Macro Regime Tracker: Policy Error

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

See all macro views laid out here for HOW the Fed’s policy error is impacting markets:

As always, all the systematic models and strategies are laid out below.

Main Developments In Macro

US–RUSSIA/UKRAINE (ALASKA MEETING & SANCTIONS)

*TRUMP AND PUTIN BEGIN THEIR MEETING IN ALASKA

*KREMLIN: USHAKOV, LAVROV TO ATTEND PUTIN-TRUMP MEETING: TASS

*US HAS READIED SUITE OF OPTIONS TO PUNISH RUSSIA IF TALKS FAIL

*US OPTIONS IF PUTIN TALKS FAIL DETAILED BY PEOPLE FAMILIAR

*US MAY PENALIZE RUSSIA OIL BUYERS INCLUDING CHINA IF TALKS FAIL

*US EYES MORE TARIFFS ON BUYERS OF RUSSIAN OIL IF TALKS FAIL

*US MULLS ROSNEFT, LUKOIL SANCTIONS IF PUTIN BALKS ON CEASEFIRE

*TRUMP ON PUTIN MEETING: THIS IS SETTING THE TABLE FOR NEXT ONE

*TRUMP: WON'T BE HAPPY IF WALK WITHOUT 'SOME FORM' OF CEASEFIRE

*TRUMP: WOULDN'T BE THRILLED IF I DON'T GET A CEASEFIRE

*TRUMP ON PUTIN MEETING: I'D LIKE TO SEE A CEASEFIRE

*TRUMP: MAY NOT HAVE ANY MORE MEETINGS AT ALL IF DOESN'T GO WELL

*TRUMP: IF MEETING WITH PUTIN DOESN'T GO WELL, I'LL HEAD HOME

*TRUMP: MAY PROVIDE SECURITY GUARANTEES TO UKRAINE W/EU NOT NATO

*TRUMP: TERRITORIAL SWAPS WILL BE DISCUSSED

*TRUMP: UKRAINE WANTS TO NEGOTIATE

*TRUMP: WITH EUROPE, POSSIBILITY OF US GUARANTEES TO UKRAINE

*TRUMP: RUSSIAN STRIKES IN UKRAINE A NEGOTIATING TACTIC

*TRUMP: SOMETHING WILL COME OUT OF PUTIN MEETING

*TRUMP: CHINA'S NOT DOING WELL ECONOMICALLY

*TRUMP: PUTIN'S COUNTRY IS NOT DOING WELL ECONOMICALLY

*ZELENSKIY: ALASKA TALKS SHOULD PAVE WAY TO JUST PEACE

