From Cuts to Credibility: U.S. Policy Progression Into Jackson Hole

How the Fed’s shifting forward guidance defines the balance between inflation risk and policy error.

From Cuts to Credibility: U.S. Policy Progression Into Jackson Hole

Main Idea: We are heading into the Jackson Hole meeting, where Powell will deliver a statement on monetary policy. These meetings serve as key inflection points for framing and contextualizing the Fed’s forward guidance. Understanding this one is critical given the Fed’s current risk of policy error, with its stance as overly accommodative relative to persistent inflation pressures.

Macro Regime:

I have already laid out the macro context for WHERE we are in the following report: INFLATION RISK IS GREATER THAN RECESSION RISK.

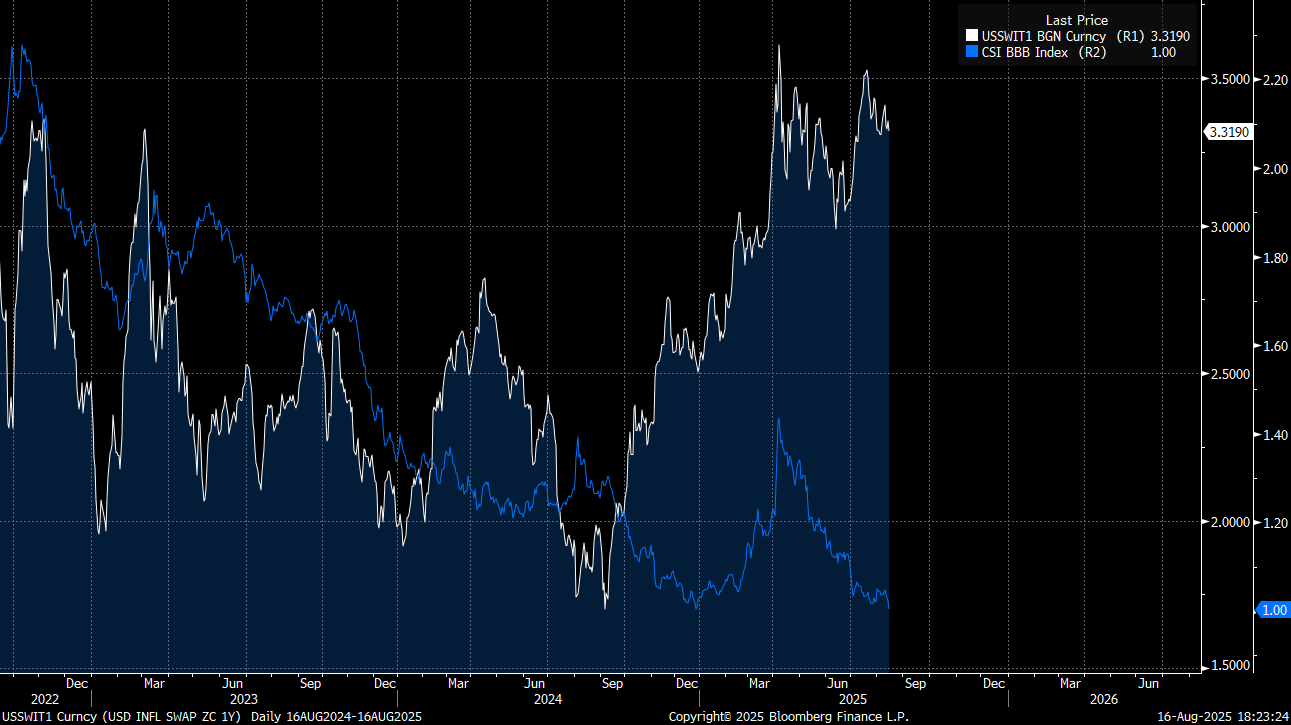

This is reflected in the recent PCE, CPI, and PPI prints as well as the significant spread between inflation swaps and credit spreads. As long as inflation swaps remain ABOVE 3% and 10s30s bear steepens, inflation risk remains above recession risk.

