Country Primer: Argentina

Oppurtunities of the future

Intro To Country Primers:

We aren’t slowing down at all! The following Country Primers have been written:

All of the educational primers on macro, trading, risk management and capital flows can be found here:

Today we are focusing on Argentina because it will be one of the single most important countries for the geopolitical regime we are moving into.

Their stock market is going parabolic right now:

And this is occurring as inflation is making an explosive move to the upside:

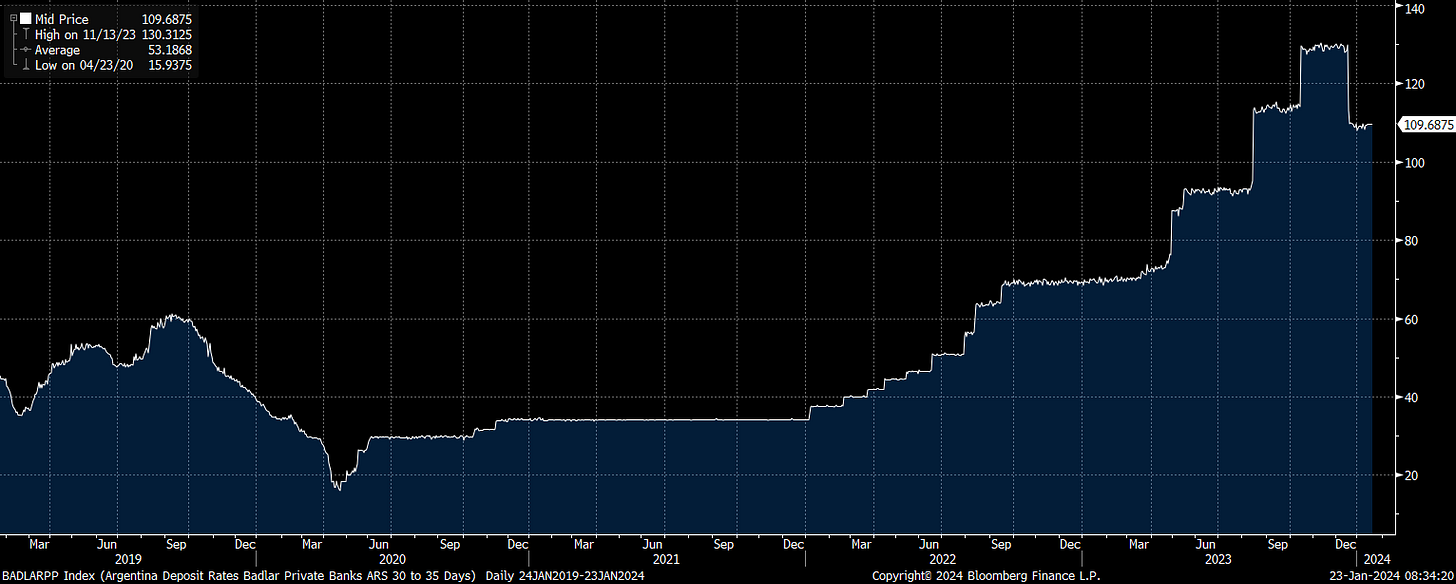

The central bank has been moving rates up on the short end to curb inflation:

And a currency devaluation has been taking place:

These are exactly the kind of events you want to see for generating asymmetrical trades because large moves are taking place that constrain large players to move significant portions of money.

While there are a lot of things happening in the short term, these events are occurring in a bigger picture context that sets the structural skew for the country as a whole. This is what we are going to break down today: the structural AND cyclical dynamics in Argentina.

As a reminder, I wrote a 5 part FX primer breaking down how to analyze and trade currencies. This will be a helpful resource for Argentina because its central bank actively manages its exchange rate. (see how countries fall on the impossible trinity for more on this):

Overview: Here is the structure for this primer

Country Overview

Geography and Demographics

Economic Data: GDP, GNI, BoP, and Balance Sheets

Financial Markets: Stocks, Bonds, and the Argentinian Peso.

History of growth, inflation, and liquidity on a structural and cyclical basis

Current growth, inflation, and liquidity regime and its connection to each financial asset

Additional resources for research and trading in Argentinian markets

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.