Macro Regime Tracker: Bitcoin, Macro Flows, and Tariff Risk

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find the recent Bitcoin report I published here:

See all the details for locking in the lower price before it increases on Friday here (bonus reports included):

As always, the systematic models and strategies are updated below.

Main Developments In Macro

U.S. Macro and Policy

US OCT. EMPIRE STATE FACTORY INDEX AT 10.7; EST. -1.8

API Reports US Crude Stockpiles Rose 7.4M Bbls Last Week

SUPREME COURT CASTS DOUBT ON USE OF RACE IN DRAWING VOTING MAPS

JUDGE BLOCKS FEDERAL FIRINGS DURING GOVERNMENT SHUTDOWN FOR NOW

JEFFRIES: WE BELIEVE THE SHUTDOWN FIRINGS ARE ILLEGAL

JEFFRIES EXPECTS LAYOFFS TO BE REVERSED BY CONGRESS OR COURTS

HOUSE DEMOCRATIC LEADER HAKEEM JEFFRIES SPEAKS TO REPORTERS

MIRAN: FED MUST BE SEEN AS NONPOLITICAL TO REMAIN INDEPENDENT

MIRAN: SEE INFLATION RETURNING TO 2% A YEAR AND A HALF FROM NOW

MIRAN: TWO MORE RATE CUTS THIS YEAR SOUNDS REALISTIC

MIRAN: I SEE SUBSTANTIAL DISINFLATION COMING A YEAR FROM NOW

MIRAN: DON’T SEE RISK PREMIUM EMBEDDED IN MARKETS BESIDES GOLD

MIRAN: DON’T KNOW WHAT BENEFIT OF MORE BALANCE-SHEET RUNOFF IS

FED’S MIRAN: US-CHINA TENSION POTENTIALLY IMPORTANT FOR OUTLOOK

FED GOVERNOR STEPHEN MIRAN SPEAKS AT CNBC EVENT

BESSENT: GOOD CHANCE WE SEE 1990S-LIKE PRODUCTIVITY MIRACLE

BESSENT: MAY BE IN THE THIRD INNING OF THE AI INVESTMENT BOOM

BESSENT: EMPLOYMENT BOOM ALWAYS FOLLOWS A CAPITAL-SPENDING BOOM

BESSENT: WE ARE PAYING OUR MILITARY TODAY

BESSENT: SEEN ESTIMATES SHUTDOWN HURTING ECONOMY UP TO $15B DAY

BOFA’S MOYNIHAN SAYS BANK’S CREDIT QUALITY HAS BEEN IMPROVING

UNITED AIRLINES SEES 4Q ADJ EPS $3 TO $3.50, EST. $2.82

UAL PLANS TO INVEST AN ADDED $1B IN CUSTOMER EXPERIENCE IN 2026

BLACKROCK AND NVIDIA IN $40B DATA CENTER TAKEOVER: FT

U.S.–China Trade & Global Supply Chain

BESSENT: CHINA ‘CAN’T BE TRUSTED WITH THE GLOBAL SUPPLY CHAIN’

BESSENT: IF CHINA AIMS TO BE UNRELIABLE, WORLD MUST DECOUPLE

BESSENT: WILL BE GROUP RESPONSE TO CHINA

BESSENT: CHINA’S RUSSIA OIL BUYING FUELS RUSSIA WAR MACHINE

BESSENT: PERHAPS CHINA VICE COMMERCE MINISTER WENT ‘ROGUE’

BESSENT SUGGESTS POSSIBILITY OF LONGER CHINA TARIFF TRUCE

BESSENT: LONGER TARIFF TRUCE POSSIBLE FOR RARE EARTH DELAY

GREER: CHINA RARE EARTHS MOVE IS GLOBAL SUPPLY CHAIN POWER GRAB

GREER: THERE IS ROOM FOR POSITIVE ECONOMIC TIES WITH CHINA

WALDRON: US-CHINA TENSIONS DO SEEM TO BE MOVING MARKETS

WALDRON: MARKETS GENERALLY UNEMOTIONAL ABOUT GEOPOLITICAL RISK

BESSENT: WILL SEE TRADE ANNOUNCEMENTS DURING TRUMP-ASIA TRIP

BESSENT: AS FAR AS I KNOW, TRUMP ‘IS A GO’ ON XI MEETING

BESSENT: US-CANADA IS ‘BACK ON TRACK’

