Macro Regime Tracker: Equity Rally

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

When we were at the equity lows last night, I published this report explaining that the driver of the selling pressure was from a positioning unwind as opposed to a macro driver. Why does this matter? Because when you understand WHERE the selling pressure is coming from (in this case, the carry trade), you can know if you want to buy the dip or derisk before further downside.

We continue to be in a macro regime where credit is getting pumped into the system but there are going to be significantly more risks to manage into the end of the year. As I laid out in this video, we are seeing unprecedented factors converge to create extreme outcomes. In other words, melt up and melt downs are a higher probability with macro volatility instead of a slow, safe grind.

All of these factors are setting the stage for much bigger forces to begin coming into play. Below are all the systematic models and strategies mapping the major macro changes across asset classes. More on this tomorrow.

Main Developments In Macro

United States: Macro, Fed, and Policy

FED GOVERNOR STEPHEN MIRAN SPEAKS IN YAHOO FINANCE INTERVIEW

MIRAN: A LOT OF MY OUTLOOK HINGES ON MORE SHELTER DISINFLATION

MIRAN: MARKET-BASED CORE PCE INFLATION IS MUCH CLOSER TO 2%

MIRAN: POLICY SHOULDN’T MECHANICALLY RESPOND TO HIGHER STOCKS

MIRAN: WOULD THINK IT’S STILL REASONABLE TO CONTINUE RATE CUTS

MIRAN: KEEPING POLICY THAT RESTRICTIVE RUNS UNNECESSARY RISKS

MIRAN: I THINK POLICY IS TOO RESTRICTIVE, TOO FAR ABOVE NEUTRAL

MIRAN: WANT TO GET TO DESTINATION FOR RATES FASTER THAN OTHERS

MIRAN: DATA SUGGEST RATES CAN BE A LITTLE LOWER THAN THEY ARE

FED’S MIRAN: BETTER-THAN-EXPECTED ADP DATA WAS WELCOME SURPRISE

US Credit & Household Leverage

US STUDENT-LOAN DEBT BECOMING DELINQUENT RISES TO RECORD 14.4%

US CONSUMER DEBT IN DELINQUENCY RISES TO HIGHEST SINCE Q1 2020

NEW YORK FED RELEASES QUARTERLY REPORT ON US HOUSEHOLD DEBT

US Fiscal, Treasury & Government

US SETS QUARTERLY REFUNDING AT $125B, IN LINE WITH ESTIMATES

US TO MAINTAIN JANUARY 10Y TIPS NEW ISSUE AUCTION AT $21B

US SEES STEADY AUCTIONS FOR `AT LEAST NEXT SEVERAL QUARTERS’