US TARIFFS / INDUSTRIAL POLICY

*TRUMP: TARIFFS ON CHIPS WILL COME NEXT WEEK

*TRUMP: TARIFFS ON CHIPS WILL BE LOW BEGINNING, THEN VERY HIGH

*TRUMP: WILL BE SETTING TARIFFS ON STEEL AND CHIPS

*TRUMP ADMINISTRATION SAID TO EYE CHIPS ACT FUND FOR INTEL STAKE

*AKAZAWA: COMPANIES ARE ALREADY IMPACTED BY US TARIFFS

US MACRO DATA

*US JULY RETAIL 'CONTROL GROUP' SALES RISE 0.5% M/M; EST. +0.4%

*US JULY RETAIL SALES EX-AUTO RISE 0.3% M/M; EST. +0.3%

*US JULY RETAIL SALES RISE 0.5% M/M; EST. +0.6%

*US JULY IMPORT PRICES EX-PETROLEUM RISE 0.3% M/M; EST. +0.1%

*US JULY IMPORT PRICES RISE 0.4% M/M; EST. +0.1%

*US JULY CAPACITY UTILIZATION 77.5%; EST. 77.6%

*US JULY INDUSTRIAL PRODUCTION FALLS 0.1% M/M; EST. 0%

*US AUG. EMPIRE STATE FACTORY INDEX AT 11.9; EST. 0

*UMICH PRELIM AUG. CONSUMER SENTIMENT FALLS TO 58.6; EST. 62

*UMICH LONG-TERM INFLATION EXPECTATIONS RISE TO 3.9%; EST. 3.4%

*UMICH 1-YR INFLATION EXPECTATIONS RISE TO 4.9%; EST. 4.4%

FED / POLICY & REGULATION

*GOOLSBEE: STILL A LOT OF STRENGTHS IN THE ECONOMY

*GOOLSBEE: LET'S NOT OVERREACT TO ONE MONTH OF IMPORT PRICE DATA

*GOOLSBEE: NEED ANOTHER INFLATION REPORT TO SEE IF ON TRACK

*GOOLSBEE: US INFLATION PICTURE HAS BEEN MIXED

*MIRAN DECLINES TO COMMENT ON RATE CUTS AS NOMINATION PENDING

*MIRAN: PLENTY OF DISINFLATION IN THE PIPELINE

*MIRAN: CPI BEEN RUNNING AT 1.9% RATE SINCE TRUMP TOOK OFFICE

*MIRAN: FED IS INDEPENDENT AGENCY, PRESIDENT HAS RIGHT TO OPINE

*FED TO END PROGRAM THAT STEPPED UP BANK-CRYPTO SCRUTINY

*TRUMP CAN PROCEED WITH CFPB FIRINGS AS APPEALS COURT LIFTS HOLD

