Macro Regime Tracker: Flows Forming

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

See the thought piece I published here:

All of the models and strategies have been updated below. Thanks

Main Developments In Macro

US Macro & Fed

*TRUMP'S 'REPEATED ATTACKS' ON FED ARE A CONCERN: MACKLEM

*GOOLSBEE: DON'T THINK FOMC MEMBERS WILL TAKE OUTSIDE DIRECTION

*GOOLSBEE: POLITICAL INTERFERENCE IN MONETARY POLICY DANGEROUS

*FED'S GOOLSBEE SAYS OFFICIALS CAN'T TAKE EYE OFF INFLATION

*POWELL: WE DO SEE MEANINGFUL WEAKNESS IN THE LABOR MARKET NOW

*POWELL: FED NEVER THINKS ABOUT POLITICS WHEN MAKING DECISIONS

*POWELL: TARIFF PASSTHROUGH HAS BEEN LESS THAN WE EXPECTED

*POWELL: TARIFFS ARE NOT A BIG INFLATIONARY FACTOR

*POWELL: US NOW COLLECTING A GOOD BIT OF REVENUE FROM TARIFFS

*POWELL: STUDIES SUGGEST AI NOT MAIN REASON FOR HIRING SLOWDOWN

*POWELL: PART OF HIRING SLOWDOWN IS UNCERTAINTY ON PUBLIC POLICY

*POWELL: JOB CREATION HAS DROPPED VERY SHARPLY

*POWELL: SOME ASSET PRICES ELEVATED VERSUS HISTORICAL LEVELS

*POWELL: BY MANY MEASURES, EQUITY PRICES FAIRLY HIGHLY VALUED

*POWELL: IT'S NOT A TIME OF ELEVATED FINANCIAL STABILITY RISKS

*POWELL: BANKS ARE WELL-CAPITALIZED, HOUSEHOLDS IN GOOD SHAPE

*Powell: Fed's Stance of Tight Focus on Inflation Needed to Moderate

*Powell: Latest Beige Book Showed Uniform Picture of Modest Growth, Uncertainty Across Country

*POWELL: BEIGE BOOK NOT SHOWING SIGNIFICANT REGIONAL DIFFERENCES

*POWELL: UNCERTAINTY OVER INFLATION’S PATH REMAINS HIGH

*POWELL: AUGUST PCE CORE INFLATION SEEN UP 2.9%, DRIVEN BY GOODS

*POWELL: RECENT PRICE INCREASES LARGELY REFLECT TARIFFS

*POWELL: DOWNSIDE RISKS TO EMPLOYMENT HAVE RISEN

*POWELL: LONG-RUN INFLATION EXPECTATIONS IN LINE WITH 2% TARGET

Other Fed Speakers

*BOSTIC: RISKS TO EMPLOYMENT ARE COMPARABLE TO INFLATION RISK

*BOSTIC: RIGHT NOW I THINK NEUTRAL REAL RATE IS AROUND 1.25%

*BOSTIC: STORY WE HEAR FROM BUSINESSES IS NOT HIRING, NOT FIRING

*BOSTIC: I THINK THERE IS MORE INFLATION TO COME

*FED'S BOSTIC: I'D BE OPEN TO USING RANGE FOR INFLATION TARGET

*BOWMAN: INFLATION TARGET RANGE WORKS FOR OTHER CENTRAL BANKS

Tariffs / Trade Policy

*ALCOA CEO WARNS TARIFFS WILL DESTROY METAL DEMAND IN US

*MACKLEM: FULL IMPACT OF US TARIFFS IS YET TO BE SEEN

*MACKLEM: US TARIFFS PROBABLY WON'T FIX GLOBAL IMBALANCES

*MACKLEM: US TRADE POLICY COULD 'DENT' USD AS GLOBAL SAFE ASSET

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Tech Stumbles, Defensives Rotate; Powell Warns on Dual Risks (S&P –0.55%)

The S&P 500 slipped 0.55%, pulling back from record highs as the “Magnificent Seven” sank 1.5% and leadership rotated into defensives. Powell avoided signaling October’s policy move, stressing the Fed faces “two-sided risks” inflation tilted higher by tariffs and employment tilted lower by a cooling labor market. His refusal to offer a dovish handhold left equities without their usual tailwind.

