Macro Regime Tracker: Managing Risk

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

See the most recent report explaining views on rates here:

Mentioned in the chat, I am turning neutral on BTC on a short term basis. We are likely to see some positioning unwind before another leg higher.

Main Developments In Macro

Federal Reserve, Rates & Monetary Independence

FORMER FED GOVERNOR KEVIN WARSH SPEAKS IN FOX NEWS INTERVIEW

WARSH SAYS WOULD SUPPORT RATE CUT NEXT WEEK IF HE WAS VOTING

TRUMP REITERATES CALL TO LOWER INTEREST RATES

VOUGHT: INTEREST RATES NEED TO COME DOWN

TRUMP: INTEREST RATES HAVE TO BE LOWER

TRUMP: WOULD LOVE FOR INTEREST RATES TO BE LOWER

TRUMP: TO FIRE POWELL IS A BIG MOVE, NOT NECESSARY

TRUMP: MAYBE THREE NAMES IN MIND FOR NEXT FED CHAIR

TRUMP: BELIEVE POWELL WILL 'DO THE RIGHT THING'

TRUMP: POWELL HAD MORE TENSION WITH SEN. SCOTT

TRUMP ON TALK WITH POWELL: THOUGHT GOOD MEETING, NO TENSION

TRUMP: NO PRESSURE FOR POWELL TO RESIGN

TRUMP, POWELL DISCUSSED INTEREST RATES ON FED TOUR

TRUMP SEEN INSIDE FEDERAL RESERVE BUILDING ON TOUR

TRUMP POSTS ABOUT FED TOUR ON TRUTH SOCIAL

TRUMP: POWELL WILL BE AT MY FED VISIT

TRUMP ON FED RENOVATIONS: TOO BAD IT STARTED

TRUMP: FED BUILDING FINISHED

TRUMP: WE'LL SEE HOW BOARD RULES ON INTEREST RATES

BLAIR: TRUMP 'NOT THINKING' ABOUT FIRING POWELL RIGHT NOW

VOUGHT, ASKED IF TRUMP WOULD FIRE POWELL: WE ARE WHERE WE ARE

BESSENT: FED HAS UNDUE INFLUENCE ON THE ECONOMY

BESSENT: OTHER FED OPERATIONS MIGHT IMPACT MONETARY INDEPENDECE

BESSENT: FED'S FOOTPRINT HAS GOTTEN TOO BIG

BESSENT: FED SHOULD GET BACK TO BASICS

BESSENT: WOULD LIKE TO SEE FED CURE ITSELF INTERNALLY

Trade & Tariff

TRUMP CITES PRAISE FOR REVENUE FROM TARIFFS

TRUMP: BRIEFED POWELL ON JAPAN TRADE DEAL

