Macro Regime Tracker: CPI set up

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find the full live stream I recorded today on the macro regime here:

Full playbooks on macro, Bitcoin, and SPX are here:

All systematic models and strategies are published below.

Main Developments In Macro

US-Centric Trade and Tariff Developments

US IMPOSES 17% DUTY ON MOST TOMATO IMPORTS FROM MEXICO

US EXITS ANTIDUMPING DEAL WITH MEXICO ON FRESH TOMATOES

TRUMP: THE TARIFFS ARE KICKING IN, ECONOMY IS STRONG

TRUMP: WILL HAVE MORE FRIENDLY TARIFFS

TRUMP ON TARIFFS: STILL WILLING TO TALK

TRUMP ON TARIFFS: ALWAYS OPEN TO TALKING INCLUDING EUROPE

TRUMP: THE TARIFF LETTERS ARE THE DEALS

TRUMP ON EU TARIFFS: WILL BE TALKING TO PEOPLE

EU MULLS TARGETING US AIRCRAFT, CARS IN TRADE MEASURES: POLITICO

SEFCOVIC: MUST PREPARE WELL BALANCED COUNTERMEASURES AGAINST US

EU'S SEFCOVIC: US TARIFF PLAN IS PROHIBITIVE FOR MUTUAL TRADE

RASMUSSEN: NEED TO BE PREPARED TO IMPOSE COUNTERMEASURES

UK NEGOTIATING WITH US TO GET STEEL TARIFFS REMOVED ASAP: PARES

INDIA TRADE TEAM IN US THIS WEEK FOR TRADE DEAL TALKS: OFFICIAL

SHEINBAUM: MEXICO, US HAVE 'WORKING SCHEME' UNTIL AUG. 1

Geopolitical and Military Policy

TRUMP THREATENS SECONDARY TARIFFS OF 100% ON RUSSIA

TRUMP: WANT TO DO SECONDARY TARIFFS WITH RUSSIA

TRUMP: SEVERE TARIFFS ON RUSSIA IF NO DEAL IN 50 DAYS

TRUMP: PATRIOT MISSILES WILL GO TO UKRAINE VIA NATO

TRUMP'S UKRAINE ARM PLAN TO INCLUDE OFFENSIVE WEAPONS: AXIOS

TRUMP WILL ANNOUNCE NEW PLAN TO ARM UKRAINE ON MONDAY: AXIOS

TRUMP: DISAPPOINTED WITH PRESIDENT PUTIN

TRUMP: WE CAN DO SECONDARY TARIFFS WITHOUT SENATE, HOUSE

GERMANY ASKS US FOR 2 MORE PATRIOT MISSILE BATTERIES: PISTORIUS

TRUMP: US WILL MANUFACTURE, THEY'LL PAY FOR IT

Fed, Rates, and Economic Commentary

TRUMP: POWELL DOESN'T KNOW WHAT HE'S DOING

TRUMP: DOING SO WELL WE BLOW THROUGH INTEREST RATES

HASSETT: FED HAS BEEN 'VERY WRONG' ON TARIFFS

HASSETT: MUST RETHINK THE WAY THE FED IS ACTING

HASSETT: ECONOMY IS NOT OVERHEATING ACCORDING TO GDP

HASSETT: WON'T SPECULATE 'ON ME BEING FED CHAIR'

TRUMP FED CHAIR SELECTION PROCESS REMAINS FLUID: WAPO

POWELL ASKS FED'S INSPECTOR TO REVIEW RENOVATION COSTS: AXIOS

Diplomatic Engagements

TRUMP: EUROPE IS COMING OVER, THEY'D LIKE TO TALK

TRUMP: HAD GREAT MEETING WITH NATO

TRUMP SPEAKS AT MEETING WITH NATO'S RUTTE

ZELENSKIY SAYS 'VERY GOOD CONVERSATION' WITH TRUMP

EU'S VON DER LEYEN SAYS HAD A 'GOOD CALL' WITH CARNEY

TRUMP SAYS BESSENT DOING FANTASTIC JOB

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

S&P 500 Inches Higher as Financials Dominate, Tariff Rhetoric Simmering Ahead of CPI and Bank Earnings

The S&P 500 edged up 0.26% on Monday, preserving recent gains and showcasing a clear rotation into financials, industrials, and real estate as investors prepare for a pivotal week of macro catalysts. Despite deep losses in energy and modest tech softness, the index held firm thanks to strong breadth in value and rate-sensitive areas. While tariff tensions remain headline risk, market participants continue treating the August 1st threat as more bark than bite… for now.

Sector Contribution Breakdown (Weighted Return to Index)

Financials (+0.13 pp) – Once again the largest driver of index gains, led by large-cap banks and insurers as the curve steepened slightly and investor positioning rotated ahead of earnings season.

