Macro Regime Tracker: All Time Highs?

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

My view on equities has not changed. My equity strategy remains long and the warning signals are NOT flashing neutral or bearish, YET.

The key thing to remember is that during this period of time, we are seeing interest rates remain stable. The decrease in inflation risk has allowed more cuts to be priced without causing risk to the long end of the curve. I laid out the logic for this and how it impacts the cycle in the recent report.

As always, all the systematic models and strategies are laid out below. Thanks

Main Developments In Macro

US Policy, Treasury & Fed-Linked

BESSENT: MIGHT SEE CPI COMING DOWN NEXT MONTH, MONTH AFTER

BESSENT: I THINK HOUSING PRICES ARE A LAGGING INDICATOR

BESSENT: GOING TO SEE SUBSTANTIAL TAX REFUNDS FOR AMERICANS

BESSENT: TREASURY BILL AUCTIONS HAVE NEVER BEEN SO SOLID

BESSENT: URGING OUR ALLIES TO JOIN US IN RUSSIA SANCTIONS

BESSENT: INCOMING RUSSIA SANCTIONS TO BE AMONG BIGGEST

BESSENT: CONTEMPLATING US, ALLIES NEXT MOVE IF CHINA TALKS FALL

BESSENT: GOING TO MEET WITH CHINESE COUNTERPART THIS WEEKEND

BESSENT: SOON REVEAL ‘SUBSTANTIAL’ PICK UP IN RUSSIA SANCTIONS

BESSENT: WILL ANNOUNCE RUSSIA SANCTIONS TODAY OR TOMORROW

BESSENT: WANT TO GET MONEY TO FARMERS, BUT GOVERNMENT IS CLOSED

BESSENT: EVERYTHING IS ON THE TABLE IN TALKS WITH CHINA

TREASURY SECRETARY BESSENT TALKS TO REPORTERS

FED FLOATS PLAN WITH MUCH SMALLER CAPITAL HIKES FOR BIG BANKS

US ‘PREPARED TO TAKE FURTHER ACTION’ IF NEEDED AGAINST RUSSIA

US TARGETS ROSNEFT, LUKOIL IN LATEST ROUND OF RUSSIA SANCTIONS

US DEMANDS MOSCOW AGREE TO ‘IMMEDIATE CEASEFIRE’: STATEMENT

US SEEKS TO QUADRUPLE BEEF PURCHASES FROM ARGENTINA: POLITICO

OIL RISES POST SETTLE AS US SET TO RAMP UP RUSSIA SANCTIONS

TREASURY WI 20Y YIELD 4.518% BEFORE $13 BILLION AUCTION

Geopolitics – US / Russia / China / NATO

RUTTE: IF NECESSARY, NATO CAN TAKE DOWN RUSSIA AIRCRAFT

RUTTE: RUSSIAN INCURSIONS IN NATO AIRSPACE MUST STOP

RUTTE: NEXT BIG THING AFTER THE MIDEAST MUST BE RUSSIA, UKRAINE

TRUMP: WILL TALK WITH XI ABOUT HOW TO END RUSSIA WAR IN UKRAINE

TRUMP: THINK XI CAN HAVE A BIG INFLUENCE ON PUTIN

TRUMP: MIGHT ADD CHINA INTO NUCLEAR DEESCALATION TALKS

TRUMP: THINK WE’LL MAKE A DEAL WITH CHINA ON EVERYTHING

TRUMP: FELT IT WAS TIME FOR RUSSIA SANCTIONS

TRUMP: CANCELLED MEETING WITH PUTIN, DIDN’T FEEL RIGHT

TRUMP: THINGS GOING ALONG WELL REGARDING UKRAINE, RUSSIA

US ‘PREPARED TO TAKE FURTHER ACTION’ IF NEEDED AGAINST RUSSIA

ZELENSKIY: UKRAINE IS READY FOR DIPLOMACY, SUPPORTS CEASEFIRE

ZELENSKIY: STILL NEED TO DISCUSS EUROPEAN PEACE PLAN PROPOSALS

KREMLIN: PUTIN WON’T GO TO G-20 SUMMIT: INTERFAX

Trade & International Relations

KOREA AIMS TO FINALIZE TRADE DEAL WITH US DURING APEC: KOO

FINALIZED US TRADE DEAL A KEY TO STABILIZING KOREAN WON: KOO

RECENT WON WEAKNESS REFLECTS CONCERN DEAL NOT FINALIZED: KOO

US UNDERSTANDS KOREA’S FX CONSTRAINTS IN INVESTMENT DEAL: KOO

SOUTH KOREA TO LAUNCH 24-HR FX AS SOON AS POSSIBLE: KOO

EU Prepares Trade Options to Counter China Rare Earth Curbs

GREER: TRUMP, XI HAVE GREAT RELATIONSHIP

GREER: THERE IS A GOOD LANDING ZONE FOR US, CHINA TRADE

GREER: CHINA MOVE ON RARE EARTHS WAS ‘AGGRESSIVE’

