Macro Regime Tracker: Global Liquidity

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Most recent macro views:

You can review the most recent video I recorded here with all of the macro ideas post FOMC:

All of the updated systematic models and strategies are updated below.

Main Developments In Macro

US Politics & Policy

TRUMP TO DISCUSS GOVT FUNDING W/ DEMOCRATIC LEADERS: PUNCHBOWL

TRUMP TO MEET WITH SCHUMER, JEFFRIES THIS WEEK: PUNCHBOWL

SUPREME COURT WILL HEAR TRUMP'S BID TO FIRE FTC COMMISSIONER

US COULD HIT ICC WITH SANCTIONS AS SOON AS THIS WEEK: REUTERS

US MULLS IMPOSING SANCTIONS ON ENTIRE ICC: REUTERS

US SEEKING TO MAKE OIL, GAS DEALS AT CLIMATE WEEK, UNGA: AXIOS

LEAVITT: DISCUSSIONS ONGOING WITH CONGRESS ON SHUTDOWN

LEAVITT: CROP PRICES PART OF US TALKS WITH CHINA

LEAVITT: US TIKTOK WILL BE GLOBALLY INTER-OPERABLE

LEAVITT: TRUMP WILL HAVE BILAT MEETING WITH EU IN NYC TUESDAY

LEAVITT: TRUMP TO HOLD MULTILATERAL MIDDLE EAST MEETING

LEAVITT: TRUMP WILL MEET LEADERS OF UKRAINE, ARGENTINA

US OFFICIAL: TRUMP WILL EXTEND TIKTOK PAUSE ADDITIONAL 20 DAYS

US OFFICIAL: TRUMP WILL SIGN TIKTOK ORDER LATER THIS WEEK

TRUMP SAYS VENEZUELAN MILITIA TRAINING IS 'VERY SERIOUS THREAT'

TRUMP: WE CAUGHT THE VENEZUELAN MILITIA IN TRAINING

Federal Reserve Commentary

FED GOVERNOR STEPHEN MIRAN COMMENTS IN Q&A IN NEW YORK

FED'S MIRAN SAYS SECOND HALF GROWTH IN 2025 WILL BE STRONGER

FED’S MIRAN SAYS CURRENT INTEREST RATES ’VERY RESTRICTIVE’