Industrials (+0.05 pp) – Benefitted from renewed optimism around capital goods and logistics, alongside Delta’s upbeat guidance from last week carrying over into airlines and transports.

Health Care (+0.03 pp) – Solid day for managed care and biotech names as sector continues to find support amid macro crosscurrents.

Communication Services (+0.02 pp) – Lifted modestly by strength in media and internet names despite valuation concerns persisting.

Consumer Discretionary, Staples, Real Estate, Utilities (+0.01 pp each) – Broad but shallow participation across these sectors, with real estate catching a slight bid as yields steadied.

Information Technology (–0.01 pp) – Slight drag, as mega-cap tech showed fatigue after a strong June–July run.

Energy (–0.02 pp) – Pulled the index lower as crude dropped sharply and recession fears re-emerged in commodity-sensitive names.

Materials (Flat) – Sector was marginal, with limited catalysts either direction.

Sector Performance Breakdown (Unweighted Index Returns)

Financials (+0.92%) – Strongest sector on the day, benefiting from firming margins and pre-earnings optimism.

Industrials (+0.60%) – Capital goods and transports advanced as cyclicals saw fresh demand.

Real Estate (+0.65%), Utilities (+0.38%), Staples (+0.22%) – Rate-sensitive sectors gained as Treasury yields cooled off intraday, supporting defensive allocation.

Health Care (+0.31%), Discretionary (+0.14%), Comm Services (+0.25%) – Moderately positive, underpinned by stable earnings expectations and limited tariff exposure.

Energy (–0.77%) – The day’s clear underperformer as oil tumbled and geopolitical news failed to prop up sentiment.

Materials (–0.22%), Tech (–0.03%) – Weakness tied to global demand worries and mild profit-taking post-Nvidia.

Macro Overlay: Tariff Tension, CPI Watch, Earnings Front-Load

1. Tariff Threats Heat Up, But Markets Stay Cool

President Trump’s tariff salvos over the weekend 30% rates threatened on Mexico and the EU—triggered EU warnings of “prohibitive” trade barriers and potential retaliation. Yet market reaction has been muted, with many investors interpreting the threats as negotiation tactics. The Aug. 1 deadline looms large but isn’t fully priced. Bloomberg's 22V survey suggests investors expect an effective tariff rate around 17%, not the full 30%.

2. CPI in Focus, Options Market Braces

The options market implies a 0.6% swing for Tuesday’s CPI print, with inflation expectations inching higher due to tariff pass-through fears. Core CPI is seen accelerating, potentially complicating the Fed's messaging. Fed Governor Hammack reiterated a cautious tone, emphasizing the need to wait before cutting rates amid inflation uncertainty.

3. Q2 Earnings: The Bar Is Low, the Stakes Are High

Financials kick off earnings season this week with expectations at their weakest in two years. With projected S&P 500 EPS growth of just 2.5%, even modest beats could trigger relief rallies. Bulls are watching for commentary on consumer resilience and corporate pricing power amid rising import costs.

Healthy Rotation or Fragile Balance?

The S&P 500 is levitating near record highs not through tech leadership but via broad, rotation-led strength in financials, industrials, and real estate. That’s constructive but not bulletproof. Tariff escalation, CPI upside surprises, or earnings downgrades could all shake this balance. For now, markets are giving the benefit of the doubt pricing in negotiation over escalation and resilience over risk. But with macro risk accumulating, this week’s CPI and bank results may determine whether the rally broadens or buckles.

US IG Credit Wrap: Spreads Drift to 50.94 bp as Volatility Slumps and Tariff Risk Lingers in the Background

Current Spread: 50.94 bp | 5-Year Average: 62.80 bp

Investment-grade credit spreads nudged higher Monday to 50.94 basis points, still comfortably below long-term averages and hovering near levels not seen since early 2018 outside crisis lows. While risk assets remain resilient and rate volatility has sharply compressed, the chart tells a more nuanced story: credit is behaving like volatility doesn't matter even though macro tail risk is arguably building.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: A Complacent Market or Just Confident?

1. Volatility Craters, But Spreads Aren’t Chasing

Implied equity vol (VIX) and rate vol (MOVE) have both retraced sharply from their spring highs, but IG spreads have only drifted modestly tighter in response. The current level just above 50 bp may reflect fatigue rather than fresh conviction, as buyers wait out CPI and the July 30 Fed meeting before chasing any further.

2. Tariff Tensions Fade from Price, Not from Risk

Trump’s weekend salvo threatening 30% tariffs on EU and Mexican goods by August 1 barely registered in credit markets. But strategists are increasingly warning that margin compression in consumer cyclicals and autos could surface in Q3 earnings a dynamic not yet reflected in spread levels. Credit is pricing a negotiated outcome, not escalation.