Bond yields fell, with 10s down 4 bps to 4.11%. The dollar wavered while gold held its record and oil climbed on NATO–Russia tension. The market tone was one of consolidation, with tech retracing after an AI-fueled run while utilities, staples, and real estate cushioned the broader index.

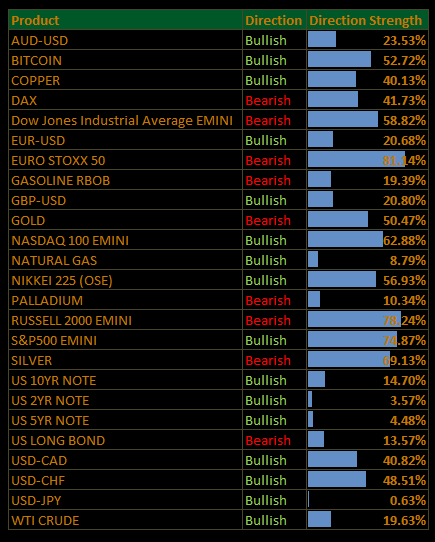

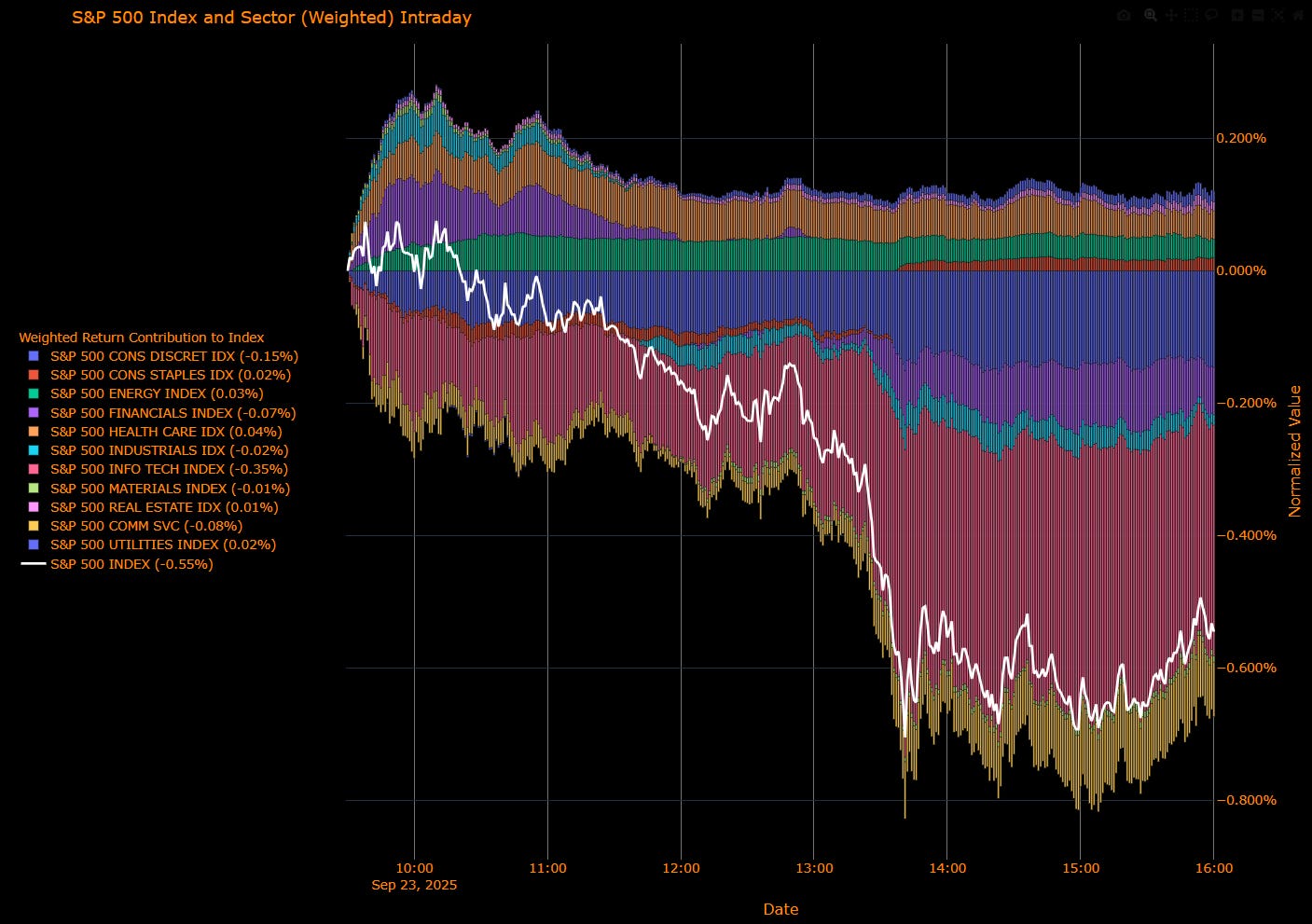

Sector Attribution

