Interest Rate Report: Inflation Risk Is GREATER Than Recession Risk

The macro drivers for WHERE we are heading in interest rates and equities

Interest Rate Report: Inflation Risk Is GREATER Than Recession Risk

Main Idea: If you only take ONE thing away from this report, it’s this: Inflation risk is GREATER than recession risk.

While we are always operating with path-dependent probabilities, the current macro regime is clearly skewing the risk-reward of rates HIGHER rather than lower. This is easy to say but difficult to actively monetize without understanding the logic of the flows. Why? Because the path to any destination in markets has a significant degree of volatility.

Methodological Framework:

I would strongly encourage you to review the following pieces on interest rates so you can understand the underlying logic for HOW I am making conclusions in the report.

All the videos: https://www.youtube.com/@CapitalFlowsResearch/videos

Interest Rate Report:

Interest rates are ALWAYS pricing the future uncertainty of growth and inflation.

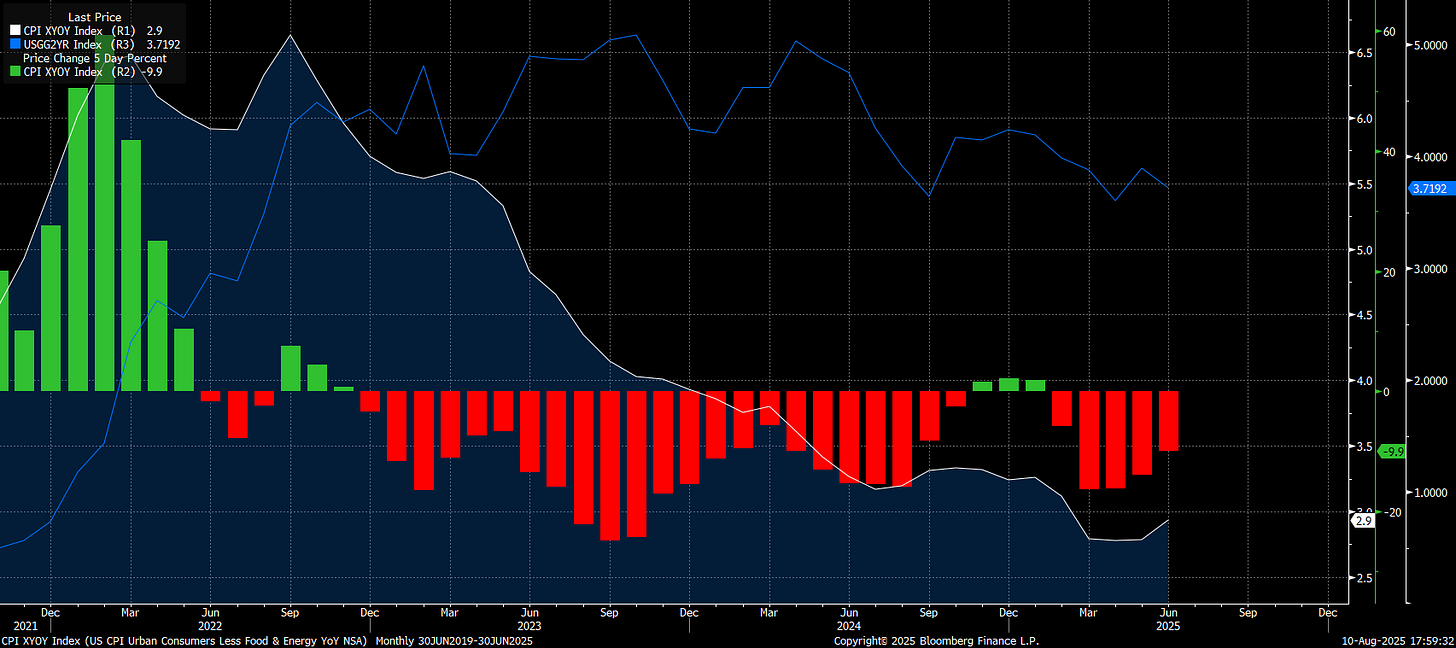

This chart illustrates how interest rates are inherently tied not just to the level of inflation, but also to its rate of change. The level of inflation anchors expectations to the Federal Reserve’s 2% target, framing the “destination” for policy. The rate of change, here shown as the 5-period lookback in core CPI, defines the “speed regime” — how quickly or slowly we are moving toward that destination. Markets extrapolate this speed: if inflation is decelerating by a known number of basis points per month, traders can estimate how many months it will take to reach a specific level. The 2-year yield in blue connects to the market’s pricing of this when, not just the where, meaning interest rates are continuously set based on where we are operating at the margin. This is why even small changes in the short-term momentum of inflation can disproportionately shift rate expectations — because they change the projected timeline to the target.

The implication of this is that even if we slow down in HOW FAST inflation is falling, it can have dramatic changes on interest rates depending on WHAT they are pricing.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.