Macro Regime Tracker: FOMC Moment

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

The macro regime continues to show strength as equities melt up. This is the theme I have consistently laid out since April. The recent video I did on the credit cycle explained that the Fed is cutting rates into accelerating growth.

As the Fed cuts rates into grwoth, we are seeing the Mag7 names get A TON of capital as market breadth is fairly neutral. In simple terms, the rally in the S&P500 is being driven by Mag7 while everything else just sits there. The macro clearing event tomorrow could cause some short term selling pressure, but this would be another buying opportunity in my view.

As always, all the systematic models and strategies are laid out below. My views on rates are laid out here as we move into tomorrow. Thanks.

Main Developments In Macro

US Policy, Government, and Fiscal

HOUSE SPEAKER MIKE JOHNSON TALKS TO REPORTERS

JOHNSON: I DON’T SEE A PATH FOR TRUMP THIRD TERM

JOHNSON SUGGESTS NO WAY TO AVOID FOOD STAMPS CLIFF ON NOV. 1

US VICE PRESIDENT JD VANCE SPEAKS TO REPORTERS AT THE CAPITOL

VANCE: TRYING TO MAKE SURE CRITICAL FOOD BENEFITS GET OUT

VANCE: WE CAN’T KEEP PAYING ALL FEDERAL WORKERS, FUNDS LIMITED

VANCE: THINK PEACE IN MIDEAST WILL HOLD DESPITE SKIRMISHES

THUNE: TRUMP WILLING TO MEET DEMS NEXT WEEK IF SHUTDOWN ENDS

JEFFRIES SAYS DEMOCRATS REMAIN FIRM IN POSITION ON STOPGAP BILL

FHFA’S PULTE: NEWS INCOMING SHORTLY ON FANNIE MAE

DOZENS OF STATES SUE TRUMP ADMIN OVER FOOD STAMP CUTS: NYT

Geopolitical & Global Risk

HAMAS CALLS ON MEDIATORS TO PRESSURE ISRAEL TO STOP VIOLATIONS

HAMAS REITERATES COMMITMENT TO GAZA CEASEFIRE AGREEMENT

HAMAS SAYS IT HAS NOTHING TO DO WITH RAFAH SHOOTING

NETANYAHU ORDERS IDF TO CARRY OUT ‘POWERFUL’ GAZA STRIKES

KATZ: HAMAS TO PAY HEAVY PRICE FOR ATTACKING IDF SOLDIERS

RUSSIAN, SYRIAN DEFENSE MINISTERS DISCUSS COOPERATION

VENEZUELA DECLARES TRINIDAD’S PRIME MINISTER PERSONA NON GRATA

MEXICO’S SHEINBAUM: US BOATS ATTACK WAS IN INTERNATIONAL WATERS

SHEINBAUM: MEXICO AGAINST US BOAT ATTACK IN INTERNATIONAL WATER

SHEINBAUM: MEXICAN NAVY HELPED RESCUE SURVIVOR AFTER US ATTACK

US–China / Tech–Industrial Policy Interface

NVIDIA CEO SAYS US STILL AHEAD OF CHINA IN AI

NVIDIA CEO SAYS POSSIBLE THAT US COULD FALL BEHIND CHINA IN AI

NVIDIA HASN’T SOUGHT LICENSE TO SHIP BLACKWELL TO CHINA: HUANG

HUANG SAYS UNSURE ABOUT STATUS OF LICENSES FOR SAUDI ARABIA

HUANG SAYS HE ASSUMES CHINA MARKET TO REMAIN AT ZERO FOR NVIDIA

HUANG SAYS HE’S CONFIDENT TRUMP WILL REACH GOOD DEAL W/ CHINA

HUANG: US NEEDS A LOT MORE ENERGY TO SUSTAIN INDUSTRY GROWTH

HUANG SAYS `I DON’T BELIEVE WE’RE IN AN AI BUBBLE’