MIRAN: COMMITTED TO BRINGING INFLATION SUSTAINABLY BACK TO 2%

MIRAN: APPROPRIATE FED FUNDS RATE IS ROUGHLY 2% TO 2.5%

MIRAN: CURRENT POLICY ’POSES MATERIAL RISKS’ TO LABOR MARKET

MIRAN: MULTIPLE TRUMP POLICIES ARE LOWERING NEUTRAL RATE

MIRAN: ESTIMATES NEUTRAL REAL INTEREST RATE TO BE CLOSE TO ZERO

MIRAN: SEE ECONOMIC GROWTH IN MID-2% AREA IN 2026

MIRAN: SERIES OF 50 BPS CUTS WILL 'RECALIBRATE' POLICY

MIRAN: AFTER STEEP CUTS, 'A LITTLE' MORE CUTTING IN 2026, 2027

MIRAN: SEE CPI RENT INFL. FALLING BELOW 1.5% IN 2027 FROM 3.5%

FED GOVERNOR STEPHEN MIRAN COMMENTS IN PREPARED TEXT

CLEVELAND FED PRESIDENT BETH HAMMACK SPEAKS AT CLEVELAND EVENT

HAMMACK: RISK IS PERSISTENT INFLATION COULD IMPACT EXPECTATIONS

HAMMACK: EXPECT ANOTHER WAVE OF PRICE PRESSURES EARLY NEXT YEAR

HAMMACK: I'M LASER-FOCUSED ON INFLATION

HAMMACK: ANTICIPATE UNEMPLOYMENT WILL KEEP RISING A LITTLE BIT

HAMMACK: IF FED CUTS TOO QUICKLY, COULD START OVERHEATING AGAIN

HAMMACK: I THINK FED IS ONLY VERY MILDLY RESTRICTIVE

HAMMACK: SHOULD BE VERY CAUTIOUS IN REMOVING POLICY RESTRICTION

HAMMACK: ON LABOR SIDE, WE'RE PRETTY CLOSE TO OUR TARGET

HAMMACK: I'M CONCERNED ABOUT LEVEL, PERSISTENCE OF INFLATION

HAMMACK: UNEMPLOYMENT RATE SAYS LABOR SUPPLY, DEMAND IN BALANCE

HAMMACK: 4.3% UNEMPLOYMENT IS PRETTY HEALTHY RATE

HAMMACK: WE'RE LIKELY TO SEE INFLATION CONTINUE TO GO UP

HAMMACK: FED IS BEING CHALLENGED ON BOTH SIDES OF ITS MANDATE

FED'S HAMMACK: GENESIS OF RATE CUT WAS SHIFTING RISK BALANCE

ST. LOUIS FED PRESIDENT ALBERTO MUSALEM COMMENTS IN Q&A

FED'S MUSALEM SAYS HE'S OPEN TO FURTHER RATE CUTS

MUSALEM: FED SHOULD TREAD CAUTIOUSLY WITH ADDITIONAL EASING

MUSALEM: LABOR MARKET RISKS WEIGHTED TO DOWNSIDE

MUSALEM: POLICY SHOULD CONTINUE TO LEAN AGAINST INFLATION

FED'S MUSALEM BACKED 'PRECAUTIONARY' CUT TO SUPPORT JOB MARKET

MUSALEM: WOULDN'T SUPPORT MORE CUTS IF INFLATION RISKS INCREASE

MUSALEM: POLICY UNCERTAINTY EASING, COULD ADD TO GROWTH

MUSALEM: LIMITED ROOM FOR FURTHER INTEREST-RATE CUTS

MUSALEM: FACTORS OUTSIDE TARIFFS ADDING TO ABOVE-TARGET INFL.

ST. LOUIS FED PRESIDENT ALBERTO MUSALEM COMMENTS IN TEXT

MUSALEM: PROMISE OF AI NOT YET VISIBLE IN MACRO DATA

MUSALEM: US CLOSE TO AN AVERAGE PRODUCTIVITY REGIME

MUSALEM: FAVOR MORE COMMUNICATION ON INTENT OF ASSET PURCHASES

FED'S BARKIN: STARTING TO SEE SOME UNCERTAINTY CLEAR NOW

BARKIN: HISTORICALLY LOW HIRING RATES, IN NO-RECESSION CONTEXT

FED'S BARKIN: TAKES TIME TO FOR TARIFFS TO GO THROUGH

WSJ CITES AN INTERVIEW WITH ATLANTA FED PRESIDENT BOSTIC

BOSTIC SAYS TARIFF COST BUFFERS MAY BE EXHAUSTED SOON: WSJ

BOSTIC SEES UNEMPLOYMENT RATE AT 4.5% BY YEAR'S END: WSJ

BOSTIC DOESNT SEE INFLATION RETURNING TO 2% UNTIL 2028: WSJ

BOSTIC SEES CORE INFLATION AT 3.1% BY YEAR'S END: WSJ

BOSTIC DOESN'T BELIEVE LABOR MARKET IS IN CRISIS RIGHT NOW: WSJ

BOSTIC PENCILS IN ONLY ONE RATE CUT FOR 2025: WSJ

BOSTIC SAYS CONCERNED ON INFLATION BEING HIGH FOR LONG TIME: WSJ

BOSTIC SEES LITTLE REASON TO CUT RATES FURTHER FOR NOW: WSJ

US Macro Data

BLS TO RELEASE 2024 CONSUMER EXPENDITURES OCT. 30

CHICAGO FED AUG. NATIONAL ACTIVITY INDEX AT -0.12

US Markets & Tech

APPLE SHARES CLIMB 4.3% TO CLOSE AT HIGHEST SINCE DECEMBER

APPLE SHARES EXTEND CLIMB TO AS MUCH AS 4.1%

NVIDIA SHARES RISE 3.9% TO CLOSE AT RECORD

OPENAI & NVIDIA TO DEPLOY 10 GIGAWATTS OF NVIDIA SYSTEMS

NVIDIA Intends to Invest Up to $100 B in OpenAI Progressively as Each Gigawatt Is Deployed >N