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

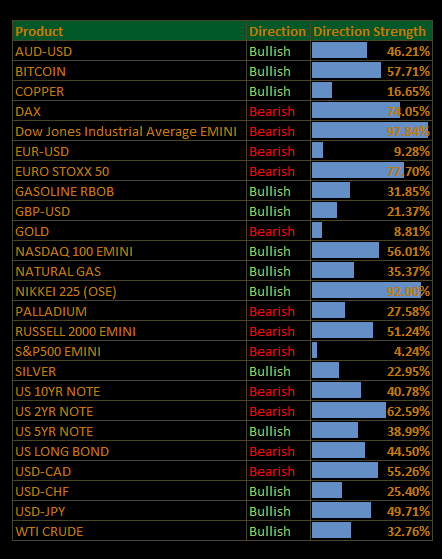

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

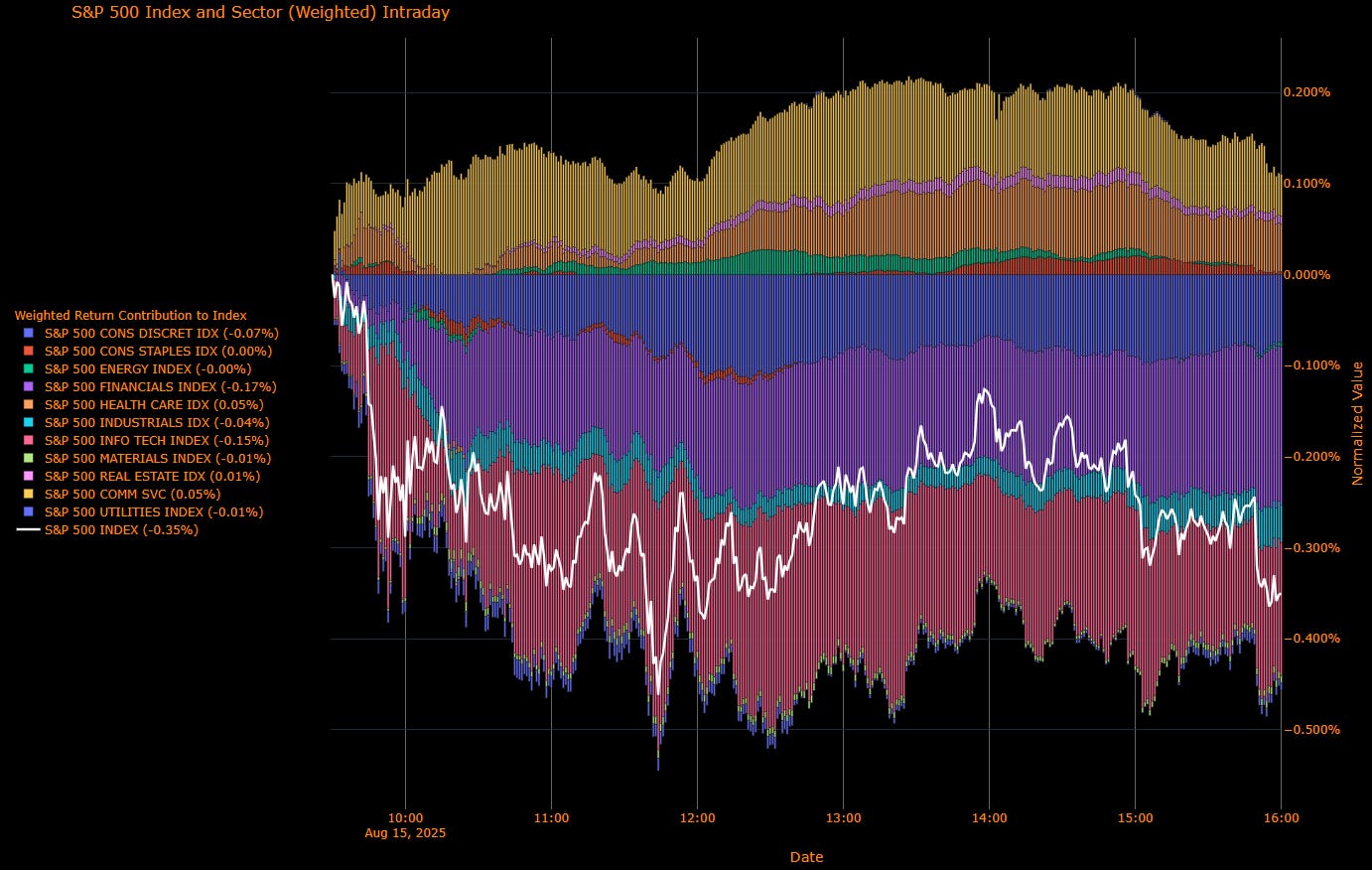

US Market Wrap: Banks & Tech Drag; Health Care/Comm Services Cushion a Headline-Sensitive Tape

The S&P 500 slipped 0.35% as mixed US data and Alaska-summit headlines kept risk appetite on a short leash. Retail sales showed a solid, broad-based advance (control group +0.5%), but University of Michigan sentiment fell for the first time since April and inflation expectations ticked higher. Longer-dated Treasuries underperformed and gold was little changed. Chips lagged on a weak guide from Applied Materials; UnitedHealth and select “platforms” helped cushion the drop. Jackson Hole now comes into view, with Daly reiterating a “gradual” path and two cuts this year as a reasonable baseline.

Sector Contribution Breakdown

(Weighted contribution to S&P 500 daily return)

Financials (–0.17 pp) — banks/insurers led the decline as the long end backed up and risk tone softened.

Information Technology (–0.15 pp) — semis heavy post-guide; mega-caps mixed.

Consumer Discretionary (–0.07 pp) — discretionary weakness alongside sentiment wobble.

Industrials (–0.04 pp), Materials (–0.01 pp), Utilities (–0.01 pp) — cyclicals/defensive duration pockets slipped.

Energy (–0.00 pp) — essentially flat with crude softer.

Consumer Staples (0.00 pp) — neutral.

Communication Services (+0.05 pp) — platforms/media bid.

Health Care (+0.05 pp) — managed care strength; stock-specific support.

Real Estate (+0.01 pp) — modest offset.