3. Primary Calendar Set to Reopen

Earnings blackouts have kept supply light, but that is about to change. Dealer desks expect a heavy wave of IG issuance post-CPI, with many issuers eager to tap markets while spreads remain tight and funding costs stable. A lumpy calendar could test demand if macro data disappoints or Treasury yields resume their climb.

4. Credit Quality Divergence Creeping In

While index-level spreads look stable, single-name dispersion is widening beneath the surface especially in lower-tier BBBs and names exposed to import costs. Recent bid-ask widening in food, retail, and transportation names suggests the street is less comfortable holding risk through the upcoming policy and earnings volatility.

Tightly Priced and Lightly Hedged

At just under 51 bp, IG credit is no longer offering a margin of safety it’s offering a macro view. And that view assumes calm into CPI, a Fed on hold, and tariffs that never bite. So far, that bet has worked. But with spreads sitting more than 11 bp below the 5-year average and real policy uncertainty rising, this feels less like confidence and more like positioning inertia.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

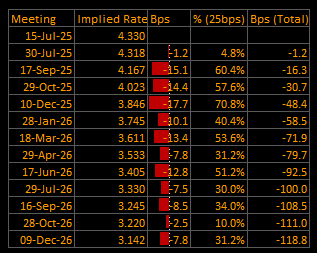

Short-End Rates Wrap: Easing Path Holds at –118.8 bp as Market Awaits CPI and Tariff Noise Fails to Derail Trajectory

Cumulative Implied Easing: –118.8 bp | Terminal Rate Seen at 3.14% (Dec 2026)

The front-end curve was largely unchanged to start the week, with traders holding their line on expectations for 119 basis points of easing by the end of 2026. While the glidepath steepened modestly into 1Q26, the September FOMC remains firmly priced as the kickoff, and there's still a visible tapering of conviction into year-end 2025 as data risk looms large. The overall shape of the OIS curve reflects data dependency, not panic… yet.

OIS-Implied Rate Path

Front-End Meetings:

15-Jul-25: 4.330% → Fully priced out; too early

30-Jul-25: 4.318% (–1.2 bp) → ~5% chance of a cut; Powell risk lingers, but no commitment

17-Sep-25: 4.167% (–15.1 bp) → ~60% cut probability → Still the clear favorite for cycle start

29-Oct-25: 4.023% (–14.4 bp) → Cumulative 1.5 cuts priced by October

10-Dec-25: 3.846% (–17.7 bp) → ~2.25 cuts expected by year-end

2026 Outlook:

28-Jan-26: 3.745% → Three cuts fully priced

29-Apr-26: 3.533% → Four cuts in hand

29-Jul-26: 3.405% → ~100 bp cumulative easing

09-Dec-26: 3.142% → Total easing of –118.8 bp from current effective rate

Macro Overlay: Cut Conviction Steady, but CPI Will Define the Pace

1. CPI in Focus as Glidepath Anchors Around September

All eyes now turn to Tuesday’s CPI print, which will be the key catalyst for validating or reshaping the curve. The market remains hesitant to price anything more than ~60% probability for a September start, but if core inflation undershoots expectations, that number could rapidly jump. Conversely, a hot print could shift the cycle into December or later.

→ The short-end is poised for a repricing event. It just needs a macro spark.

2. Tariff Risk Still Background Noise for Rates

Despite another escalation in Trump’s tariff rhetoric now including the EU, Mexico, and murmurs of secondary sanctions traders are still treating it as negotiation theater. Rate vol and implied easing are untouched, reinforcing the view that tariffs may impact equities and inflation marginally, but not the Fed’s glidepath unless they turn systemic.

→ The market is playing defense via duration, not inflation hedges.

3. Fed Doves Still Cautious — But Not Blocking the Door

Cleveland Fed’s Hammack reiterated a wait-and-see stance on cuts, aligning with broader FOMC caution. While two members have opened the door to September, most are signaling a desire for “a few more good months” of inflation data. Traders interpret this as: September is live, but only with CPI cooperation.

→ The Fed isn’t in a rush — but they’re also no longer in denial.

4. Rate Volatility Compresses, Reinforcing Steady Curve

With MOVE index levels back near 2023 lows and Treasury auctions well absorbed, the backdrop for short-end carry remains constructive. The lack of significant vol premium means traders are comfortable with the glidepath, for now. Any deviation will likely stem from CPI or labor.

Tension Builds Beneath a Calm Curve

The short-end remains stubbornly steady, with September penciled as the starting gun and a gradual easing path leading to 3.14% by late 2026. That’s a soft-landing story one that still assumes tariffs stay bluster and inflation cooperates. But the curve is thinly priced for surprises, and CPI is the next inflection point. If Tuesday’s data disappoints either way, expect traders to reprice aggressively. Until then, the short-end is in wait mode cautious, but committed.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.