How Much Risk Is Priced In Markets?

The set up moving into FOMC

The Big Picture:

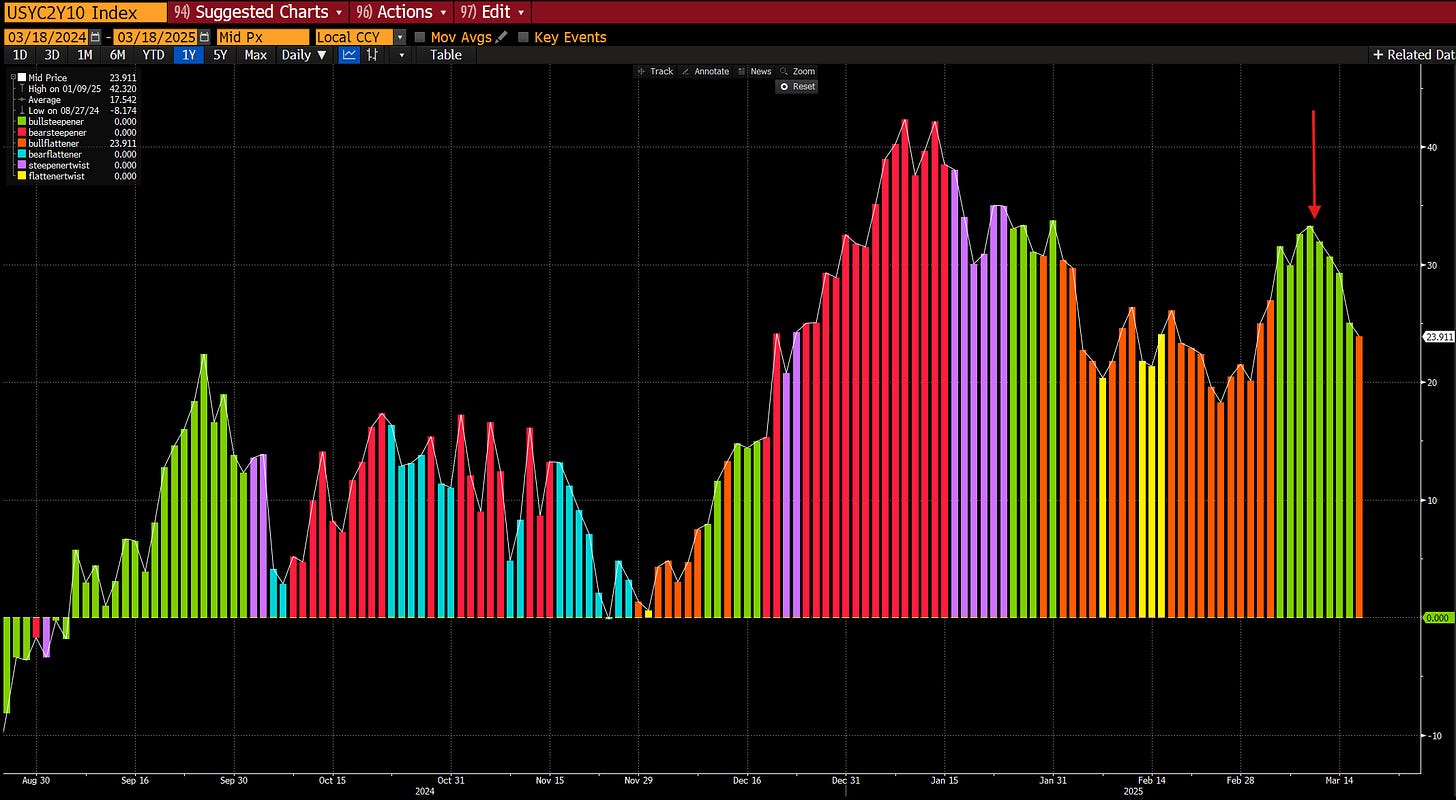

As we move into FOMC tomorrow, it is important to remember WHERE we are on a cyclical basis. The 2-year yield has made a series of short tops and the most recent one is lower than the previous two indicating that inflation risk has come down.