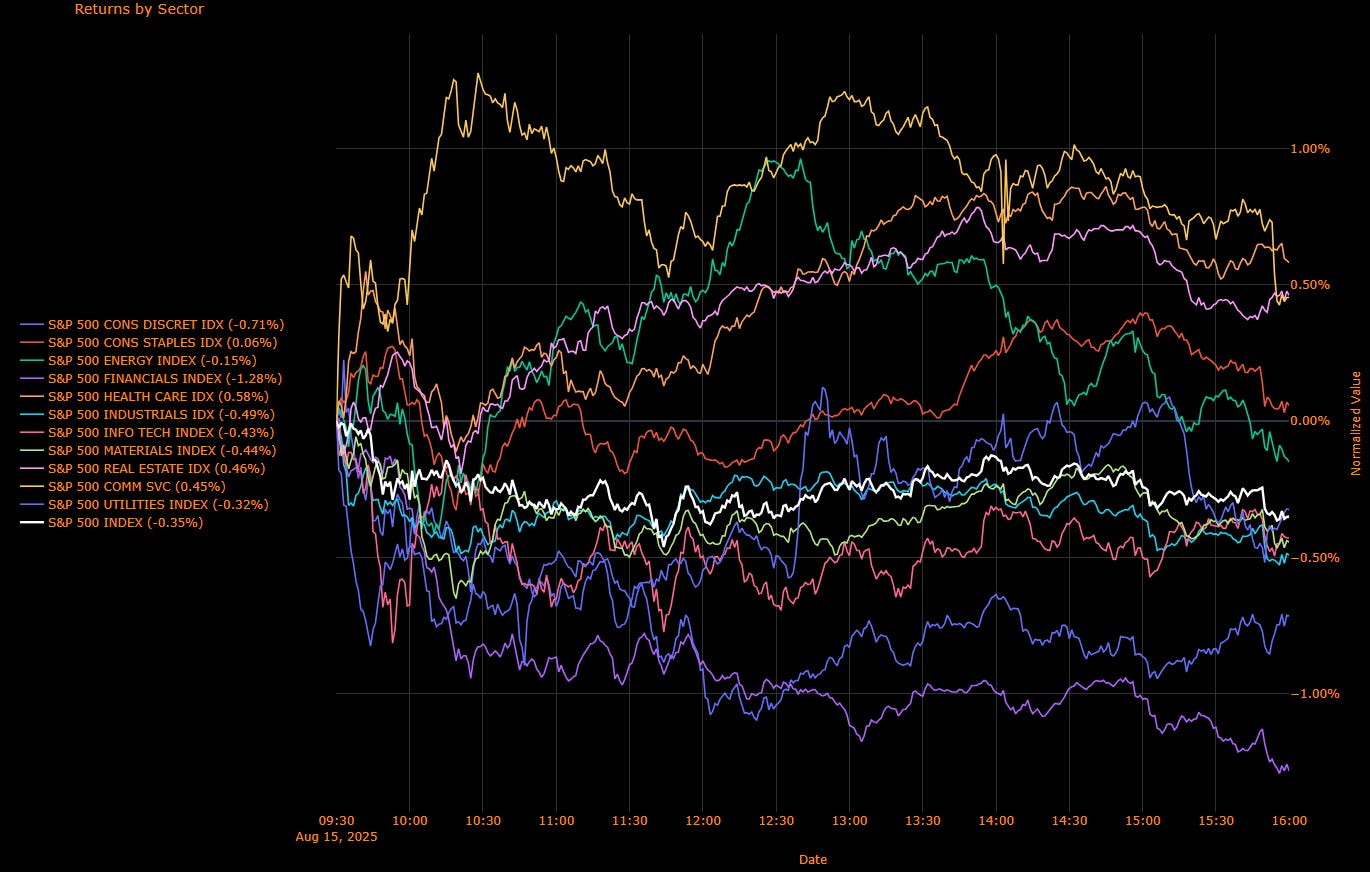

Sector Performance Breakdown

(Unweighted daily returns)

Leaders:

Health Care (+0.58%), Real Estate (+0.46%), Communication Services (+0.45%), Consumer Staples (+0.06%).

Laggards:

Financials (–1.28%), Consumer Discretionary (–0.71%), Industrials (–0.49%), Materials (–0.44%), Information Technology (–0.43%), Utilities (–0.32%), Energy (–0.15%).