Weighted Return Contribution to Index

Biggest drag: Information Technology (–0.35%), driving most of the S&P’s decline.

Other negatives: Consumer Discretionary (–0.15%), Communication Services (–0.08%), Financials (–0.07%).

Offsets: Energy (+0.03%), Health Care (+0.04%), Staples (+0.02%), Utilities (+0.02%).

Net impact: S&P 500 (–0.55%).

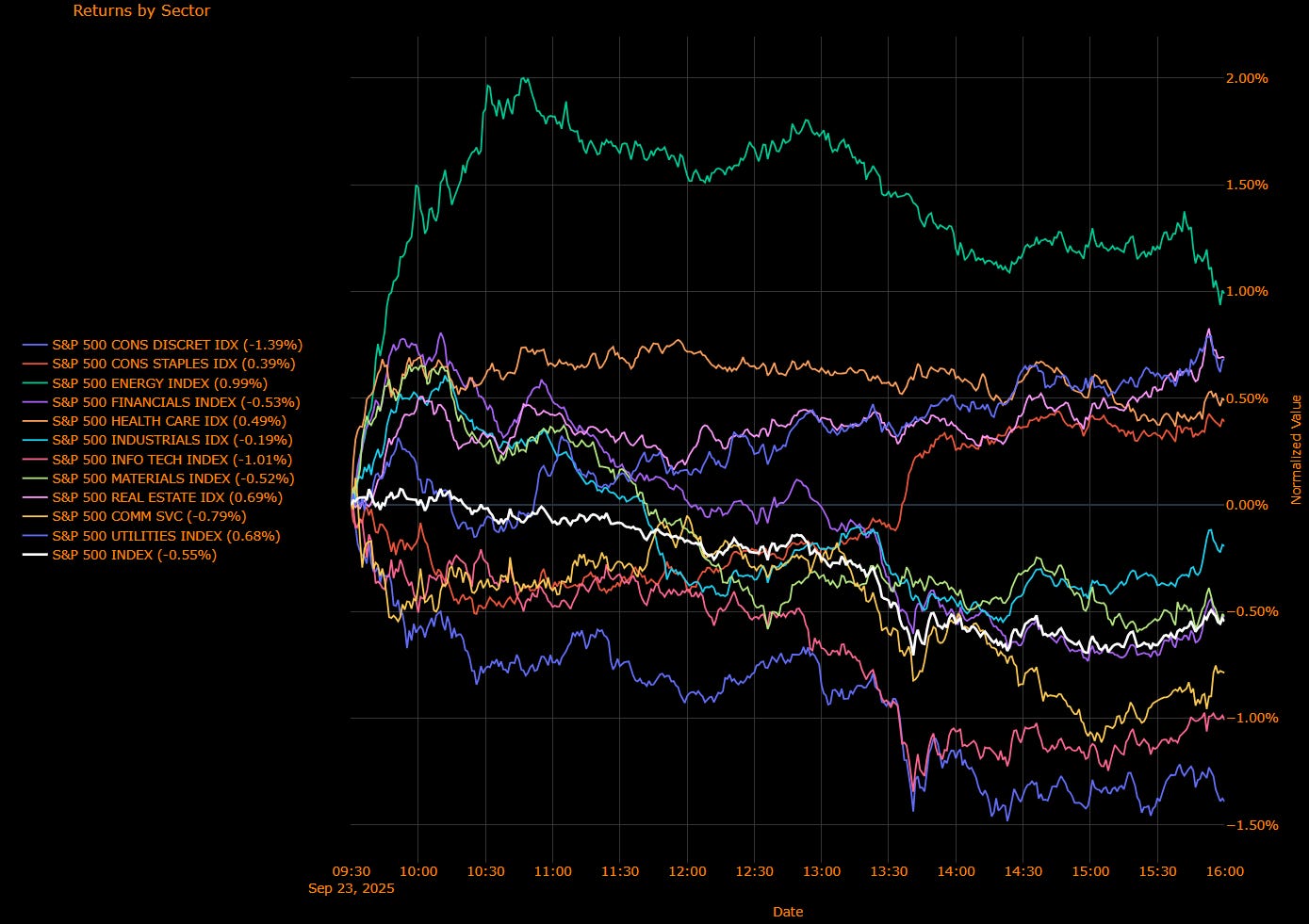

Sector Performance (Unweighted Breadth)

