Inflation Playbook

The single most valuable resource for managing inflation cycles

The Silo:

It is abundantly clear that a silo of knowledge exists between academics and practitioners. Most traders don’t have extensive historical knowledge of macro mechanics and most academics lack the ability to ask the questions a practitioner needs the answer to for extracting returns.

For example, an academic is primarily trying to weave a historical narrative together for the purpose of conveying information. By default, this creates the illusion of a deterministic outcome. Furthermore, academics rarely backtest their ideas for the purpose of testing the validity of their conclusions. If backtests are performed, they are rarely done on extensive datasets.

In contrast, practitioners are simply trying to find ideas with reasonable risk rewards and reasonable hit ratios. They care less about being right and more about whether a set of bets will pay on net.

The resulting silo between academics and practitioners creates a host of problems and opportunities in financial markets (and functionally every domain that involves risk-taking). I have spent significant amounts of time attempting to generate alpha in financial markets by taking advantage of this silo. In order to accomplish this, I spend time creating, systematizing, and utilizing what I call “Playbooks.” Simply put, when I build out a playbook, it is meant to aggregate all relevant academic literature, books, data, and resources on an element of the economy (such as growth, inflation, or liquidity) or financial markets (such as characteristics of price action due to market microstructure). I then take these elements and run them through a specific research process for identifying continuity and discontinuity with various points of the current cycle.

Edge:

Part of the reason behind this is that we are always trying to identify some type of edge. Anything that receives outsized focus in the media or regular Wall Street investment bank research is likely already being utilized to guide decision-making. There is still significant work that can be accomplished in this domain but the majority of work that would function as an example remains private due to intellectual property or alpha decay concerns.

While I cannot share full breakdowns of the Playbooks I currently utilize, I can share an extensive list of resources and fundamental principles. The purpose of this article is to provide you with an “Inflation Playbook” that frames the dynamics of the current inflationary regime.

Playbook Structure:

The Structure of the article will be as follows:

Inflation mechanics (causal drivers vs regressions)

Inflation In the United States (and resources)

Inflation mechanics (causal drivers vs regressions):

When analyzing inflationary regimes across multiple countries for the past several centuries, there needs to be a fundamental understanding of what causes inflation. While many people have elaborate explanations for inflation such as psychology, monetary supply, demographics, technology, war or geopolitical volatility, none of these provide a consistent causal impact that has 100% predictability.

For example:

Does x change in psychology always equal y change in inflation?

Does x change in monetary supply always equal y change in inflation?

Does x change in demographics always equal y change in inflation?

etc etc etc

Fundamentally, inflation (or disinflation and deflation) is about a supply and demand imbalance between the amount of nominal demand compared to the amount of real output (supply). While this definition of inflation (assuming its correct) quantifies inflation into two variables (supply and demand), it doesn’t explain the component parts driving each of these variables.

Breaking down a variable into two parts provides an initial way to structure variables hierarchically but it hasn’t begun to identify causal drivers that would provide some degree of predictability. For example, saying the market or inflation is driven by supply and demand is a true statement and an important presupposition but it isn’t really answering the implication behind the question. A comparable example would be if someone asked why the Twin Towers crashed and was answered with, “gravity.” While technically this might be a true answer (and obviously an important presupposition), it doesn’t take into account the underlying drivers as well as their implications (post 9/11 regulation was implemented on airport security, not gravity).

With this being said, the supply and demand side of inflation is always in a constant state of dynamic shifting. While academics or media personalities will pull on a single strand and extrapolate it to the whole to provide a retrospective and reductionistic explanation for inflation, the practitioner must correctly identify all the underlying causal drivers, quantify their potential impact, and net out these impacts with the other underlying causal drivers. These underlying drivers can be monitored in real-time via regressions and aggregated into diffusion indices to provide further visibility. For more on this, see The Origin Of Wealth and papers at the Santa Fe Institute.

While the specific data structuring will vary marginally depending on the reporting agency, every country will have the same causal drivers dynamically influencing supply and demand (see Country Primers for examples: Link). As you will see, supply and demand are actually intricately connected and have a high degree of reflexivity to them. Reflexivity (and the resulting correlations) occur when the input for one variable is the output for another variable.

