Macro Liquidity and Positioning In Bitcoin/MSTR

Everything is setting up for capital to move out the risk curve

Macro Liquidity and Positioning In Bitcoin/MSTR

Charts From Video:

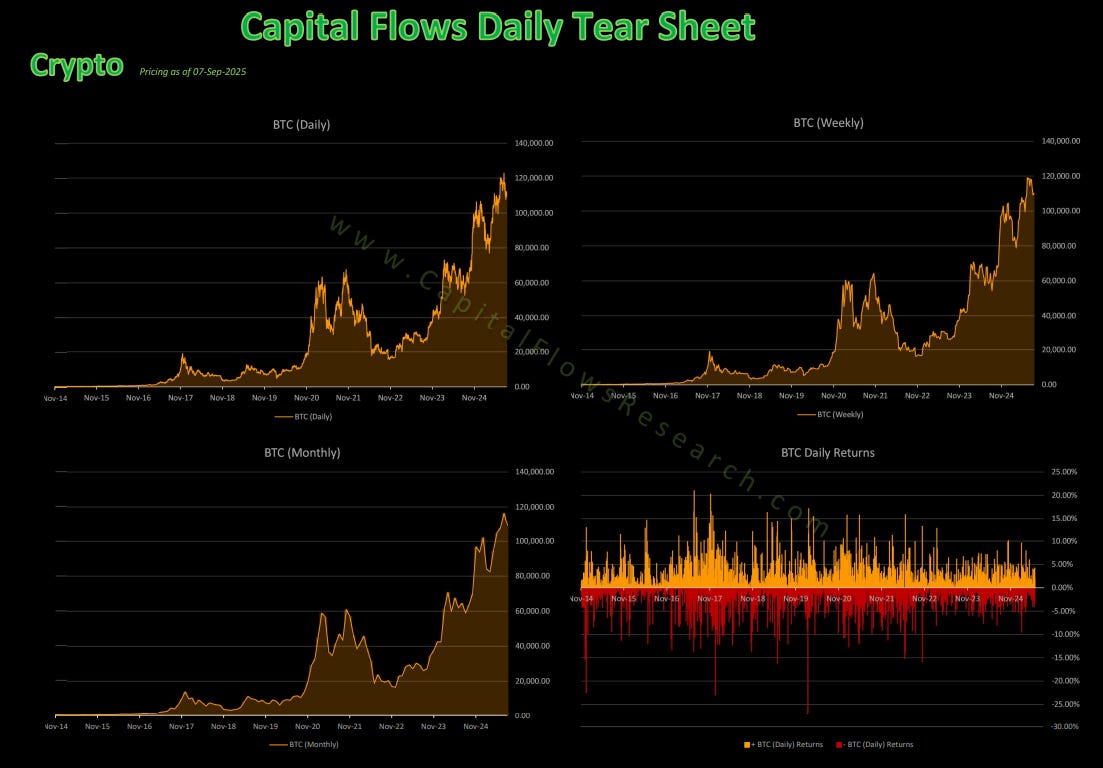

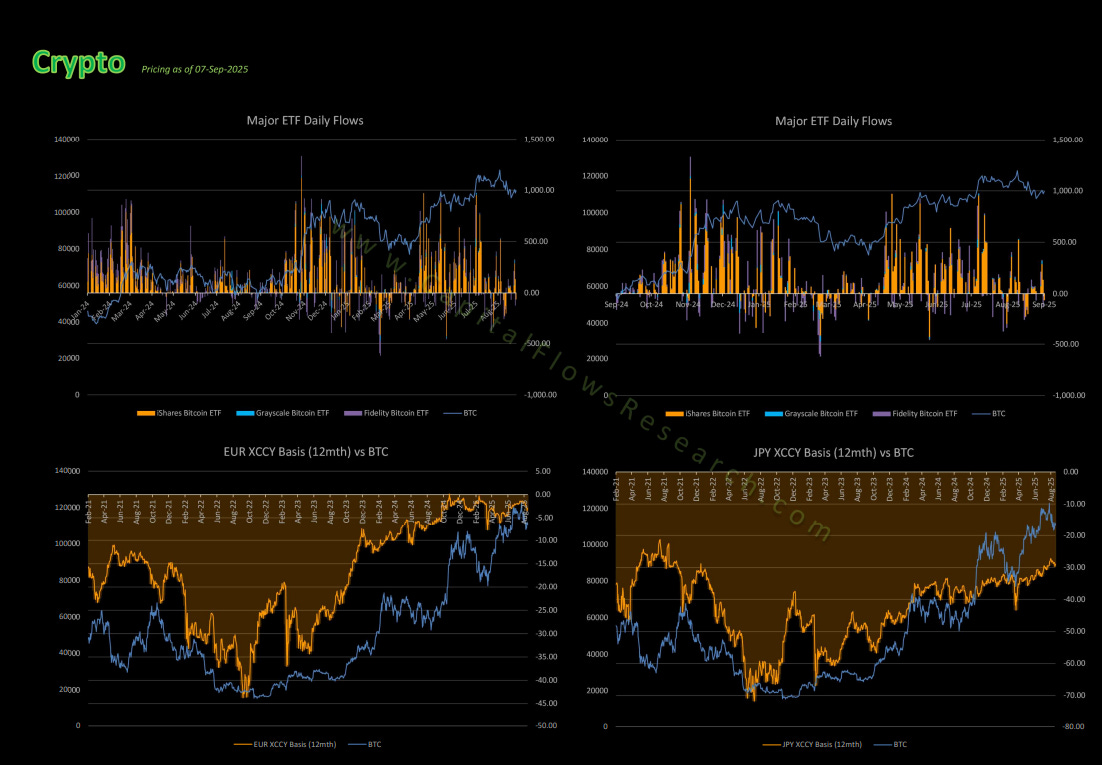

Crypto Tear Sheets are sent out daily to subscribers and can be found on this tab: LINK (these are 100% free)

Bitcoin PlayBook and TradingView Indicator:

Bitcoin Indicator From Tradingview: LINK

All the educational primers, models, and playbooks:

Positioning and Flows Analysis In The Macro Regime:

I already laid out my views on interest rates, macro liquidity, and the cycle here:

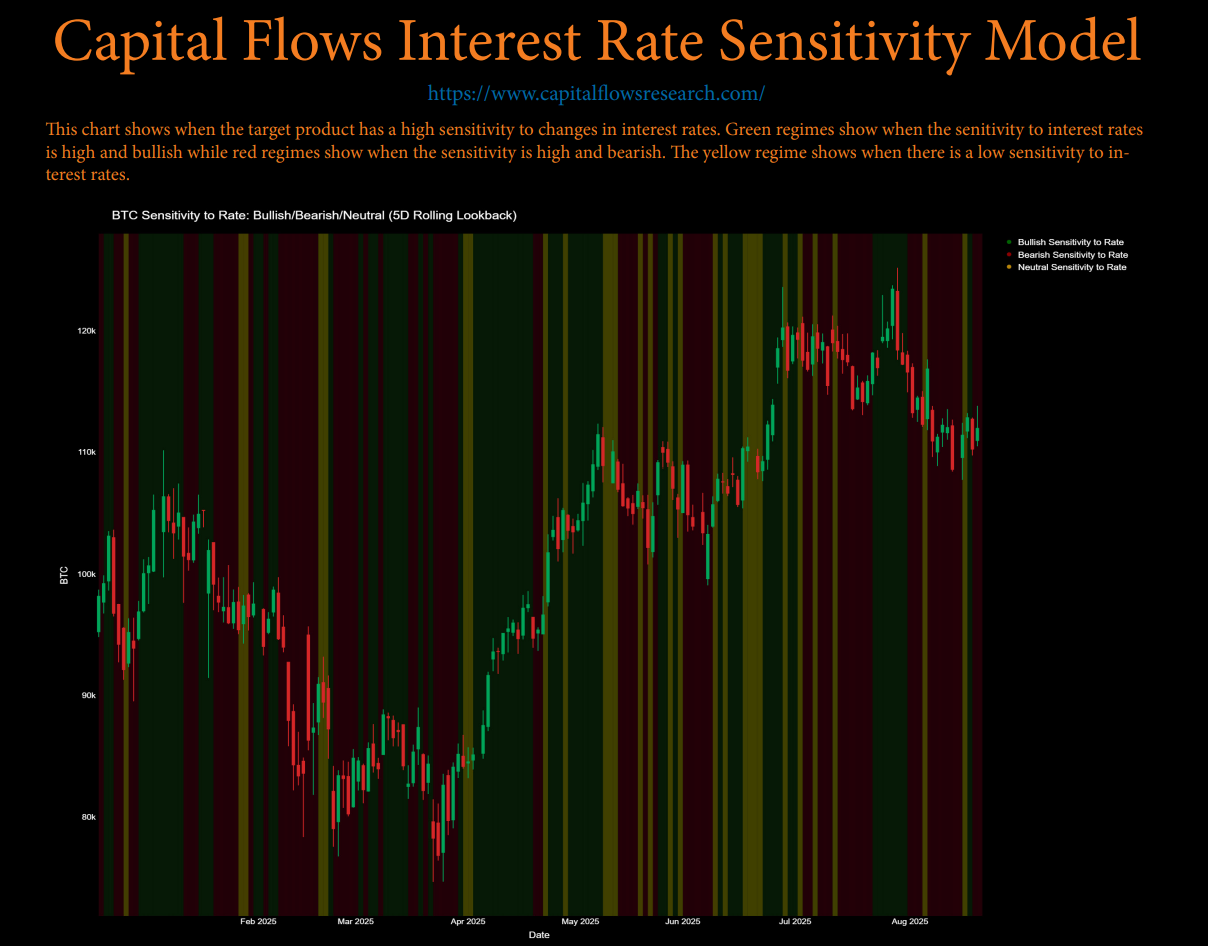

As I noted in the report, if you understand HOW interest rates contextualize everything, then you will know that it is the price of money. All goods, services, and assets are priced in MONEY. Bitcoin specifically is a release valve for macro liquidity, which means its sensitivity to interest rates is THE most critical thing to know when predicting the price.

Macro Flows:

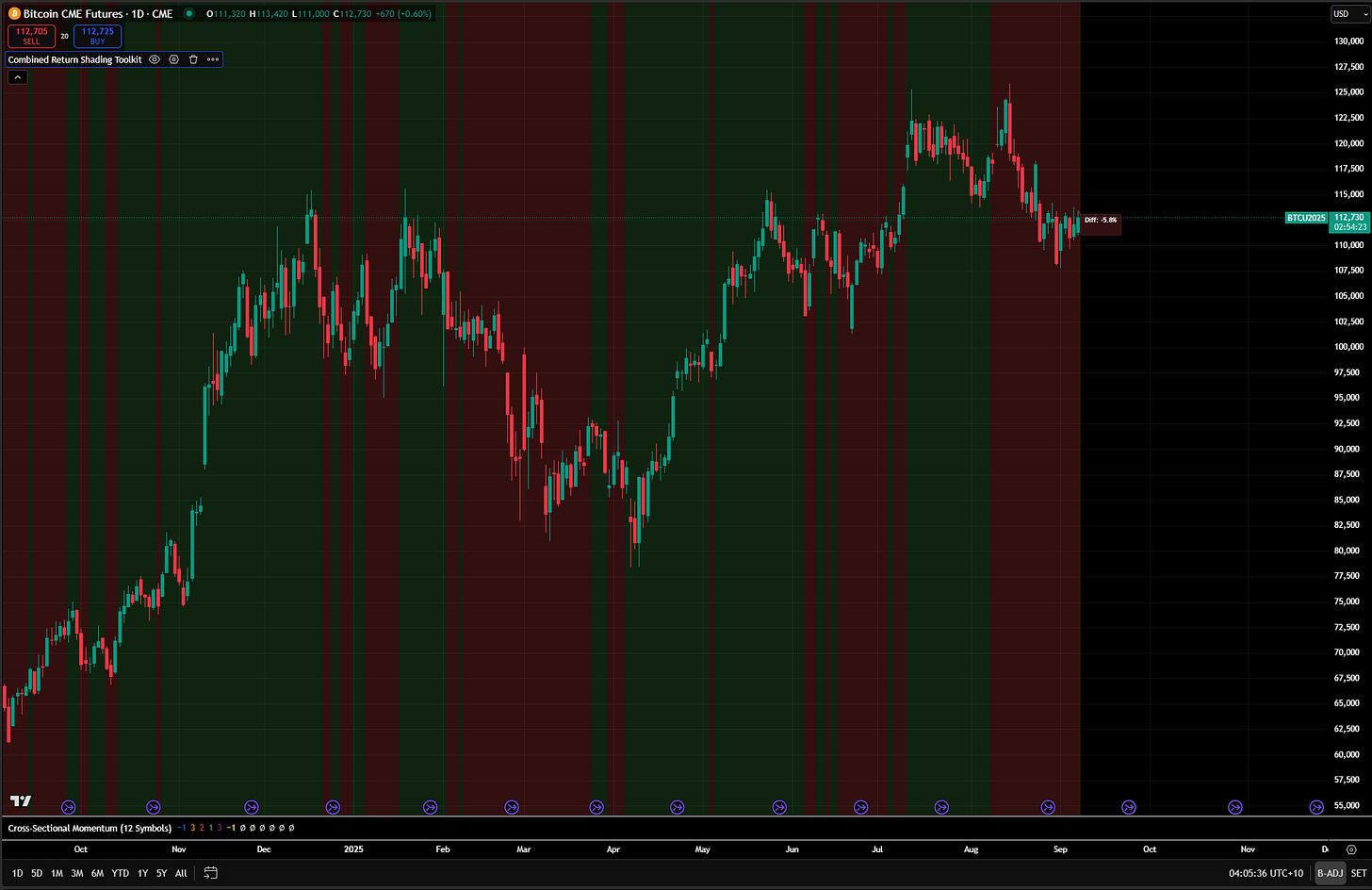

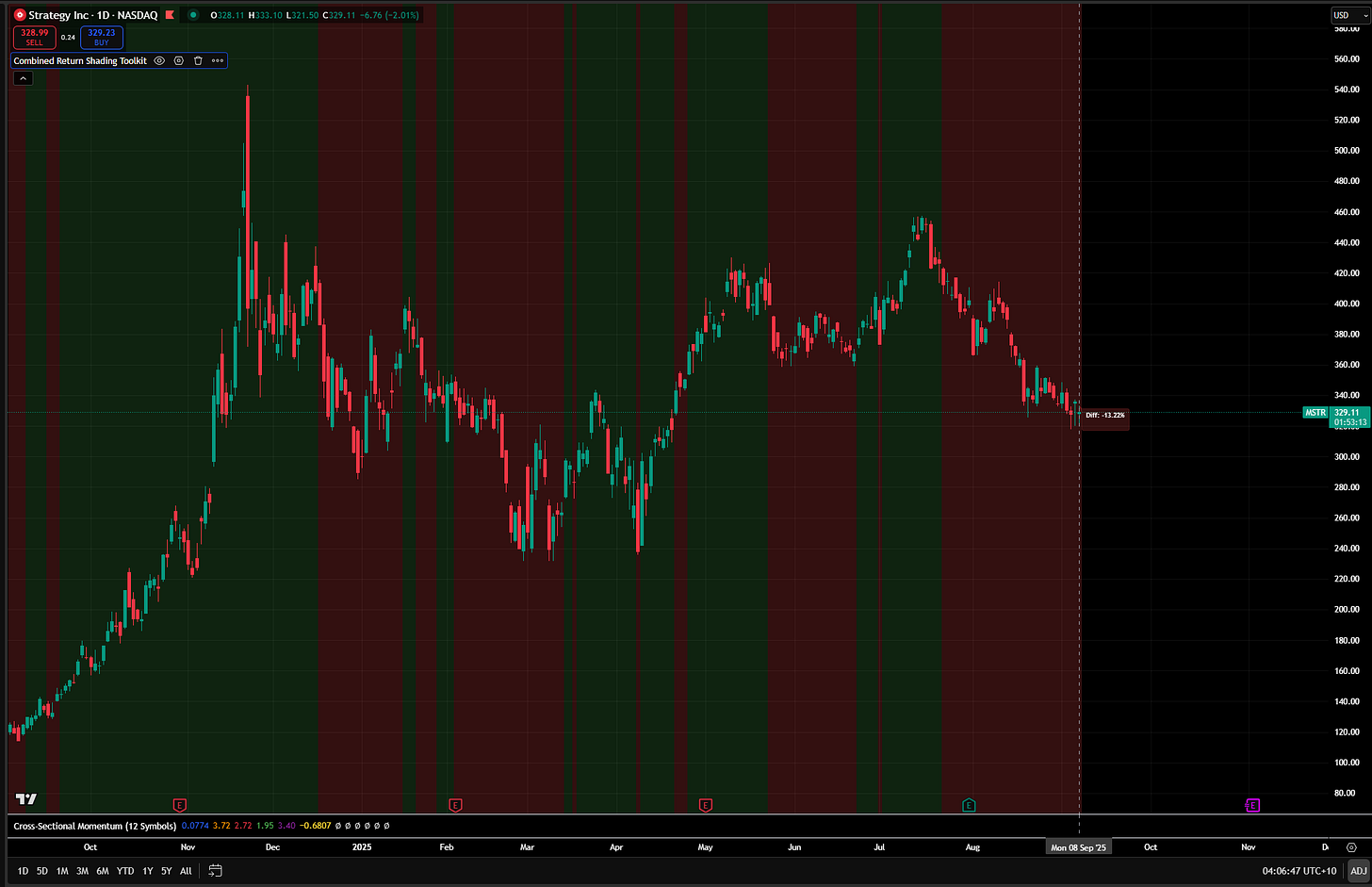

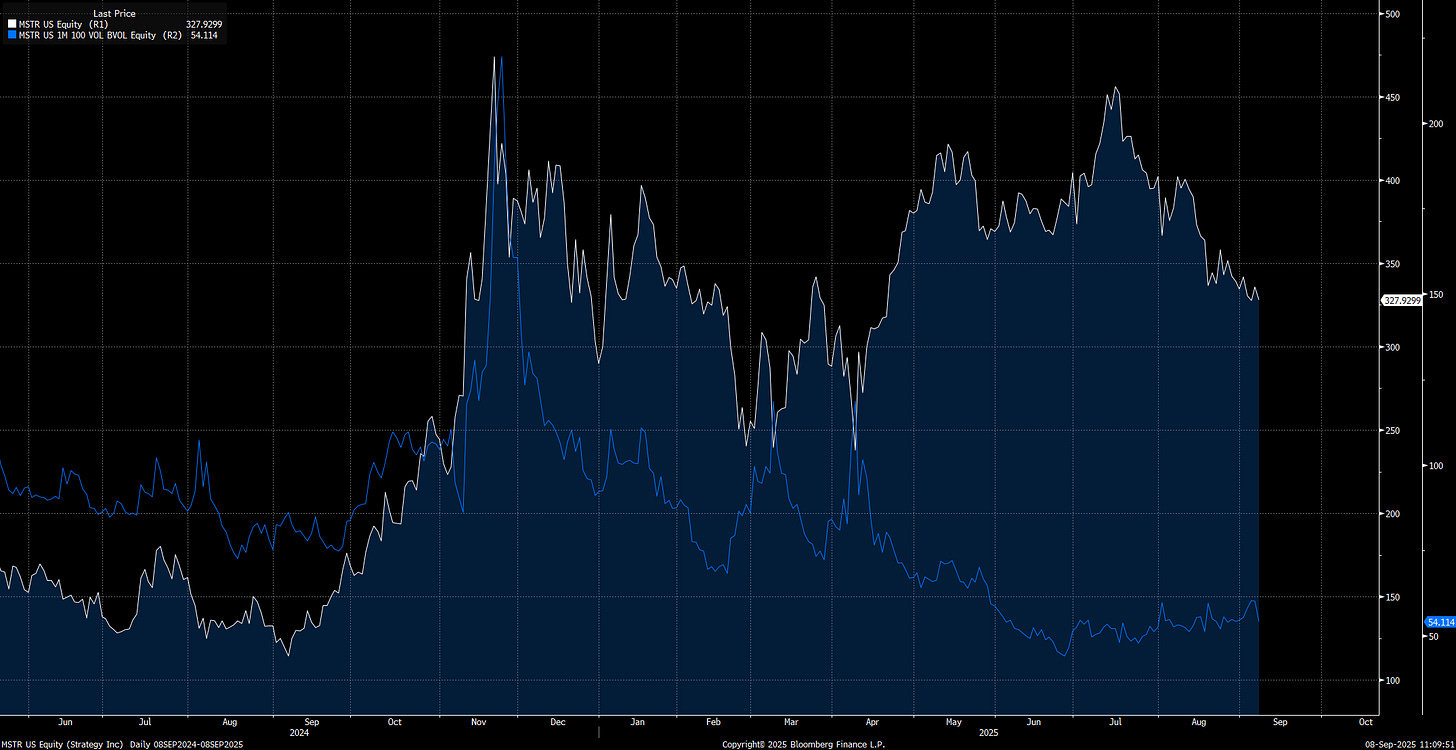

The interest rate sensitivity model for Bitcoin shows that over the past three weeks, its price has had a negative response to interest rates, underperforming ES. This is critical because real rates have declined, yet Bitcoin has not rallied. The key question now is whether Bitcoin shifts into a phase of outperformance—and how that will flow through to MSTR, especially given the recent news that it will not be included in the S&P 500.

I am going to lay out these flows, positioning, and trade implications below.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.

![[FREE] Educational Primers On Every Aspect Of Macro & Markets](https://substackcdn.com/image/fetch/$s_!tfas!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F69c49472-3d63-47f0-9b8c-2a682fa625f1_1024x1024.jpeg)