US ENERGY DEPARTMENT RELEASES STATEMENT ON SUPERCOMPUTERS

US SELECTS HPE, NVIDIA AS PARTNERS FOR 2 NEW SUPERCOMPUTERS

NVIDIA TO HELP BUILD SEVEN SUPERCOMPUTERS WITH US ENERGY DEPT

SUPERMICRO, NVIDIA EXPAND GOVERNMENT SOLUTIONS PARTNERSHIP

SUPERMICRO EXPANDS COLLABORATION WITH NVIDIA

NVIDIA, NOKIA IN NEW PARTNERSHIP

NVIDIA TO MAKE $1.0B EQUITY INVESTMENT IN NOKIA

Nvidia, Nokia: T-Mobile U.S. 6G Trials Expected to Start in 2026

Nvidia, Nokia: T-Mobile U.S. Working to Integrate AI-RAN Technologies Into 6G Development Program

NVIDIA CEO SAYS BLACKWELL IN ‘FULL PRODUCTION’ IN ARIZONA

Nvidia CEO Huang at GTC: Nvidia Partners with Uber to Connect ‘Robo-Taxi Ready’ Computing Platform

Nvidia: Palantir Integrating Nvidia Accelerated Computing Into Ontology Framework

Nvidia: Lowe’s Pioneering Operational AI for Supply-Chain Logistics With Palantir, Nvidia

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data,

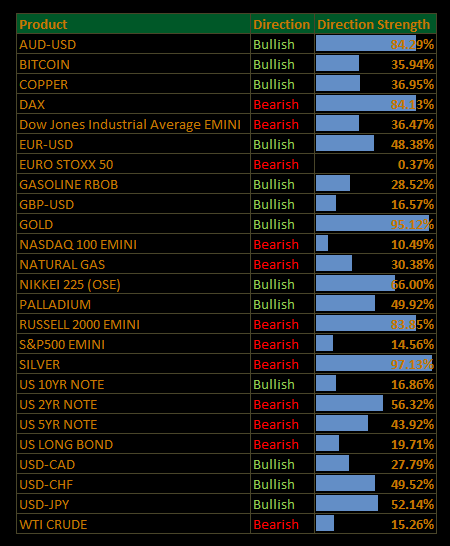

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Tech Offsets Weak Breadth Ahead of Fed; Index Flat (S&P −0.02%)

Markets traded sideways into Wednesday’s Fed decision and a critical stretch of megacap tech earnings. The S&P 500 ended marginally lower (−0.02%), masking a sharp dispersion beneath the surface: Tech strength kept the tape afloat, while defensives and interest-sensitive sectors extended declines. Liquidity stayed ample and rates were contained, but breadth deteriorated again, nearly 400 stocks fell on the day.

