Macro Regime Tracker: Bitcoin and Macro Flows

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I took an extended period of time in the livestream today explaining how to think about the macro picture, equities, gold, Bitcoin, and bonds. This video brings everything together:

The Bitcoin report I referenced in the video is here:

And Friday will be the last day to lock in the lower rate for the Substack before the price increase. I will be publishing some important pieces for paid subscribers tomorrow as well, so be on the lookout for this.

As always, all the systematic models and strategies are updated below. Thanks.

Main Developments In Macro

U.S. Macro, Policy & Banking

KASHKARI: DEMAND FOR LABOR SEEMS LIKE IT’S SOFTENED A BIT

FED’S KASHKARI: TARIFF IMPACT IS TAKING LONGER THAN I’D GUESSED

FED’S MIRAN SAYS NO MATERIAL SIGNS OF GROWTH DRAG FROM TARIFFS

FED’S MIRAN SAYS NOT FOCUSED ON ASSET PRICE BOOM: REUTERS

MIRAN: 25 BPS CUTS IS MAKING ADJUSTMENT SLOWER THAN NEEDS TO BE

MIRAN: LONGER POLICY STAYS RESTRICTIVE, GREATER THE DOWNSIDE

FED GOVERNOR STEPHEN MIRAN SPEAKS AT EVENT IN WASHINGTON

FED’S MIRAN: ECONOMY IS IN PRETTY GOOD PLACE, BUT HAS NEW RISKS

WALLER: FED’S BASIC STRUCTURE HAS SERVED THE COUNTRY WELL

WALLER: STABLE FISCAL POLICY BEST WAY TO KEEP YIELDS DOWN

WALLER: POLICY MORE RESTRICTIVE FOR SOME GROUPS THAN OTHERS

WALLER: WE’D BE ‘HURTING’ IF NOT FOR DECLINE IN LABOR SUPPLY

FED GOVERNOR CHRISTOPHER WALLER COMMENTS IN Q&A

FED’S WALLER SAYS IMMIGR. SHIFT MASKING DROP IN LABOR DEMAND

FED’S WALLER REPEATS HE FAVORS QUARTER-POINT OCTOBER RATE CUT

WALLER: RATE OUTLOOK AFTER OCTOBER DEPENDENT ON LABOR MARKET

FED SAYS LENDERS SHOULD BE RESILIENT TO A RANGE OF FACTORS

FED TO RELEASE NEW STRESS TEST PLANS FOR BIG BANKS THIS MONTH

US BANK RESERVES RESUME DECLINE, FALL BACK BELOW $3 TRILLION

US OCT. 2025 HOMEBUILDER INDEX AT 37; HIGHEST SINCE APRIL

U.S. Trade/Tariffs & Industrial Policy

US ANNOUNCEMENT ON AUTOS TARIFF RELIEF MAY COME SOON AS FRIDAY

COMMERCE DEPT SET TO EASE CAR PARTS TARIFFS ON US AUTO INDUSTRY

US NEARS TARIFF RELIEF FOR AUTO INDUSTRY: PEOPLE FAMILIAR

Europe (Macro/Central Banks)

ECB’S SCICLUNA: WE WILL HAVE MUCH MORE DATA IN DECEMBER

ECB’S SCICLUNA SAYS PRICE EFFECTS OF US TARIFFS STILL UNCLEAR

ECB’S SCICLUNA: WOULD NEED TO BE CONVINCED ON ANOTHER CUT

ECB’S NAGEL: NOT SO CONCERNED ABOUT INFLATION UNDERSHOOT

ECB GOVERNING COUNCIL MEMBER NAGEL SPEAKS ON BLOOMBERG TV

ECB’S NAGEL: FOR THE MOMENT `IT’S GOOD WHERE WE ARE’

WUNSCH: ECB ESSENTIALLY IN A GOOD PLACE

WUNSCH: RISKS A BIT MORE ON DOWNSIDE FOR INFLATION

WUNSCH: ECB HAS DONE CLOSE TO PERFECT JOB

ECB GOVERNING COUNCIL MEMBER WUNSCH SPEAKS IN WASHINGTON

ECB’S WUNSCH: EUROPE’S ECONOMY HAS BEEN RESILIENT

LAGARDE: ECB WELL POSITIONED TO FACE FUTURE SHOCKS

ECB’S KOCHER: NO NEED TO BE OVER-ACTIVE

KOCHER: ECB POLICY IS IN A `GOOD PLACE’