TREASURY PROJECTS STEADY NOMINAL AUCTION SIZES FOR NOV-JAN

Global Macro & Policy Context

ECB’S STOURNARAS: MORE EASING CAN’T BE RULED OUT: MNI

STOURNARAS: NOT JUMPING TO CONCLUSION THAT DEC. CUT NEEDED: MNI

ECB’S NAGEL: MEDIUM-TERM INFLATION PRETTY CLOSE TO TARGET

TSCHUDIN: SNB MONETARY POLICY IS EXPANSIONARY

RBNZ’S HAWKESBY: LABOR MARKET HAS DETERIORATED AS EXPECTED

RBNZ’S HAWKESBY: EXPECT EMPLOYMENT TO IMPROVE FROM HERE

RBNZ’S HAWKESBY: NOT YET SEEING RATE CUTS LIFT ASSET PRICES

RBNZ GOVERNOR CHRISTIAN HAWKESBY SPEAKS AT PARLIAMENT COMMITTEE

SWEDEN’S RIKSBANK LEAVES POLICY RATE AT 1.75%; EST. 1.750%

China Trade & Tariffs

CHINA TO LIFT ANTI-MONOPOLY DUTY OVER US COS. EFFECTIVE SEPT. 4

CHINA TO LIFT SOME EXPORT CONTROL MEASURES ON US FIRMS

CHINA TO ADJUST UNRELIABLE ENTITIES LIST AFTER US TALKS

CHINA SAYS TO RETAIN 10% TARIFFS ON US GOODS

CHINA TO SUSPEND 24% TARIFFS ON US GOODS FOR 1 YEAR

CHINA TO SUSPEND TARIFFS ON SOME US GOODS FROM NOV 10

🏛️ US Political / Fiscal Dynamics

SCHUMER, JEFFRIES DEMAND BIPARTISAN MEETING WITH TRUMP

SCHUMER, JEFFRIES SEEK MEETING TO END GOVERNMENT SHUTDOWN