BESSENT: BESSENT TARIFF-TRUCE COMMENT TIED TO CHINA RARE-EARTH DELAY

GLOBAL TIMES: TRUMP’S THREAT ON CHINA COOKING OIL ‘INEFFECTIVE’

MEXICO TO TALK US TARIFF DISCOUNTS ON HEAVY TRUCK PARTS: EBRARD

MEXICO, US AGREE TO KEEP CONSTRUCTIVE DIALOG IN DC MEETING

Monetary Policy (Global)

ECB’S NAGEL: STICKY SERVICES INFLATION MEANS NO COMPLACENCY

ECB’S NAGEL: TOO EARLY TO GIVE INDICATIONS ABOUT NEXT RATE MOVE

ECB’S VILLEROY REITERATES RATE CUT MORE LIKELY THAN A RATE HIKE

ECB’S MULLER: INFLATION RISKS ARE MORE OR LESS BALANCED NOW

ECB’S MULLER: I DON’T SEE WHY WE SHOULD HAVE AN EASING BIAS

ECB’S MULLER: CHINA EXPORT CONTROLS COULD BE INFLATIONARY

ECB’S VILLEROY: GLOBAL ECONOMY SURPRISINGLY RESILIENT

RBA’S BULLOCK: 4.2% UNEMPLOYMENT AT THE MOMENT IS GOOD

RBA’S BULLOCK SAYS HER JOB IS NOT DONE ON POLICY OBJECTIVES

RBA’S KENT: EASING FINANCIAL CONDITIONS HELP BALANCE ECONOMY

BULLOCK SAYS RBA POLICY IS CURRENTLY ‘MARGINALLY TIGHT’