ECB GOVERNING COUNCIL MEMBER MARTIN KOCHER SPEAKS IN WASHINGTON

FRENCH-GERMAN 10Y SPREAD FALLS BELOW 76BPS TO LOWEST SINCE AUG

UK (Macro/Central Bank)

BOE’S GREENE: TRADE UNCERTAINTY COULD ‘CHILL’ ECONOMIC ACTIVITY

BOE’S GREENE: IMPROVED EU TIES WOULD HELP CONTROL INFLATION

GREENE: PRETTY HIGH LIKELIHOOD OF SIMULTANEOUS SUPPLY SHOCKS

BOE’S MANN: WOULD BUY INTO ‘MORE RESTRICTIVE FOR LONGER’ PATH

BOE’S MANN: DON’T AGREE SHOULD LOOK THROUGH INFLATION SPIKE

BOE’S MANN: EXPECTATIONS DRIFTED FROM TARGET-CONSISTENT RATES

BOE’S MANN: TRADE IS NOT WEIGHING ON INFLATION

BOE’S MANN: DOMESTIC PRICE FACTORS DOMINATE EXTERNAL FACTORS

BOE POLICYMAKER CATHERINE MANN SPEAKS AT EVENT IN WASHINGTON

BOE’S MANN: COULD BE MORE FINANCIAL TURBULENCE GOING FORWARD

BOE’S MANN: INFLATION PERSISTENCE IS MAIN POLICY CHALLENGE

BOE’S MANN: RESTRICTION NEEDED TO REIN IN PRICE EXPECTATIONS

BOE’S MANN: ECONOMIC ACTIVITY MODEST, LABOR MARKETS SOFTENING

BOE POLICYMAKER CATHERINE MANN SPEAKS IN WASHINGTON

BOE’S MANN: DOMESTIC COMPONENT IS DOMINANT INFLATION FEATURE

Japan (Macro/Central Bank / FX Backdrop)

BOJ’S UEDA: WILL COLLECT MORE INFORMATION BEFORE OCT. DECISION

BOJ’S UEDA: WILL TIGHTEN IF EXPECTED OUTLOOK MATERIALIZES

BOJ’S UEDA: TARIFF IMPACT HAS BEEN EMERGING WITH A LAG

BOJ’S UEDA: GEOPOLITICAL, TRADE TENSIONS POSE DOWNSIDE RISKS

BANK OF JAPAN GOVERNOR UEDA SPEAKS IN WASHINGTON

BOJ’S UEDA: THE GLOBAL ECONOMY REMAINS RESILIENT SO FAR

JAPAN’S VICE FINANCE MINISTER MIMURA SPEAKS IN WASHINGTON

JAPAN’S MIMURA: WELCOME NATIONS INTRODUCING STABLECOIN RULES

China/Asia–U.S. Relations

YONHAP CITES STATE DEPT ON CHINA SANCTION AGAINST SKOREA HANWHA

US SAYS CHINA BIDS TO WEAKEN US-SKOREA SHIPBUILDING TIES:YONHAP

CHINA’S WANG YI CALLS FOR EFFECTIVE COMMUNICATION WITH US

DECOUPLING BETWEEN CHINA, US ISN’T RATIONAL CHOICE: WANG YI

CHINA’S WANG BLAMES US’S RESTRICTIVE MEASURES FOR TRADE TENSION

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

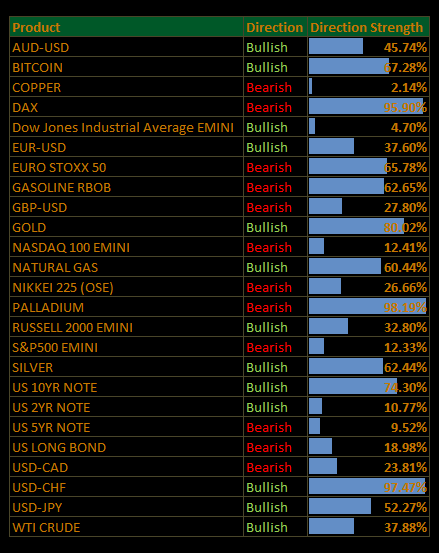

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Credit Jitters Dominate; Fed Caution vs. Growth Risk; Banks Lead Drawdown (S&P −0.96%)

The tape cracked as regional-bank stress returned to center stage and credit worries overwhelmed a steady Fed message. The S&P 500 fell −0.96%, a broad de-risking that pushed gold to fresh highs and pulled Treasury yields lower (10y ~4%, 2y making new cycle lows). With earnings unable to offset the macro overhang (tariffs, shutdown, AI froth), the path of least resistance was down, and most painfully for Financials.