TRUMP: SHUTDOWN BIG FACTOR IN ELECTIONS LAST NIGHT

TRUMP PRAISES CRYPTO, SAYS IT TAKES PRESSURE OFF THE DOLLAR

TRUMP: XI IS A FRIEND OF MINE, AS MUCH AS HE CAN BE

US GOVERNMENT SHUTDOWN SETS RECORD FOR LONGEST EVER AT 36 DAYS

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data,

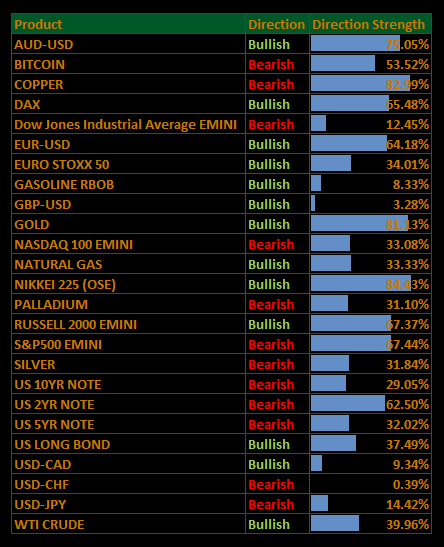

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

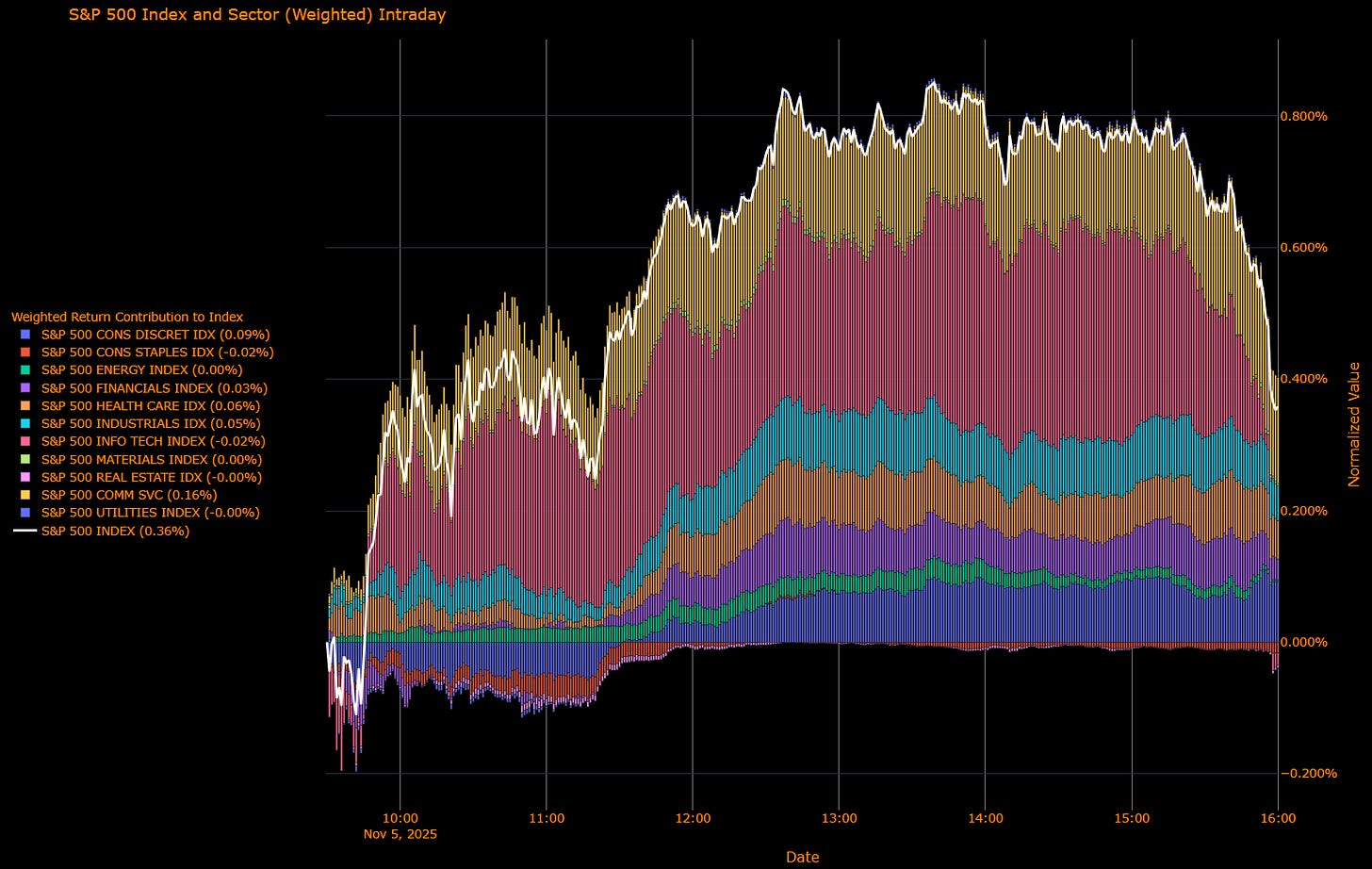

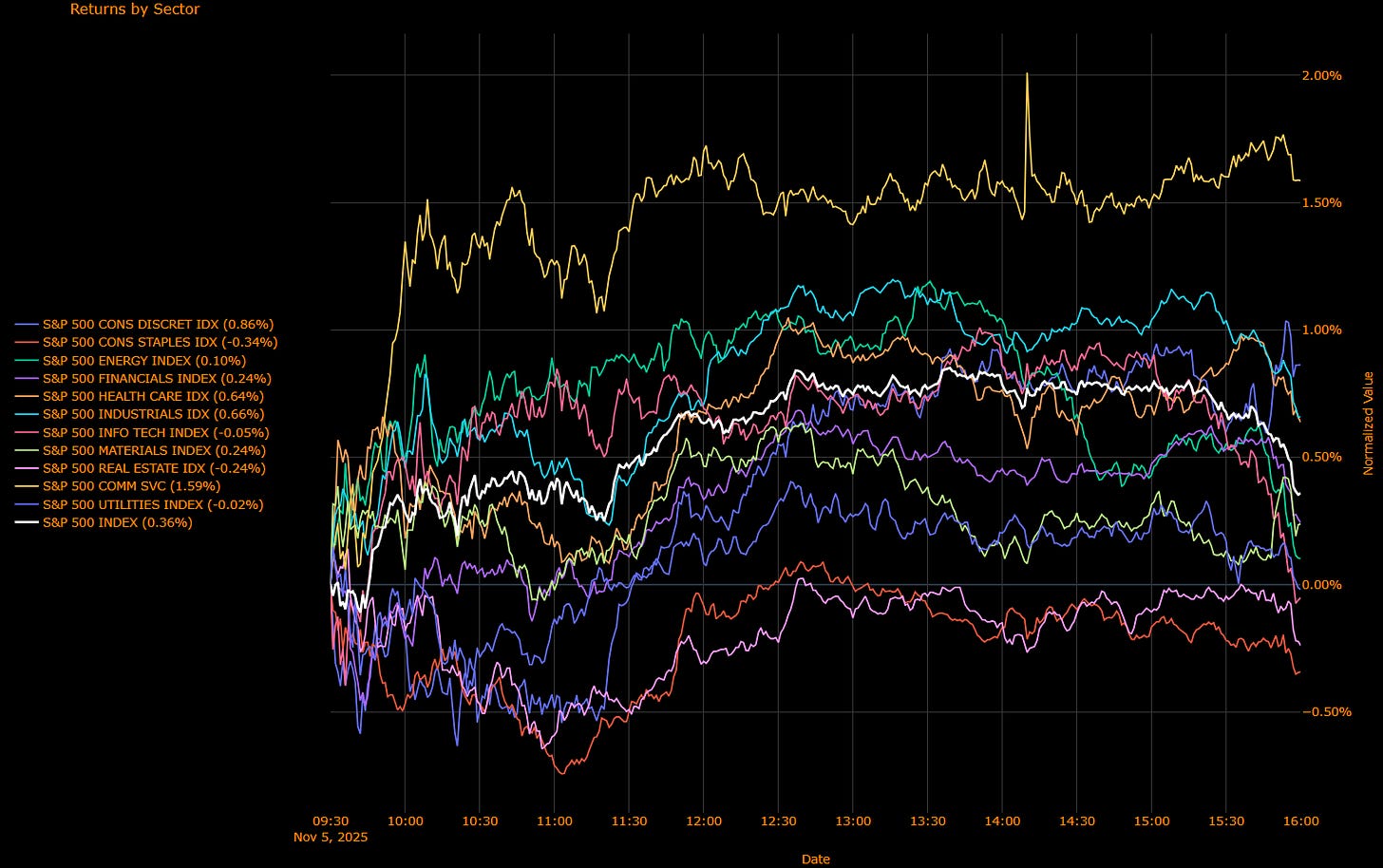

US Market Wrap: “Good Data, Higher Yields, Still Green”; S&P +0.36%, Comm/Disc Lead, Tech Small Drag

Dip-buyers stayed active even as ISM Services re-accelerated and 10s pushed ~7 bp higher to ~4.16%. The tape read the print as “growth > inflation scare,” with cyclicals and communications leadership offsetting a small Tech dip. Breadth improved, and weakness clustered in defensives and rate-sensitives.

Sector Attribution

Weighted contribution (Index +0.36 pp)

Leaders: Comm Svcs +0.16 pp, Cons Disc +0.09 pp, Industrials +0.05 pp, Health Care +0.06 pp, Financials +0.03 pp

Laggards/flat: Info Tech −0.02 pp, Staples −0.02 pp, RE/Utils ≈ 0, Energy/Materials ≈ 0

Unweighted performance (breadth)

Leaders: Comm Svcs +1.59%, Cons Disc +0.86%, Industrials +0.66%, Health Care +0.64%

Mid: Financials/Materials +0.24%, Energy +0.10%

Laggards: Info Tech −0.05%, Real Estate −0.24%, Staples −0.34%, Utilities −0.02%

Read: Participation broadened beyond mega-cap Tech; cyclicals and services-heavy groups did the lifting while duration-sensitives lagged—textbook response to firmer growth + higher yields.

Macro Overlay

Activity/Prices: ISM Services 52.4 (8-month high) with Prices Paid 70 (3-yr high). Demand firm; inflation signal warm but not regime-changing.

Rates/Curve: 10y ~4.16% in a modest bear-steepener; rate vol contained, letting equities digest higher yields.

FX/Crypto: USD little changed; BTC +3.6% / ETH +7.3%, risk tone constructive.

Earnings/AI: Semis leadership cooled at the margin vs yesterday’s pop; Tech small net drag while Comm Svcs and Disc carried beta.

Positioning/Flows: Still a buy-the-dip backdrop; systematic re-add + seasonal buybacks aid downside containment.

The Read-Through

Growth > rates headwind: Higher yields didn’t derail risk, cyclicals outperformed; defensives and RE/Utils lagged.