Macro Themes

IMF PREDICTS GLOBAL PUBLIC DEBT TO EXCEED 100% OF GDP BY 2029

BESSENT: THE EURO SHOULD BE STRONG, POINTING TO FISCAL POLICY

BESSENT: WE URGE WORLD BANK TO FINANCE RELIABLE ENERGY SOURCES

BESSENT: SUPPLY CHAINS FOR CRITICAL MINERALS IS A US PRIORITY

BESSENT URGES WORLD BANK TO END SUPPORT FOR CHINA

WALDRON: ANIMAL SPIRITS ARE THERE, BUILDING AND GROWING

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

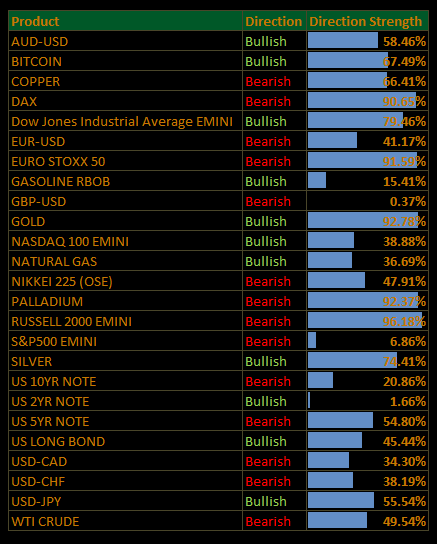

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

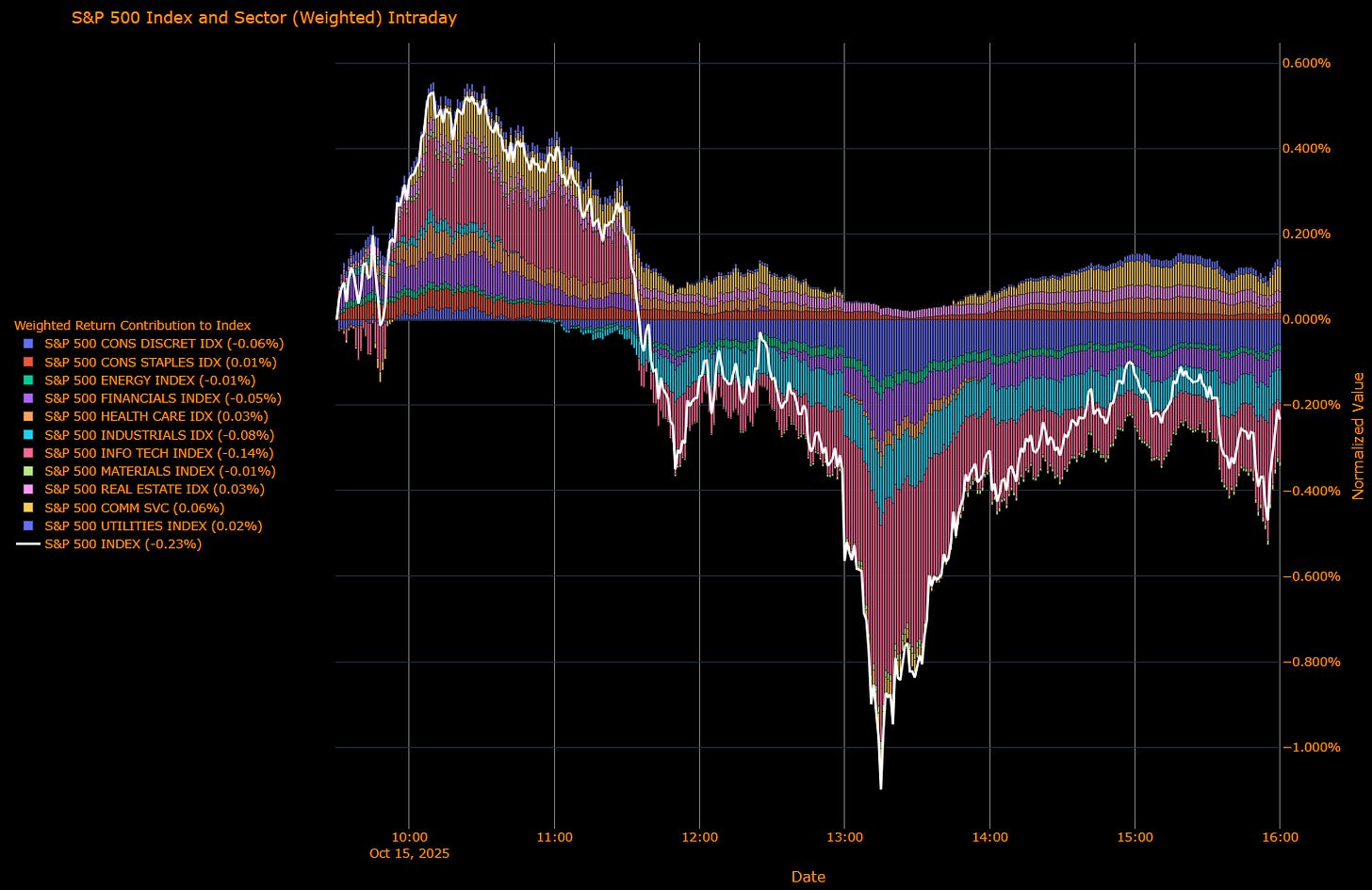

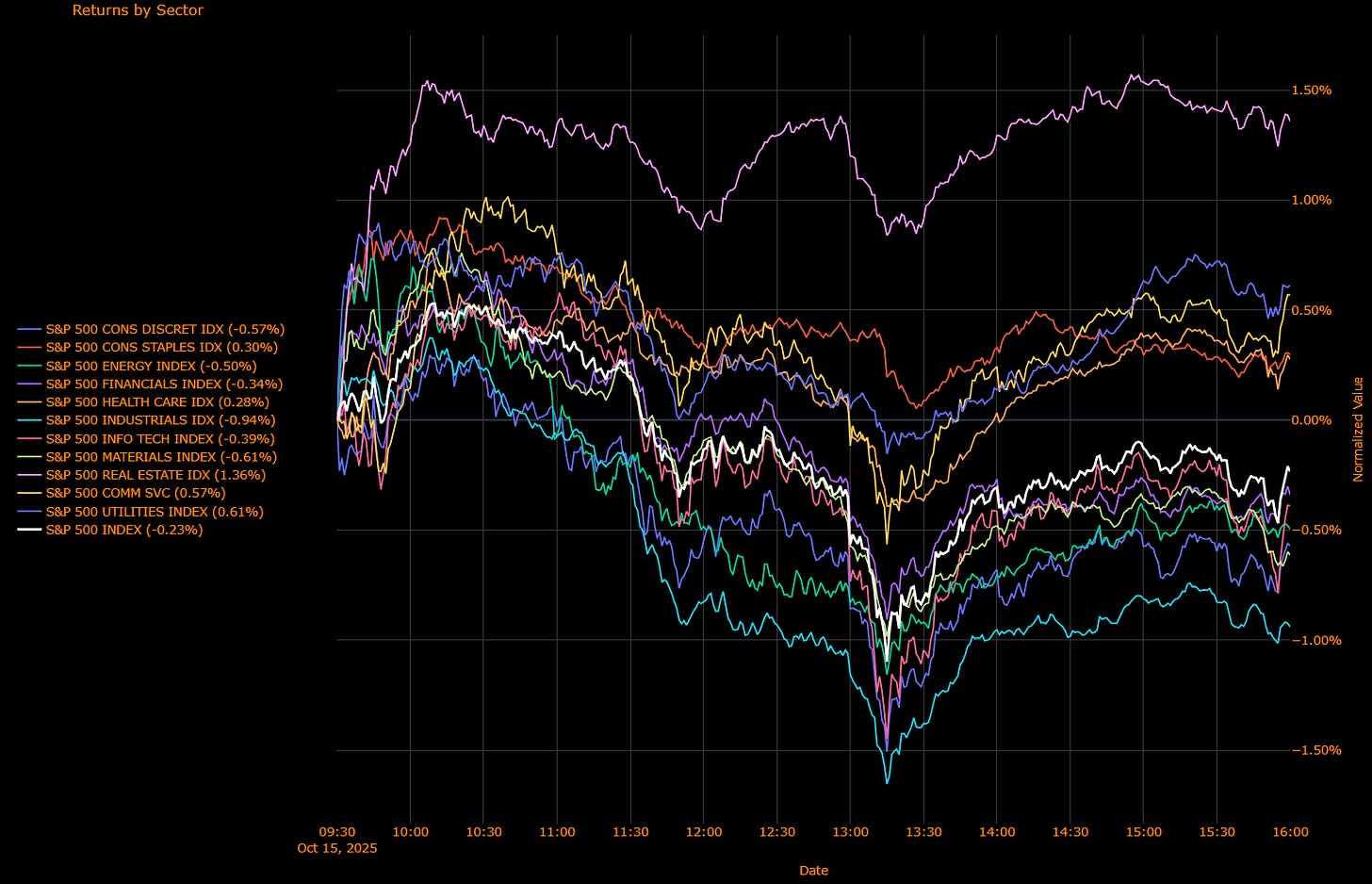

US Market Wrap: Tariff Volatility Meets Fed Calm — Defensive Rotation as Growth Wobbles (S&P −0.23%)

Markets gave back early-week gains as renewed trade-war rhetoric from President Trump collided with resilient but cautious Fed signals. The S&P 500 slipped −0.23%, reversing intraday gains as tariff headlines once again dictated direction. Treasury yields edged higher after briefly testing year-to-date lows, while gold briefly topped $4,200/oz as haven demand resurfaced. The session’s tone was one of indecision, neither panic nor conviction, caught between policy optimism and geopolitical anxiety.

Sector Attribution

Weighted Return Contribution (S&P −0.23%)