TRUMP SIGNS RESCISSIONS BILL TO CUT AID, NPR FUNDING: OFFICIAL

MEXICO PRESENTED PLAN TO US TO REDUCE TRADE DEFICIT: SHEINBAUM

MEXICO WORKING TO AVOID A US TARIFF INCREASE IN AUG.: SHEINBAUM

SHEINBAUM 'CONFIDENT' MEXICO CAN REACH TARIFF AGREEMENT WITH US

WEG SAYS ITS LONG-TERM PROJECTS ARE SEEING MORE TARIFF IMPACT

WEG HAS A PLAN TO MITIGATE 50% TARIFFS, CFO SAYS

BESSENT: COUNTRIES WILLING TO PAY A 'TOLL' TO TRADE WITH US

BESSENT: US IN A PRETTY GOOD PLACE WITH CHINA ON TRADE

HADDAD: WILL PRESENT TARIFFS CONTINGENCY PLAN TO LULA ON MONDAY

BRAZIL GOVT TRYING TO HOLD TALKS WITH US GOVT: BRAZIL'S HADDAD

BRAZIL, US TALKS HAPPENING AT STAFF LEVEL, BRAZIL'S HADDAD SAYS

SHEINBAUM: MEXICO, BRAZIL DISCUSSED SUPPORTING THEIR ECONOMIES

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

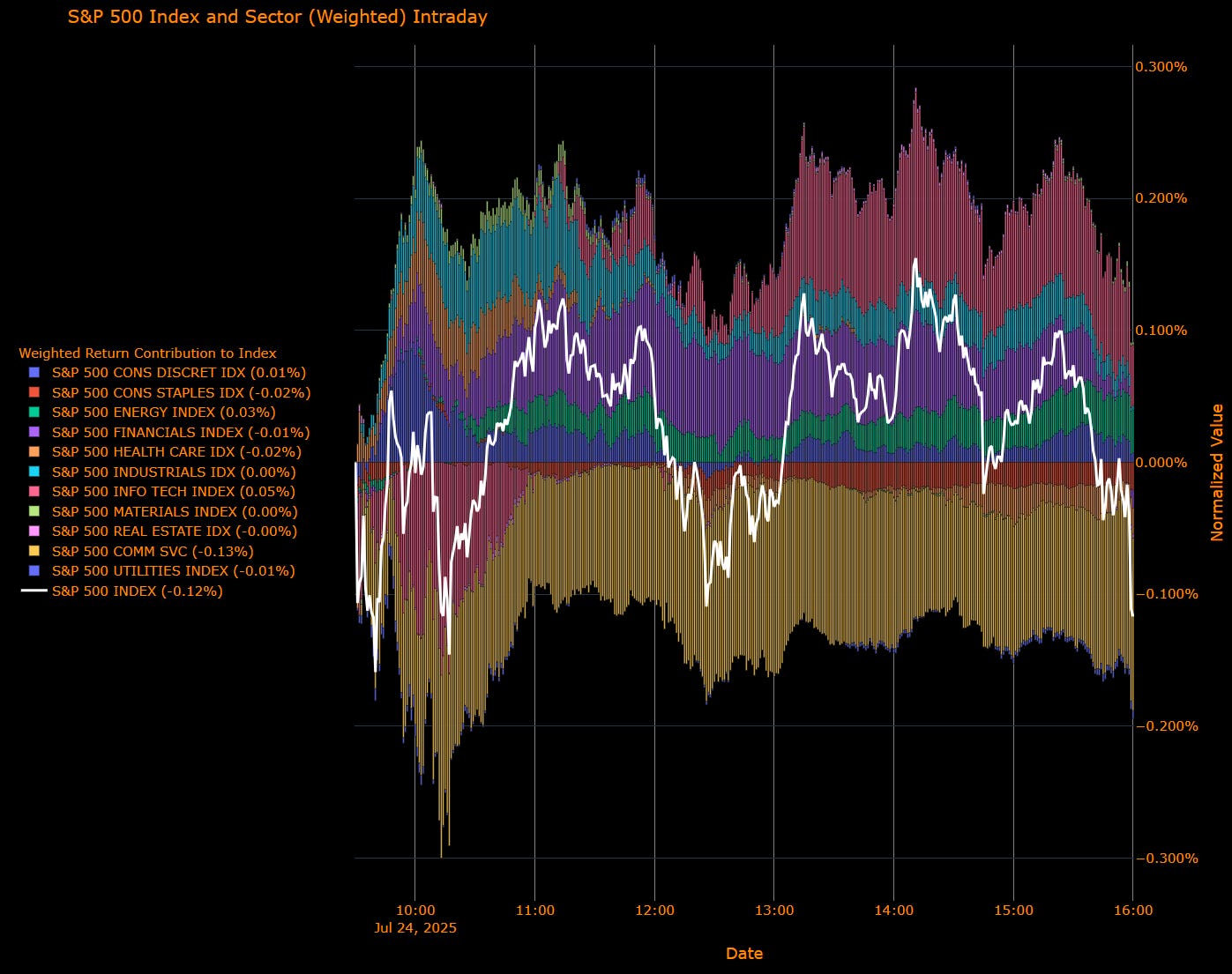

US Market Wrap: S&P 500 Slips as Communication, Staples Weigh; Tariff Overhang Persists

The S&P 500 dipped 0.12% Thursday, ending its recent record-setting streak as investor optimism wavered on renewed tariff uncertainty and a rotation out of defensives. While the index masked relatively narrow breadth under the surface, sector dispersion was sharp with Comm Services and Consumer Staples dragging the tape lower. Gains in Energy and Tech weren’t enough to offset the broader weight of cautious positioning ahead of the August 1 tariff deadline.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Info Tech (+0.05 pp) – Another session of quiet leadership, driven by semis and AI-linked software. Google and Nvidia continued to stabilize the broader complex.

Energy (+0.03 pp) – Crude strength and rotation into inflation-sensitive names kept Energy green for the second session in a row.