Supply: this is about the quantity of goods and services that are able to be transmitted through the value chain to the final agent of consumption.

Goods are sourced from some type of raw materials and transformed into final products for consumption. However, the value chain for transforming goods into a final product is never smooth which is why we have various datasets that map prices across different parts of the value chain. For example, commodity prices, PPI data, and CPI data are all different parts of the value chain. While these typically have a reasonable degree of transmission between each other, temporal constraints can exist along the supply chain such as transportation, policy/regulation, efficiency of production, and delivery to the end consumer agent. Technology, geopolitical risk, or capital constraints can impact this value chain or the decision of agents along this value chain.

The KEY thing to note here is that at the end of the day, if any part of this value chain bottlenecks and constrains supply, this will directly impact overall inflation.

Services are primarily about labor which is directly connected to the availability of labor and the skill of said labor. The availability of labor is directly influenced by demographics and the labor force participation rate. The skill of that labor is from the level of education or training in a specific domain. The skill of labor matters when you are dealing with highly specialized components such as semiconductors.

Goods and services are directly connected and ALWAYS overlap. However, we make distinctions between them because wages have a closer to connection to services while goods have a closer connection to price inputs from materials across the value chain.

Demand: this is about the quantity of nominal demand that exists across various agents (consumers, corporates, and the sovereign).

The “nominal” distinction is key here because nominal dollars can come from two places: current income or credit. An increase in current income or credit relative to the amount of supply will result in the price of goods and services. The difficulty here is that credit and income are not always evenly distributed between agents.

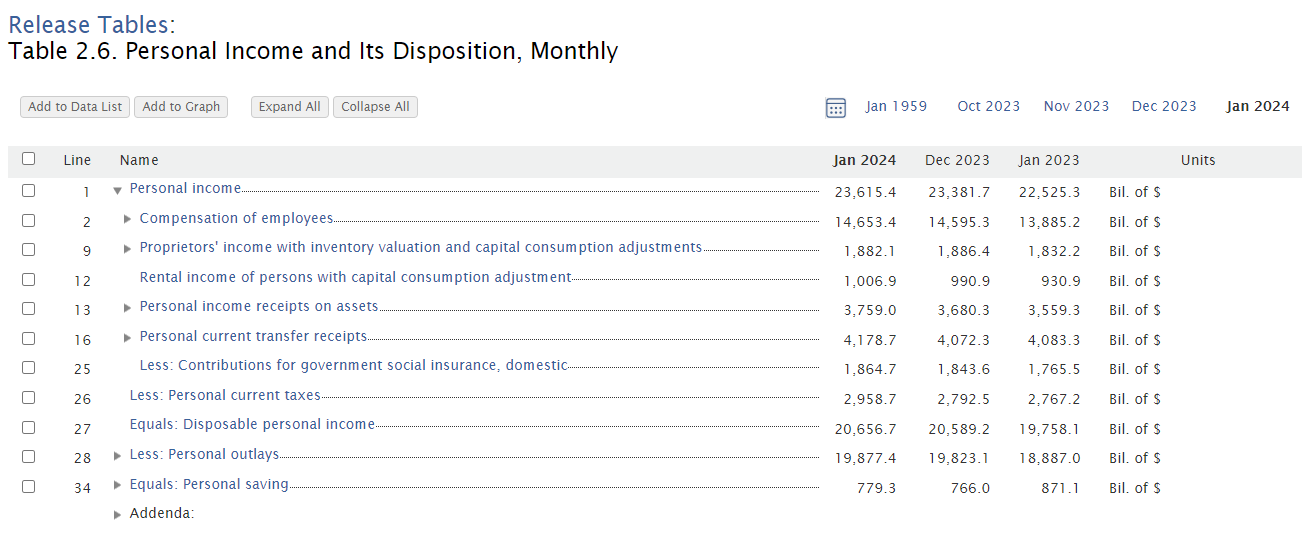

Incomes or credit creation will be reflected in the income statement and balance sheet of each agent. For example, here is the personal income and outlays data for the consumer (link). As you can see, it flows like a regular income statement in a 10-K.