Losses were concentrated in cyclicals. Industrials (−0.08%), Consumer Discretionary (−0.06%), and Financials (−0.05%) led the drag, while Tech (−0.14%) was the single largest detractor, erasing Monday’s AI-led gains. Offsetting that, modest strength in Real Estate (+0.03%), Health Care (+0.03%), and Communication Services (+0.06%) cushioned the downside.

Unweighted Performance (Breadth)

The breadth picture was defensive. Real Estate (+1.36%) topped the leaderboard alongside Utilities (+0.61%) and Communication Services (+0.57%) — a clear pivot toward yield and stability. Cyclicals bore the brunt: Industrials (−0.94%), Materials (−0.61%), and Energy (−0.50%) all weakened on concerns that the tariff escalation could dent trade-sensitive earnings. Discretionary (−0.57%) and Tech (−0.39%) followed, underscoring fading momentum in high-beta sectors.

Macro Overlay

Catalyst & Tape:

President Trump formally declared the U.S. is “in a trade war” with China, following Treasury Secretary Bessent’s attempt to de-escalate tensions by proposing a longer tariff truce tied to China’s rare-earth export controls. Markets initially rallied on Bessent’s remarks before reversing as Trump doubled down on a 100% tariff threat, warning that “without tariffs, we’d be exposed as nothing.” The intraday whipsaw reflected investor unease at the policy inconsistency, stimulus hopes clashing with protectionist reflexes.

