Macro Insights/Report: CPI Set Up

Prices are shifting

We are entering a pivotal period of time with how inflation prints are coming out and HOW the forward curve is pricing rate cuts. I just published the macro report that provides a clear picture of how these tensions are unfolding. I think this is an important period of time for trading so I turned on free trials for the next week so you can read the macro report:

Why is this period of time important? Well we have a tension between the passive flows that Michael W. Green noted in the podcast I did with him (link) and economic data.

Notice that the ISM prices index came in well above expectations today. This will directly influence HOW traders position into CPI:

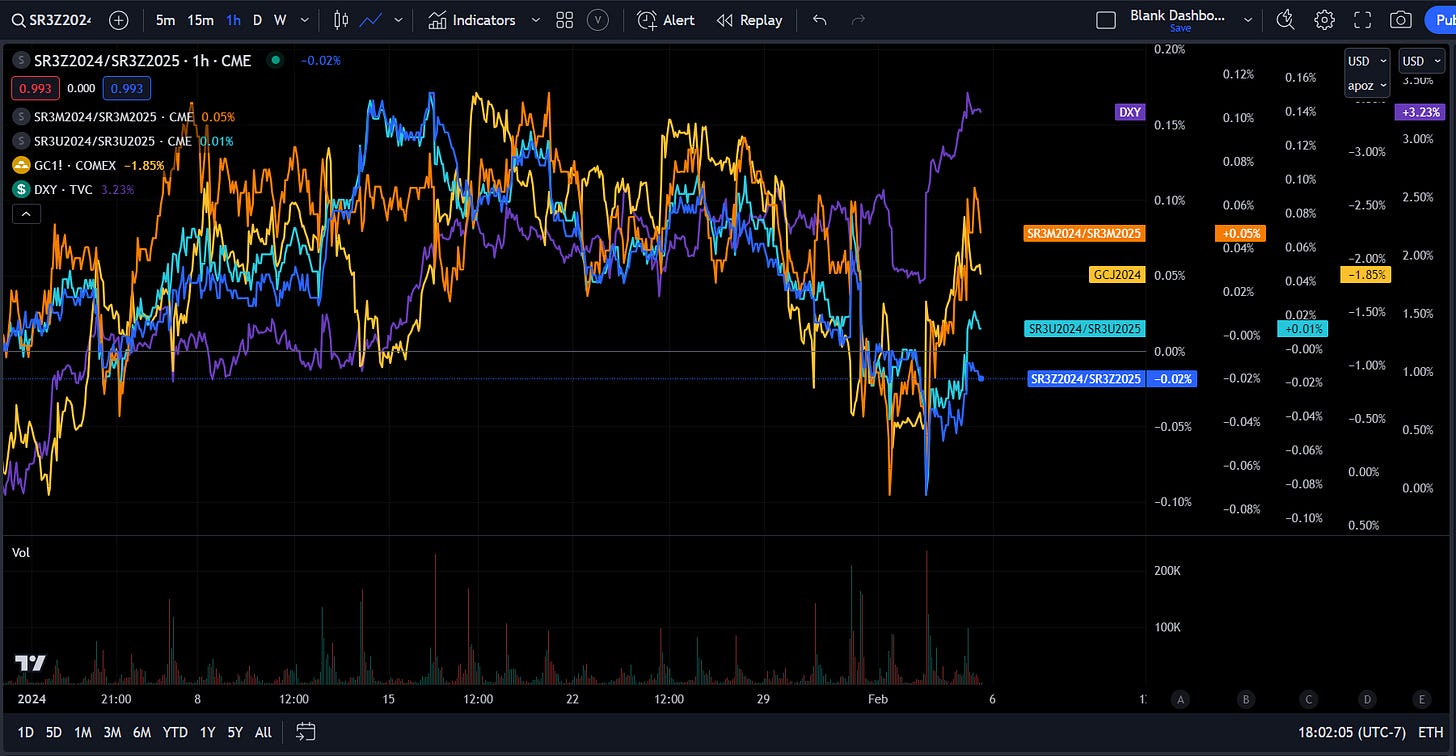

You always need to think multiple weeks ahead in terms of positioning for execution and think 3-6 months ahead for a macro view. For example, notice that SOFR spreads between 2024 and 2025 rose considerably today:

Why do these spreads matter? Basically, these spreads quantify the relative hawkishness/dovishness that the forward curve is pricing between 2024 and 2025. These spreads are directly impacting FX and metal positioning. Notice how the dollar and gold moved in lockstep with these spreads today.