Correlation and Drivers:

While there are a lot of rabbit holes we can go down for each of the underlying drivers for supply and demand, a key thing to note is the autocorrelation of underlying drivers and WHICH underlying drivers are causing an imbalance.

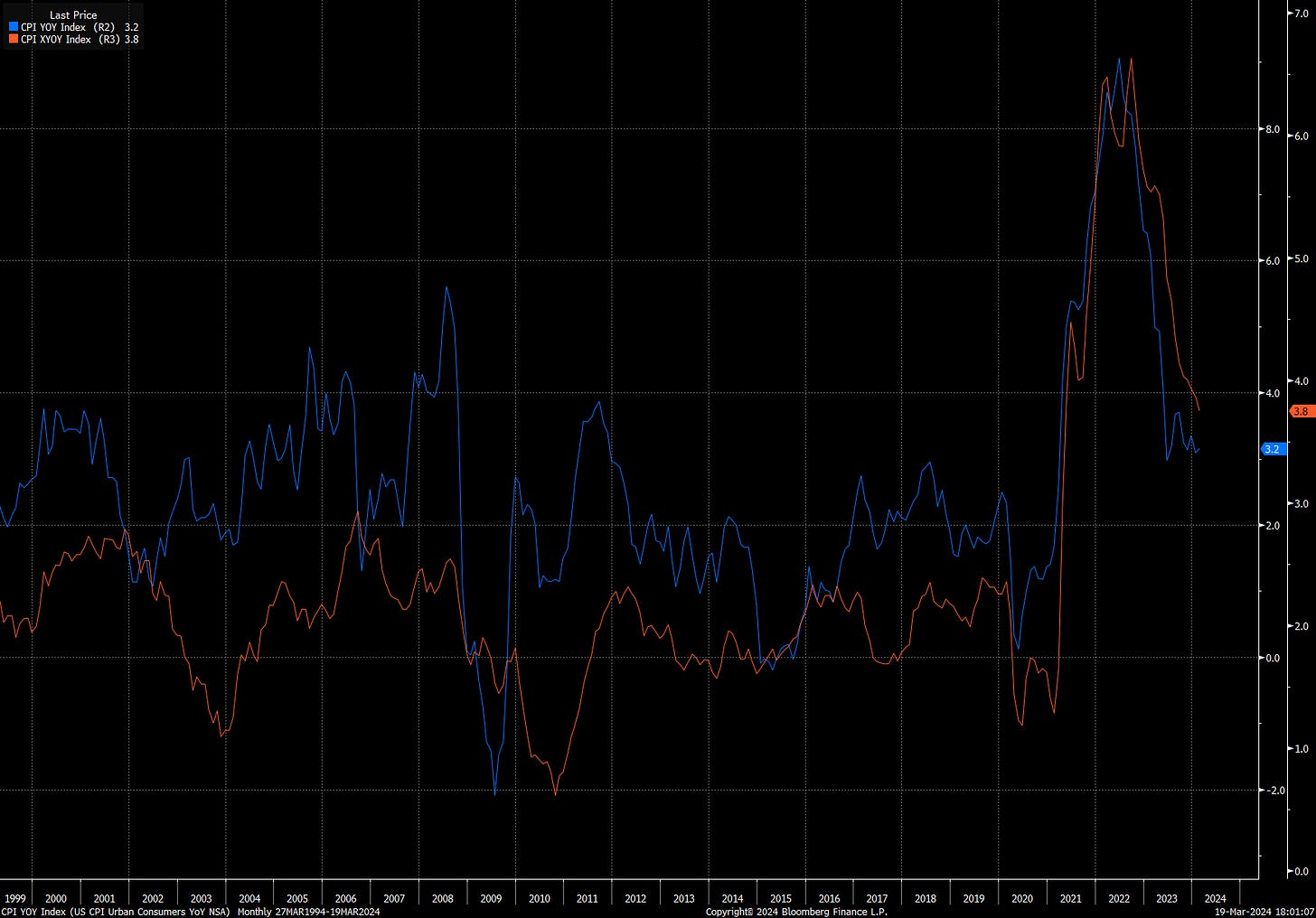

Autocorrelation is a fancy way of showing HOW MANY of the underlying drivers are moving up vs down. For example, here is a chart of the number of CPI components that are over 2% (white) with headline (blue) and core CPI (orange).