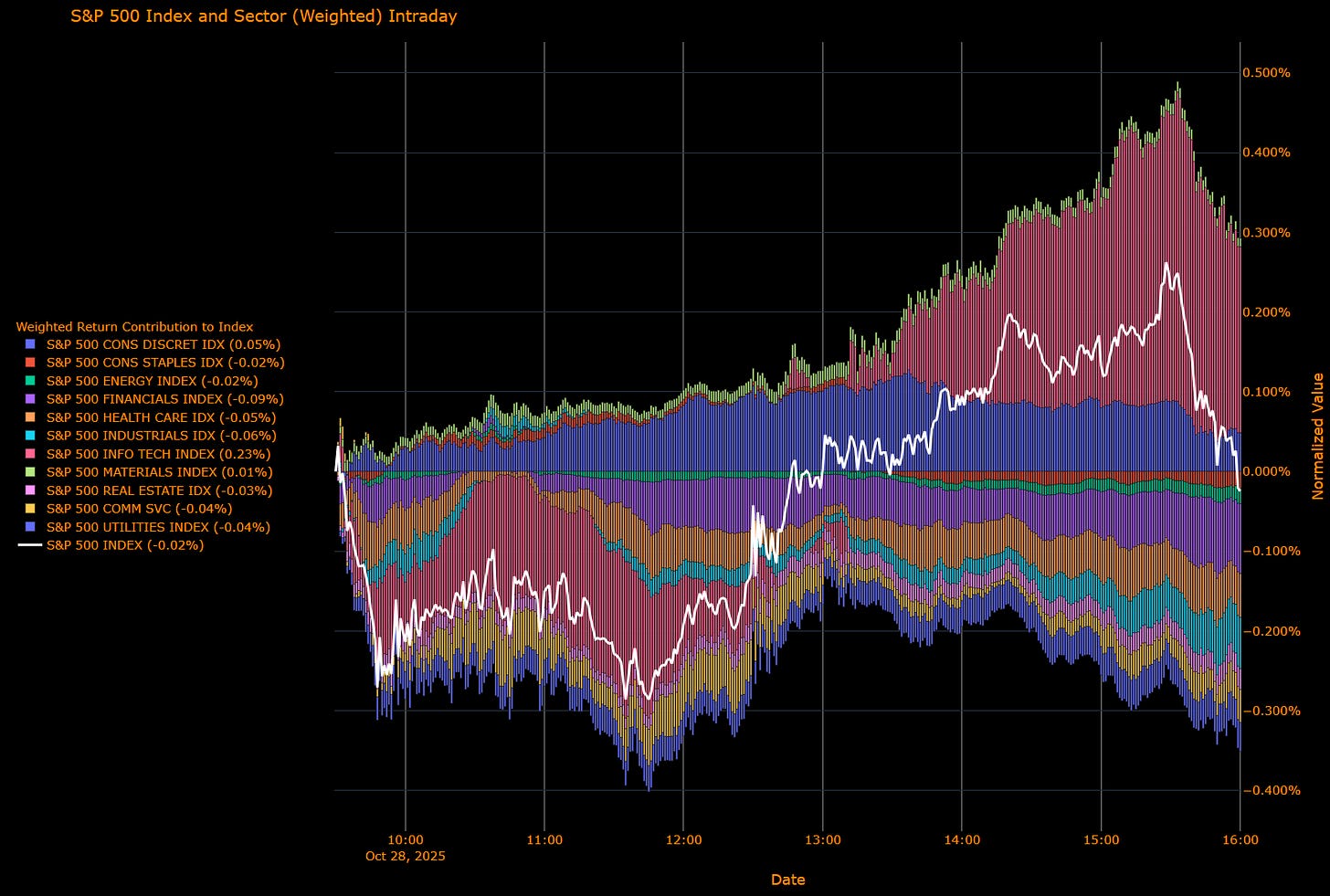

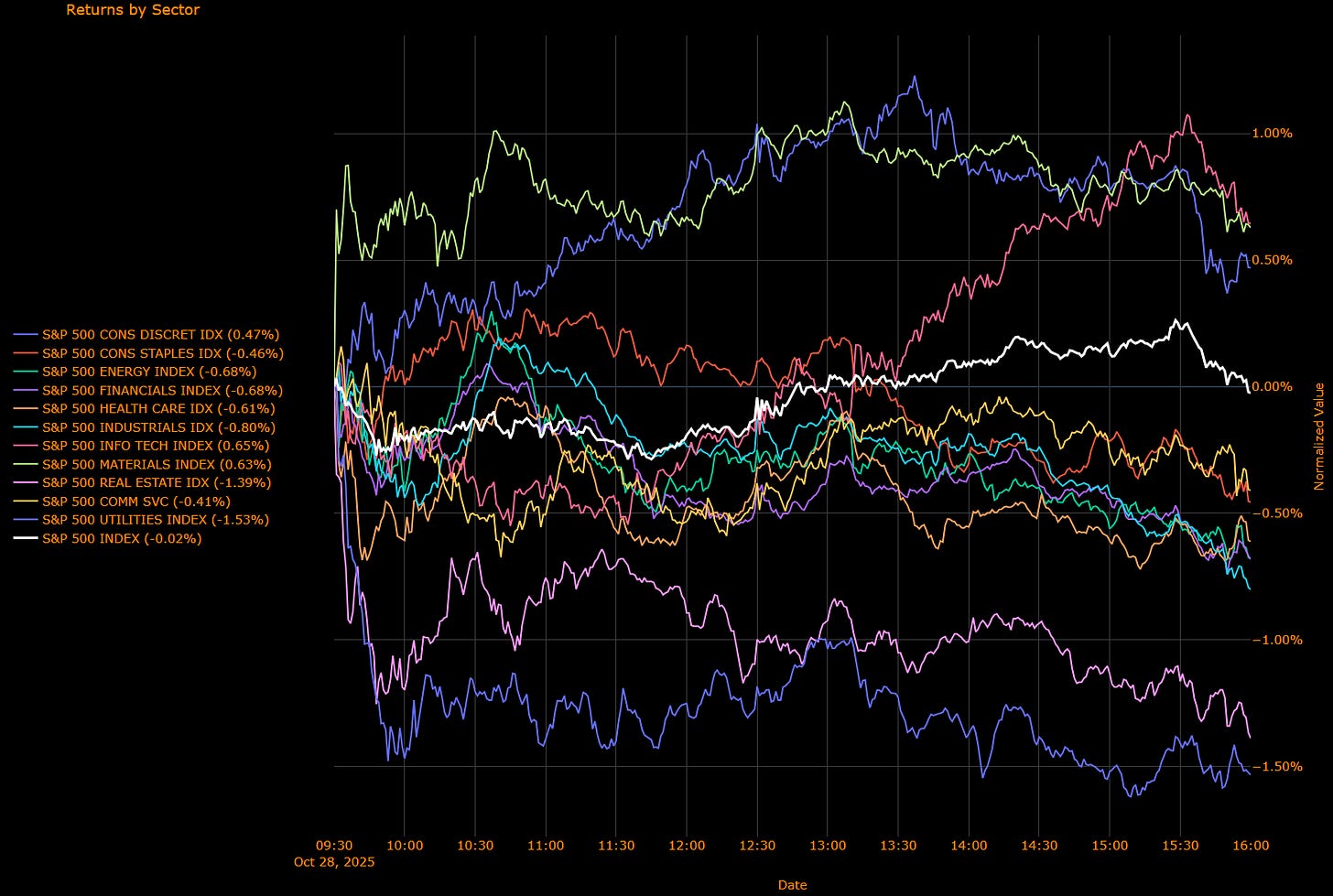

Sector Attribution

Weighted Return Contribution (Index −0.02%)

Leaders: Info Tech (+0.23%), Cons Discretionary (+0.05%), Materials (+0.01%)

Drags: Financials (−0.09%), Health Care (−0.05%), Industrials (−0.06%), Real Estate (−0.03%), Comm Services (−0.04%), Utilities (−0.04%), Staples (−0.02%), Energy (−0.02%)

Unweighted Performance (Breadth)

Leaders: Info Tech (+0.65%), Materials (+0.63%), Cons Discretionary (+0.47%)

Laggards: Utilities (−1.53%), Real Estate (−1.39%), Industrials (−0.80%), Energy (−0.68%), Financials (−0.68%), Health Care (−0.61%), Staples (−0.46%), Comm Services (−0.41%)

The index stayed near record highs thanks entirely to Tech’s +0.23 pp contribution, masking broad underperformance elsewhere. Weakness clustered in rate-sensitive groups (Utilities, REITs, Financials) as investors trimmed duration exposure ahead of the FOMC. Cyclicals like Materials and Discretionary held up modestly, consistent with resilient growth expectations.

Macro Overlay

Fed and Policy Context

The market is marking time before Wednesday’s expected quarter-point rate cut. Futures imply high confidence in the move but little clarity on the guidance, most expect Powell to keep optionality open on ending quantitative tightening. A calm front end and contained term premium continue to support valuations, but the weaker sector breadth shows some unease about follow-through beyond Tech.

AI & Earnings Focus

Five megacaps; MSFT, GOOGL, META, AMZN, AAPL all report within 48 hours. Nvidia’s +5% gain and suppliers’ blowout prints (SK Hynix +4%, Advantest +20%) reinforced the “AI-supercycle” theme, while expectations remain elevated: the Magnificent 7 are projected to post +14% profit growth versus +8% for the broader S&P. The test now is whether guidance sustains that gap.

Macro Backdrop

Consumer confidence fell for a third month (Conference Board 94.6), underscoring a softer household outlook even as spending stays firm. Oil held near $60 and gold bounced modestly, while the USD drifted lower for a third session. The 10-yr yield was steady at 3.98%. Trump’s Asia trip, featuring talk of tariff relief and a prospective US-China tech-cooperation deal, added a mild geopolitical tailwind.

The Read-Through

1. Narrow leadership: The rally’s dependency on Tech is deepening, breadth deterioration despite record-high prints signals fragility beneath the index.

