Why the US Economy Can Withstand Much Higher Interest Rates - The AI BID

How structural balance-sheet reform and fiscal dominance have changed the rate sensitivity of the economy

Why the US Economy Can Withstand Much Higher Interest Rates - The AI BID

All The Playbooks, Educational Resources, and Book Recommendations:

Macro Slide Deck:

Credit Cycle Breakdown: Signals and Managing Risk

MAIN IDEA: We are in a macro environment where resilient growth, procyclical fiscal and monetary policy, and expanding liquidity are aligning to create conditions for a melt-up in risk assets. Equities are broadly outperforming bonds as capital flows further out the risk curve, supported by a labor market that remains stable and corporate earnings that continue to expand. At the same time, inflation is still sitting above the Federal Reserve’s target, which complicates the policy response and raises the probability of asymmetric outcomes depending on how the next catalysts unfold. This backdrop creates opportunity but also demands precision in measuring the extent of the cycle’s continuation rather than assuming it will persist indefinitely.

The recent reports where I laid out all of the structural and cyclical factors:

Watch this before moving forward:

3 Signals To Watch For Mapping The Credit Cycle:

The credit cycle is being driven by a surplus of liquidity in financial markets, matched with an increase in credit issuance in the underlying economy. If these shift, it will begin to increase the probability of downside in equities. We are NOT seeing this take place yet.

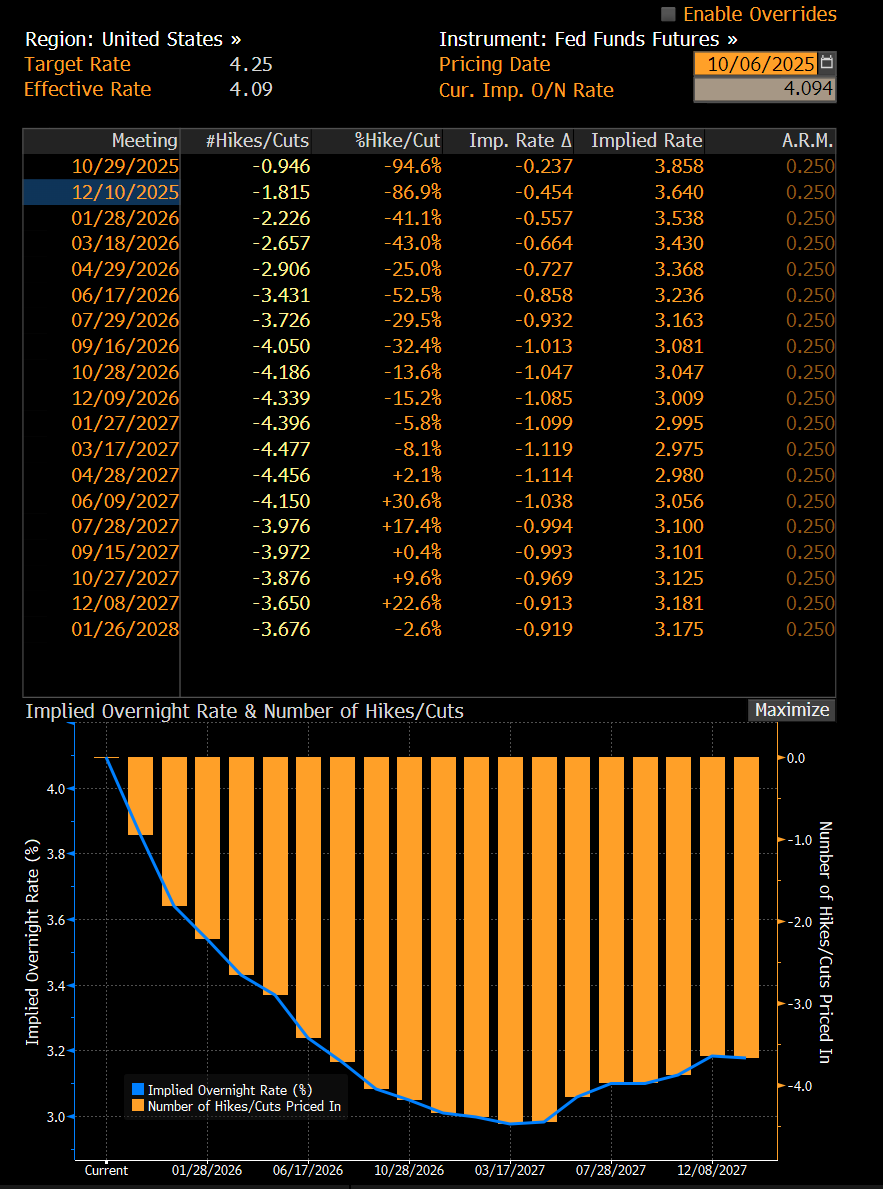

As long as 1y inflation swaps are pricing ABOVE 3% and the forward curve is pricing more than 40bps of cuts for this year, it is a very accommodative environment for risk assets to rally.

If the Fed continues to make the policy error of being overly accommodative at this high level of nominal GDP, the long end of the curve will price this. Simply put, if the Fed is to lose, long-end interest rates can move up to price the difference, which could ultimately pull risk assets down. We have not seen this yet because the last 2 inflation prints came in flat, but I expect these to come in higher over the next 6 months. This means watching long end rates and their potential drag on equities will be critical. We are not seeing this yet as the Russell is sitting at all time highs and capital continues to move into low quality factors.

When FX and Bond volatility rise on a shift in correlations and a change in the underlying information, it will signal more potential downside in equities. We are not there yet as implied volatility in FX and bonds continues to compress:

If we see the collocation of these factors simaltanously shift, it will begin to exptoentially increase the probability of a regime shift and indicate the credit cycle is losing momentum. WE ARE NOT THERE YET

Once we begin to shift, I will publish a report on it and explain everything in detail. Until then, I remain bullish.

As always, a pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

![[FREE] Educational Primers On Every Aspect Of Macro & Markets](https://substackcdn.com/image/fetch/$s_!tfas!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F69c49472-3d63-47f0-9b8c-2a682fa625f1_1024x1024.jpeg)