Macro Regime Tracker: Market Cycles

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find the livestream I recorded today here:

And the most recent trade write up here:

I also recorded a short Twitter Spaces with my views on the recession here: LINK

I continue to believe we are in a unique period where significant liquidity is entering public markets and the underlying economy remains resilient. The Fed is cutting into this, which is pushing capital out the risk curve, the dollar lower, and gold higher. All of this continues to move in lockstep with the other trades I laid out here:

As always, all the systematic models and strategies are laid out below.

Main Developments In Macro

US–China / Trade & TikTok

TRUMP: MAYBE TIKTOK COULD BRING US CLOSER TO CHINA

TRUMP: THINK CONVERSATION WITH XI WILL CONFIRM THINGS

TRUMP: WILL SPEAK WITH XI ABOUT A BIG DEAL

TRUMP: HAVEN'T DECIDED ON TIKTOK STAKE

TRUMP IS WILLING TO LET TIKTOK BAN GO AHEAD: US OFFICIAL

CHINA SAYS REACHED FRAMEWORK CONSENSUS ON TIKTOK

CHINA'S LI: TIKTOK FRAMEWORK IS GOOD FOR BOTH PARTIES

CHINA'S LI: BOTH SIDES AGREE IMPORTANCE OF STABLE US CHINA TIES

CHINA URGES US TO REMOVE ITS RESTRICTIONS ASAP: LI

CHINA'S LI: RAISED CONCERN DURING MEETING ON US SANCTIONS

CHINA'S LI: IT IS COMMON FOR US, CHINA TO HAVE DISAGREEMENT

CHINA'S LI CHENGGANG: US, CHINA HAD CANDID, INDEPTH TALKS

CHINA’S TRADE ENVOY LI CHENGGANG SPEAKS IN MADRID

PRINCIPAL LEVEL US-CHINA TALKS IN MADRID RESUME

US, CHINA PRINCIPALS CONCLUDE SECOND DAY OF TALKS IN MADRID

GREER SUGGESTS US IS OPEN TO ACTION ON EXTENDING CHINA TRUCE

GREER: TOPIC OF EXPORT CONTROLS CAME UP WITH CHINA

BESSENT: VERY GOOD DISCUSSIONS ON TIKTOK

BESSENT: XI, TRUMP TO SPEAK TO COMPLETE TIKTOK DEAL

BESSENT: MADE GOOD PROGESS ON TECHNICAL DETAILS WITH CHINA

BESSENT: CHINESE COUNTERPART HAVE AN ‘AGGRESSIVE ASK’

BESSENT SAYS THERE IS FRAMEWORK FOR TIKTOK DEAL

CORRECT: CLOSE TO RESOLVING TIKTOK WITH CHINA, BESSENT SAYS

BESSENT: TRUMP HAS GREAT RESPECT FOR XI

BESSENT: TALKS ON TRADE WILL CONTINUE

Fed / Rates

TRUMP: POWELL MUST CUT RATES BIGGER THAN HE HAD IN MIND

US SEPT. EMPIRE STATE FACTORY INDEX FALLS TO -8.7; EST. 5

BULLARD SAYS HE MET WITH BESSENT ABOUT FED CHAIR JOB: REUTERS

US Politics / Security

TRUMP: NO US FORCES WERE HARMED IN THIS STRIKE ON CARTELS

TRUMP: US STRUCK VENEZUELANS IN INTERNATIONAL WATERS

TRUMP: US STRUCK 'NARCOTERRORISTS' FROM VENEZUELA

TRUMP: STRIKE ON DRUG CARTELS RESULTED IN 3 MALES KILLED

TRUMP: US STRUCK CARTELS IN SOUTHCOM AREA

TRUMP: THREATENS TO CALL NATIONAL EMERGENCY, FEDERALIZE DC

US Macro / Markets

NASDAQ 100 RISES FOR 9TH SESSION, LONGEST WIN STREAK SINCE 2023

ALPHABET RISES 4.1% TO SURPASS $3 TRILLION IN MARKET VALUE

Global Macro (US-linked context)