Inflation is never evenly distributed in an economy but it can reflexively feed on itself. For example, SOMETIMES higher energy prices can fuel into higher prices across other sectors due to transportation, production and gas prices. This isn’t always the case though which should be clear in the historical divergences between headline and core CPI.

Many times what I see is people making deterministic statements about how inflation works when it is always incredibly dynamic in its underlying drivers. For example, a supply chain issue can cause an immediate spike in goods inflation while demand remains constant. However, as soon as the supply chain issue is resolved, a specific agent might begin to spend more due to a change in monetary policy. This could increase demand while supply is reverting marginally resulting in a neutral net effect.

The main idea is that if you have a specific view on the drivers of inflation, you ALWAYS need to see HOW its transmitted into either the supply side or the demand side.

Government deficits CAN = higher inflation but not always

Supply chain issues CAN = higher inflation but not always

Demographic (or migration) changes CAN = higher inflation but not always

Technological changes CAN = higher inflation but not always

Once you begin to understand the transmission mechanisms for price on both the supply and demand side, then you can begin to take views on how technology might change the production efficiency of goods or services. Changes in consumption patterns (like work from home) can also be quantified on the goods vs services side of consumption in the income statements of agents.

At the end of the day, all money that is anywhere has to come from somewhere. The accounting mechanism we use to attain visibility into the economic system doesn’t imply predictability but it does provide a framework for comparing variables properly.

Now let’s get to the fun part!

Inflation In the United States:

While base effects need to be taken account, spikes in inflation are a consistent characteristic of US history. The chart below shows headline CPI (white) and core CPI (blue).

Inflation since the founding of the US (link):

It is also important to note that the consumption basket of the economy changes as any country progresses through the process of industrialization and urbanization. For example, during the 1800s a lot of inflation data was primarily based on land prices and oil prices.

Historical Data for income and employment in the United States can be found here:

Here is YoY wage data in the United States from 1820 to the early 1910s. The Civil War (1861-1865) contributed to this spike in wages: Link

Resources: I will share a number of resources on this topic and then expand on several ideas from them:

Investor Amnesia has aggregated a number of helpful datasets and has some good courses on the history of financial markets:

https://investoramnesia.com/historical-data/

Papers:

https://academic.oup.com/ooec/article/doi/10.1093/ooec/odac008/6698713

https://www.imf.org/en/Publications/WP/Issues/2017/11/13/Global-Trade-and-the-Dollar-45336

https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Fiscal-Deficits-and-Inflation-16352

https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Exports-Inflation-and-Growth-2337

https://www.imf.org/en/Publications/WP/Issues/2016/12/30/On-Credible-Disinflation-1066

https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Are-Prices-Countercyclical-839

https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Asymmetry-in-the-U-S-1872

https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Inflation-Targeting-Regimes-16239

https://www.imf.org/en/Publications/WP/Issues/2016/12/31/U-K-20945

https://www.imf.org/en/Publications/WP/Issues/2016/12/31/U-S-19378

https://www.imf.org/en/Publications/WP/Issues/2016/12/31/What-is-Keeping-U-S-44047

https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Does-Money-Matter-for-U-S-21744

https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Recent-Dynamics-of-Crude-Oil-Prices-20195

https://www.imf.org/en/Publications/WP/Issues/2020/11/13/Inflation-Expectations-in-the-U-S-49815

https://www.imf.org/en/Publications/WP/Issues/2019/12/27/U-S-48770

https://www.imf.org/en/Publications/WP/Issues/2019/08/23/The-Negative-Mean-Output-Gap-48605

https://www.imf.org/en/Publications/WP/Issues/2022/04/29/Shocks-to-Inflation-Expectations-517437