GREER: IT HAS TO BE A MUTUAL DECISION FOR XI, TRUMP TO MEET

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

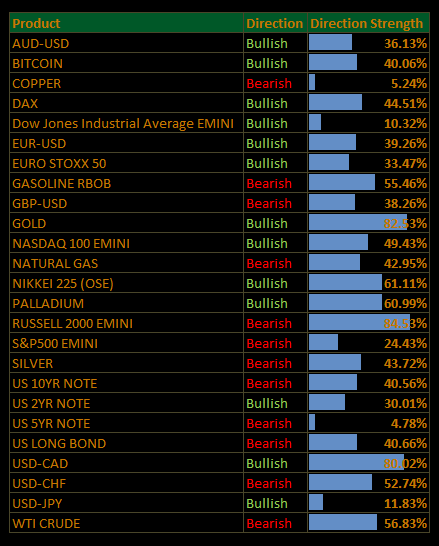

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

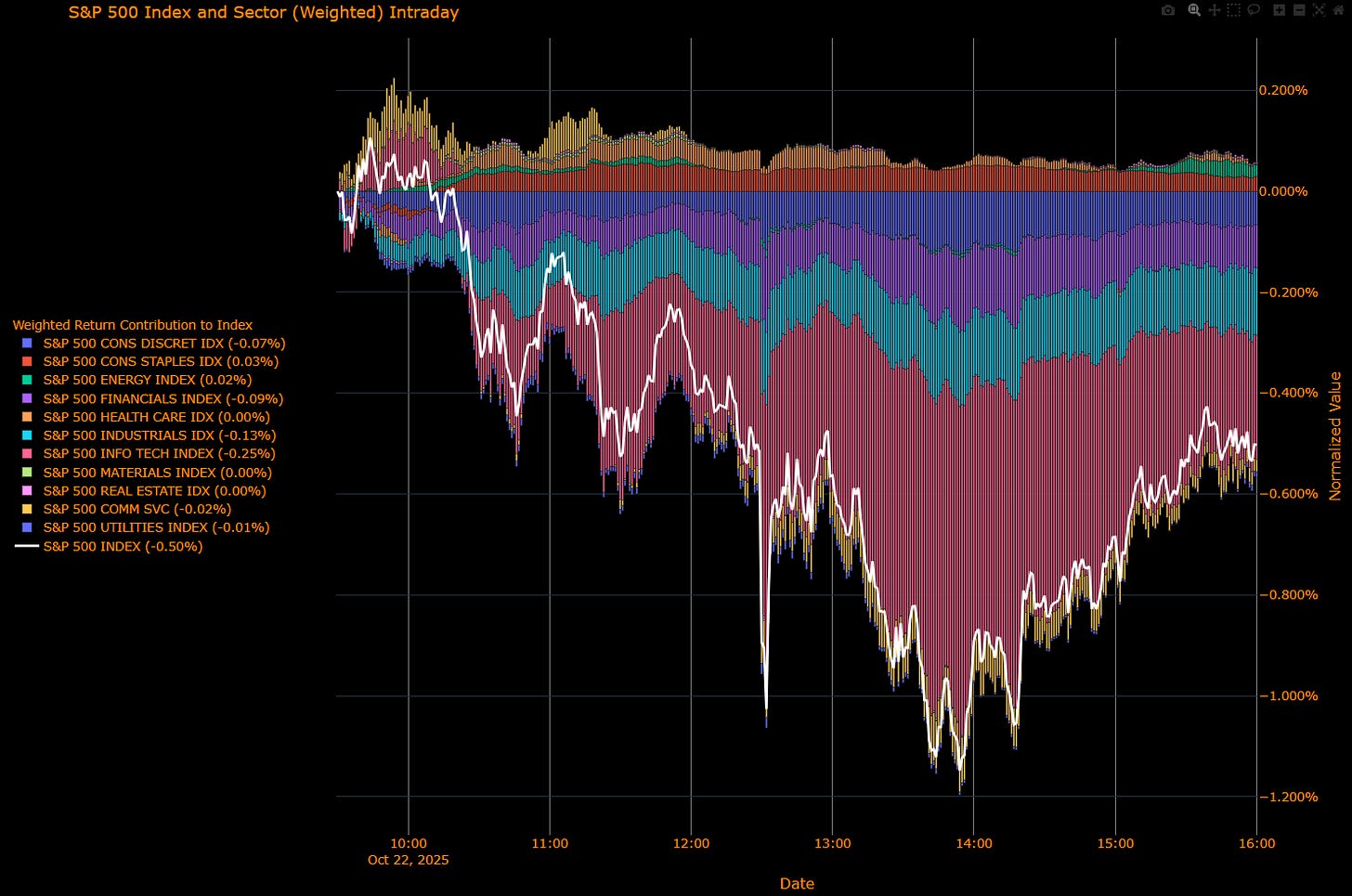

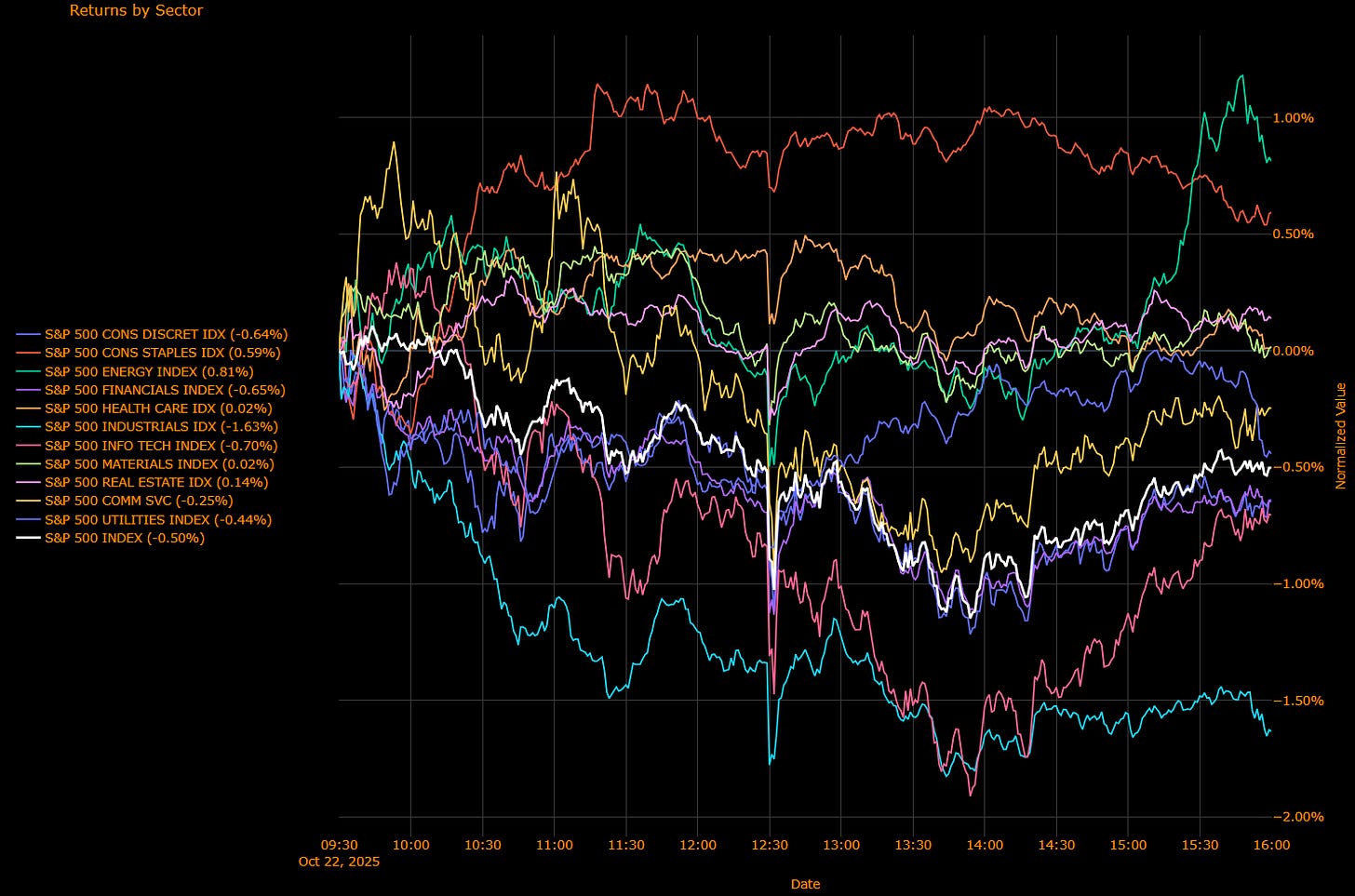

US Market Wrap: Tech Drags, Cyclicals Crack — Risk Tone Fades (S&P −0.50%)

Wall Street lost traction overnight as the post-rally fatigue turned into a broad de-risking. The S&P 500 slipped −0.5%, with Tech and Industrials leading the retreat while Energy was the lone standout. The move was part of a wider cross-asset shakeout as momentum-heavy names AI, crypto, and precious metals were hit again. A mix of weaker earnings tone (Netflix, Tesla), renewed US-China tension on export curbs, and sanction-driven oil strength as reasons for the rotation.

Sector Attribution