US WILLING TO WORK WITH CHINA TO CUT INVESTMENT BARRIERS: LI

WARREN: A FOREIGN POWER, IN ESSENCE, CO-OPTED US FOREIGN POLICY

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

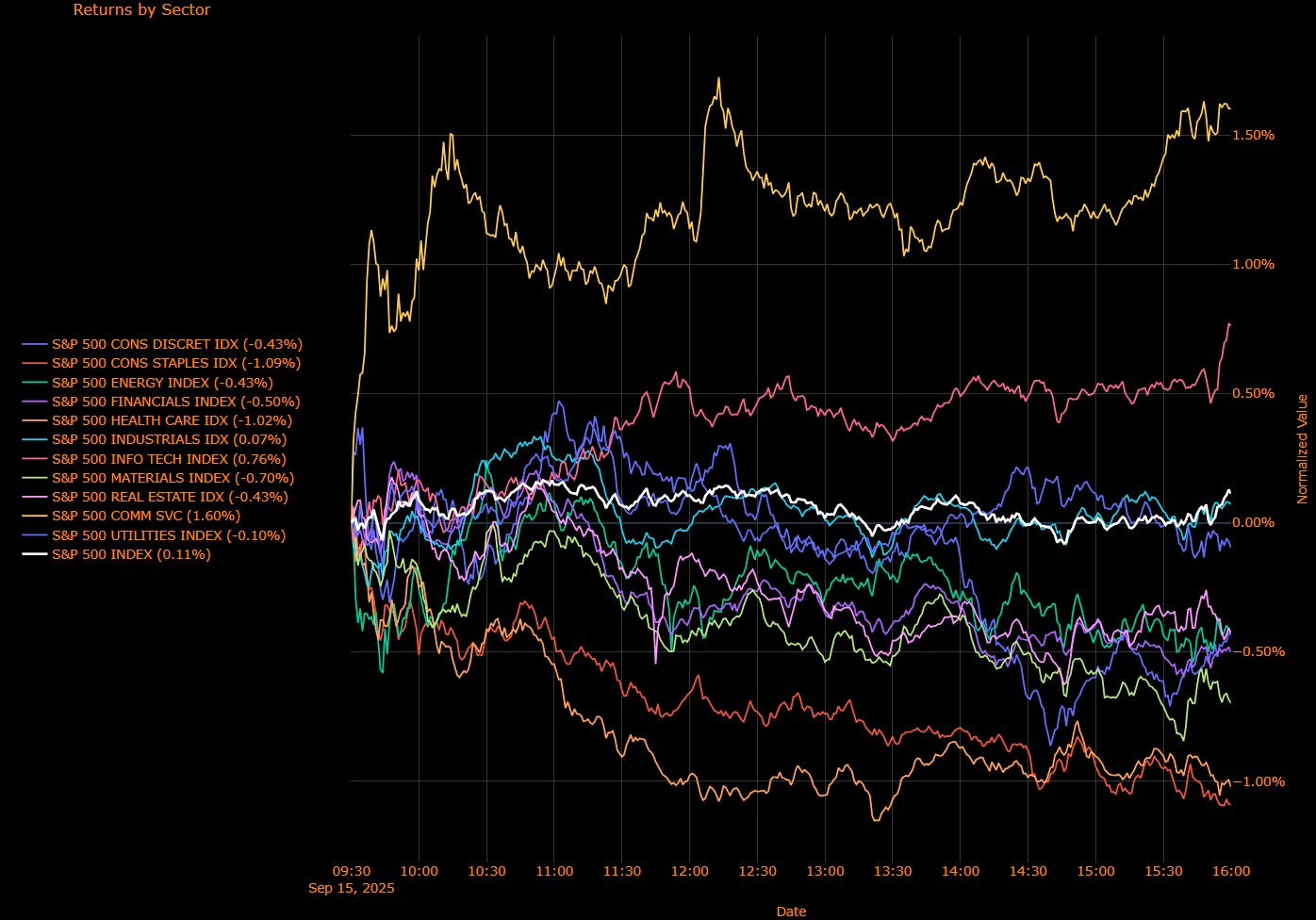

US Market Wrap: Fed Cut Looms, Tech & Comms Lead; Cyclicals Lag (S&P +0.11%)

The S&P 500 closed modestly higher (+0.11%), setting fresh highs as traders leaned into certainty of a September Fed cut. Treasuries firmed, with 2-year yields hovering at the lowest levels since last September, while the dollar slipped. Optimism on easing kept equity flows buoyant, but sector rotation signaled caution: defensives lagged and cyclical weakness left breadth narrow.

Momentum from megacap tech and communication services extended the index’s record-breaking run, even as most sectors traded in the red. With Powell’s guidance and the updated SEP dot plot due mid-week, markets remain focused not on “if” but “how fast” the Fed will ease.