Tech (–1.01%) and Consumer Discretionary (–1.39%) bore the brunt of the selling, alongside Communication Services (–0.79%).

Defensives led: Energy (+0.99%), Utilities (+0.68%), Real Estate (+0.69%), Staples (+0.39%), Health Care (+0.49%).

Industrials (–0.19%) and Materials (–0.52%) treaded water.

The split highlighted a clear rotation into yield-sensitive defensives, unusual given falling rates but consistent with a market hedging growth downside.

Macro Overlay

Powell’s Stance

Powell reiterated that “there is no risk-free path,” with tariffs driving near-term price pressure while jobs data weakens. He stressed the Fed is not acting politically, but acknowledged public trust risks. His framing mirrors September’s “risk-management cut” easing is possible, but contingent on labor.

Policy Split

Bowman urged decisive cuts as the labor market weakens.

Bostic and Goolsbee warned inflation risks persist, with Bostic flagging more inflation to come.

Miran remains an outlier, pushing for steep cuts.

This range of views underscores a fractured Fed, balancing sticky tariffs against a cooling jobs market.

Market Dynamics

Lower yields buoyed defensives (Utilities, Real Estate, Staples).

Tech lost steam, confirming stretched positioning risk.

Energy rallied on geopolitical headlines, cushioning cyclicals.

Market Tone

The index’s pullback was less about panic and more about rotation under the surface. Defensives are asserting themselves as Powell signals a longer balancing act. With Friday’s PCE looming, the question is whether investors buy this dip in tech or extend into defensives as the “dual risk” message takes hold.

The Read-Through

Base Case: Powell keeps October optionality; two cuts remain penciled for 2025, conditional on labor.

Risks: Tariffs push inflation higher into Q4, limiting dovish momentum.

US IG Credit Wrap: Powell’s ‘Two-Sided Risks’ Meets Dip in Yields; Carry Still Rules (IG OAS ~52.2 bp)

IG spreads held in the low-50s even as mega-cap tech wobbled and 10-year yields fell ~4 bp to ~4.11%. Bloomberg US IG OAS printed ~52.2 bp (chart last: 52.152), a modest cheapening from sub-50 tights but still squarely in the carry zone. Powell offered no October signal and reiterated “two-sided risks” tariffs biasing inflation up, labor softening, which keeps the easing path optional, not pre-committed.

Credit Context

IG OAS: ~52.2 bp

5-yr avg: ~62.5 bp → ~10 bp inside

Cycle tights: ~43.8 bp → ~8–9 bp off

COVID peak: ~151.8 bp → ~100 bp tighter

Read: Low-50s regime = carry positive with room for two-way around data/issuance.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today

Macro tape: S&P –0.55% as the “Mag 7” fell –1.5%; 10y –4 bp to ~4.11%; dollar mixed; gold firmer, WTI +2.3%.

Fed tone: Powell: no “risk-free path,” tariffs a near-term price level shock; Bowman leans to faster cuts on labor, Bostic/Goolsbee emphasize inflation risk. Net: optionality > pivot.

Risks to Watch

Data: A hot core PCE or re-accel in services could cheapen duration and add +2–5 bp to beta OAS.

Labor air-pocket: Faster weakening = dispersion (cyclical IG/BBB long tenors underperform).

Curve dynamics: Growth-scare bull steepening is more credit-hostile than supply-led sell-offs.

Supply windows: Heavy prints into thin liquidity can widen tails.

The Read-Through

Carry remains the game. Low-50s OAS supports clip-the-coupon returns with modest MTM chop while the Fed talks optionality and long rates drift lower.

Final Word

From “too tight to chase” to “tight but tolerable” again. Unless PCE surprises hot or labor cracks, IG should grind with defensiveness underneath. Keep a hand on the duration dial, but let carry do the heavy lifting.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.