Weighted Return Contribution (S&P −0.50%)

Leaders: Energy (+0.02%), Staples (+0.03%).

Drags: Info Tech (−0.25%), Industrials (−0.13%), Financials (−0.09%), Discretionary (−0.07%), Comm Services (−0.02%), Utilities (−0.01%); Materials and Health Care flat.

Unweighted Performance (Breadth)

Leaders: Energy (+0.81%), Staples (+0.59%), Real Estate (+0.14%).

Laggards: Industrials (−1.63%), Financials (−0.65%), Info Tech (−0.70%), Discretionary (−0.64%), Utilities (−0.44%), Comm Services (−0.25%).

Read: The index fell on concentration risk, Tech and Industrials weighed most while Energy’s oil-linked rebound offered limited offset. Breadth skewed sharply negative, revealing profit-taking across growth and momentum pockets, particularly AI and semis.

Macro Overlay

Catalysts / Tape Feel

The risk unwind followed a cluster of catalysts: US sanctions on Russian oil majors lifted crude ~2%, Tesla’s earnings miss dampened animal spirits, and talk of potential export curbs to China revived trade anxiety. Retail momentum and AI-linked names extended their drawdown, echoing the “music-stopped” feel noted by Bespoke.

Policy / Rates / FX

Treasuries were steady (10-yr 3.95%, −1 bp) with a firm $13 bn 20-yr auction signaling healthy demand. The Fed narrative turned political as Governor Waller’s measured quarter-point vote reinforced independence amid Trump pressure for deeper cuts. The USD held firm; gold pared losses after an intraday −2.9% swing.

Cross-Asset Pulse

Oil +2% (WTI ~$60) on sanctions headlines. Gold and crypto slipped as liquidity rotated back to the USD. Momentum baskets especially AI, metals, and beta proxies saw further liquidation, tightening overall financial conditions at the margin.