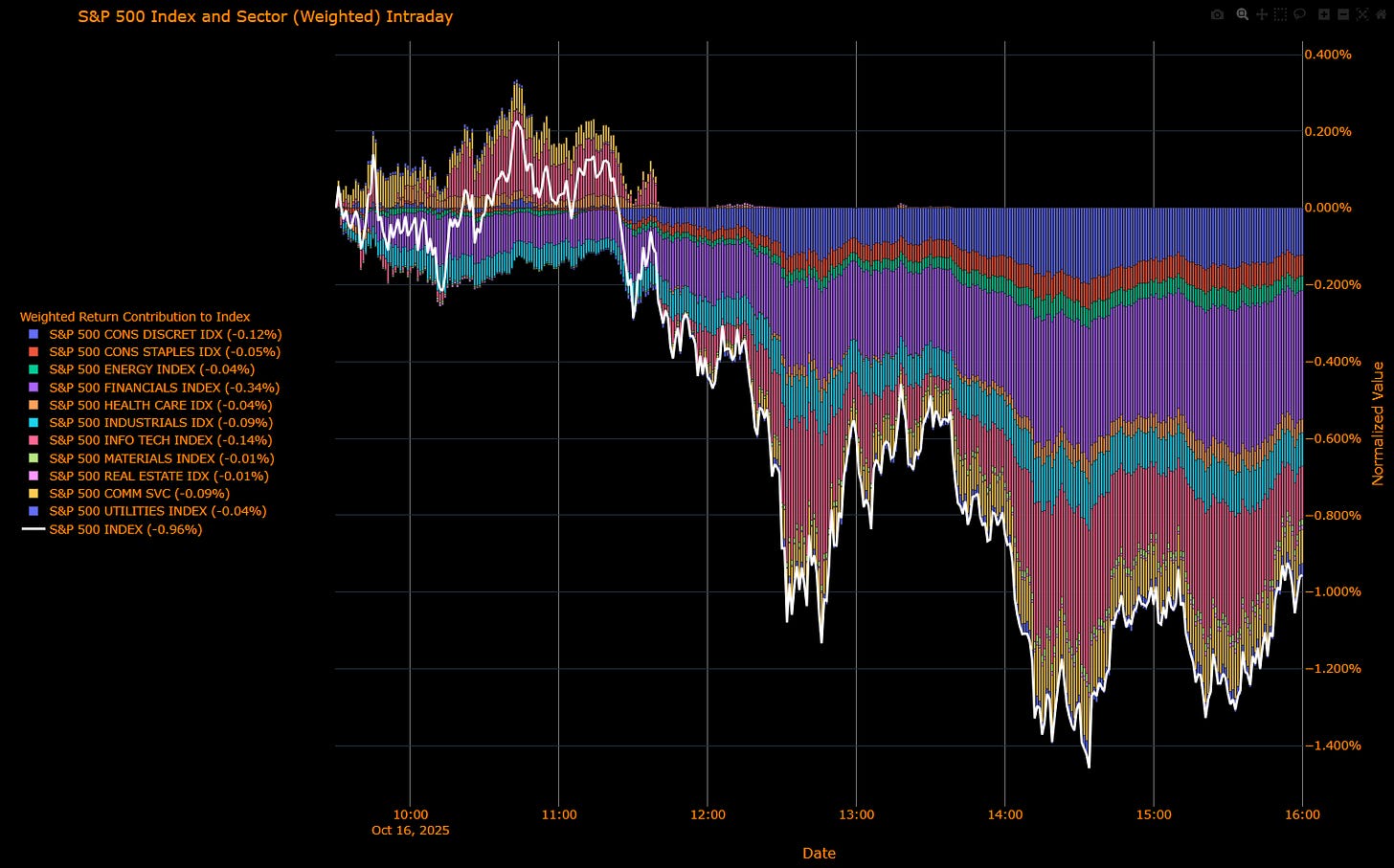

Sector Attribution

Weighted Return Contribution (S&P −0.96%)

Financials (−0.34%) was the single largest drag, eclipsing Tech (−0.14%). Discretionary (−0.12%), Communication Services (−0.09%), Industrials (−0.09%), and a cluster of defensives—Staples, Utilities, Health Care, Energy (each around −0.04%)—added steady bleed. Materials and Real Estate were marginal (each −0.01%). The message: this was a credit-led draw, not a pure growth/tech unwind.