Leadership broadening: Comm Svcs/Disc/Industrials/HC did the heavy lifting, healthier than a one-factor Tech tape.

Valuation still the governor: With Tech a small drag, the index can still climb if breadth persists, but lofty multiples keep pullback risk alive on any earnings/guidance wobble.

What I’m Watching

Reals & MOVE: A reals-led rates pop with vol would hit long-duration growth and RE/Utils harder.

Breadth follow-through: Can Industrials/Financials maintain leadership if Tech chops sideways?

Services-price persistence: Another hot print would test the “cuts-ahead” narrative even if growth is firm.

Consumer pulse: Disc vs Staples spread—today’s risk-on tilt wants resilient spending.

Bottom Line

A classic “good data, higher yields, still green” session: cyclicals and services leadership offset a mild Tech drag, leaving the S&P up +0.36% with better breadth. As long as rate vol stays tame and earnings breadth holds, dips remain buyable, though the mix (hot ISM prices, firm reals) argues for cyclical over duration on the margin and a wary eye on defensives and RE/Utilities

US IG Credit Wrap: Tighter on “Good Growth” Day; Carry Still the Anchor (IG OAS ≈52.8 bp)

Spreads tightened alongside a broad equity rebound and hotter ISM services print. The tone was risk-positive, not euphoric, primary remains open, rates vol contained, and the market read the data as “growth confirmation” rather than a policy scare. Net: carry intact, beta modestly bid.

Where We Sit (from today’s chart)

IG OAS: ~52.8 bp (last 52.751)

5-yr average: ~61.9 bp → ~9 bp inside

Cycle tights: ~46.1 bp → ~6–7 bp above

2022 wides: ~111.2 bp → ~58 bp tighter

We’re back toward the lower half of the 50–55 bp equilibrium band, flirting with the low-50s without threatening cycle tights.

Macro & Tape Overlay

Data: ISM Services 52.4 (8-month high); Prices Paid 70 (3-year high). Demand re-accelerates; inflation signal warm but not disruptive.

Rates: 10y +7 bp to ~4.16%; curve bear-steepened modestly. MOVE muted → spread beta can live with small rate back-ups when vol is contained.

Equities/Flows: >300 S&P advancers; Semis +3%, RTY +1.5%, a cleaner risk tone. Credit followed equities, not rates.

FX/Crypto: USD steady; Bitcoin +3.6%, risk appetite constructive at the margin.

Energy/Commodities: WTI −1.6% helps the disinflation narrative even as ISM prices run hot; benign for IG.

Mapping to IG Credit

Fair-value band: 50–55 bp still feels like “carry equilibrium.” At ~52.8 we’re near the middle-low of that range.

Path to the 40s: Needs a disinflation + softer-labor mix that drags reals lower and compresses rate vol further, plus steady primary.

What pushes us back to 55–58: A rates-vol pop (reals-led), a broader equity drawdown that dents new-issue demand, or unexpectedly hawkish Fed rhetoric.

Primary & Positioning

New issue: books well-covered, concessions lean; refinancing windows open.

Positioning: Not stretched, room for incremental beta add if breadth persists. Financials/Industrial paper benefitting from improved cyclical tone.

Risk Markers to Watch

MOVE vs. real yields (reals-led bear move matters more than nominal drift).

Primary health: order multiples/concessions/after-market.

Earnings breadth & equity leadership: if gains narrow back to mega-cap only, beta tightens less easily.

ISM prices follow-through: one print is fine; persistence would pressure reals.

The Read-Through

“Good growth, tame vol” is the sweet spot, today fit that script, so spreads tightened.

Carry remains king inside 50–55; buyers showed up quickly after yesterday’s wobble.

Asymmetric risks sit above current levels (a vol shock widens faster than a drift to the 40s).

IG reconfirmed its resilience, tightening with higher yields tells you the market sees growth without stress. Until rates vol bites or primary balks, carry first, volatility later remains the trade.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.