S&P 500 (–0.35%).

Macro Overlay: Mixed Consumer Signals, Policy in Focus

Data: Retail sales beat on the control group and June was revised higher, but sentiment fell and inflation expectations rose; IP dipped (–0.1% m/m) and capacity use edged to 77.5%. The read-through is a still-resilient goods pulse against softer confidence and a hint of tariff-related pricing risk.

Policy path: Markets remain anchored on a 25 bp September cut with another move later this year; Daly called two cuts a “good projection” while pushing back on an outsized September step. Powell’s Jackson Hole speech is the next risk marker.

Geopolitics: The Trump–Putin Alaska meeting kept headline risk elevated (ceasefire talk, potential sanction/tariff paths). Chips/steel tariff chatter and the reported Chips Act/Intel discussions added to idiosyncratic sector swings.

Cross-asset: Bear-steepening bias (30s > 10s > 2s), softer dollar, oil down, gold steady.

Breadth weakened and leadership rotated: Financials and Tech did the damage; Health Care/Comm Services provided the ballast. With consumer “do vs. say” splitting (sales firm, sentiment softer) and Jackson Hole ahead, the base case remains a 25 bp September cut framed less dovishly.

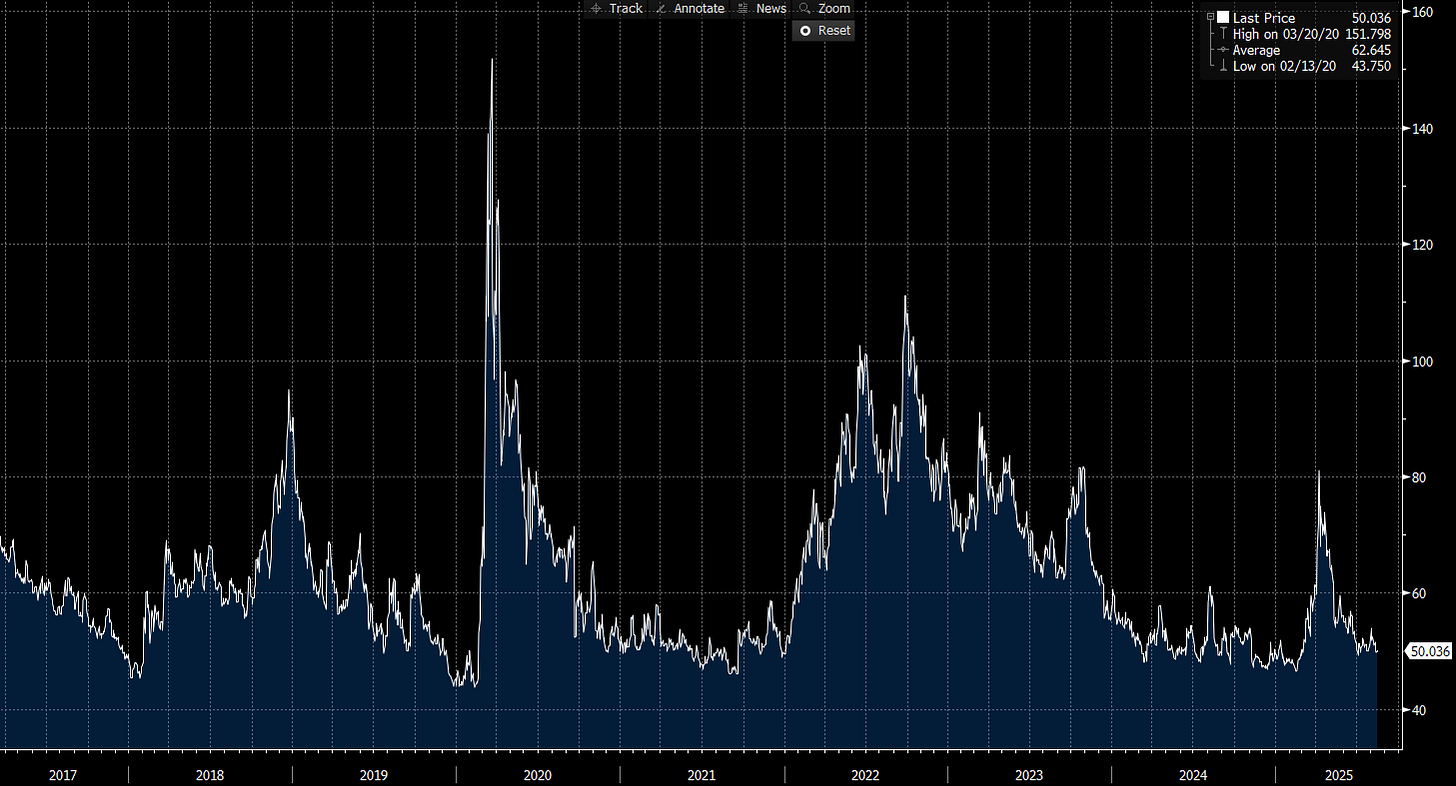

US IG Credit Wrap: OAS Anchored Near 50 bp; Bear-Steepening Hits Rates, Not Credit

IG OAS: 50.04 bp • 5-yr avg: 62.65 bp (≈12.6 bp inside) • Cycle low: 43.75 bp (≈6.3 bp off tights) • COVID high: 151.80 bp

Rates: 2y 3.75% (+2 bp) • 10y 4.32% (+3 bp) • 30y 4.92% (+5 bp) • Dollar –0.2% • WTI $63.12 (–1.3%) • Gold +0.1%

IG spreads finished essentially unchanged around the 50 bp handle—calm in the face of a mild bear-steepening in Treasuries and headline risk around the Alaska summit. The level keeps IG squarely in the carry zone: ~6 bp off cycle tights and ~13 bp inside the 5-year average, with rates, not OAS doing the P&L lifting.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay for IG