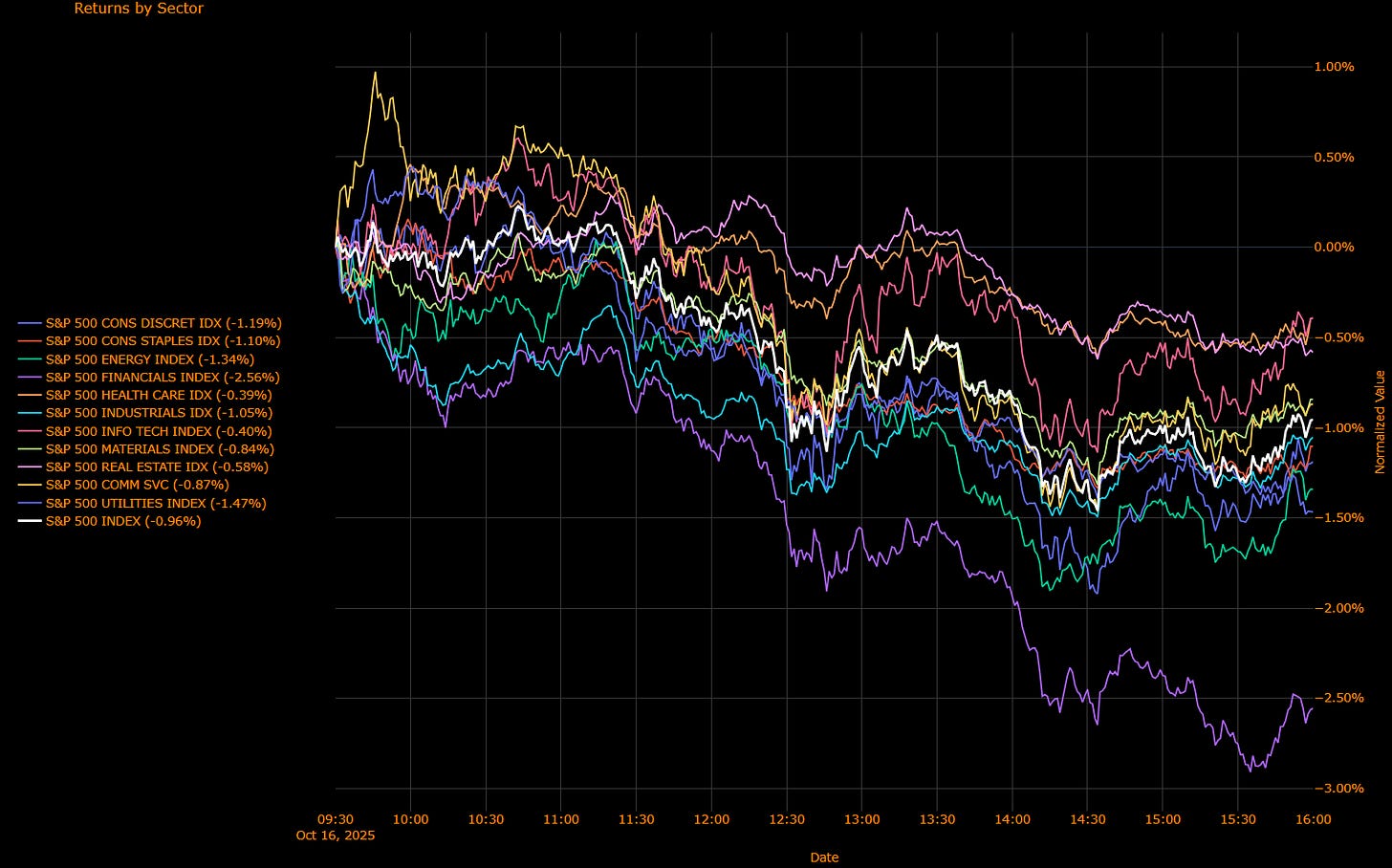

Unweighted Performance (Breadth)