Rates & FX:

Two-year yields closed near 3.50%, up slightly but still hugging their lowest levels since 2022, while 10s held near 4.02%. Fed Governor Miran reiterated expectations for “two more rate cuts this year,” keeping easing priced near 125 bps through end-2026. The dollar eased modestly (−0.3%), yen steadied around 151.1, and the euro hovered near 1.1650. The policy narrative remains one of gradual disinflation against a backdrop of rising global trade risk.

Commodities & Crypto:

WTI rebounded +0.9% to $58.80/bbl after Trump claimed India would halt purchases of Russian oil, a move that could tighten global supply. Gold briefly breached $4,200/oz as traders rotated toward havens. Crypto was stable, Bitcoin +0.2%, Ether +0.3%, after the prior session’s sharp pullback.

Corporate & Credit:

Earnings were mixed. United Airlines beat expectations and guided higher on travel demand; banks extended strength from earlier in the week with Morgan Stanley and BofA posting solid results. AI enthusiasm steadied after ASML’s upbeat guidance on chip demand, though rotation into defensives hinted that investors are hedging the policy risk premium.

The Read-Through

This was a risk-parity unwind day. modest index losses masking deep internal rotation. The market remains torn between Fed relief and tariff escalation, with the market unwilling to fully commit to either risk-on or risk-off. The outperformance of Real Estate, Utilities, and Communication Services tells the story of, capital preservation is moving into focus.

The broader takeaway is that liquidity and policy reassurance can slow volatility but not suppress it in a politically charged environment. With Trump openly framing the U.S.–China relationship as a “trade war,” the market now faces another bout of headline risk just as the Fed signals its easing phase is intact. Breadth suggests risk appetite isn’t dead, it’s defensive.