Consumer Discretionary (+0.01 pp) – Minimal impact on index level, with mixed performance beneath the surface.

Financials, Health Care, Utilities (–0.01 pp each) – All three detracted slightly as yields nudged higher and investors trimmed exposure to long-duration or defensive equities.

Comm Services (–0.13 pp) – The clear laggard. Mega-cap media and ad-tech names reversed, erasing recent outperformance.

Consumer Staples (–0.02 pp) – Continued derating, with pressure in household goods and food retail weighing.

All other sectors (Materials, Real Estate, Industrials) – Net-zero contribution.

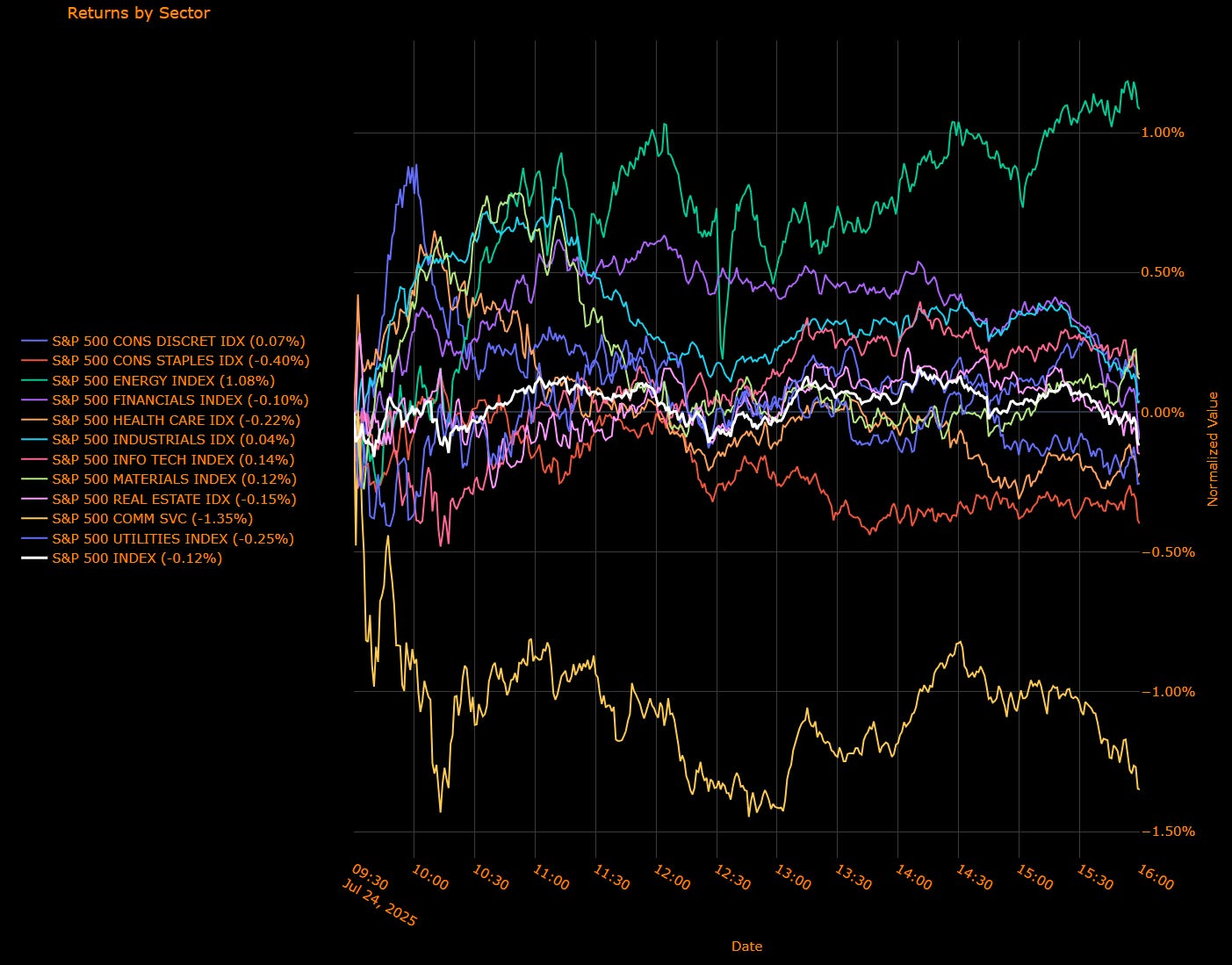

Sector Performance Breakdown

(Unweighted Daily Returns)

Energy (+1.08%) – Led the day. Strength in oil futures and tightening US inventory data supported integrated and E&P names.

