Interest Rate Update: QRA

Bond shorts won't pay

In the interest rate report I published on July 9th (link), I noted that the whole supply-side dynamics were decreasing significantly in their impact on markets:

In 2023 everyone found out what the QRA actually was and since then have been over-extrapolating it to markets. We saw this again today with bond shorts expecting a down day on the QRA announcement. This idea that bonds are going down continues to be falsified because of where we are in the cycle. Remember, your view of the long end is a derivative of your view of the short end.

If all of this is new to you, check out these resources:

Interest rate primer: Link (this has a comprehensive list of resources to learn about interest rates)

Macro Alpha Webinar With Prometheus Research: Link (this is a breakdown of how term premia and the curve works with Prometheus Research. If you aren’t following them, you should definitely do so now!)

All the macro educational articles I have written: Link

I have laid out where we are as we move into FOMC this week here:

The QRA announcement today continued to show that the supply side doesn’t matter to bonds right now.

What does matter for interest rates? The yield curve and aggressiveness in rate cuts through 2025. The yield curve remains inverted which means it is difficult for capital to move out the duration risk curve when they are receiving lower yield than the “T-Bill-n-Chill” trade.

ZN continues to move UP in confluence with the views I have laid out over and over (see views here: Link)

While the curve is bull flattening marginally today, it will be Powell’s forward guidance that will set the stage for the next move:

We are likely to see the Move Index push DOWN as we move through FOMC and this will set the stage for cross-asset volatility to move back down as well:

We can already see the beginning of this as the VIX rolls over from its highs:

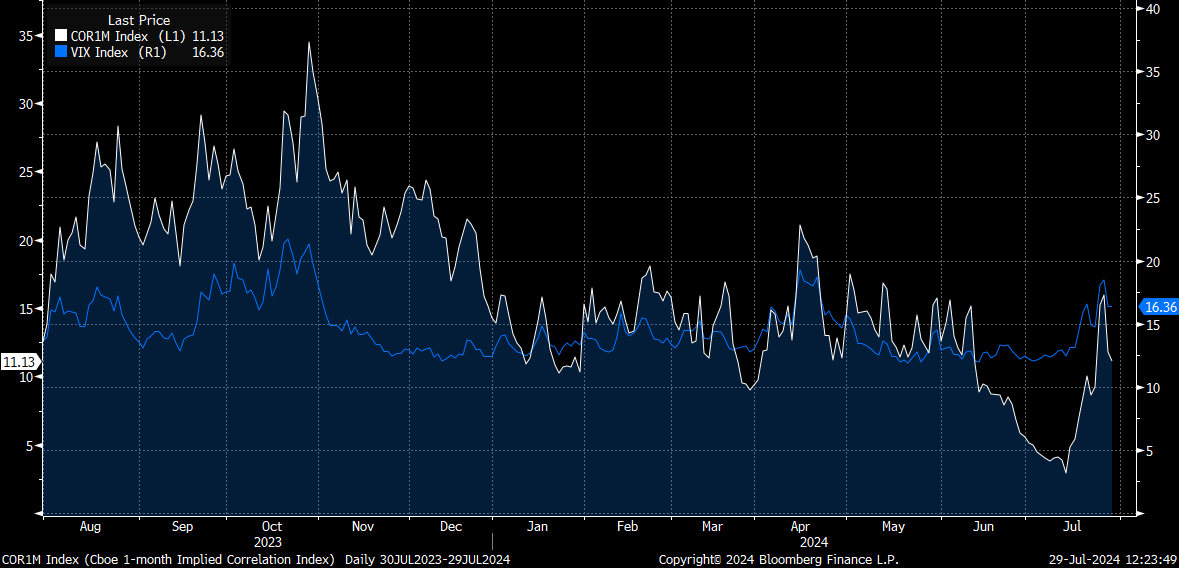

And implied correlation is reverting back down:

As I noted over and over, this pullback in equities has been driven by an unwind in positioning as opposed to a recessionary impulse in the economy:

All of the trades I have on are laid out here:

For now, we wait and prepare