https://www.bis.org/publ/work647.htm

https://www.bis.org/publ/econ24.htm

https://www.bis.org/publ/work1152.htm

https://www.bis.org/publ/bisbull55.htm

https://www.bis.org/publ/work1082.htm

https://www.bis.org/publ/work1054.htm

https://www.bis.org/publ/work883.htm

https://www.bis.org/publ/work759.htm

https://www.bis.org/publ/work776.htm

https://www.bis.org/publ/work485.htm

https://www.bis.org/publ/work1056.htm

https://www.bis.org/publ/othp30.htm

https://www.bis.org/publ/work1141.htm

https://www.bis.org/publ/bppdf/bispap49.htm

https://www.bis.org/publ/bisbull67.htm

https://www.bis.org/publ/work809.htm

https://www.bis.org/publ/econ11.htm

https://www.bis.org/publ/work980.htm

https://www.bis.org/publ/work713.htm

https://www.bis.org/publ/work623.htm

https://www.bis.org/publ/work895.htm

https://www.bis.org/publ/work1077.htm

https://www.bis.org/publ/arpdf/ar2014e3.htm

https://www.bis.org/publ/work896.htm

https://www.bis.org/publ/work185.htm

https://www.bis.org/publ/bppdf/bispap89.htm

https://www.bis.org/publ/bppdf/bispap03.htm

https://www.bis.org/publ/bisbull47.htm

https://www.bis.org/publ/bppdf/bispap89b_rh.pdf

https://www.bis.org/publ/work1028.htm

https://www.bis.org/publ/qtrpdf/r_qt2103x.htm

https://www.bis.org/publ/bisbull28.htm

https://www.bis.org/publ/bppdf/bispap142_a_rh.pdf

https://www.bis.org/publ/bppdf/bispap89n.pdf

https://www.bis.org/publ/work196.htm

https://bis.org/publ/bisbull48.htm

https://www.bis.org/publ/work1077.pdf

https://www.bis.org/publ/bppdf/bispap77.htm

https://www.bis.org/publ/work1047.htm

https://www.bis.org/publ/confp04.htm

https://www.bis.org/publ/bppdf/bispap133.htm

https://www.bis.org/publ/arpdf/ar2022e2.htm

https://www.bis.org/publ/bisbull60.htm

https://www.bis.org/publ/bisp05.htm

https://www.bis.org/publ/bisbull82.htm

https://www.bis.org/publ/work602.htm

https://www.bis.org/publ/work1114.htm

https://www.bis.org/publ/work582.htm

https://www.bis.org/publ/work427.htm

https://www.bis.org/publ/othp78.htm

https://www.bis.org/publ/work789.htm

https://www.bis.org/publ/work464.htm

https://www.bis.org/publ/work688.htm

https://www.bis.org/publ/work791.htm

https://www.bis.org/publ/econ24.htm

https://www.bis.org/publ/econ11.htm

https://www.bis.org/publ/econ3.htm

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

Framework for moving forward:

Inflation and deflation consistently exert themselves throughout history in the United States. In the early years of the country, the primary drivers of inflation were oil, railroads, and land prices. Today, consumption baskets have shifted to have significantly more service spending and more complexity around the value chain.

There are several things you want to keep in mind when going through these papers and studying inflation:

First, identify how specific drivers transmit into the net supply and demand impact that moves inflation datasets. You MUST connect these to the actual data and market pricing.

Second, identify why a specific driver is taking place, where it falls on the value chain, and if it is likely to persist.

Third, remember that most market participants are only looking at the datasets for inflation and not the WHY for each of those components. Understanding these WHYs is how you can get an edge into the persistence and speed of inflation in a specific direction. You can also begin to connect these specific inflationary drivers to single-name equities and their respective income statement line items.

While growth and inflation set the distribution of returns for all major assets, their dispersion is what allows you to identify outperformance within assets (From The Long Good Buy):

While this article is by no means comprehensive or include very qualification for inflation and how to trade said regimes, it can function as a foundation for further direction.

Conclusion:

There will always be a place for the individual who can correctly identify underlying drivers and show how they have continuity and discontinuity with the past. This serves as the prerequisite for knowing the future distribution of probabilities and how to take bets on it. Knowing the present incredibly well and how it fits into a larger dataset is what sets the foundation for properly extracting returns from future unknowns.

While this article primarily focused on the US, I will be releasing several others that cover other G7 countries.

The best is yet to come! Check out the most recent alpha generation report if you’re trying to understand how to implement these types of things in real-time:

Keep studying

😈

What a sea of papers. I haven't even finished those recommended resources on carry. I'm starting to doubt you're actually a ruthless AI that feeds on endless information...