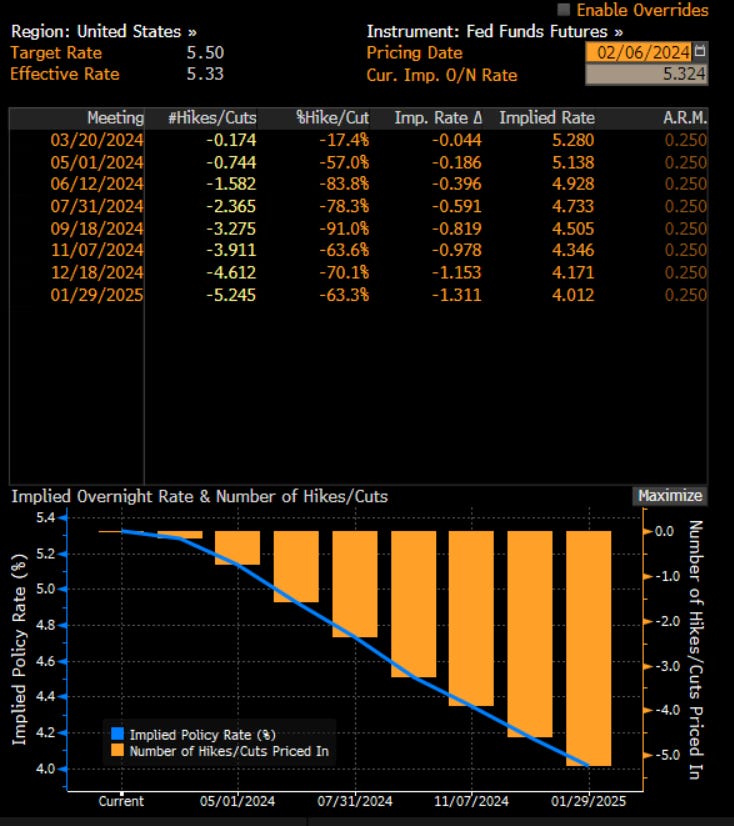

Just last week the May contract was pricing an almost 100% probability of a rate cut and now it’s down to 57%:

This directly impacts risk flows across markets. However, Mag7 continues to rally!

