Interest Rates, Equity Sectors, and Macro Positioning

Positioning for flows as risks are building

Interest Rates, Equity Sectors, and Macro Positioning

In this report, I want to cover my views on interest rates, equity sectors, and what we are seeing for macro positioning. Please review the macro report here for a full breakdown of the structural and cyclical regime we are in so that you have the full context:

Main Idea: We are in a regime characterized by resilient growth and a neutral-to-positive inflation trend. The Federal Reserve is cutting rates into this environment, while government expenditures are rising. Together, this creates both procyclical monetary policy and procyclical fiscal policy.

To navigate markets correctly, we must answer two fundamental questions:

How does the current regime set the preconditions for the future or unseen regime?

How much of the current regime is already priced in, thereby reducing the risk-reward of betting on its continuation?

If we can correctly answer these questions, we can understand WHY markets are moving, establish the respective scenario analysis, and define the risk-reward for trading opportunities.

Macro Picture:

I want to start with a quick summary of WHERE we are and WHY procyclical policy is such a massive driver of risk flows right now. There are 4 major forces that I am watching right now for this.

First, on a quarterly basis, we are seeing net government outlays rise in the level AND rate of change (the chart below shows net outlays with the bars showing rate of change):

Second, the investment line item of GDP and goods spending, both of which have higher sensitivity to interest rates, are accelerating right now. The implication is that we are NOT seeing interest rates have a restrictive impact on economic growth or inflationary pressure.