Info Tech (+0.14%) – Stable leadership. Alphabet’s AI tailwinds and upbeat Intel commentary lent support to the sector.

Materials (+0.12%) / Industrials (+0.04%) – Marginal gains helped by tariff rotation and steady PMI momentum.

Consumer Discretionary (+0.07%) – Modest advance, with autos up but housing-linked names flat.

Financials (–0.10%) / Real Estate (–0.15%) – Both struggled as yields drifted higher and chatter around Fed hikes lingered.

Health Care (–0.22%) / Utilities (–0.25%) – Defensives came under pressure as investors pulled back from high-duration exposures.

Consumer Staples (–0.40%) – Broad-based decline. Profit-taking and weak earnings commentary from household names dragged the tape.

Comm Services (–1.35%) – Sharp selloff. Media, telecom, and streaming names all reversed lower, wiping out recent sector gains.

Macro Overlay: Trade Fatigue Meets Policy Scrutiny

Tariff Watch Back in Focus

President Trump reiterated a hard floor of 15% tariffs with potential to rise toward 50%, reviving fears of broader trade fallout. Talks with the EU remain “serious” but unresolved, and several emerging markets are still scrambling to bring their effective rate down. Markets are no longer pricing the tariff headlines as noise cyclicals are showing resilience, but defensive sectors are taking the hit.

Fed Drama Escalates

The Fed’s $2.5B renovation project remains a political lightning rod. The optics of Powell’s site tour with Trump amid pointed criticisms and talk of new candidates for Fed Chair underscore how far central bank independence has become a market-sensitive issue. While rate cut expectations have been pared, traders are now pricing fewer than two cuts for 2025.

Rotation Resumes Amid Valuation Jitters

The recent melt-up in equities appears to be losing steam. A sharp unwind in Comm Services and weakness in Staples/Utilities suggests investors are trimming risk in crowded trades, even as the broader tape holds up. Sector rotation remains the key story: flows are leaning into Energy and Tech, but a growing number of desks including Goldman and Citadel — are urging clients to buy downside protection.

A Market on the Edge of Policy Shifts

With strong PMIs, tight labor markets, and yields nudging higher again, the Fed has fewer excuses to ease aggressively and investors know it. Meanwhile, Trump’s tariff campaign is evolving from posturing to policy. The August 1 deadline looms large. If no deals materialize, the market may face a repricing shock.

Tariffs Are the New Rates

For now, the S&P 500 looks steady on the surface but the undercurrent is shifting. With Comm Services and Staples cracking while Energy and AI-linked Tech carry the baton, this isn’t a rally driven by broad conviction. It’s one held together by rotation and hope that tariffs don’t turn into a macro wrecking ball.

Trump’s 15–50% tariff framework is more than political theater it’s quickly becoming the fulcrum for equity positioning, sector leadership, and potentially even Fed timing. The market is betting that deals get done and Powell stays put, but neither is guaranteed. As we head toward August 1, expect more chop, more rotation, and a growing focus on what policy means for real-world earnings.

US IG Credit Wrap: Spreads Tighten to 50.14 bp, But Fragility Creeps In

Current IG Spread: 50.14 bp | 5-Year Avg: 62.76 bp | COVID High: 151.80 bp | Cycle Low: 43.75 bp

Investment-grade credit held firm on Thursday, with spreads grinding fractionally tighter to 50.14 bp just above the post-COVID lows and back to levels last seen before the 2022 tightening cycle. While the move aligns with strong equity breadth and low volatility, the backdrop feels increasingly unstable. Trump’s latest tariff remarks, Powell’s public clashes with fiscal conservatives, and rising rates are all clouding what had been a clean credit narrative.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Calm Spread, No Cushion

Tariff Path Gets Bumpier

Trump’s reaffirmation of a 15–50% tariff corridor ahead of the August 1 deadline is now being read less as a negotiating tactic and more as a policy base case. Talks with the EU and others are ongoing, but the tone is hardening and the equity market’s sensitivity to these headlines is rising. Credit hasn’t priced it in. Export-levered IG names in industrials, tech hardware, and autos remain particularly exposed.

