Macro Regime Tracker: NO RECESSION

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I recorded 3 macro videos today that can be found here:

Additionally, spaces recording from today is here: LINK

I also laid out the risk reward for bonds as we move into NFP. This will be an important week as we approach CPI and FOMC:

Finally, I would encourage everyone to take advantage of the discount that my friends at Prometheus Research are offering right now. These guys are the best systematic macro guys in the business and provide a ton of rigor.

https://www.prometheus-macro.com/subscribe?coupon=551c5334

Main Developments In Macro

*LOGAN: FED SHOULD FOCUS ON INF. TARGET AND NOT PAST SHORTFALLS

*LOGAN SAYS FED'S FRAMEWORK SHOULD WORK IN A RANGE OF SCENARIOS

*LOGAN: ATTENTIVE TO EMPLOYMENT ABOVE MAX SUSTAINABLE LEVEL

*TRUMP, SENATE FINANCE PANEL MEETING ON WEDNESDAY: POLITICO

*TRUMP INVITED GOP SENATE FINANCE PANEL TO WHITE HOUSE: POLITICO

*US RESTRICTS VISA FOR SOME CENTRAL AMERICAN GOVT OFFICIALS

*BESSENT, THUNE MEETING ON TAX PORTION OF TRUMP BILL: POLITICO

*LEAVITT: 50% STEEL, ALUMINUM IMPORT TARIFF TAKE EFFECT TOMORROW

*LEAVITT: TRUMP WILL SIGN STEEL, ALUMINUM TARIFF ORDER TODAY

*LEAVITT: UNDOCUMENTED FARMWORKERS NOT EXEMPTED FROM DEPORTATION

*LEAVITT: AWARE OF REPORTS OF RECENT ISRAELI ATTACKS IN GAZA

*LEAVITT: TRUMP WAS NOT AWARE OF UKRAINE DRONE ATTACK BEFOREHAND

*COOK: FED MUST BE OPEN TO 'ALL POSSIBILITIES' REGARDING RATES

*MUSK CALLS SPENDING BILL 'A DISGUSTING ABOMINATION'

*MUSK SAYS THOSE WHO VOTED FOR US SPENDING BILL 'DID WRONG'

*LEAVITT: PLAN IS FOR TARIFF DEAL ANNOUNCEMENTS TO BE MADE SOON

*MUSK CALLS US SPENDING BILL 'MASSIVE, OUTRAGEOUS, PORK-FILLED'

*LEAVITT: WILL BE TRUMP-XI TALK VERY SOON

*LEAVITT: WHITE HOUSE MONITORING CHINA COMPLIANCE W/ GENEVA PACT

*LEAVITT: WHITE HOUSE WILL BE SENDING RESCISSION PACKAGE TODAY

*LEAVITT: TRUMP WILL ATTEND NATO SUMMIT

*LEAVITT: WITKOFF SENT DETAILED PROPOSAL TO IRAN

*LEAVITT: TRUMP KEEPING SANCTIONS ON RUSSIA AS TOOL IN TOOLBOX

*FED GOVERNOR LISA COOK COMMENTS IN Q&A SESSION

*COOK SAYS FED FACING CHALLENGING SITUATION WITH MANDATE TENSION

*FED'S GOOLSBEE: HAVE TO WAIT AND SEE TARIFF IMPACT ON INFLATION

*COOK: TARIFF PRICE HIKES MAY MAKE NEAR-TERM INF. PROGRESS HARD

*COOK: ECONOMY STILL ON FIRM FOOTING BUT UNCERTAINTY HAS RISEN

*COOK: PRICE STABILITY ESSENTIAL FOR ACHIEVING STRONG LABOR MKT

*COOK: CURRENT STANCE OF MONETARY POLICY IS WELL POSITIONED

*COOK: THERE IS EVIDENCE TRADE POLICY STARTING TO AFFECT ECONOMY

*COOK: COMMITTED TO POLICY THAT KEEPS INF. EXPECTATIONS ANCHORED

*COOK: TARIFFS RAISE CHANCES OF JOB MARKET COOLING, HIGHER INF.

