How Much Cash Is Really On the Sidelines?

Liquidity ?

The macro-liquidity environment has confused most market participants over the past two years. Rates moved the market in 2022 but then the stock-bond correlation made a significant divergence in 2023 and 2024:

Why? Liquidity isn’t just about rates, it is about the underlying quantity of money in the system. I explained this dynamic in the article below:

Main idea: The quantity of money has been increasing as rates remain flat.

Does it make more sense now WHY fx pairs and gold have deviated from bonds? It is because of the quantity of money vs price of money netting out:

Here are the alpha trades I am running in connection with this:

The question is, how much cash is on the sidelines? Here is a chart of cash as a % of financial assets and corporate equities as a % of financial assets:

And the majority of these funds continue to be pushed into passive vehicles:

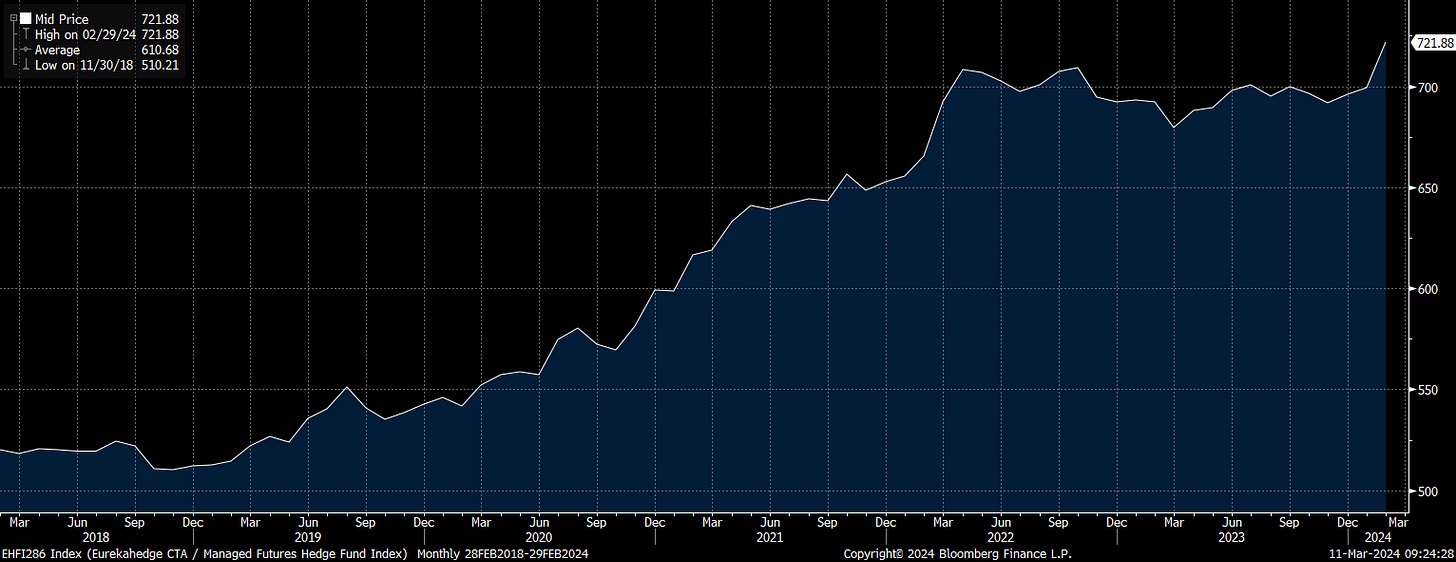

And in terms of positioning, CTA funds are beginning to tick up again as equities exhibit significantly more positive momentum:

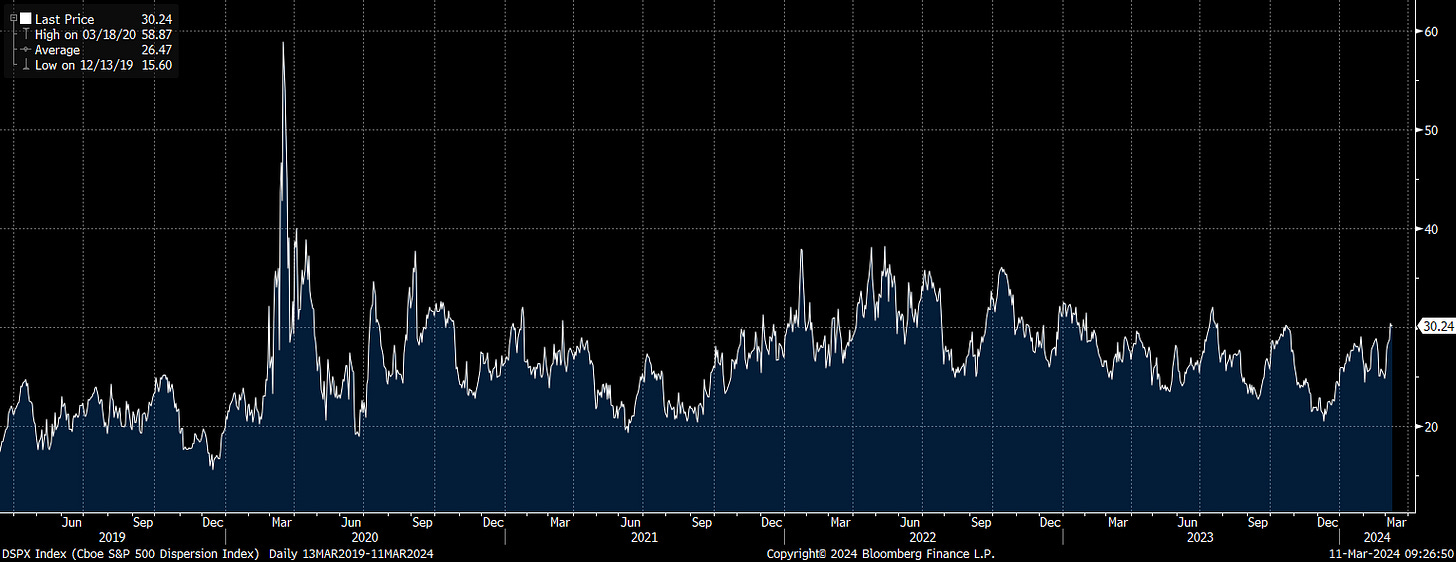

Macro conditions continue to skew equities to the upside, but there are a ton of underlying rotations and dispersions taking place. The CBOE Implied dispersion index is significantly elevated right now which reflects this dynamic:

The implication is that this is the time for active management to shine and generate alpha. Alpha is intentionally about taking returns from other market participants who aren’t as efficient as you or positioned correctly. It is zero-sum and requires 100% of your attention.

I’ll touch on it in the next macro webinar. It can be quite long tbh

Could you elaborate more on the “quantity of money vs price of money netting out” part?