Breadth was decisively risk-off. Financials (−2.56%) collapsed on renewed regional-bank concerns (bad-loan disclosures), with Utilities (−1.47%), Energy (−1.34%), Discretionary (−1.19%), Staples (−1.10%), Industrials (−1.05%), and Real Estate (−0.58%) all weak. Tech (−0.40%) and Materials (−0.40%) slipped but were not the epicenter. Communication Services (−0.87%) rounded out the broad deterioration. This is classic “credit scare → beta and yield-sensitives sell together.”

Macro Overlay

Catalyst mix: Headlines around bad loans at two regional lenders reignited fears about the health of U.S. credit just as shutdown risk and tariff noise linger. Asia is set to follow lower. Haven demand surged, gold to new records, while oil slipped to fresh five-month lows on rising de-escalation hopes around Russia supply.

Policy: The Fed tone stayed steady but split on dose. Governor Waller leaned into “careful cuts” (25 bp steps, watch the labor softening), while Miran argued for a larger move given tariff-driven downside risks. Markets still price a gradual easing path through 2026, but today’s price action said the growth/credit channel, not inflation, is steering risk.

Rates/FX: Bullish duration with curve rally led by the front end (labor cooling + credit nerves). The dollar eased as havens rotated to gold and JPY, but FX stayed orderly, this was about domestic credit first, global risk second.

The Read-Through

This was a credit-led risk-off, not a simple cyclical wobble. Financials’ outsized weighted drag confirms the locus of stress; Utilities’ and Staples’ weakness alongside falling yields flags de-risking rather than a clean “defensive bid.” If the bank headlines remain contained, the damage stays tactical; if not, the equity-bond correlation flips back to “bad is bad.”

US IG Credit Wrap: Credit Nerves, Fed Dovish Drift, Spreads Still Anchored in Mid-50s (IG OAS ~54.9 bp)

IG took the bank-scare headlines in stride. Despite equities rolling over (S&P −0.96% with Financials the heaviest hit), gold at fresh records and a front-end rates rally, cash IG stayed orderly and OAS held the familiar mid-50s channel. Tone = “risk wobbly, carry intact.”

Where We Sit (from the chart)

IG OAS: ~54.9 bp (last 54.87)

5-yr avg: ~61.9 bp → ~7 bp inside

Cycle tights: ~46.1 bp → ~8–9 bp above

2022 wides: ~111.2 bp → ~56 bp tighter

Tape & Macro Overlay

Catalyst mix: Regional-bank charge-off headlines reignited credit worries; Asia is set to open softer.

Policy: Waller keeps pushing “careful cuts” (25s, watch the softening labor market). Miran argues for a larger move given tariff-shock downside risk. The market still embeds a steady easing glide through ’26.

Rates/FX/Commodities: Bullish duration (2y to new cycle lows, 10y ~4%). DXY softer; JPY steadier. Gold makes new highs; oil sits near five-month lows on rising odds of freer Russian flows.

Mapping to IG

Base case: 50–60 bp range persists. Fed easing + potential QT flexibility cushion funding; tariff/geopolitics cap the upside for spreads.

Banks: The locus of equity stress, but senior IG remains supported by abundant term funding and a friendlier rates backdrop; watch for idiosyncratic widening, not systemic.

Cyclicals (Energy/Materials/Industrials): Two-way with oil and tariff tape; stay up-in-quality, duration neutral.

Defensives (Staples/HC/REIT IG): Rich but resilient; carry over capital gains unless rates rally accelerates.

Risk Markers to Watch

Regional-bank disclosures/charge-offs breadth (does it spread beyond a couple names?).

Front-end OIS vs. data vacuum from the shutdown (labor signals will steer the dose of cuts).

Gold ↑ / oil ↓ mix: clean credit hedge vs. creeping growth scare.

This was a credit-led equity drawdown day, but IG beta didn’t crack. As long as bank stress looks contained and the Fed stays in easing mode, IG OAS should remain range-bound with a slight grind-tighter bias inside 50–60 bp. A decisive break wider likely needs a genuine growth or funding shock; absent that, carry still does the work.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.