2. Rates pause helps valuation, not participation: Stable yields are supporting multiples, but rate-sensitive sectors remain sellers’ territory.

3. Growth narrative intact: Cyclicals’ relative resilience and commodity stability suggest no sharp downgrade to the macro growth view yet.

What I’m Watching

FOMC tone: Whether Powell signals a pause in QT or a dovish bias beyond this cut.

Megacap guidance: Cloud, AI-infrastructure, and capex commentary, do they validate current leadership?

Breadth check: Does participation rebound if the Fed confirms a soft-landing stance?

A flat index that hides a hollow advance, Tech’s strength offset broad sector weakness. Markets are holding steady into the dual catalysts of Fed guidance and Big Tech earnings. The next move hinges on whether policy reassurance and profit momentum can reignite breadth or whether leadership concentration tightens further.

US IG Credit Wrap: Fed in Focus, Spreads Steady; Carry Still the Core Story (IG OAS ≈50.7 bp)

Investment-grade credit remains locked in a remarkably tight range, with the Bloomberg US IG OAS holding near 50.7 bp, barely changed on the week. The stability underscores just how anchored credit risk has become in a market balancing strong liquidity, contained volatility, and an improving macro narrative into the Fed’s expected quarter-point rate cut.

Where We Sit (from today’s chart)

IG OAS: ~50.7 bp (last 50.74)

5-yr avg: ~61.9 bp → ~11 bp inside

Cycle tights: ~46.1 bp → ~4–5 bp above

2022 wides: ~111.2 bp → ~60 bp tighter

The OAS sits comfortably in its lower quartile of the 5-year range, reflecting normalized liquidity and well-anchored risk appetite. Despite cross-asset rotation under the surface, rate-sensitives soft, Tech still dominant, credit spreads show zero sign of strain. Carry remains the defining theme: slow grind, low vol, and asymmetric upside to holding risk.

Macro & Tape Overlay

Fed and Macro:

Markets are coiled ahead of Wednesday’s FOMC, where a 25 bp rate cut is fully priced. The debate has shifted to guidance, whether Powell hints at an end to quantitative tightening. A dovish-leaning communication would reinforce the current “liquidity cushion” narrative, key to maintaining tight credit spreads.

Equities:

The S&P 500 closed −0.02%, masking weak breadth as rate-sensitives (Utilities, REITs, Financials) lagged while Tech stayed strong. The leadership concentration in megacaps hasn’t disturbed credit yet; balance-sheet quality in those names keeps IG confidence high.

Rates/FX:

The 10-yr UST yield held near 3.98%, with the front end steady (~3.50%), preserving the curve’s shallow slope. Dollar drifted modestly lower for a third session, and gold regained footing after a three-day pullback.

Commodities:

WTI around $60 after a three-day slide; stable energy prices remove inflation anxiety and support the Fed’s latitude to cut. Oil’s round-trip from mid-60s to low-60s helped Energy credit remain resilient, no sectoral spread contagion.

Global Tone:

Asia firmed on AI optimism ahead of megacap earnings (MSFT, GOOGL, META, AMZN, AAPL). Trump’s Asia tour, including tariff-reduction hints and US-China tech cooperation headlines, further underpinned the global risk tone.

Mapping to IG Credit

Fair value remains 50–55 bp, representing “carry equilibrium.” Absent a rates shock or policy misstep, the 40s remain a plausible target range by year-end.

Risk Markers to Watch

Fed tone: A cut without QT clarity could nudge spreads wider, but liquidity remains abundant.

Oil path: Sustained <$60 could tighten Energy spreads; a sharp reversal above $70 might test cyclicals.

Equity breadth: Continued narrow leadership without stress in credit = late-cycle melt-up, not fragility.

Systemic tell: Only a decisive break above 60 bp OAS would flag a regime shift; still a low-probability tail.

Bottom Line

Credit’s calm persists, spreads are steady, carry is king, and liquidity is ample.

Even as equities wobble under sector rotation and macro data show mild consumer fatigue, US IG remains the anchor of cross-asset stability. With the Fed expected to reinforce a patient, liquidity-friendly stance, expect OAS to hover near 50 bp and grind tighter on dips, a quiet affirmation that the credit market still believes in the soft-landing narrative.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.