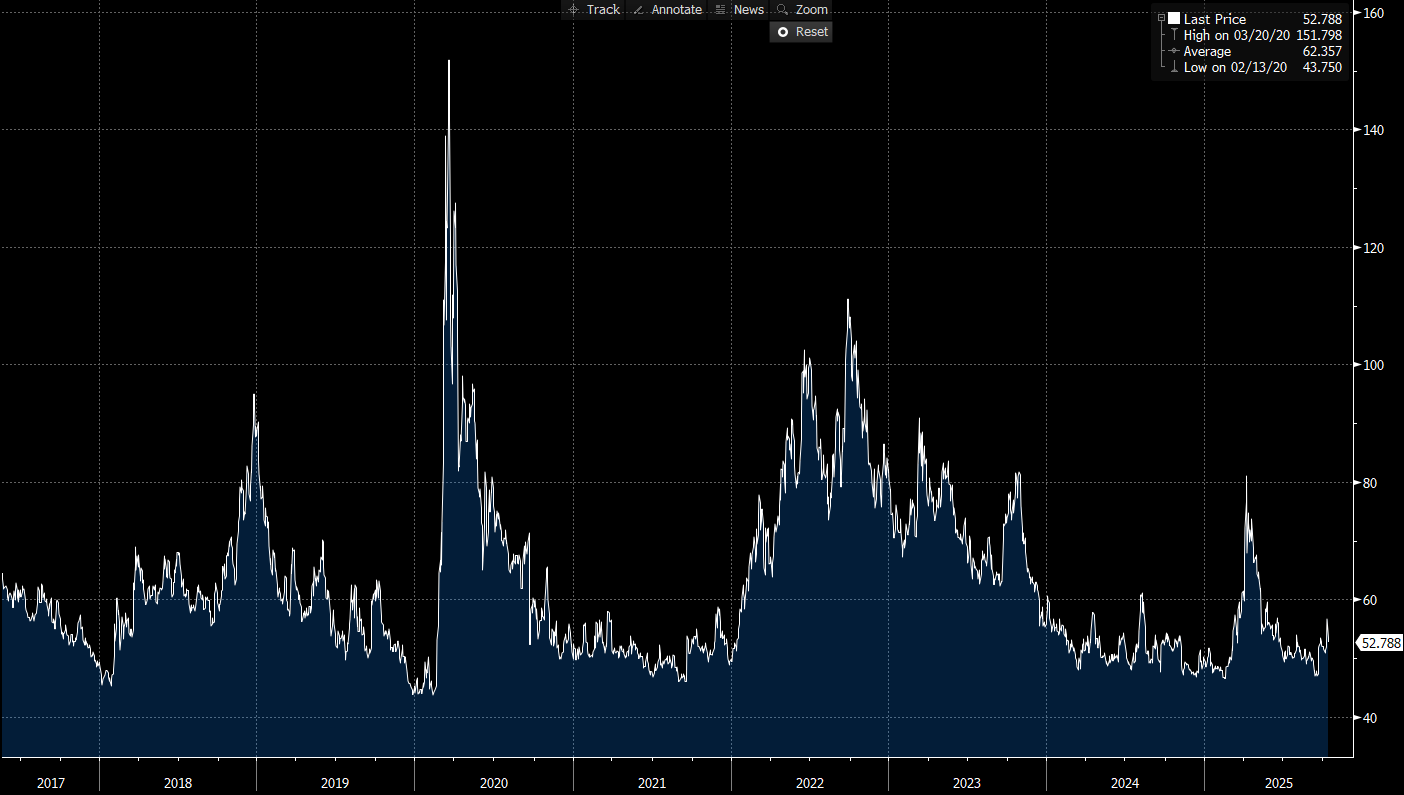

US IG Credit Wrap: Tariff Whipsaw, Fed Cushion — Spreads Hold the Mid-50s Channel (IG OAS ~52.8 bp)

Another headliney session, Bessent floated a longer tariff truce on rare earths, Trump declared “you’re in a trade war” but IG held firm. Equities chopped, gold stayed bid, front-end yields edged up from the lows, yet spreads barely blinked. The read from credit remains “carry intact, nerves audible.”

Where We Sit (from the chart)

IG OAS: ~52.8 bp

5-yr avg: ~62.4 bp → ~9.6 bp inside

Cycle tights: 43.8 bp → ~9.0 bp above

Pandemic wides: 151.8 bp → ~99 bp tighter

(Chart stats: Last ~52.79 | High 151.8 on 03/20/20 | Avg 62.36 | Low 43.75 on 02/13/20.)

Credit Context

≤50–60 bp: Carry-positive zone for IG beta; room to oscillate with headlines without breaking trend.

60–70 bp: The “noise band” where trade or growth scares can nudge beta wider temporarily.

>90 bp: Needs a real macro shock — still low probability with easing expectations firm and QT-pause talk in play.

Tape & Macro Overlay

Policy vs. politics: Bessent’s de-escalation attempt (longer tariff pause if China backs off rare-earth controls) briefly steadied risk; Trump’s “100% tariff” posture re-introduced uncertainty. Markets are toggling between liquidity relief and policy risk.

Rates/FX: 2y closed ~3.50%, near YTD lows; 10y ~4.0%. The street leans to at least one outsized cut by year-end, with ~’26 cumulative easing still embedded. A potential QT pause remains a tailwind for spreads via funding/swap-spread channels.

Commodities: WTI +0.9% off five-month lows on chatter India could curb Russian barrels; gold >$4,200/oz on hedging demand.

Asia handoff: Futures signal a choppy open as the region digests the “trade-war” framing; volatility there matters at the margin for EM-heavy IG corporates but not thesis-changing while U.S. funding stays benign.

Mapping to IG

Base case: 50–60 bp range, with a grind-tighter bias if earnings stay constructive and tariff rhetoric cools into November.

Sectors:

Banks: Supported by cleaner earnings prints and easier term funding; senior preferred should remain well-bid.

Cyclicals (Energy/Materials/Industrials): Two-way with tariff headlines and oil. Keep duration neutral and lean up-in-quality.

Defensives (Staples/HC/REITs IG): Benefit from dip-buying on any wobble; spreads already rich, so carry > capital gains.

We’ve shifted from “holiday-quiet mid-50s” to “headline-tested but anchored mid-50s.” The Fed cushion (cuts priced, QT-pause risk) keeps the downside contained for IG even as trade friction caps the upside. Until policy rhetoric decisively escalates or growth data crack, the path of least resistance is sideways-to-slightly-tighter in a 50–60 bp channel. Upside risk to OAS (wider) = a sudden growth scare or disorderly tariff step; downside (tighter) needs a clean risk tape and a live duration bid.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Equity Indices:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.