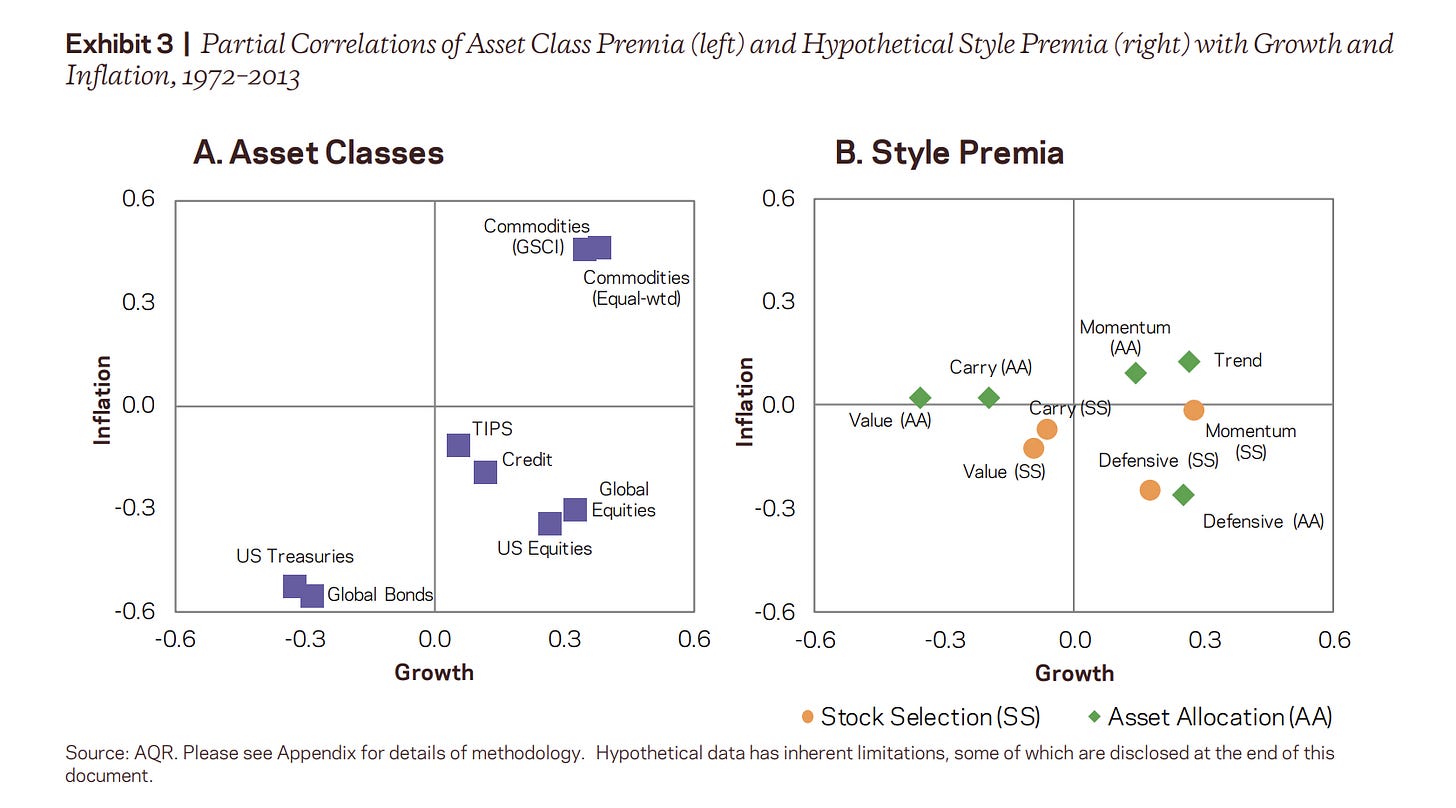

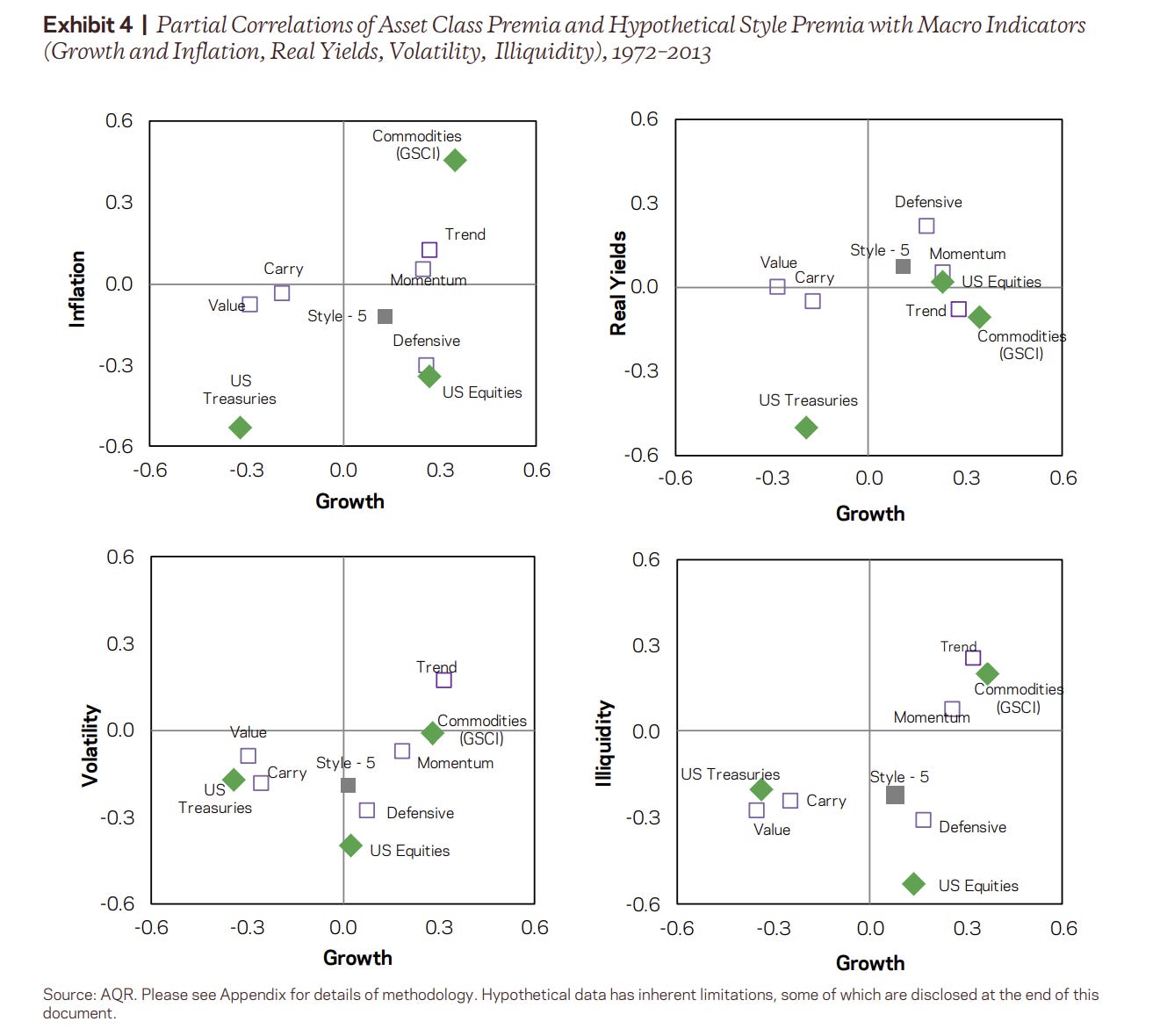

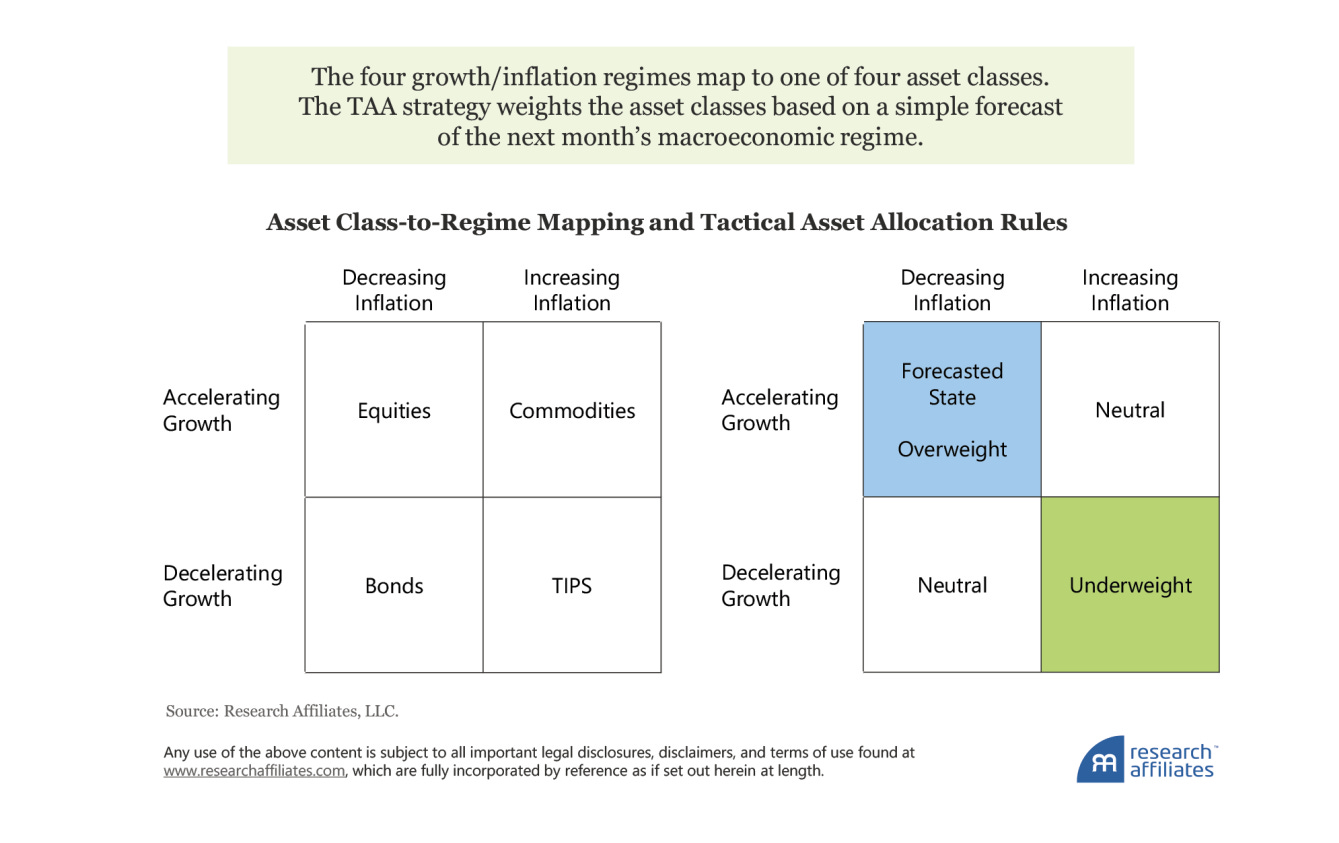

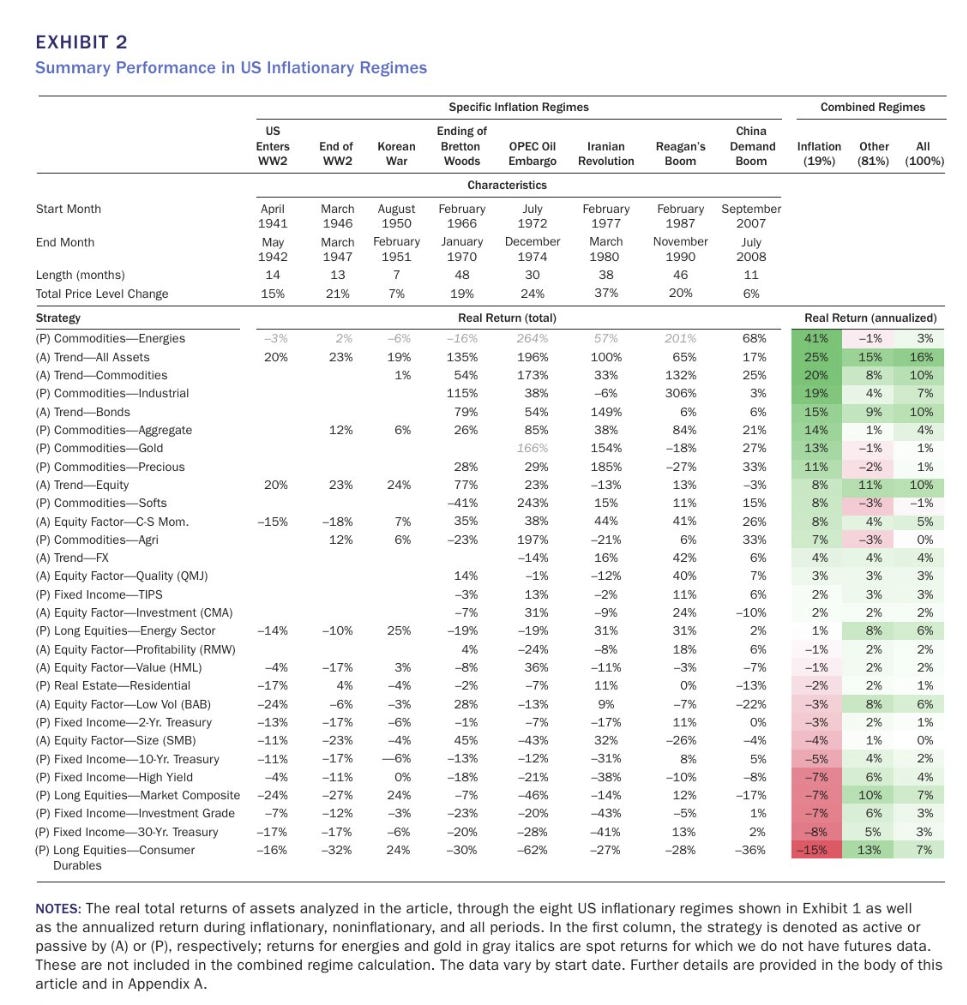

Understanding that inflation risk is GREATER than recession risk contextualizes ALL action for asset moves over the next 3 months. The distribution of returns for all assets is directly linked to WHERE we are in the macro regime. AQR has a great visual on this in its paper:

Some additional papers:

LINK (or its linked here if there are any issues with the initial link: HERE)

The implications of these papers is that if you are running any type of asset allocation or portfolio construction process, you must recognize that regimes create structural headwinds or tailwinds for assets. These regimes frame the context in which all decisions are made, shaping whether exposures work with or against prevailing macro forces. The task of the allocator is not just picking assets, but understanding which regime they are operating in so decisions are calibrated to the environment rather than made in isolation.

Macro Regime To Jackson Hole:

This sets the stage for Jackson Hole: the meeting is not just another communication point, but the venue where Powell will contextualize policy within this inflation-dominant regime. Markets are already expressing that tension in the forward curve, where rate cuts have been priced on the basis of growth risks, but the underlying reality is that inflation risk caps the Fed’s ability to deliver them (specifically, 2026 STIR pricing). The task for allocators this week is to read Jackson Hole as the re-framing moment that will either validate or challenge how the forward curve has priced the balance between growth fears and inflation credibility.

I am going to break down HOW to think about this event as it directly relates to the forward curve AND risk assets (primarily SPX and BTC). As a reminder, you can review all of the playbooks for HOW the credit cycle functions here:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.