The Read-Through

De-risking, not panic: Losses clustered in high-beta, high-valuation sectors while defensives stabilized, classic “risk fatigue” rather than fundamental stress.

Energy lone bright spot: Crude’s rally turned Energy into the day’s ballast; cyclical correlation flipped.

Fed independence theme: Waller’s stance and chatter of Bessent’s shortlist framed the Fed’s credibility as the next macro debate.

Rotation check: Momentum unwinds are widening beyond AI, watch if Staples/Real Estate follow-through to confirm a defensive tilt.

What to Watch Next

CPI (Friday): Core 0.3% keeps the soft-landing script intact; 0.4–0.5% risks reigniting the USD and pressuring duration.

Breadth test: Does Energy leadership broaden or stay isolated while Tech/Industrials lag?

Fed politics: Follow Waller and Bessent commentary for hints on institutional independence vs. Trump influence.

Oil vs. Growth: If crude sustains above $60 while demand data softens, inflation-vs-growth trade-offs may re-price quickly.

US IG Credit Wrap: Momentum Unwinds, Oil Pops; OAS Still Anchored in Carry Range (IG OAS ~53.0 bp)

IG spreads stayed resilient as equities wobbled and crude jumped on fresh Russia sanctions. With 10-yr USTs essentially unchanged (~3.95%) and a solid 20-yr auction, OAS is still camped in the low-50s, textbook carry behavior despite noisier headlines around tech earnings, China export-curb chatter, and the momentum unwind in AI/crypto/metals.

Where We Sit (from today’s chart)

IG OAS: ~53.0 bp (last 53.05)

5-yr avg: ~61.9 bp → ~9 bp inside

Cycle tights: ~46.1 bp → ~7 bp above

2022 wides: ~111.2 bp → ~58 bp tighter

Read: We’re mid-channel between cycle tights and the 5-yr mean, comfortably “normal,” not stretched.

Tape & Macro Overlay

Equities: Broad risk-off day (S&P −0.5%); Tech/Industrials led the drag while Energy outperformed on oil strength. Momentum baskets have been bleeding for days, classic de-risking, not disorderly.

Rates/FX: 10s steady; $13bn 20-yr sale came through well. USD mixed; gold swung hard intraday again.

Commodities: WTI ~+2% (≈$60) on sanctions headlines; distillate/gasoline draws add to the bid.

Policy: Fed politics in focus, Waller reaffirmed the incremental/cuts-but-independent stance; regulators are exploring a softer bank-capital path, marginally constructive for IG financials.

China/Trade: Talk of software-export curbs keeps a lid on animal spirits but hasn’t migrated into credit risk premia.

Mapping to IG

Base case: The 50–60 bp corral remains the center of gravity. With rates contained and funding windows open, grind-tighter bias persists toward high-40s only if macro stays calm and oil doesn’t morph into an inflation scare.

Financials: Senior paper steady to a touch better, capital-rule relaxation chatter offsets equity volatility. Supply windows remain healthy.

Cyclicals (Energy/Materials/Industrials): Oil pop helps Energy credits; broader cyclicals are two-way with tariff/export-curb noise, but high-quality BBB/A compression continues.

Defensives (Staples/HC/REIT IG): Rich but stable; carry dominates unless we get a sharp duration rally.

Tech/Comms: Equity noise (guidance/misses) hasn’t translated into spread stress for mega-cap balance sheets.

Risk Markers to Watch

CPI (Fri): 0.3% core = carry on; 0.4–0.5% risks a brief rates tantrum and stalls further tightening.

Oil path: Sustained move >$60 with draws would nudge breakevens up and could cheapen beta sleeves.

Fed personnel/politics: Waller vs. “bigger cuts” pressure and independence headlines matter for term premium, not today’s OAS.

China export-curb escalation: A headline shock could widen Tech/Comms secondaries and cap the grind.

Regional-bank updates: A clean break back above ~60 bp would be the early systemic tell.

Despite equity chop and sanction-driven oil, IG remains in carry mode. Absent a hot CPI or policy shock, OAS should hug the low-50s and grind, with any risk-off widening likely shallow and fleeting.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.