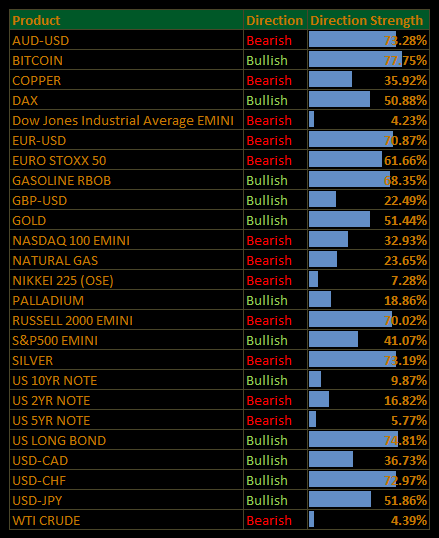

Sector Attribution

Weighted Return Contribution to Index

Information Technology (+0.26%) and Communication Services (+0.17%) drove index gains.

Industrials (+0.01%) provided a marginal offset.

Financials (–0.07%), Health Care (–0.09%), and Consumer sectors (–0.05% each for Staples/Discretionary) were notable drags.

Other sectors contributed close to zero.

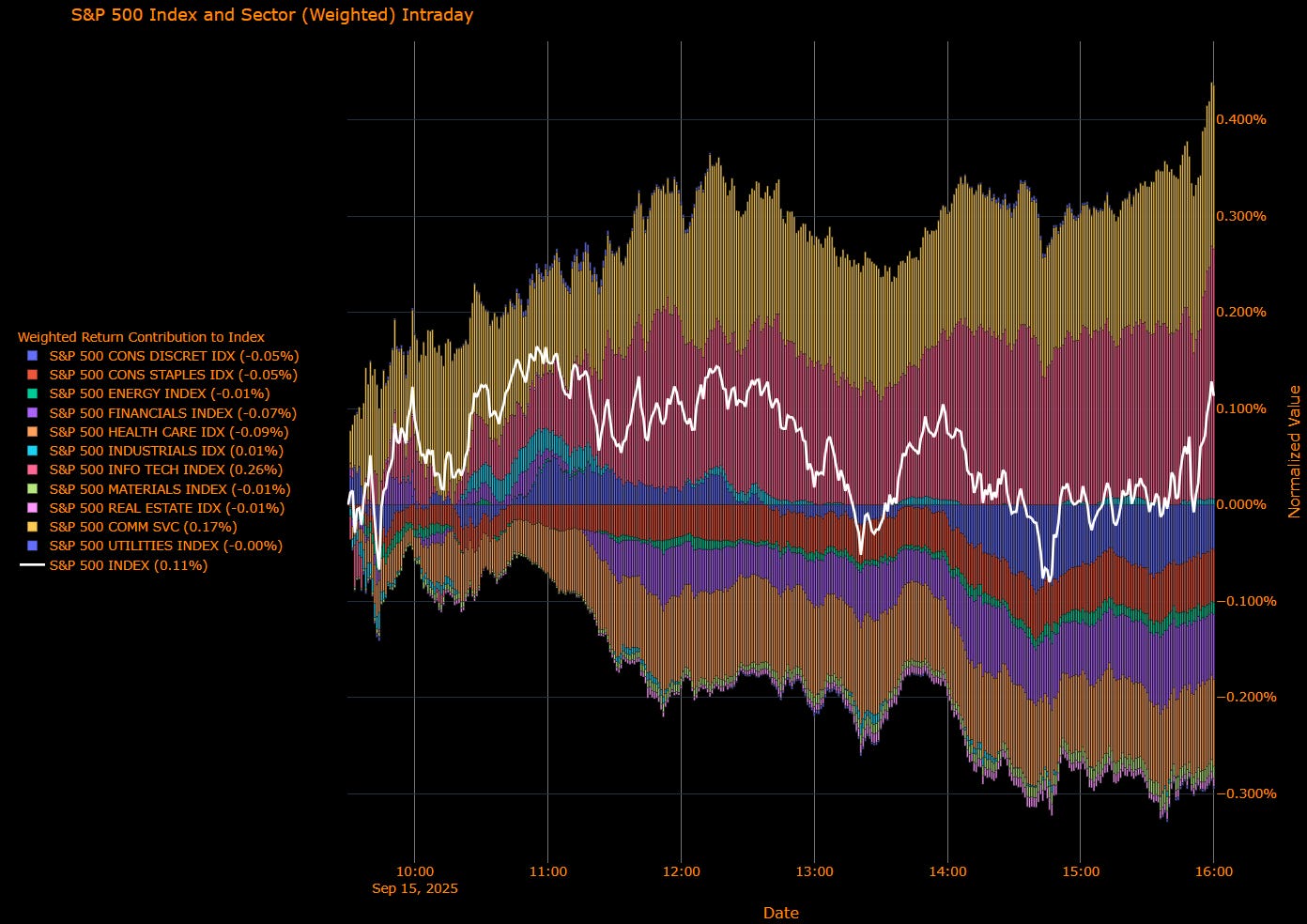

Sector Performance (Unweighted Breadth)