Every trader knows there is going to be a cut this year, the question is about WHEN and HOW MANY? On the WHEN question, the curve is pricing a higher conviction of cuts in June of this year. In my view, we are almost certainly going to get a cut between June and August. If we get the cut in June, that opens the door to a total of 3 cuts this year and the December contract pricing 75bps. If Powell pushes back against the forward curve on a marginal basis then we are likely to price out the June contract and begin pushing more cuts out to 2026 (as I laid out in the trade write-up, this sets the stage for the next trade: Link):

Notice that the pricing of these cuts occurred with bull steepening.

What Is Bull Steepening?

The Fed eases policy by cutting expected Fed funds in response to weakening short-term conditions, while long-term nominal GDP expectations remain stable or decline less, causing short-term rates to fall more than long-term rates.

The idea behind bull steepening here is that the Fed is allowing the forward curve to price cuts into declining nominal GDP expectations. The question is, will the lower rates be accommodative and supportive to the economy OR is it functionally neutral in its impact?

How can we know which one of these will take place? Notice in the chart below that the CDX index shows credit risk and the 2-year yield represents HOW AGGRESSIVELY the forward curve is pricing cuts. 2-year yields collapsed into low credit spreads during 2024. In other words, the price of money decreased while growth remained constant and the result was inflation reccelerating on a marginal basis at the end of 2024.

Where Is Growth?

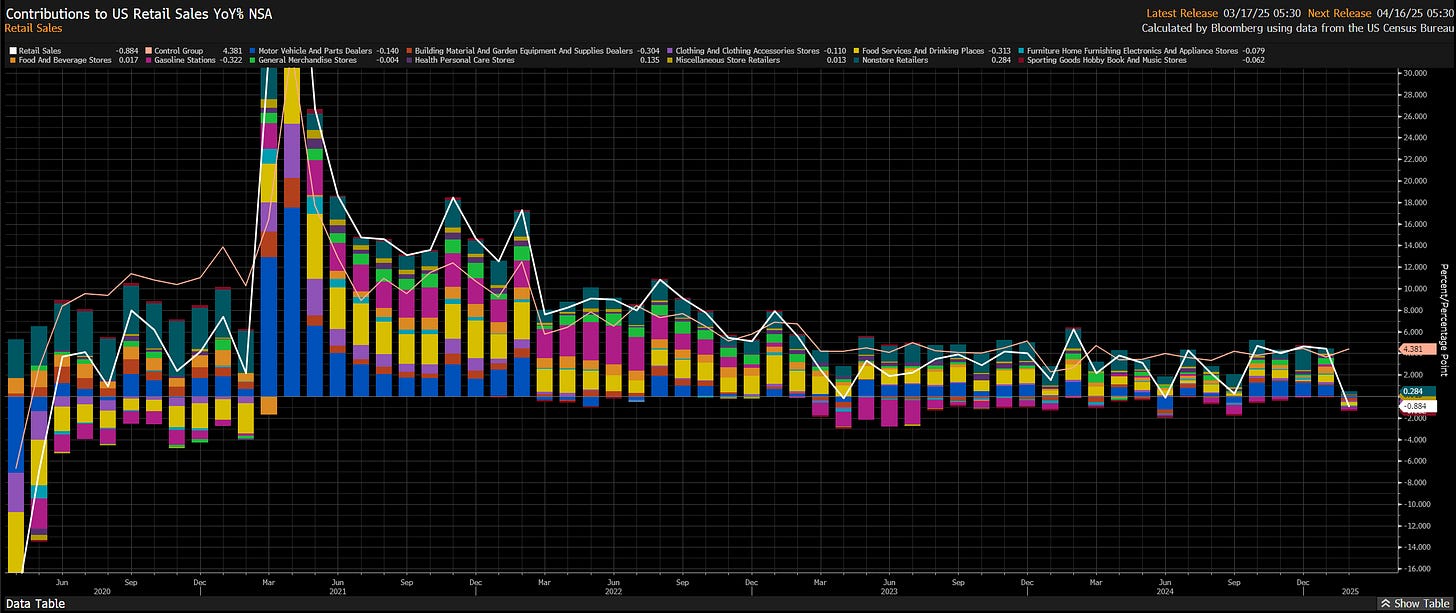

Now we are at a different place today than we were in 2024 because the LEVEL of growth is lower. The retail sales print showed this which is why bonds didn’t collapse on the day. Retail sales came in negative on a YoY basis:

NFP is showing the same tension where jobs are being added to the economy every month but definitely not at the same levels as in 2023:

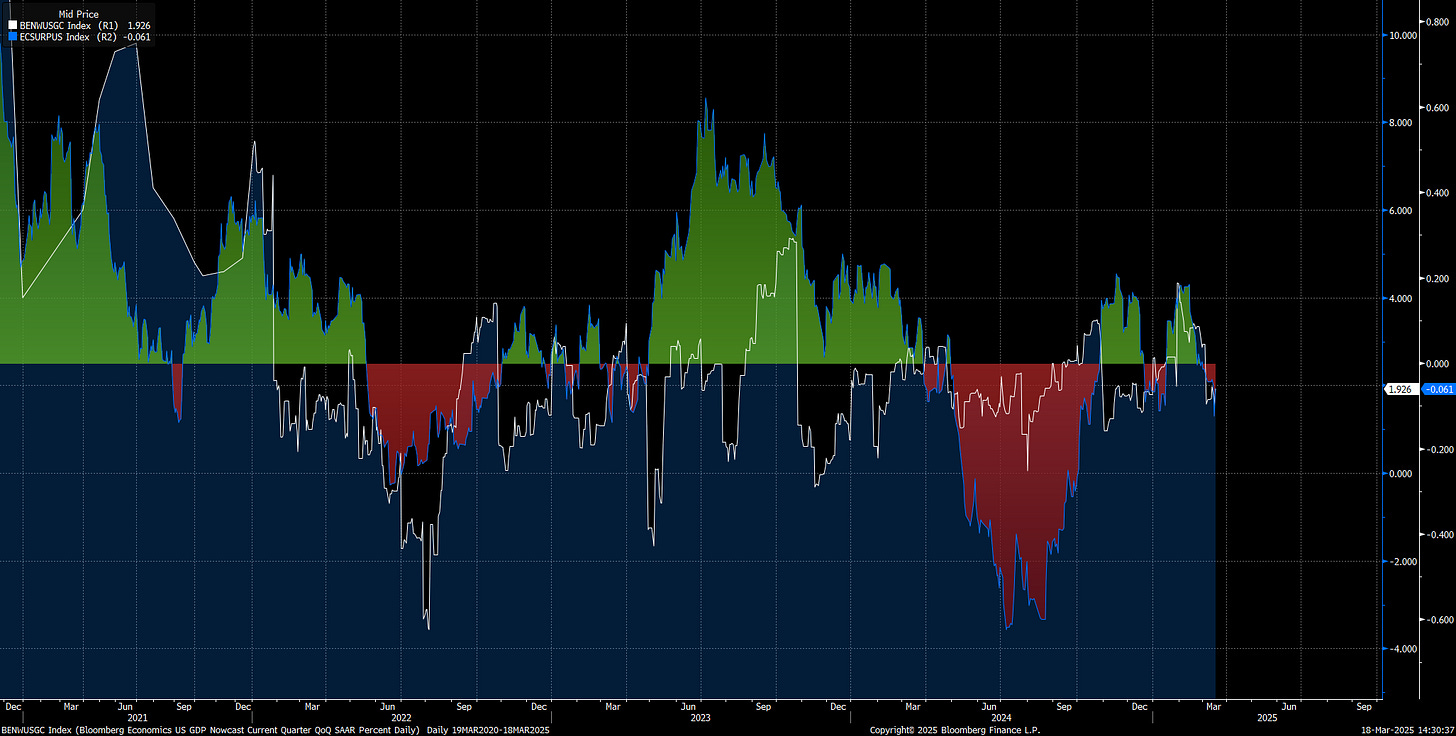

The lower level of growth is also reflected in the Bloomberg nowcast. In 2023 it was sitting above 4%. In 2024 it was closer to 3.10%. It is now at 1.9%. This is very reasonable and displays the logic of the situation: Growth is lower than the last two years but NOT negative:

It is when growth turns negative and the credit spigot to the economy shuts off that recessions happen. This isn’t occurring yet but we know the signs to watch for. See the trade write up where I cover how this connects to equity drivers and the bond trade.

See the report I published on credit risk and recession risk here: Link. Youtube video where I break this down is here:

As always, a Pepe for the culture

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.