Powell vs. the Optics

The Fed’s $2.5B renovation saga is becoming a political slow-burn risk. Trump’s site visit, accusations of waste, and legal threats around Powell’s past testimony haven’t yet spilled over into market pricing but they’re eroding the quiet confidence in institutional continuity. This matters. Not because Powell’s job is at risk today, but because Fed credibility is what holds the long end together in times of stress. IG spreads tend to lag until that confidence breaks.

Rates Rising, But Credit Ignores

The 10-year yield pushed to 4.41% its highest since early July and real rates are testing cycle highs. But IG credit barely blinked. That disconnect can’t last forever. If yields back up further or rate cut expectations fade, duration-heavy credit portfolios could come under pressure quickly. Right now, the marginal buyer seems to be betting on “rates up, spreads flat,” which doesn’t hold in persistent bear steepeners.

Low Spreads, High Sensitivity

We’re back in “priced-for-perfect” territory. Spreads at 50 bp are sending a message: the market believes tariffs get managed, Powell stays in place, the Fed doesn’t overtighten, and global demand holds up.

That may be right but it leaves no margin for error. The tape is one headline away from a reprice. The August 1 tariff clock is ticking, Treasury yields are rising, and political friction at the Fed is mounting. Credit is tight, but not safe. The compression might continue… until it doesn’t.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap: Cumulative Easing Holds at –114.1 bp as Terminal Drift Stalls

Cumulative Implied Easing (to Dec 2026): –114.1 bp | Terminal Rate: 3.189%

September OIS Cut Probability: 63.2% | Implied Rate: 4.165%

Markets remain committed to the easing path but that commitment isn’t getting any stronger. The OIS curve held steady Thursday, with total implied cuts through end-2026 at –114.1 bp, just a touch firmer than Wednesday. That mild recalibration reflects sticky front-end expectations around the September meeting and growing signs that the back end has reached its tolerance limit for soft-landing assumptions without more validation.

OIS-Implied Policy Path

September: Firm, but Fragile

The September meeting is now pricing a 63.2% chance of a cut, implying 15.8 bp of easing. That’s a hair tighter than midweek, but the tone is hesitant. Traders want confirmation either via July PCE, Jackson Hole, or labor softness before conviction builds further. Without it, the 4.16% pivot risks drifting higher into the August payrolls window.

Macro Overlay: Narrative Resilience or Blind Faith?

Tariff Fog Re-enters the Chat

Trump’s reiteration of a 15–50% tariff regime sets the floor higher and the risk wider. While reciprocal deal headlines with Japan and South Korea provided a bid to sentiment early in the week, traders are now acknowledging that the next few weeks carry real headline risk. The rate curve, however, is still discounting perfect resolution. The risk? Any abrupt shift in trade tone or a renewed spike in goods inflation could blow out 2s and 5s, repricing 30–40 bp in a heartbeat.

Fed Noise Grows Louder

The Powell renovation drama refuses to fade, and Trump’s increasingly public disdain for his Chair isn't going unnoticed. While rate markets continue to treat Fed independence as sacred and untouchable, that assumption is wobbly. A Powell exit or an overtly political replacement may not shift the easing path immediately but it could erode trust in forward guidance, making future cuts harder to anchor.

Rates vs. Risk Assets

The disconnect between rates and equities continues to widen. Stocks are at all-time highs. IG credit spreads are just 6 bp off post-pandemic tights. Yet the 10-year yield is sitting at 4.41%, with real yields near cycle highs. This divergence won’t last. Either inflation falls sharply and allows everything to rally… or rate-sensitive risk gets repriced. OIS traders are betting on the former. They’d better be right.

Final Word: Comfortable, but Cornered

The curve is still floating on the soft-landing breeze but the breeze is getting weaker. Implied easing is now a consensus trade: nearly 115 bp of cuts over the next 18 months, with precision that leaves very little room for error. It’s all predicated on diplomacy holding, inflation staying subdued, and Powell guiding the glidepath into 2026.

But none of that is guaranteed. Tariff risk is reawakening. Powell’s independence is being dragged into politics. And the labor market hasn’t cracked yet. The curve isn’t wrong. But it is overconfident. And that makes the next data point or headline more dangerous than the last.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.