*BOSTIC: MUCH DEPENDS ON WHERE TARIFFS AND OTHER POLICIES SETTLE

*BOSTIC: SOME INDICATIONS OF POTENTIAL WEAKNESS IN LABOR MARKET

*BOSTIC: NO GLARING SIGNS OF SERIOUS LABOR MARKET DETERIORATION

*BOSTIC: STILL THINK THERE'S SPACE FOR ONE RATE CUT THIS YEAR

*FED'S BOSTIC SAYS PATIENCE IS BEST APPROACH TO MONETARY POLICY

*BOSTIC: NO CLEAR SIGNS OF TARIFFS BOOSTING INFL. AS OF APRIL

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Real Estate Spreadsheet Video: LINK

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

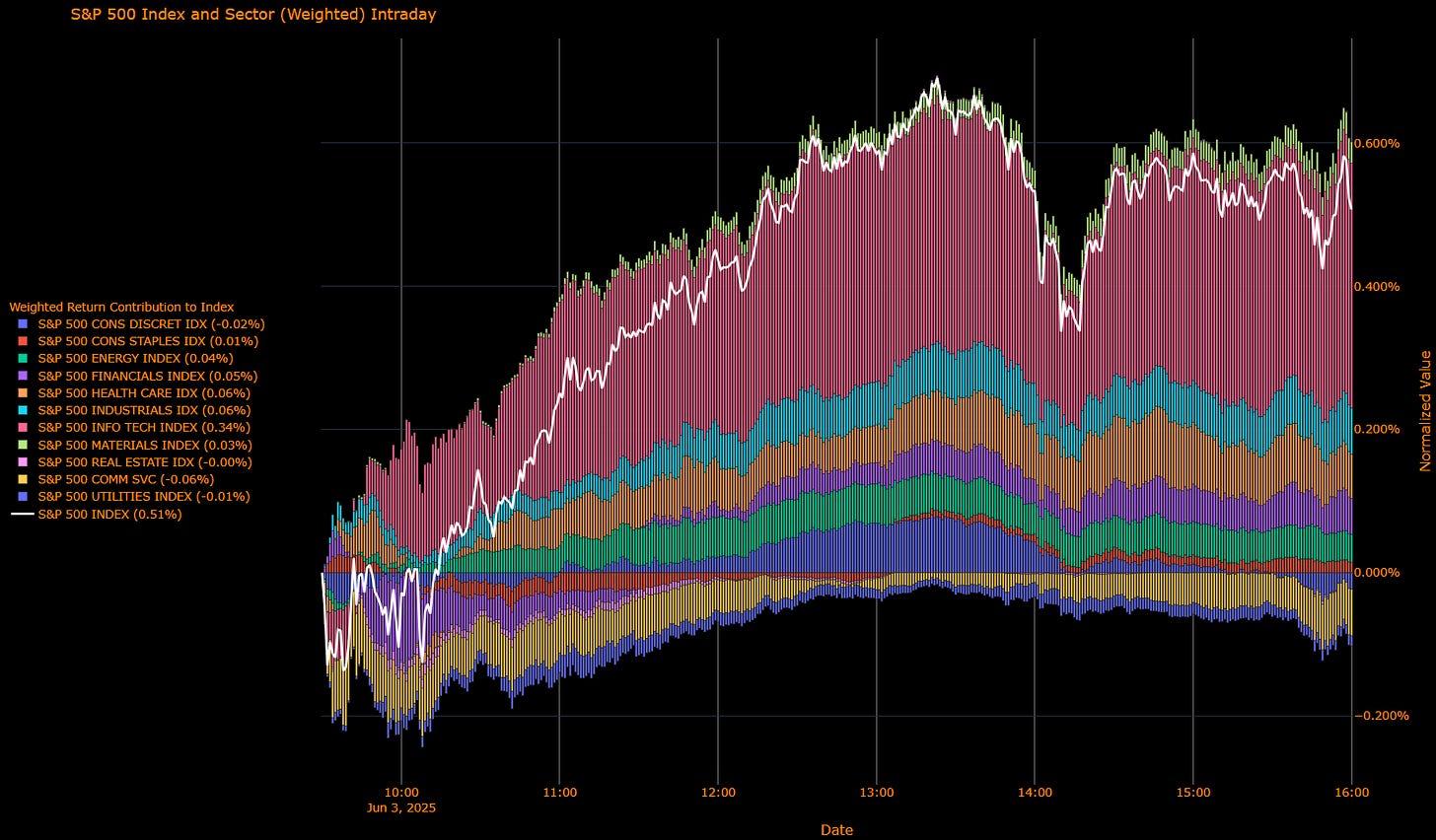

S&P 500 Wrap — Index Advances +0.51%, Tech and Energy Lead Gains; Communication Services and Utilities Lag

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Information Technology (+0.34 pp) – Largest positive contributor, driven by continued strength in tech and semiconductors amid resilient investor optimism.