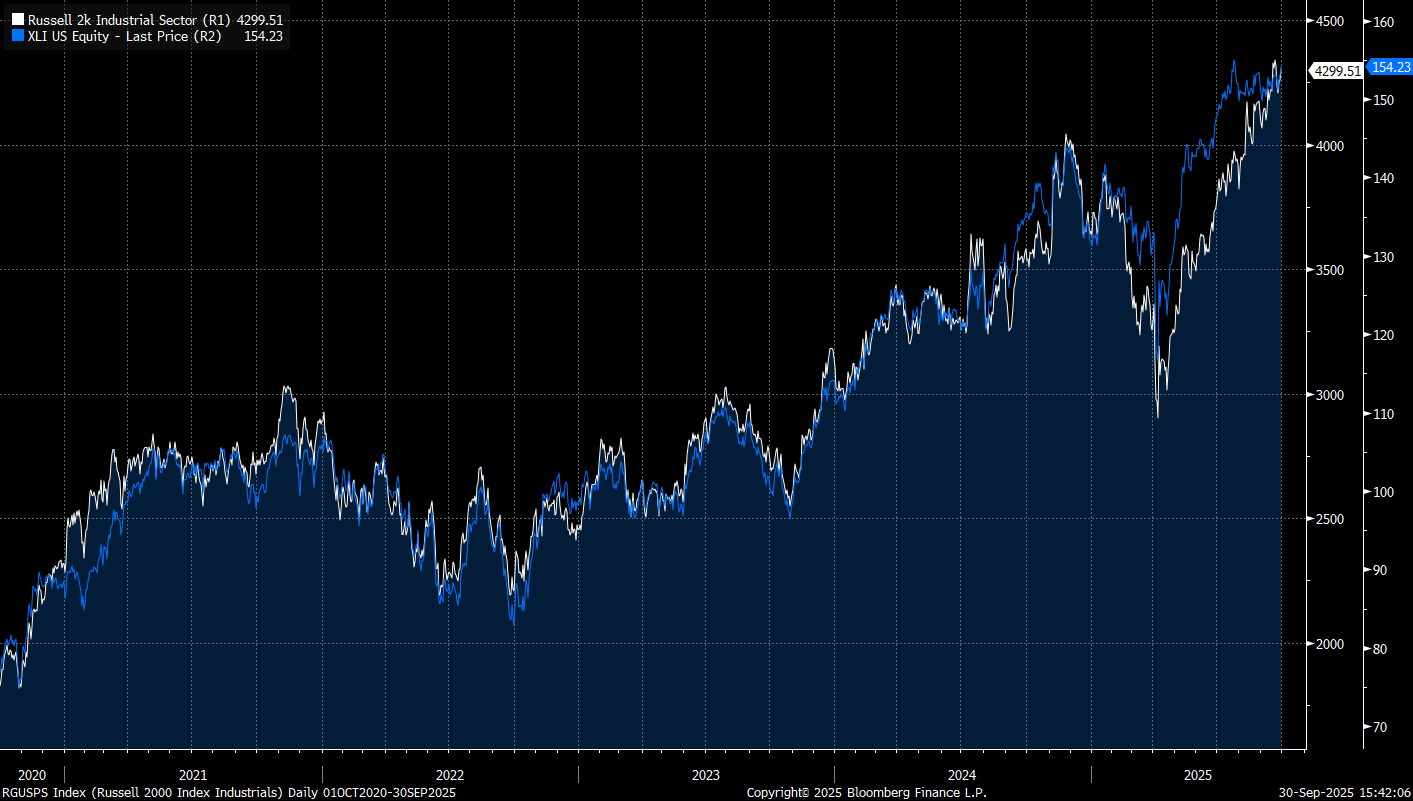

If the economy were highly sensitive to interest rates and corporations were cutting back investment, the industrial sector would be underperforming significantly, but instead we are seeing the opposite, with industrials in the Russell and S&P 500 emerging as clear leaders just behind tech and telecom.

Third, the labor market is not collapsing because it is the flip side of GDP. You can’t have the labor market collapse if GDP is expanding. I explained the consumer in the July piece:

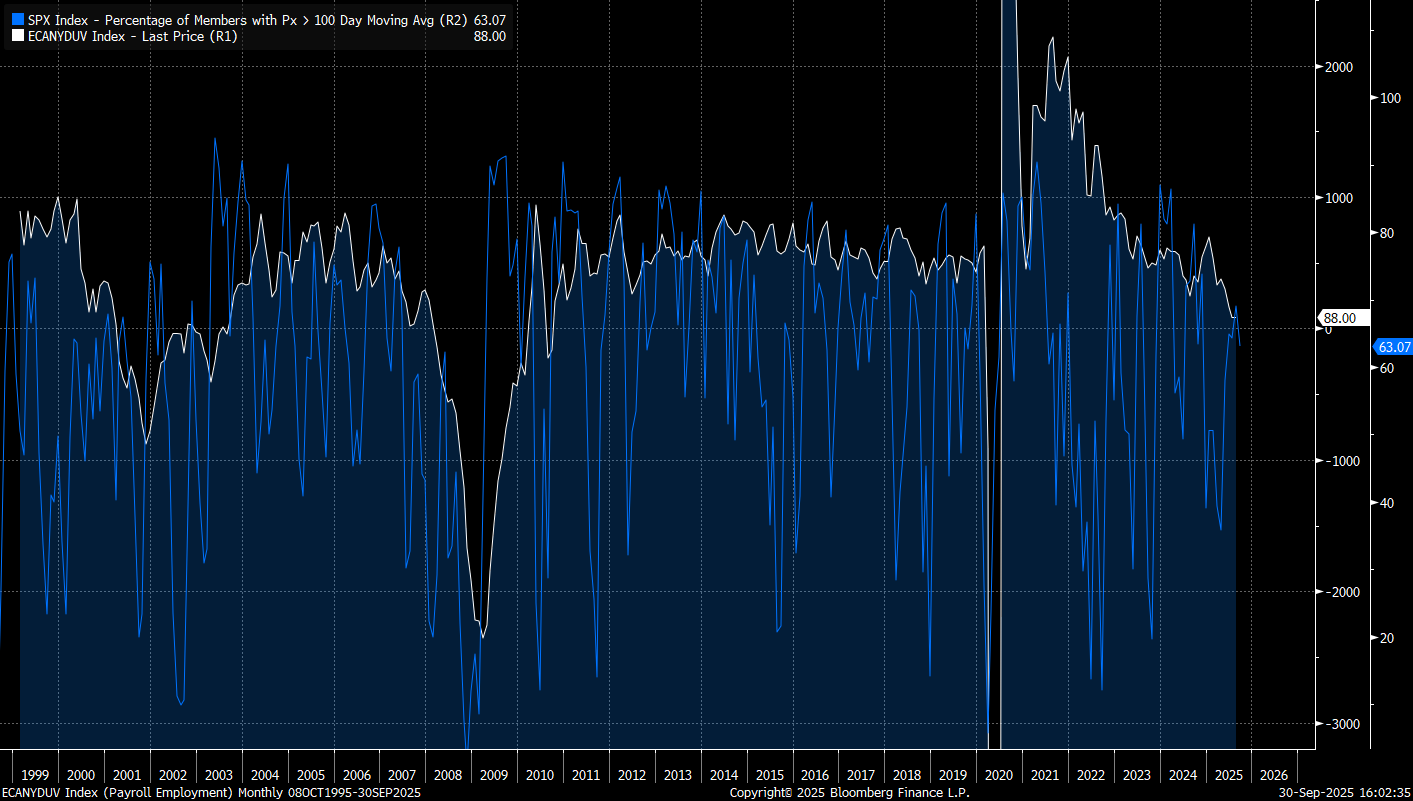

Let me put this simply: GDP is the flip side of the labor market. GDP functionally moves in lockstep with earnings in sectors. Earnings for companies are priced with a very high degree of efficiency in today’s world due to all the L/S funds running alternative data models to get almost real-time estimates of all major line items in the income statement of a company. The MoM and 3-month trend (white line in chart) in NFP data is likely to remain in expansionary territory. We are likely to see breadth in the index remain squarely positive, especially as the Russell is pushing higher. If the labor market actually began to unwind, we would begin to see significant underlying rotations in the underlying index to price the marginal probability of this before it even hit the lagging headlines in the media.

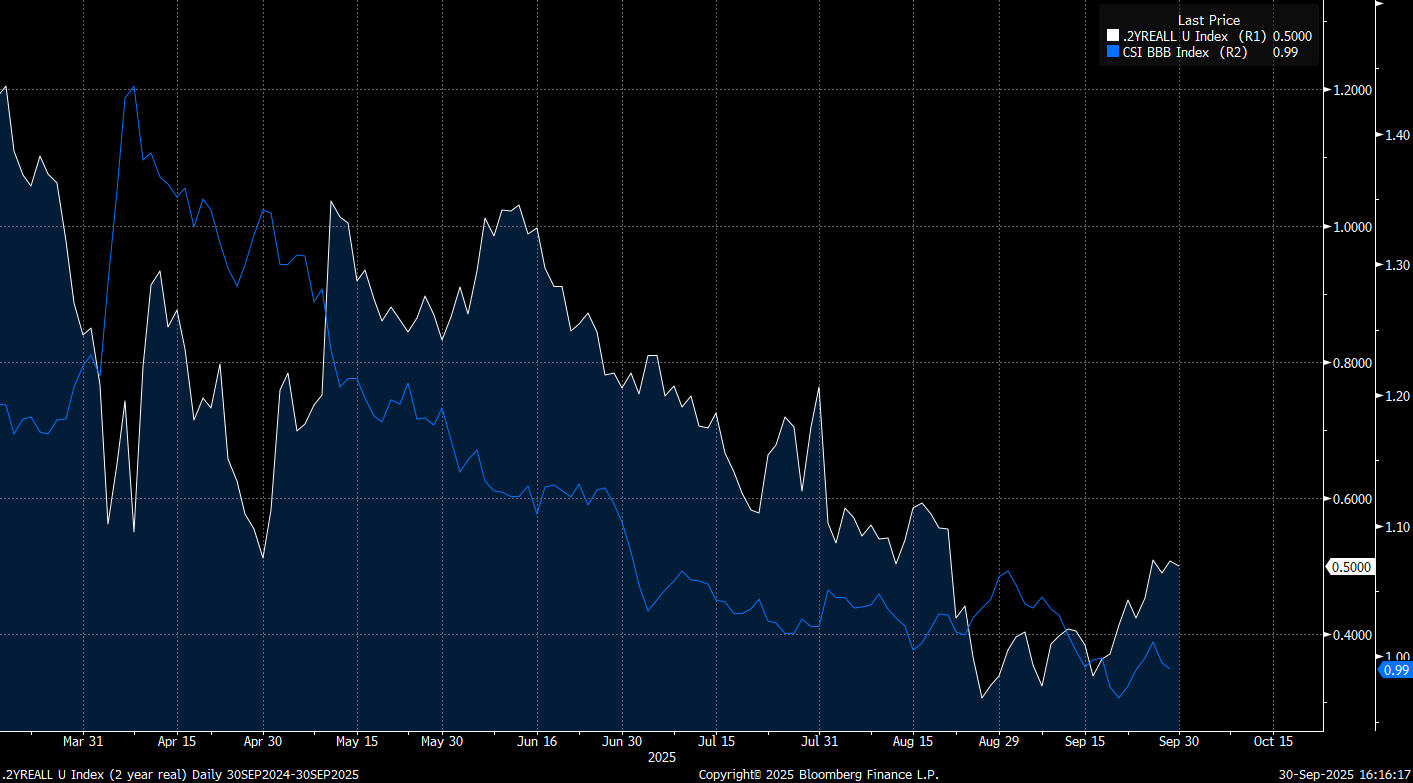

Fourth, the Fed’s stance is clearly pushing short-end real rates lower as credit spreads continue to fall, a trend that has persisted since the spike during the Q1 drawdown, leaving both real rates and credit spreads lower and creating a net benefit for companies that gain from strong top-line nominal GDP and reduced real financing costs.

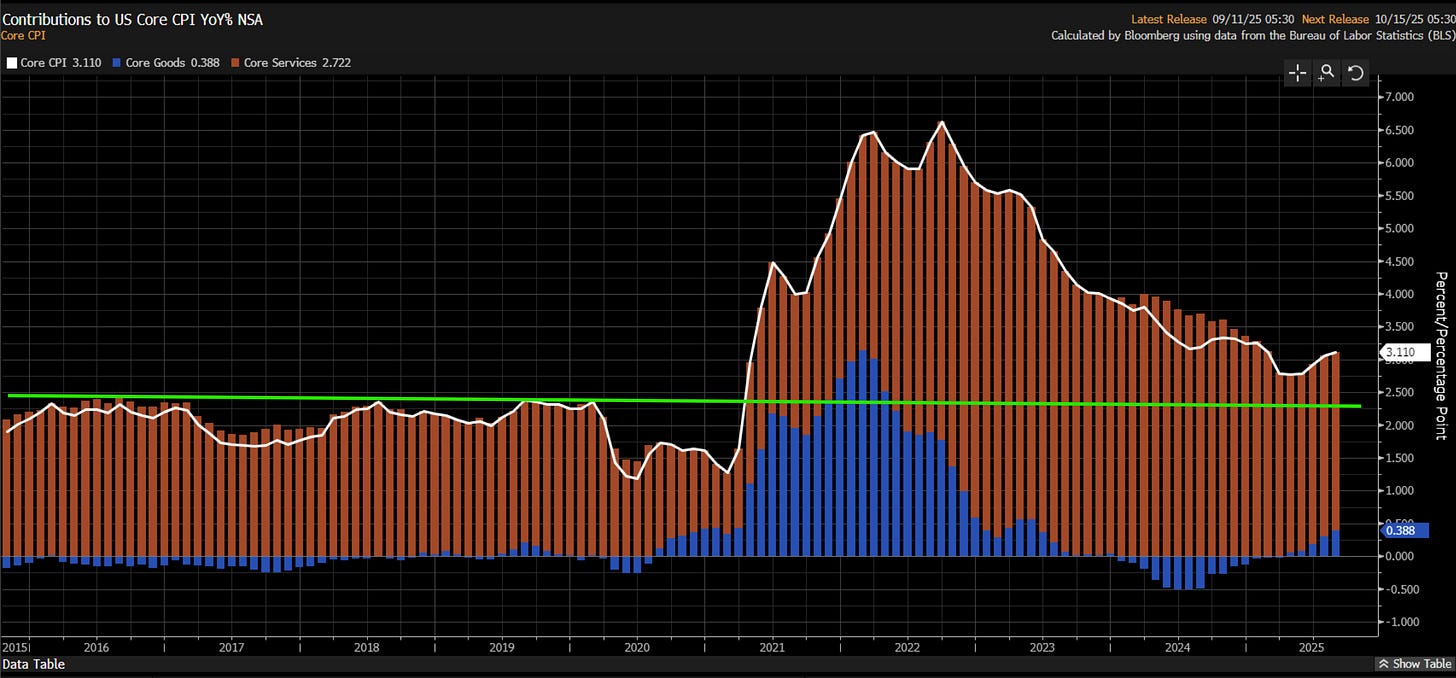

This wouldn’t be an issue, and we would have already transitioned into a Goldilocks regime if inflation weren’t sitting at 3% in core:

This is WHY ES has outperformed bonds on a cross-sectional basis recently. Simply put, stocks are outperforming bonds (green box) because the net liquidity impulse, combined with accelerating growth, is pushing equities HIGHER while creating headwinds for bonds, as long-term bonds are NEGATIVE BENEFICIARIES of rising long-term nominal GDP and expanding macro liquidity:

The specific level that functions as a signal for WHERE we are in the macro regime is the FOMC level in equities and bonds. As I explained in the positioning report, we are likely to remain BELOW the FOMC level in bonds and ABOVE it in equities. Following the stronger-than-expected JOLTS data this morning, equities moved higher while long-duration bonds ended marginally lower.

Summary of WHERE We Are:

Now that we understand the current regime, it becomes clear how critical this period is: all major macro forces are aligning to create a melt-up and an acceleration in the credit cycle. We know what is happening with resilient growth, procyclical policy, and liquidity tailwinds, but the real challenge is answering the second question: how high can this run go? The opportunity and the risk-reward from here depend on moving beyond describing the regime to measuring the extent of its continuation.

This brings us back to the two questions I started with:

How does the current regime set the preconditions for the future or unseen regime?

How much of the current regime is already priced in, thereby reducing the risk-reward of betting on its continuation?

Answering The Most Important Questions In Macro:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.