Clarity Amidst Uncertainty

Why thinking with clarity is the greatest asset in a world of uncertainty

Clarity Amidst Uncertainty:

The type of market we are in is confounding conservative investors who always want to play it safe. For years, you could rely on bonds steadily moving upward to support portfolio returns. If a recession hit, bonds would rally to offset equity drawdowns. Things might get a little dicey, but the Fed always had your back. That playbook worked perfectly until the problem shifted to real interest rates and the currency.

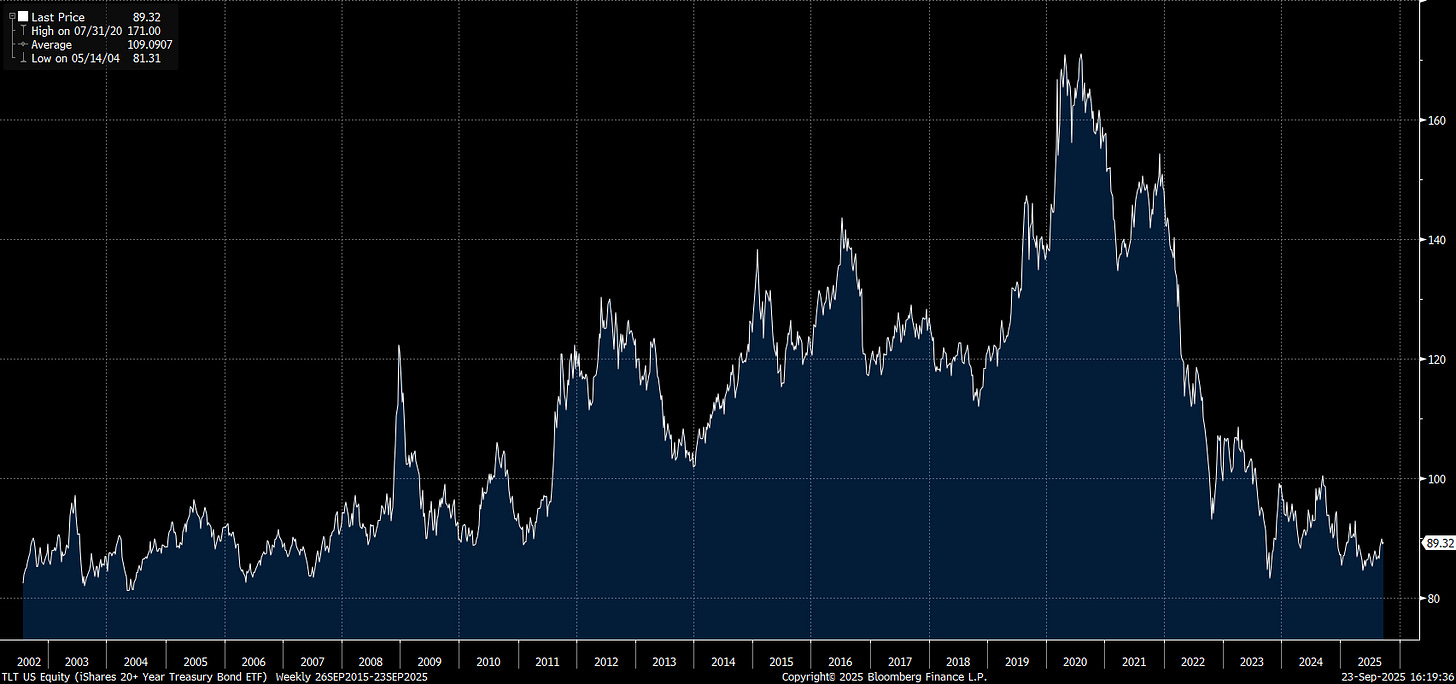

We are now in one of the largest bond drawdowns in US history without any end in sight:

While bonds decline, gold has begun a rally that remains underappreciated by the Wall Street community. The entire industry is still fixated on traditional 60/40 portfolios despite the fact that a very clear regime change is underway.

The current rally in gold looks very similar to the rally of the 1970s when the dollar was taken off the gold standard. The problem is that the regime change is NOTHING like 1971.

Instead of the dollar being taken off the gold standard, this period is defined by the dollar’s role as the world’s reserve currency colliding with a highly modernized era of industrialization supercharged by AI. The result is much faster transactions, WAY more transactions, and a constant increase in the speed at which they occur. When more transactions flow through a currency with greater efficiency and velocity, it creates a flywheel effect that moves money around more quickly, thereby expanding the amount of money in the system.

This is one of THE main themes I have highlighted in relation to cross-border liquidity in the three most recent macro reports:

The Only Life Raft Left:

When the pace of change in growth, inflation, and liquidity accelerates, the stability of returns erodes. What once could be managed with passive positioning now requires deliberate, active decisions. In a faster-moving environment, maintaining the same level of returns demands more frequent adjustments because the underlying drivers of asset prices are shifting more often.

This accelerated pace of change is converging with the attention economy and the rise of social media, where complex problems are increasingly reduced to simple, all-in-one solutions. We see it in the way people sell Bitcoin, an altcoin, a tactical asset allocation strategy, or a trend-following system as the universal answer to every challenge in markets and the economy. This reductionistic mindset is fundamentally flawed because the future world does not work through single solutions; it works through adaptation to the causal mechanics of the system.

The only durable edge comes from becoming the kind of person who can actively make decisions in real time, adapt as conditions evolve, and surround yourself with others who operate at that same level. Looking ahead, this reality also means that human capital will matter more than ever. The largest companies of the future will be built and run by individuals who can leverage networks, knowledge, and adaptability at scale, making human capital and the connections to it far more important than any single stock or static strategy.

What are the tangible actions to take?

Build a durable base of specialized knowledge to understand and consistently interpret the world

Have the highest quality of information flow from the clearest thinkers

Identify all of the ways people don’t want to embrace uncertainty, chaos, imperfect knowledge, and risk. Take the bets no one else wants to take.

Develop a consistent process for making decisions that accounts for both the seen and unseen, and that stays aligned with changes in both nominal and real terms.

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.