Macro Regime Tracker: Interest Rates and AI

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

The most recent macro video and connected report can be found here:

And the Twitter Spaces on the credit cycle can be found here: LINK

As always, you can find all of the updated systematic models and strategies below. Thanks

Main Developments In Macro

US & Federal Reserve

FED’S SCHMID SAYS INSTANT PAYMENTS PROBABLY LEAPFROG STABLECOIN

SCHMID: LABOR MARKET HAS COOLED BUT REMAINS HEALTHY

SCHMID: PRICE INCREASES BECOMING MORE WIDESPREAD

SCHMID: AGGRESSIVELY BOOSTING DEMAND RISKS BIG PRICE INCREASES

SCHMID: POLICY IN RIGHT PLACE, ONLY SLIGHTLY RESTRICTIVE

FED’S SCHMID SAYS RATES SHOULD LEAN AGAINST DEMAND GROWTH

CITADEL’S GRIFFIN SAYS US ECONOMY IS ON A BIT OF A ‘SUGAR HIGH’

US Fiscal, Policy & Political Developments

THUNE: SHUTDOWN LAYOFFS WILL BE JUDGEMENT CALL BY WHITE HOUSE

SENATE MAJORITY LEADER JOHN THUNE SPEAKS TO REPORTERS

THUNE: FATE OF ACA SUBSIDIES ‘PROBABLY’ DEPENDS ON WHITE HOUSE

LEAVITT: HAVE NOT SEEN ACA SUBSIDY PROPOSALS

LEAVITT: OMB CONTINUES TO WORK WITH AGENCIES ON LAYOFFS

JOHNSON: THE HOUSE DID ITS JOB, SENATE DEMOCRATS HAVE THE BALL

JOHNSON: THERE’S NOTHING FOR US TO NEGOTIATE ON STOPGAP FUNDING

JOHNSON: GOP HAS MANY IDEAS TO FIX HEALTH CARE IN COMING MONTHS

HOUSE SPEAKER MIKE JOHNSON TALKS TO REPORTERS ON SHUTDOWN

Trade & Geopolitics (US-Led Focus)

TRUMP: DOING SOMETHING ON FARMERS THIS WEEK

TRUMP: CARNEY WILL PROBABLY TALK ABOUT TARIFFS AT MEETING

TRUMP: MEDIUM, HEAVY DUTY TRUCKS TO FACE 25% TARIFF FROM NOV 1

TRUMP: TRUCK TARIFFS TO BEGIN NOV 1ST, 2025

TRUMP: TARIFFS ON SOME TRUCKS BEGIN NOV. 1

LEAVITT: TRADE WILL BE TOPIC OF DISCUSSION W/ TRUMP, CARNEY

LEAVITT: TECHNICAL TALKS HAPPENING IN EGYPT W/ WITKOFF, KUSHNER

TRUMP: LULA WILL COME TO US

TRUMP ON BRAZIL: WILL START DOING BUSINESS

TRUMP: WILL HAVE FURTHER TALKS WITH LULA

TRUMP: HAD A GOOD CALL WITH LULA

LULA WILLING TO TRAVEL TO THE US, BRAZIL PRESIDENCY SAYS

LULA, TRUMP AGREED TO MEET IN PERSON ‘SOON’, BRAZIL PRESIDENCY

LULA ASKED TRUMP TO REMOVE 40% TAX ON BRAZIL IMPORTS

LULA, TRUMP TALKED FOR ABOUT 30 MINUTES, BRAZIL PRESIDENCY SAYS

TRUMP, LULA CALL WAS ‘POSITIVE,’ BRAZIL’S HADDAD SAYS

HADDAD: GOVT WILL RELEASE STATEMENT ON TRUMP, LULA CALL SOON

TRUMP AND BRAZILIAN PRESIDENT LULA ARE SPEAKING NOW: REUTERS

TRUMP: REALLY GOOD CHANCE OF ISRAEL, HAMAS DEAL

PUTIN, NETANYAHU HOLD TELEPHONE CONVERSATION, KREMLIN SAYS

INDIRECT TALKS BETWEEN ISRAEL, HAMAS BEGIN IN EGYPT: ALQAHERA

Foreign Policy, Emerging Markets & US Relations

BESSENT: WILL DISCUSS THE SEVERAL OPTIONS TO SUPPORT ARGENTINA

BESSENT: WILL CONTINUE DISCUSSIONS WITH ARGENTINA’S CAPUTO

BRAZIL’S MINISTRY: - EXPORTS TO US ARE LIKELY TO KEEP FALLLING

BRAZIL’S MINISTRY: IF US TARIFFS ARE KEPT IN PLACE -

ARGENTINA SELLS DOLLARS FOR FIFTH STRAIGHT FX TRADING SESSION

Europe (Macro Relevance)

LAGARDE: STILL ANTICIPATING GROWTH IN 2H, BUT WEAKER THAN IN 1H

LAGARDE: WE ARE DATA DEPENDENT ON RATES

LAGARDE: ECB IS IN A GOOD PLACE

LAGARDE: NO CURRENCY’S GLOBAL POSITION IS GUARANTEED

LAGARDE: UNIQUE OPPORTUNITY TO STRENGTHEN EURO’S GLOBAL ROLE

LAGARDE: WAGE GROWTH TO MODERATE FURTHER

LAGARDE: INFLATION REMAINS CLOSE TO 2% TARGET

LAGARDE: HEADWINDS TO GROWTH SHOULD FADE NEXT YEAR

LAGARDE: SLUGGISH EXPORTS, STRONG EURO TO HOLD BACK ECONOMY

LANE: OUR APPROACH TO MONETARY POLICY MUST REMAIN OPEN-MINDED

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

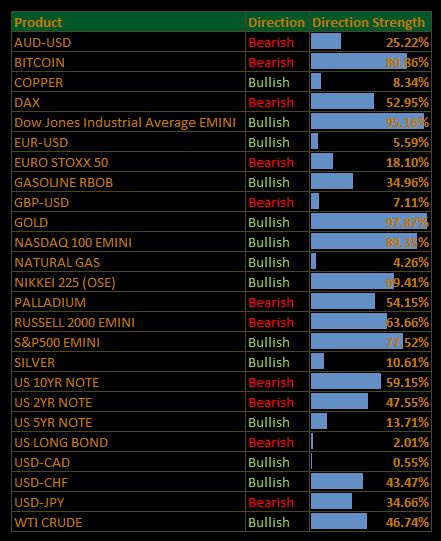

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Communication Services and Discretionary Lead as AI Momentum Extends (S&P +0.05%)

The S&P 500 eked out a modest gain of 0.05%, extending its winning streak to a seventh session the longest since May as an AI-fueled rally in chipmakers and megacaps offset weakness across financials and health care. The day’s tone was defined by momentum rather than breadth, with a narrow set of leaders driving index stability amid rising yields and lingering fiscal uncertainty.

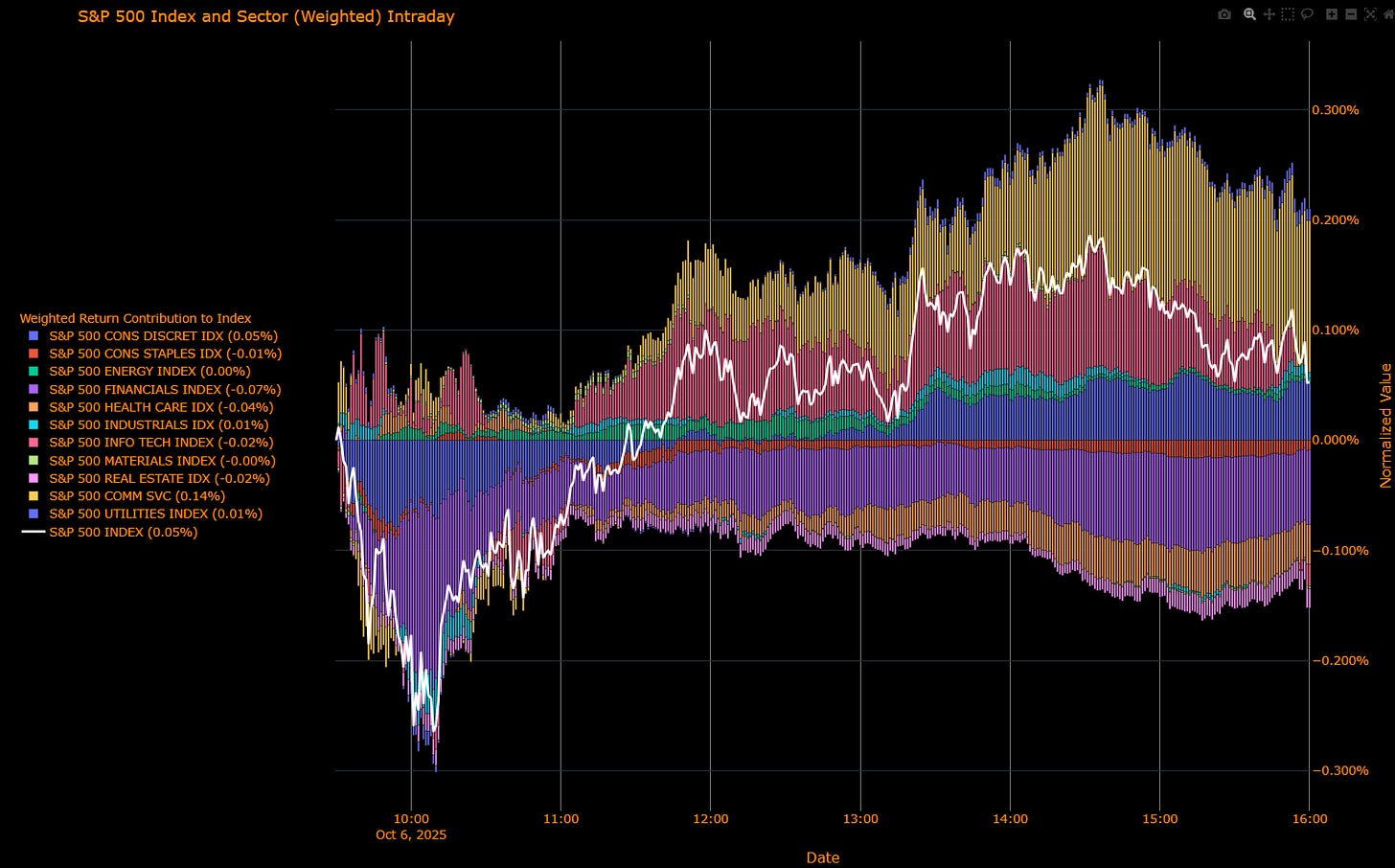

Sector Attribution

Weighted Return Contribution to Index

Leaders: Communication Services (+0.14%), Consumer Discretionary (+0.05%), Utilities (+0.01%), Industrials (+0.01%)

Drags: Financials (–0.07%), Health Care (–0.04%), Info Tech (–0.02%), Real Estate (–0.02%)

Net: S&P 500 +0.05%

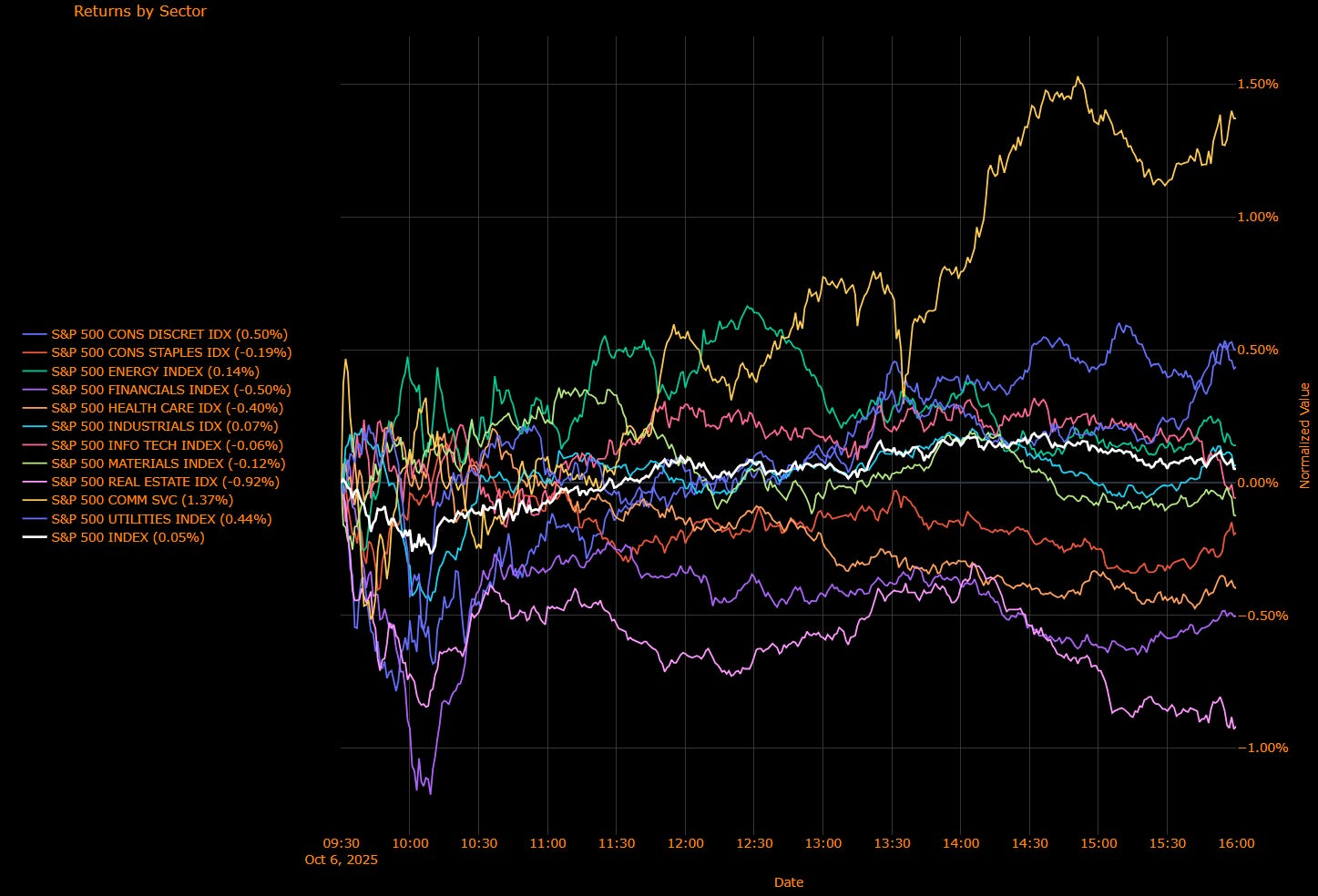

Sector Performance (Unweighted Breadth)

Winners: Communication Services (+1.37%), Consumer Discretionary (+0.50%), Utilities (+0.44%), Energy (+0.14%)

Losers: Financials (–0.50%), Real Estate (–0.92%), Health Care (–0.40%), Materials (–0.12%), Staples (–0.19%)

Net: S&P 500 +0.05%

Macro Overlay

AI Momentum vs. Macro Caution

Markets once again leaned into the AI narrative after AMD surged 24% on its OpenAI data-center deal, igniting another leg higher in semiconductor and cloud infrastructure names. Despite scattered bubble chatter, institutional flows suggest growing conviction that earnings season will validate valuations, particularly across the “Magnificent 7.” Citigroup and Goldman both flagged upside to consensus EPS driven by resilient consumption and capex in AI-linked sectors.

Rates & the Fed Context

Treasury yields rose modestly 10s at 4.16%, +4bp on the day with the front end also firmer as Fed speakers maintained a “measured easing” bias. St. Louis Fed’s Schmid noted policy remains “only slightly restrictive” and should continue to “lean against demand growth.” The comments reinforced the idea that cuts are conditional on data rather than pre-committed a meaningful distinction given the risk of a prolonged government data blackout.

Shutdown Still a Background Risk

Washington gridlock remains a latent volatility trigger, but traders are largely ignoring it for now. House Speaker Johnson reiterated there’s “nothing to negotiate” on stopgap funding, while Senate leadership called White House discretion on shutdown-related layoffs a “judgment call.” Despite this, risk appetite held firm, underscoring the extent to which AI optimism has overwhelmed fiscal noise.

Cross-Asset Tone

The dollar firmed (+0.3%) and long-end Treasuries underperformed globally. Gold extended toward $4,000/oz, Bitcoin hit fresh records, and oil rose 1.4% to $61.76/bbl on limited OPEC+ supply gains.

The Read-Through

The equity rally remains narrow but unrelenting powered by tech and communications leadership tied to the AI buildout while cyclicals fade under higher yields and muted macro data. With yields climbing, breadth thinning, and sentiment euphoric, the setup resembles a “momentum melt-up” phase rather than a balanced advance.

Takeaway:

The market is brushing off policy uncertainty, shutdown risk, and even modest yield pressure as AI-linked growth stories dominate narrative space. The result is a self-reinforcing cycle, optimism feeding price action feeding optimism. For now, defensives are passive passengers; communication and discretionary sectors are steering the rally.

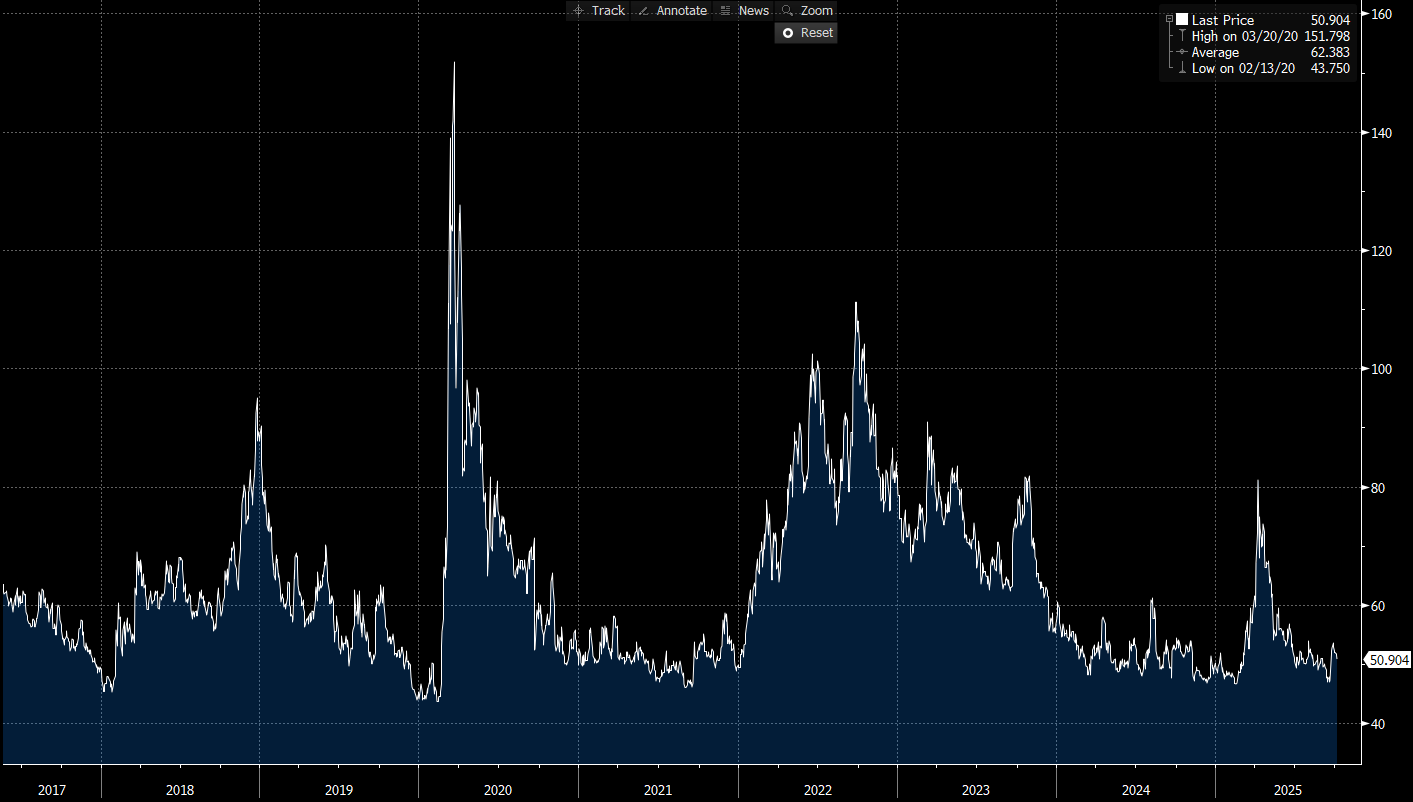

US IG Credit Wrap: Low-50s Grind, AI Melt-Up vs. Higher Yields (IG OAS ~50.9 bp)

IG spreads stayed in the carry channel even as equities notched fresh highs on AI euphoria and Treasury yields pushed up. Bloomberg US IG OAS prints ~50.9 bp (chart last: 50.904), little changed as investors prioritize earnings momentum over macro noise.

Where we sit (from the chart)

IG OAS: ~50.9 bp

5-yr avg: ~62.4 bp → ~11–12 bp inside

Cycle tights: 43.8 bp → ~7 bp off

Pandemic wides: 151.8 bp → ~101 bp tighter

(Chart stats: Last 50.904 | High 151.798 on 03/20/20 | Avg 62.383 | Low 43.750 on 02/13/20.)

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro

Equities: AI bid intact; chips rip on AMD-OpenAI headlines; leadership narrow.

Rates: UST 10y ~4.16% (+4bp); long end underperforms.

USD / Commodities: Dollar firmer; gold near ~$4,000/oz; WTI ~+$1.4%.

Policy backdrop: Shutdown risk still a visibility issue more than a growth shock; Fed rhetoric stays data-dependent with “measured easing” optionality intact.

How this maps to credit

Carry dominates: Low-50s OAS = duration-friendly, carry-positive for LDI/insurers; beta hedges doing the work as spreads refuse to chase equities.

Correlation check: Rising reals and a firmer USD usually lean wider, but earnings strength + AI capex are offsetting keeping IG in a sideways grind rather than a re-risking.

Quality skew: OAS stability hides micro dispersion, idiosyncratic leverage/term-structure names still pay up; high-beta BBB cyclicals more sensitive to the bear-steepening risk.

The read-through

Base case remains “carry over convexity”: a sideways drift in the low-50s while equities melt up on AI and rates edge higher. Until the macro narrative breaks one way (labor cracks or inflation re-accelerates), IG is a clipping-carry market

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.