OPENAI, NVIDIA ANNOUNCED LETTER OF INTENT FOR A PARTNERSHIP

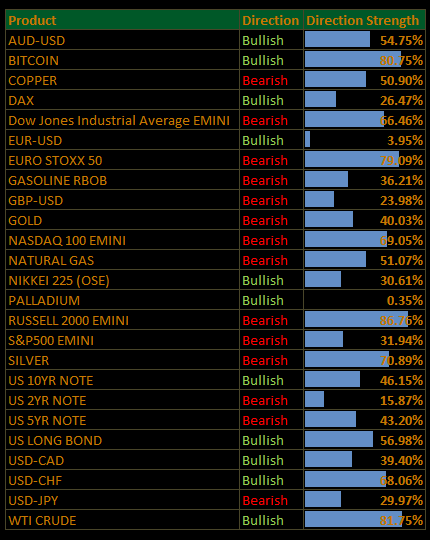

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

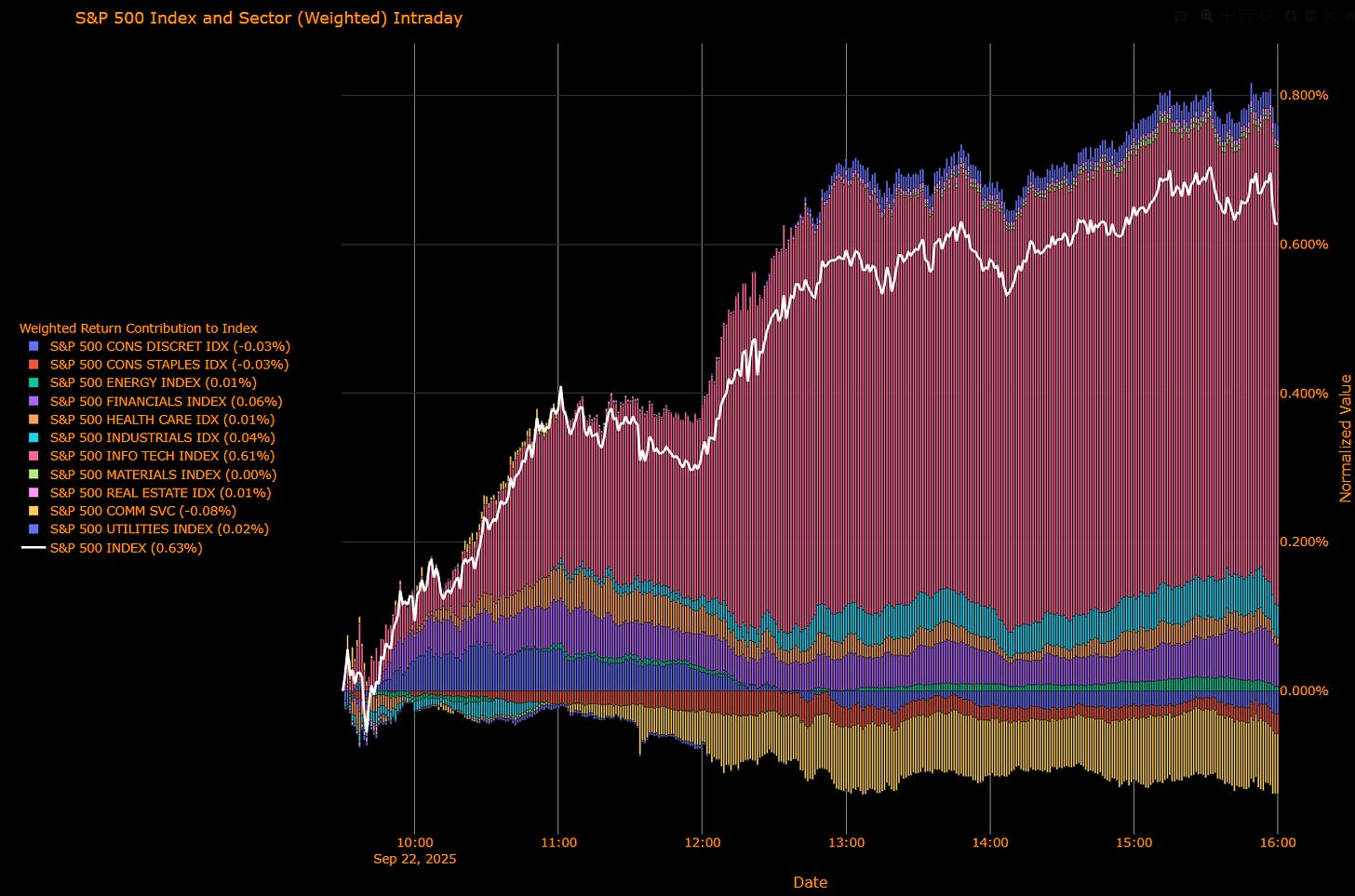

US Market Wrap: Tech Freight Train Drives New Highs; Cyclicals Trail (S&P +0.63%)

The S&P 500 surged 0.63% to notch its 28th record close of the year, carried almost entirely by mega-cap technology. Nvidia climbed 4% after pledging up to $100 billion in OpenAI, a commitment to build out 10 gigawatts of AI infrastructure. The rally reinforced the “tech freight train” narrative flagged by Goldman’s Pasquariello, even as breadth outside the sector remained mixed.

Bond markets were subdued, with 10s up 2 bps to 4.15%, while gold touched a record $3,745/oz before easing. The dollar slipped, breaking a three-day winning streak. Investors now look ahead to Powell’s Tuesday remarks and Friday’s PCE print, with the debate shifting from labor risk to tolerance for sticky inflation into 2026.

Sector Attribution

Weighted Return Contribution to Index

Biggest support: Information Technology (+0.61%), nearly the entire index gain.

Other positives: Financials (+0.06%), Industrials (+0.04%), Utilities (+0.02%), Energy (+0.01%), Health Care (+0.01%), Real Estate (+0.01%).

Drags: Communication Services (–0.08%), Staples (–0.03%), Discretionary (–0.03%).

Net impact: S&P 500 (+0.63%).

Sector Performance (Unweighted Breadth)

Tech (+1.77%) was the runaway leader.

Utilities (+0.86%), Industrials (+0.54%), Financials (+0.41%), Real Estate (+0.41%), and Energy (+0.22%) also advanced.

Defensives showed strain: Staples (–0.55%), Communication Services (–0.77%), Discretionary (–0.29%).

Health Care (+0.11%) and Materials (+0.19%) eked out modest gains.

S&P 500 Index: +0.63%.

Macro Overlay

Fed Posture

Governor Miran struck a dovish chord, arguing policy is “very restrictive” and risks raising unemployment, with an appropriate funds rate closer to 2–2.5%. Cleveland’s Hammack pushed back, warning that inflation remains persistent and urging caution on easing. St. Louis’ Musalem described last week’s cut as “precautionary” but said room for further easing is limited unless labor weakens materially. Atlanta’s Bostic, in contrast, penciled in just one more cut this year, reiterating inflation is unlikely to return to 2% until 2028. The split reflects a Fed still walking the tightrope between labor risks and entrenched inflation.

Market Dynamics

Tech’s dominance was overwhelming, masking otherwise narrow leadership. Banks and industrials found support from modestly higher yields, while defensives lagged. Utilities’ sharp bounce was a rare counter-trend to higher rates, but communication services and consumer sectors underscored fragility in broad demand.

Rates & Commodities

Treasury yields nudged higher but the curve was stable, keeping October and December cuts in play. Oil was flat near $74/bbl, while gold’s record underscored hedging demand as investors weigh sticky inflation against policy easing.

Market Tone

The takeaway is one of asymmetric leadership: mega-cap tech lifted the tape, but underlying breadth showed strain. Investors appear “responsibly bullish,” riding the AI-driven growth narrative while acknowledging policy risk and inflation stickiness into 2026.

The Read-Through

Base Case: Fed maintains optionality, more cuts possible but conditional on labor softening. Sticky inflation into 2026 caps the dovish runway.

Risks: Excessive reliance on tech leadership raises fragility; inflation surprises could stall easing momentum.

Positioning Lens: Stay tactically long tech but monitor for yield sensitivity; Financials and Industrials ride modest curve steepening; defensives remain weak hedges.

The market has given another record close, but one carried on the shoulders of a few names. Powell’s remarks and Friday’s PCE will determine whether the rally broadens or remains a one-sector story.

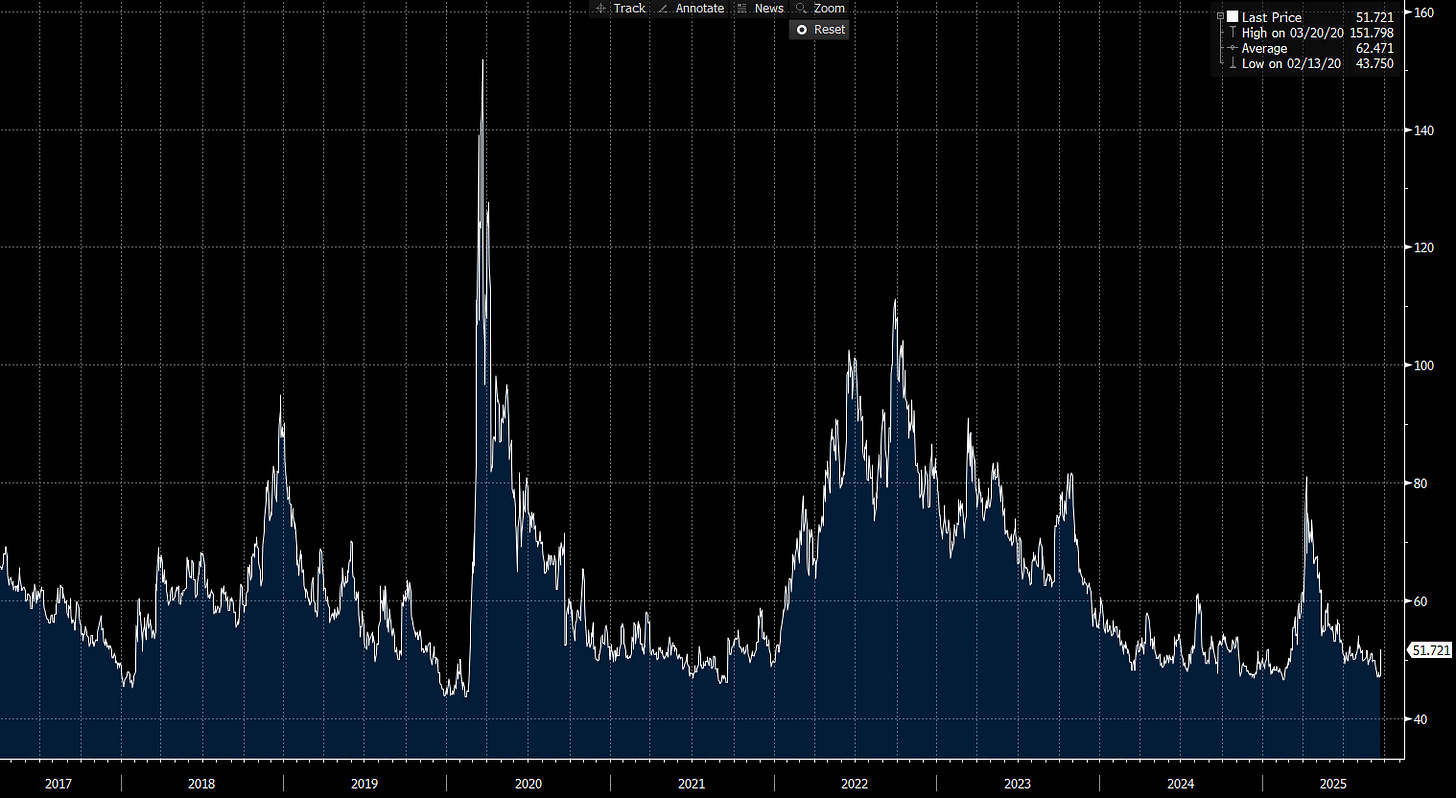

US IG Credit Wrap: Tech Records, Modest Widening; Carry Still Fine, Not Free (IG OAS ~51.7 bp)

IG spreads cheapened a touch as equities set fresh highs on AI optimism and UST 10s nudged to ~4.15%. Bloomberg US IG OAS printed ~51.7 bp, a ~4 bp move off yesterday’s high-40s that keeps credit comfortably inside the carry zone but further from cycle tights.

Credit Context

IG OAS: ~51.7 bp (chart last: 51.721)

5-yr avg: ~62.5 bp → ~11 bp inside

Cycle tights: ~43.8 bp → ~8 bp off

COVID peak: ~151.8 bp → ~100 bp tighter

Read: Still a low-50s regime—carry positive, with a little more room for two-way after the pop from sub-50.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today

Macro tape: S&P +0.6% to a new record on mega-cap tech strength; DXY softer; 10s +2 bp to ~4.15%; gold near records.

Fed speakers: Mixed. Miran flagged policy as “very restrictive” (dovish tilt), while Musalem/Hammack stressed limited room to ease with inflation still sticky. Net: optionality preserved, not a dovish pivot.

Primary/secondary: New-issue calendar steady; concessions modest; secondary saw light widening in beta/longer duration while high-quality money center paper stayed better bid. ETFs handled flows cleanly.

Risks to Watch

Rates vol/data: Hot PCE or re-accel in growth = duration cheapening, OAS +2–5 bp in beta.

Labor air-pocket: Faster weakening pushes dispersion—cyclical IG and BBB long-tenor underperform.

Curve dynamics: Growth-scare steepening is more credit-hostile than supply-led selloffs.

Liquidity/issuance: Heavy supply into thin windows could slow the grind and widen tails.

The Read-Through

Carry still rules, but the risk-reward narrowed from yesterday’s sub-50 print. Low-50s OAS supports clip-the-coupon returns with modest mark-to-market chop. Dips should remain shallow and bought while the Fed talks optionality and data cools, notably if Friday’s core PCE lands ~0.2% m/m.

Final Word

Spreads backed up from “too tight to chase” to “tight but tolerable.” As long as policy stays gradual and growth avoids an air-pocket, carry is the game, just play it with quality bias and a hand on the duration dial.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Equity Indices:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.