Communication Services (+1.60%) and Information Technology (+0.76%) dominated gains, extending momentum in growth sectors.

Industrials (+0.07%) eked out a small positive.

Defensives underperformed: Staples (–1.09%), Health Care (–1.02%), and Utilities (–0.10%).

Cyclicals dragged: Materials (–0.70%), Energy (–0.43%), and Financials (–0.50%).

S&P 500 Index: +0.11%

Macro Overlay

Fed Countdown

Markets remain fully priced for a September 25 bp cut, with the focus shifting to Powell’s tone and the dot plot trajectory. Labor market softening has sealed the deal, but inflation expectations remain stubbornly above 2%. Policymakers are expected to emphasize balance: easing enough to cushion employment but avoiding signals of an aggressive cutting cycle.

Positioning & Flows

The rally remains concentrated, with megacap tech and communications carrying the tape. The defensive bid that supported utilities and staples last week reversed, suggesting investors are less interested in pure safety and more focused on sectors with earnings resilience plus rate sensitivity.

Rates & Commodities

Treasuries extended their rally into the Fed meeting, with the curve holding its recent steepening bias. The dollar softened further, while gold climbed near record highs and oil recovered modestly, consistent with easing expectations and geopolitical hedging.

Market Tone

The index gain masked narrow leadership: tech and communications absorbed the bulk of flows, while cyclicals and defensives alike underperformed. The setup remains one of “insurance cuts without crisis” but the real inflection comes Wednesday with Powell’s press conference and the dots.

The Read-Through

Base Case: September cut delivered, Powell stresses data dependence rather than committing to a sequence.

Risks: A cautious Fed tone could stall equities; faster labor deterioration could accelerate cuts beyond current pricing.

Positioning Lens: Favor growth sectors (Tech, Comms) with earnings momentum, alongside selective rate-sensitives. Cyclicals likely to remain under pressure until clarity emerges on pace of easing.

The rally is still intact, but leadership is narrowing. With the Fed about to reset expectations, the market remains perched between optimism on cuts and fragility in breadth. Wednesday is the hinge: Powell’s ability to reassure without overcommitting will decide whether this record run broadens out or stalls at the top.

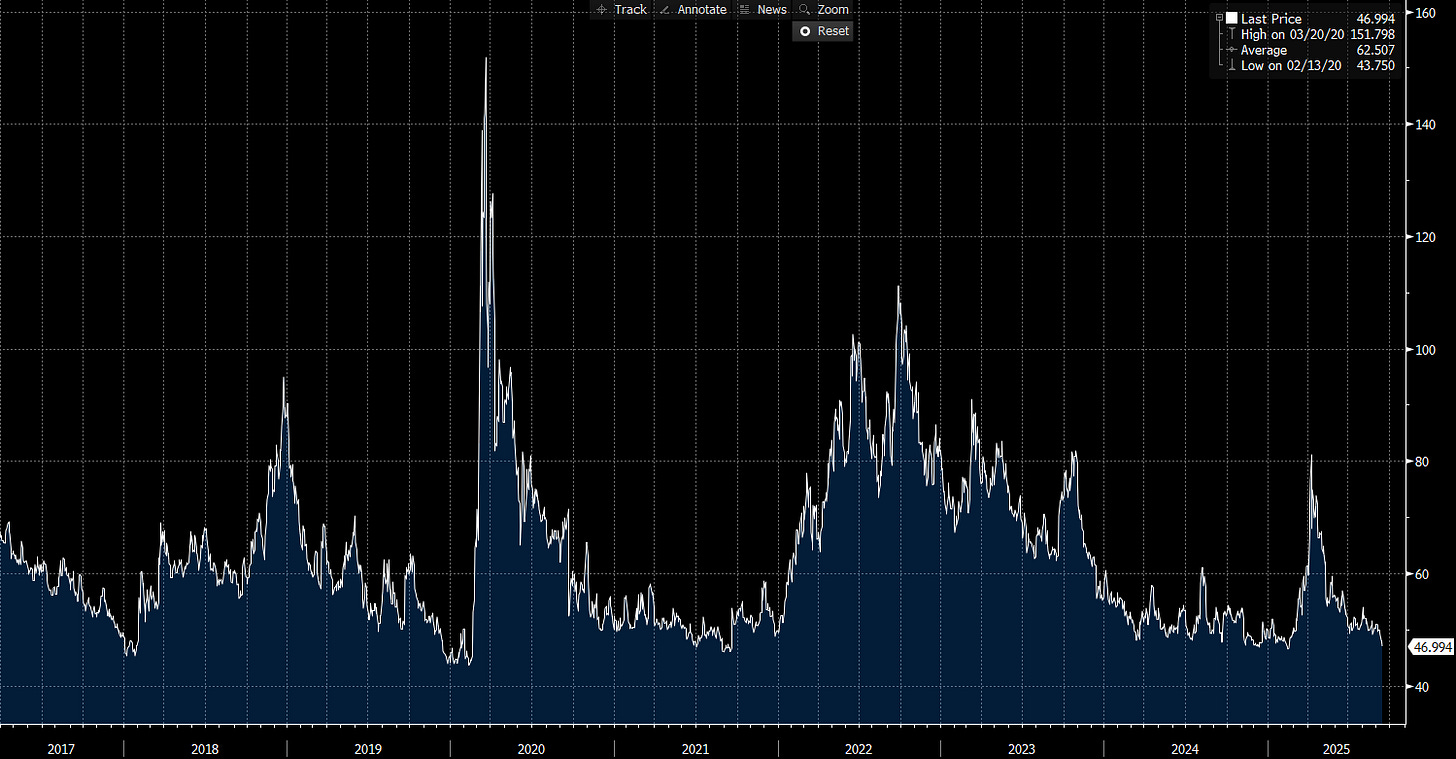

US IG Credit Wrap: Pre-Fed Calm, OAS Drifts Tighter; Carry Still King (IG OAS ~47.0 bp)

IG spreads edged tighter into the Fed, reinforcing the “carry first, volatility second” regime. Bloomberg IG OAS prints ~46.99 bp, leaving credit ~15.5 bp inside the five-year average and only ~3.3 bp off the cycle low. With the S&P at fresh highs, 2-yr yields near the lows since last September, and the dollar softer, credit is signaling confidence in “cuts without crisis.”

Credit Context

IG OAS: ~47.0 bp (chart last: 46.994)

5-yr average: 62.5 bp → ~15.5 bp inside

Cycle low: 43.8 bp → ~3.2 bp off tights

COVID peak: 151.8 bp → ~105 bp tighter

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

What Changed Today

Macro tape: Equities at records; Nasdaq winning streak extended. A framework to keep TikTok operating in the US helped tech sentiment. Labor data remain softening-not-collapsing; no fresh inflation shock.

Policy path: Markets fully priced for a 25 bp cut in September; debate is about pace thereafter. Powell’s tone and the dots are the swing factors.

Rates/backdrop: Treasuries bid (2s near YTD lows), dollar softer; gold firm, oil modestly higher consistent with easing expectations and benign growth.

Credit tone: Primary well-absorbed with light concessions; secondary two-way but balanced. ETFs and real-money demand continue to pin OAS in the high-40s.

Risks to Watch

Guidance surprise: A cautious, “wait-and-see” Powell could rekindle rates vol → +2–5 bp to OAS.

Labor slippage: Faster claims/payroll deterioration would pressure lower-tier IG and cyclicals.

Steepener shock: Growth-scare steepening is more problematic for spreads than a supply-led selloff.

Liquidity windows: Heavy calendars into thin tape can stall the grind and widen idiosyncratically.

Read-Through

IG continues to price insurance easing without a growth accident. At ~47 bp, the next ~10 bp is about Fed communication and rates vol, not micro credit fundamentals. Unless the labor cooldown accelerates or inflation expectations re-re-accelerate, dips should be brief and bought but carry discipline and liquidity respect matter at these valuations.

Final Word

Pre-Fed calm favors carry. With OAS a whisker off cycle tights and equities at highs, credit is granting the Fed the benefit of the doubt: cut, keep optionality, avoid promising a sequence. If Powell threads that needle, spreads can stay pinned; if he blinks hawkish or data crack, the first move is rates vol credit follows, but from a position of strength.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Equity Indices:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.