Energy (+0.04 pp) – Positive contribution reflecting a rebound driven by improved sentiment around global demand and stable oil prices.

Industrials (+0.06 pp) – Benefited from improving economic outlook and diminished near-term tariff concerns.

Health Care (+0.06 pp) – Modestly positive, buoyed by stable demand and investor appetite for defensive sectors.

Financials (+0.05 pp) – Supported by steady yield environment and investor optimism in financial institutions.

Materials (+0.03 pp) – Slight positive impact, reflecting stable commodity prices and balanced market sentiment.

Consumer Staples (+0.01 pp) – Minimal positive contribution, demonstrating continued investor interest in defensive, yield-oriented companies.

Consumer Discretionary (-0.02 pp) – Mild negative impact, reflecting mixed consumer sentiment amid ongoing economic uncertainty.

Real Estate (-0.00 pp) – Neutral impact, as yield stability offset broader economic caution.

Utilities (-0.01 pp) – Slight negative contribution, with defensive yield appeal offset by broader market rotation.

Communication Services (-0.06 pp) – Largest negative contributor, impacted by cautious sentiment amid uncertainty regarding regulatory and competitive pressures.

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Materials (+1.51%) – Top-performing sector, supported by improved sentiment on commodity markets.

Energy (+1.28%) – Strong gains driven by rising optimism over global energy demand.

Information Technology (+1.07%) – Solid gains as investor confidence remains buoyant, particularly within chipmakers and tech firms.

Industrials (+0.74%) – Positive returns from expectations of diminishing trade tensions and improving economic forecasts.

Health Care (+0.65%) – Consistent positive performance from stable sector fundamentals.

Financials (+0.35%) – Modest performance uplift supported by stable yield outlook.

Consumer Staples (+0.26%) – Gains reflecting continued defensive appeal.

Real Estate (-0.02%) – Slight underperformance reflecting limited investor appetite amid cautious yield environment.

Consumer Discretionary (-0.21%) – Negative returns, weighed by cautious consumer spending outlook.

Utilities (-0.58%) – Weakness driven by rotation away from defensive yield-driven sectors.

Communication Services (-0.68%) – Lagging sector amid uncertainty around regulatory and competitive dynamics.

Macro Overlay

The S&P 500 index closed up +0.51%, driven primarily by gains in Information Technology and Energy sectors, supported by stable commodity pricing and renewed optimism about global economic conditions. Communication Services and Utilities sectors notably lagged, reflecting investor caution due to regulatory uncertainty and rotation out of defensive sectors. Market sentiment continues to remain sensitive to evolving macroeconomic indicators, ongoing tariff developments, and Federal Reserve policy signals emphasizing patience amid balanced economic data.

Bottom Line

The S&P 500 advanced moderately by +0.51%, led by strong gains in Tech and Energy. Communication Services and Utilities sectors notably underperformed. Investors should continue monitoring macroeconomic indicators, trade developments, and central bank communications closely, maintaining preparedness for potential market volatility.

US IG Credit Wrap — Spreads Tighten Slightly to 55.0 bp Amid Stabilizing Market Sentiment

Current Spread: 55.0 bp (▼ ~0.3 bp d/d), indicating continued modest tightening. Current spreads remain comfortably below the 5-year historical average (~62.9 bp), underscoring persistent stability despite macroeconomic uncertainties.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

The marginal tightening in IG credit spreads to 54.96 bp today underscores investor sentiment buoyed by cautious optimism surrounding expected trade discussions between President Trump and President Xi Jinping. The prospect of easing tariff tensions continues to partially counterbalance persistent macroeconomic concerns, including inflation uncertainties, softening consumer demand, and subdued international trade activity. Treasury yields have remained broadly stable, contributing to a supportive backdrop for credit market dynamics.

Credit market participants remain cautiously optimistic, carefully weighing trade dialogue prospects against broader macroeconomic and policy uncertainty, particularly from evolving Federal Reserve guidance emphasizing patience amid balanced risks.

Bottom Line

IG credit spreads narrowed slightly to 54.96 bp, reflecting balanced investor sentiment underpinned by cautious optimism around forthcoming trade discussions.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.