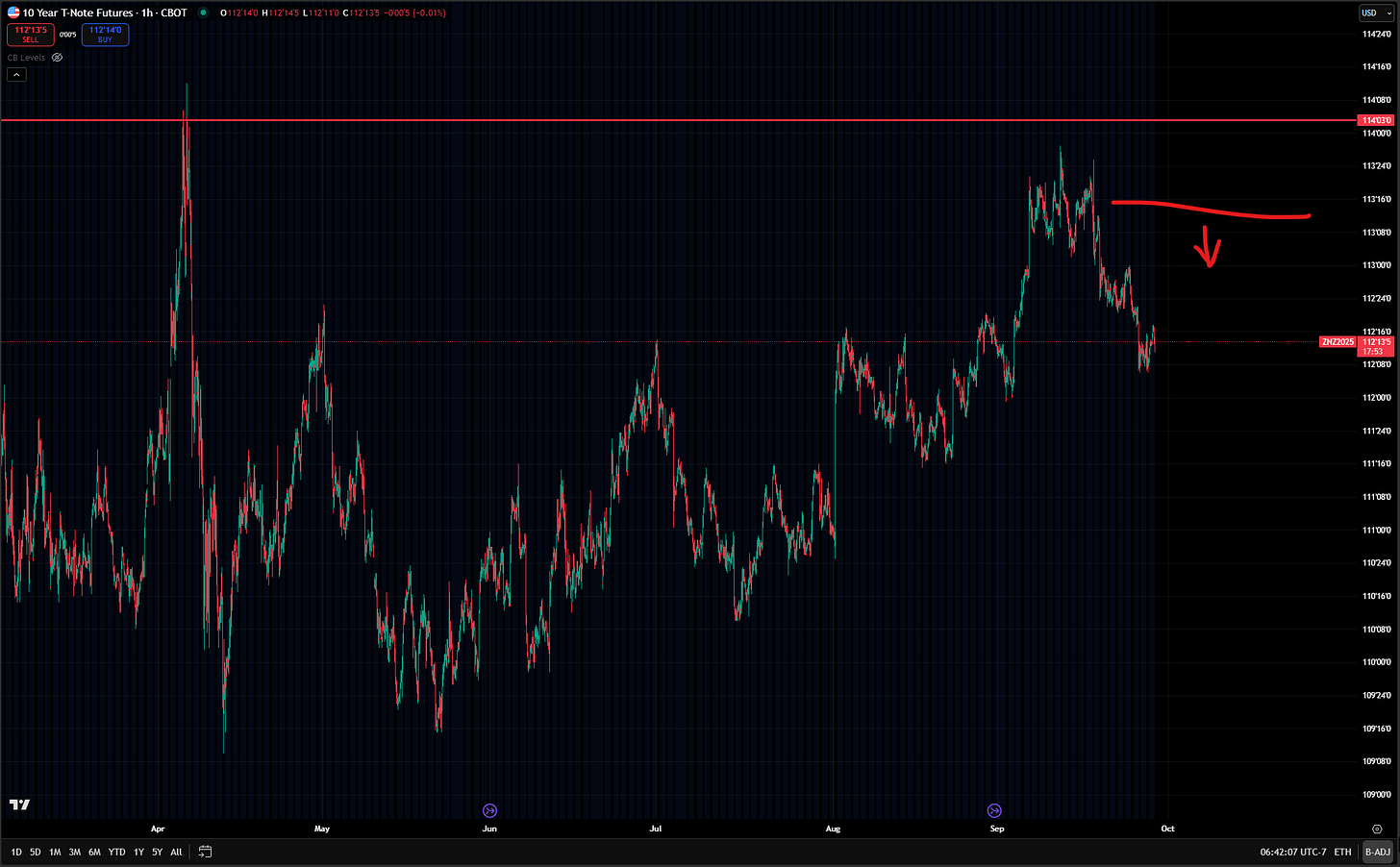

Bond Positioning:

As we progress through the labor market prints this week, I believe we are going to remain below the FOMC highs in bonds. Why? Because the Fed is cutting into resilient growth. The only reason bonds aren’t even lower is that inflation has come in flat instead of above expectations. This level is something I noted before we had FOMC: LINK

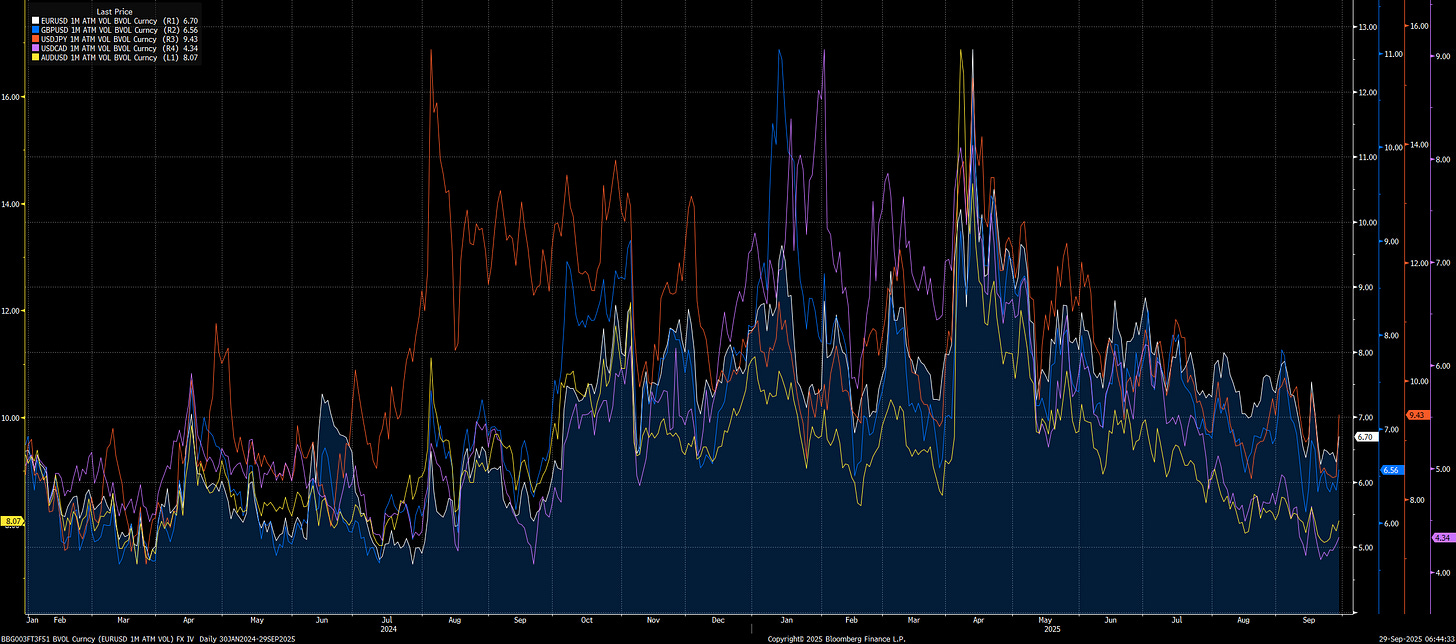

FX and bond volatility continue to compress as the Fed is cutting rates but I believe there will be a moment where the excess liquidity in the system creates larger problems in the currency or in long term interest rates:

Gold and silver are the clearest outperformers in this context as the Fed is overly accommodative into low credit spreads and the global system is on edge due to all of the international changes Trump and Bessent are attempting right now. I believe we are going to remain above the FOMC levels in the metals:

The same is true for copper. We continue to print in the risk reward I shared:

Pulling Things Together:

The regime I have been laying out in the macro reports continues to be confirmed by the flows and progression of economic data. I think the labor market prints will come in line or maybe marginally above expectations this week to show resilience in the US economy.

I would encourage people to review the recent macro reports because they frame everything: LINK

Thanks

As always, a Pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.