Consumer mix: July retail sales were solid (control group +0.5%) while UMich sentiment slipped and inflation expectations rose—“what they do” firm, “what they say” softer.

Policy path: Markets still lean to a 25 bp cut in September with another move later this year; Daly called two cuts a “good projection,” toning down 50 bp chatter. Jackson Hole is the next risk marker for rates volatility rather than spread risk.

Geopolitics/industry: Alaska talks and sanction/tariff headlines (chips/steel) add idiosyncratic sector noise, but not a systemic credit impulse at current levels.

Rates the Focus:

Key risks to a wider regime are a sharp long-end selloff, a meaningful tariff pass-through to margins, or a geopolitics shock; absent that, IG should grind around ~50 bp.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

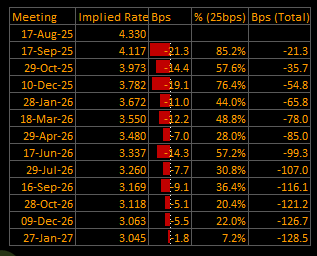

US Short-End Rates Wrap: Sept 25 bp Still Base Case; Path Edges Shallower to –128.5 bp, Terminal ~3.05%

Cumulative Implied Easing (to Jan 2027): –128.5 bp

Terminal Rate (Jan 2027): 3.045%

September OIS Cut Probability: 85.2% — Implied Rate: 4.117% | Implied Move: –21.3 bp (~0.85×25)

The front end held its “gradual opener” stance. Pricing still favors a 25 bp cut in September, but the overall glide has nudged a touch shallower versus yesterday: terminal sits a bit higher (~3.05% vs ~3.02%). Year-end 2025 embeds ~–55 bp of easing (10-Dec-25 implied 3.872%), with the curve penciling in a further ~–45 bp through 1H26 (to ~–99 bp by 17-Jun-26) and ~–107 bp by late July 2026, before grinding toward the –128.5 bp endpoint by Jan ’27.

OIS-Implied Policy Path

Macro Overlay: Mixed Consumer Signals, