Macro Regime Tracker: Macro Flows

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I laid out all the macro view here:

As always, all the systematic models and strategies are updated below.

Main Developments In Macro

Tariffs / Trade Policy

NIKE LIFTS VIEW OF INCREMENTAL TARIFF COSTS FROM PRIOR $1B

NIKE CFO SEES $1.5B OF INCREMENTAL COSTS FROM TARIFFS

FED’S GOOLSBEE SAYS US SEEMS HEADED INTO NEW WAVE OF TARIFFS

GOOLSBEE: MOST OF RECENT INFLATION RISE FROM TARIFFS

GOOLSBEE: HOPING FOR MODEST, ONE-TIME IMPACT FROM TARIFFS

GOOLSBEE: IF INFL. MORE PERSISTENT, WOULD BE DIFFICULT SCENARIO

COLLINS: PRODUCTIVITY GROWTH MIGHT HELP LIMIT TARIFF INFLATION

COLLINS: NO LONGER EXPECTING AS LARGE A TARIFF INFLATION IMPACT

USTR GREER EXPECTS TRUMP TO SIGN TRADE DEALS ON ASIA TRIP

Fed / Monetary Policy

FED TO EASE MORGAN STANLEY’S CAPITAL REQUIREMENTS AFTER REVIEW

GOOLSBEE: UNCOMFORTABLE FRONTLOADING A WHOLE BUNCH OF RATE CUTS

GOOLSBEE: HOLDING RATES STEADY AS INFLATION RISES IS LIKE A CUT

GOOLSBEE: HARD TO EXPLAIN RISE IN SERVICES INFLATION

GOOLSBEE: SHORT GOV. SHUTDOWNS HAVE LITTLE IMPACT ON ECONOMY

GOOLSBEE: BLS IS BEST DATA PROVIDER IN THE WORLD

COLLINS: VERY STRONG EQUITY MARKETS BOOSTING HOUSEHOLD WEALTH

COLLINS: HIGHER HOUSEHOLD WEALTH PART OF STRONGER CONSUMPTION

COLLINS: MODESTLY OR MILDLY RESTRICTIVE STANCE IS APPROPRIATE

FED’S COLLINS: MANY INDICATORS MAKE LABOR SOFTENING QUITE CLEAR

Shutdown / Fiscal Risk

TRUMP: HAVE TO DO LAYOFFS WITH SHUTDOWN

TRUMP ON SHUTDOWN: PROBABLY LIKELY

TRUMP: WE CAN DO THINGS DURING SHUTDOWN THAT ARE IRREVERSIBLE

CHAVEZ-DEREMER: SHUTDOWN WILL HALT UNEMPLOYMENT PROGRESS

CHAVEZ-DEREMER: BLS REPORT WILL BE DELAYED IN EVENT OF SHUTDOWN

SCHUMER: GOP HAS UNTIL MIDNIGHT TO ‘GET SERIOUS’ ON HEALTH CARE

SCHUMER: HOUSE SPEAKER ENSURED SHUTDOWN BY SENDING MEMBERS HOME

SCHUMER: WE ARE HEADING INTO A SHUTDOWN

CBO: 750,000 EMPLOYEES COULD BE FURLOUGHED EACH DAY IN SHUTDOWN

Alex Bolton: Sen. Lisa Murkowski (R-Alaska) tells reporters she will vote for the House-passed seven-…

Sahil Kapur: Senate Majority Whip @SenJohnBarrasso tells me there won’t be negotiations during a shut…

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

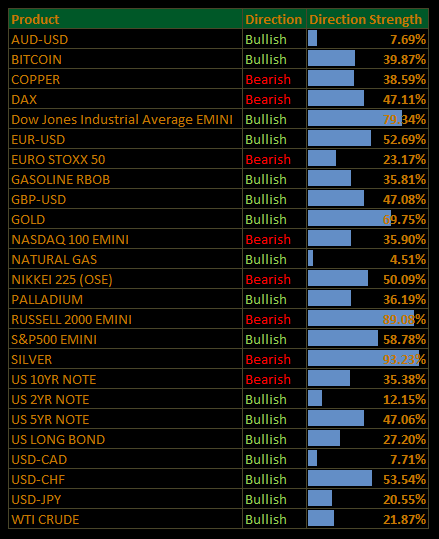

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

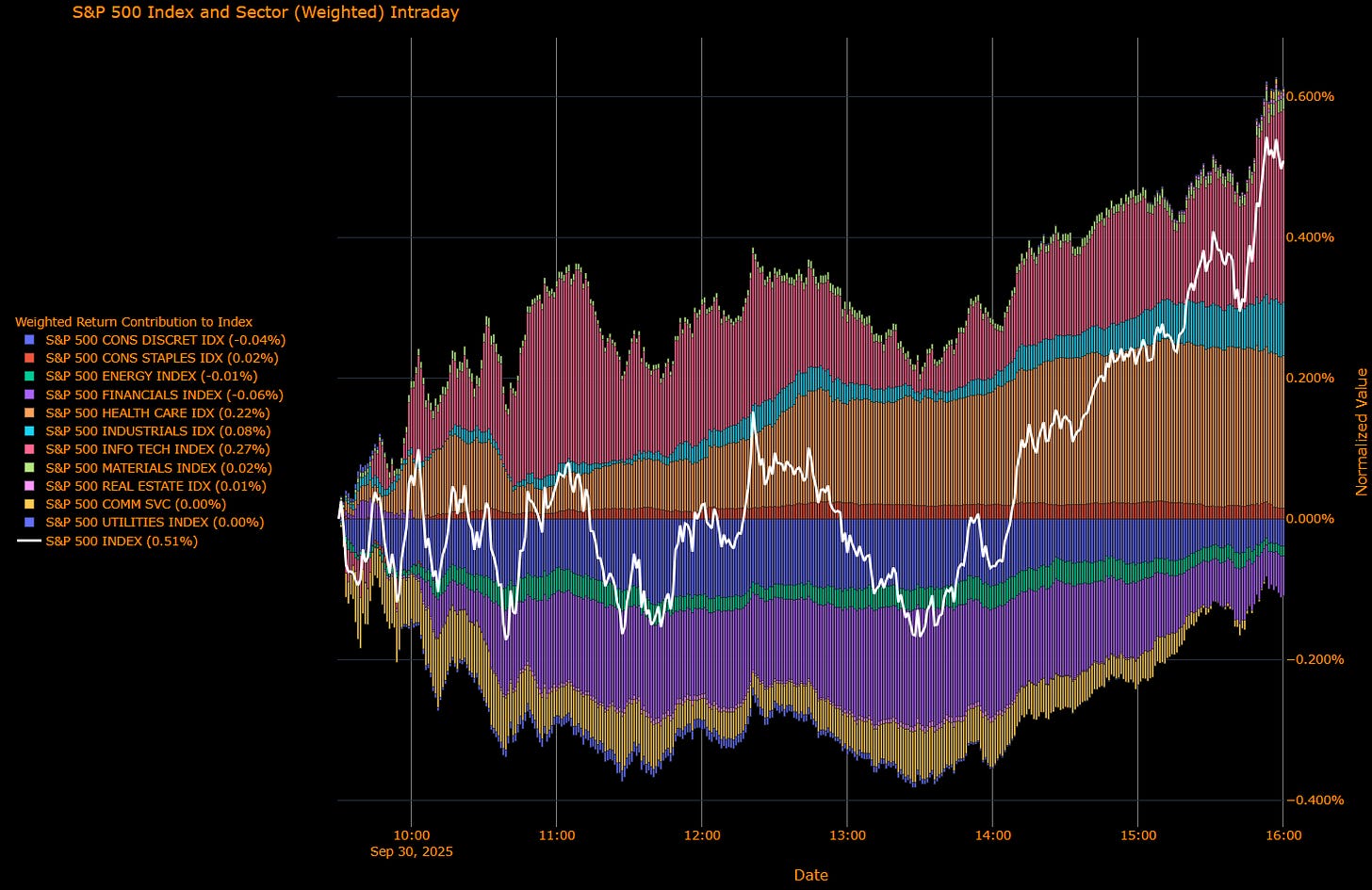

US Market Wrap: Health Care Leads; Shutdown Shadows Jobs Data (S&P +0.51%)

The S&P 500 climbed 0.51%, with the quarter closing on a firmer note despite looming risks around Friday’s nonfarm payrolls release. Sector performance was bifurcated: Health Care surged on policy-sensitive flows, while cyclicals like Energy and Financials lagged. The overarching backdrop remains defined by the approaching government shutdown, which could black out key labor and inflation data that anchors the Fed’s reaction function.

Sector Attribution

Weighted Return Contribution to Index

Leaders: Info Tech (+0.27%), Industrials (+0.08%), Health Care (+0.22%).

Drags: Financials (–0.06%), Consumer Discretionary (–0.04%), Energy (–0.01%).

Net: S&P 500 +0.51%.

Sector Performance (Unweighted Breadth)

Winners: Health Care (+2.45%), Materials (+1.00%), Industrials (+0.92%), Info Tech (+0.79%), Real Estate (+0.38%), Staples (+0.31%).

Losers: Energy (–0.49%), Financials (–0.42%), Discretionary (–0.37%).

Net: S&P 500 +0.51%.

Macro Overlay

Shutdown & Data Risk

Markets remain fixated on the shutdown countdown. If triggered, Friday’s BLS payrolls release would be delayed, depriving the Fed of high-frequency labor signals at a critical juncture. Historical precedent shows limited GDP and equity fallout from short shutdowns, but the information vacuum risk is acute for a data-dependent Fed.

Fed Speak

Goolsbee (Chicago): Warned tariffs are contributing to stickier inflation and cautioned against “frontloading” cuts.

Collins (Boston): Signaled further easing may be needed given labor softening, though inflation persistence remains a risk.

Jefferson (Vice Chair): Stressed the Fed faces downside risks on jobs alongside upside risks on inflation, highlighting the two-sided policy bind.

Macro Data

Consumer Confidence fell to 94.2 (five-month low), with the “jobs plentiful” share at its weakest since 2021.

JOLTS showed little change in job openings (7.23m), reinforcing the view of gradual labor market cooling.

The Read-Through

The Fed’s path remains gradual and conditional: October cut odds are alive but not pre-signaled. The sharper divergence in sector leadership; Health Care, Tech, Materials carrying the tape while Energy and Financials fade, reflects positioning for a world of slower growth, policy easing, and tariff-related inflation tail risks.

Takeaway: With consumer confidence slipping and shutdown risks muddying the data stream, the market is leaning on defensives and rate-sensitive growth, hedging uncertainty rather than embracing a risk-on narrative.

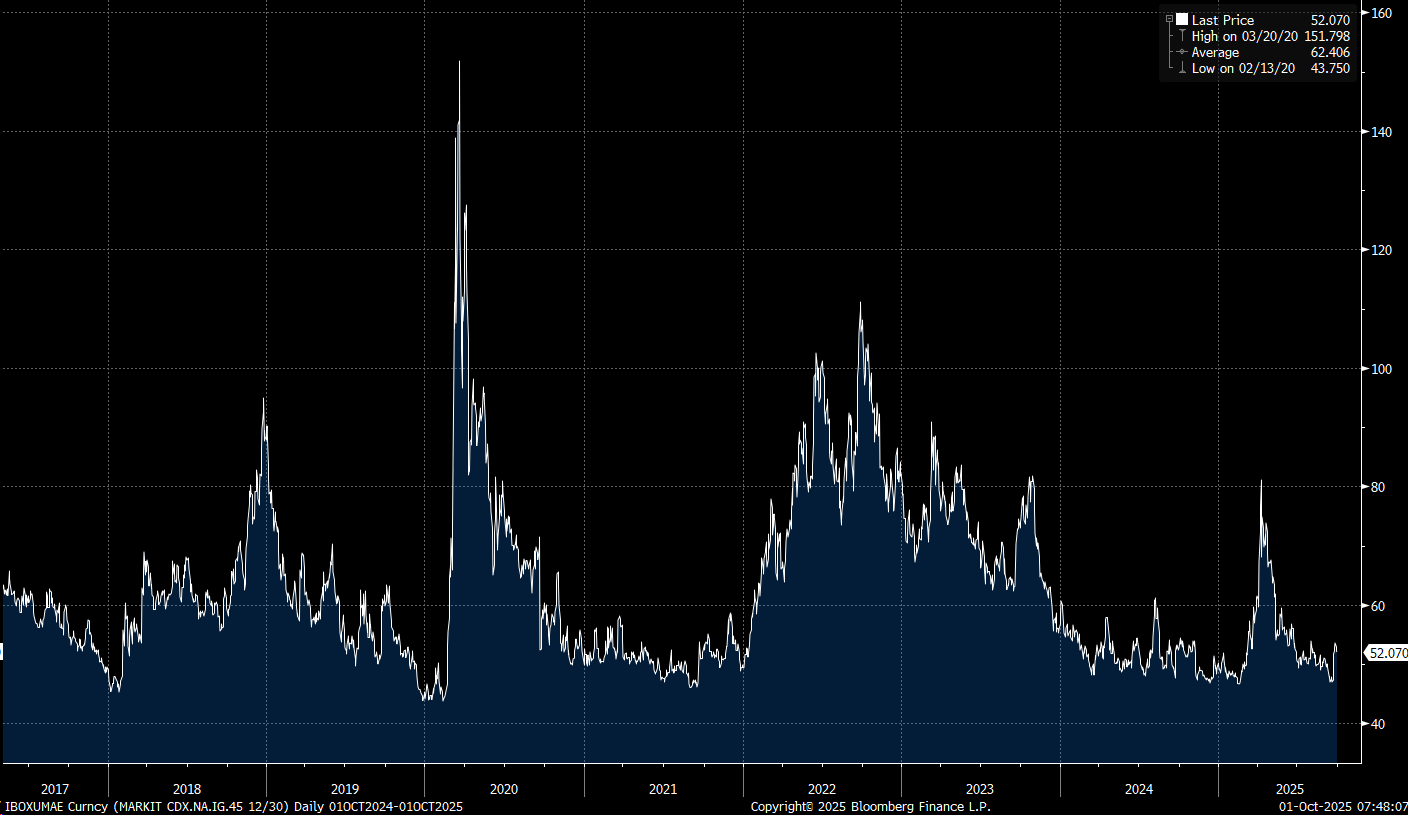

US IG Credit Wrap: Low-50s Hold; Shutdown Fog, Fed Split (IG OAS ~52.1 bp)

Investment-grade spreads remain locked in the “carry channel,” Bloomberg US IG OAS printing at ~52.1 bp (chart last: 52.070). That’s virtually unchanged from yesterday and still ~10 bp inside the 5-yr average (~62.4). The regime remains firmly low-50s: carry-positive, resilient to macro chop, but capped by headline risk.

Credit Context (where we sit)

IG OAS: ~52.1 bp

5-yr avg: ~62.4 bp → ~10 bp inside

Cycle tights: ~43.8 bp → ~8–9 bp away

’22 wides: ~111 bp → ~59 bp tighter

Read: Spreads are grinding, not breaking. The carry-friendly zone is intact; the only way tighter is if shutdown risks fade and labor cools smoothly.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today (macro tape)

Shutdown risk: Friday’s payrolls release may not print if the government closes. Markets are treating this as visibility risk, not GDP risk, but event-gap danger rises the longer the data blackout lasts.

Data: JOLTS showed job openings steady at 7.23m, consumer confidence slumped to 94.2 (five-month low). Labor cooling is visible, but without Friday’s NFP, confirmation may be delayed.

Fed speak:

Goolsbee (Chicago): Tariffs feeding into inflation, warns against over-frontloading cuts.

Collins (Boston): Further cuts plausible on labor weakness, but inflation risk lingers.

Jefferson (Vice Chair): Both sides of the mandate under pressure — jobs softening, inflation sticky.

Risks to Watch

Data blackout: Missing NFP/Inflation prints complicates Fed communication and repricing risk.

Tariff pass-through: Sector-specific cost pressure (importers) could widen idiosyncratic IG names.

Rates dynamic: Bull steepener from growth scare is more credit-hostile than a parallel rally.

The Read-Through

Base case: IG OAS grinds sideways in low-50s. Carry appeal intact; insurers, pensions, and LDI buyers stay engaged.

Risk case: If shutdown prolongs and jobs data blackout coincides with tariff noise, credit could cheapen toward high-50s.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.