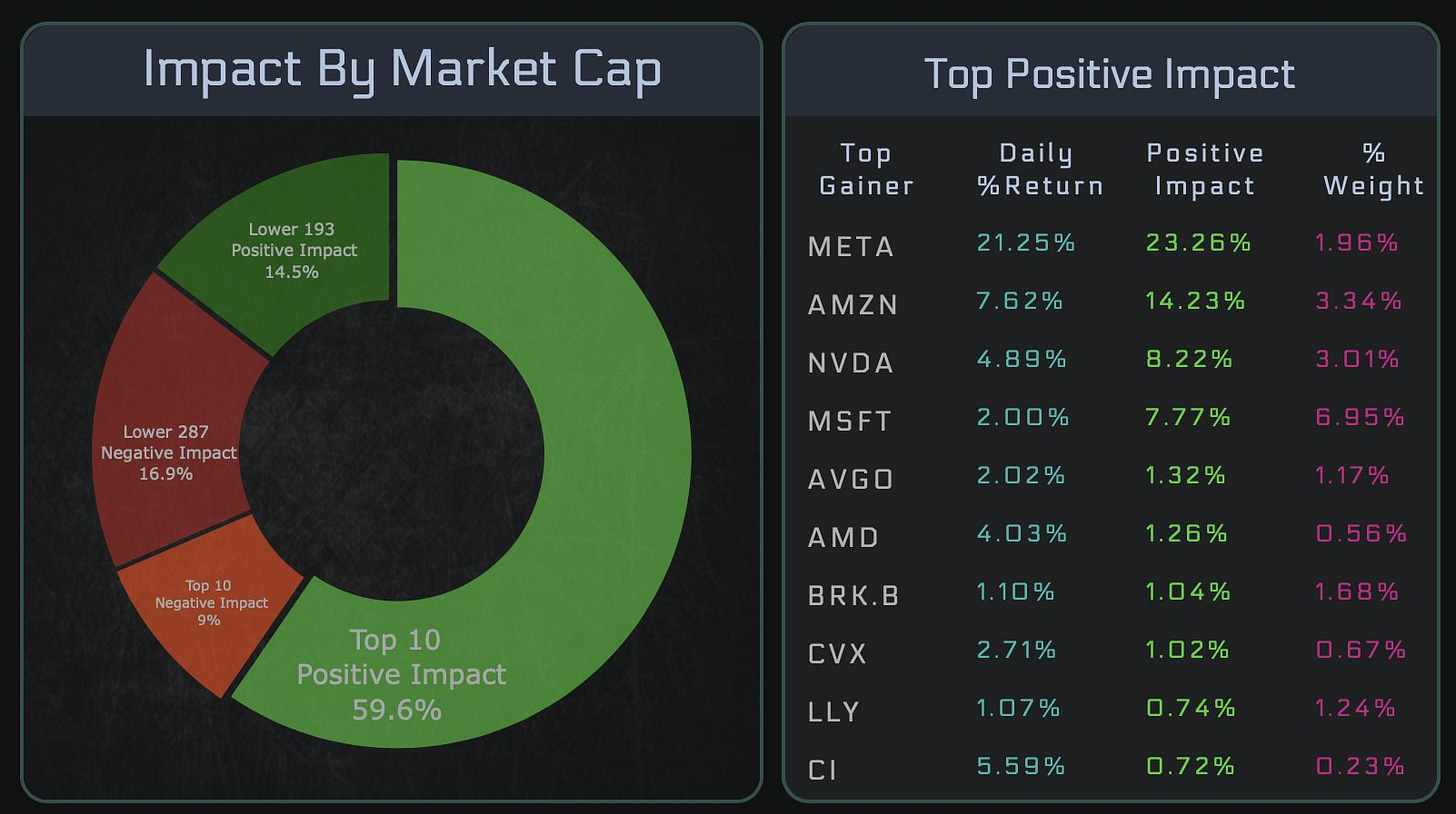

In periods of low breadth in markets, Mag7 holds an outsized impact for moving the index. If you are taking a view on the S&P500 or any global equity, these signals should be direct inputs for how you are thinking.

Notice how bonds are diverging from ES here:

Why? META, MSFT and NVDA continue to rally with incredible strength:

You’ll also notice TSLA has been moving down and AAPL and GOOGL sold off post earnings. What do you think happens when these stocks rally and join NVDA and META?

T1alpha has done a great job at quantifying this impact with their tools:

On top of this, we are seeing other names like PLTR have earnings come in above expectations. PLTR had a marginal pull back but it has been part of the AI and risk on flows due to falling real rates:

This is why PLTR has rallied from the lows at the same time as BTC:

We are also seeing names like CVNA consolidate. If beta continues to rally, we could see a considerable gamma squeeze in CVNA again as the price rises with implied vol. The call skew on these types of names is key to watch!

This is all occurring while the Atlanta FED GDP nowcast is accelerating significantly:

The PCE nowcast is diverging from breakevens which is why these signals need to be monitored so closely moving into this week. Traders will position for next week’s CPI this week:

Bringing It Together:

All of this comes back to the video I shared in the synthesis article (link): You want to be an exceptional redundancy planner so that it almost looks like you had a false start in your ability to act.

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

Keep your seat at the table and always be ready to swing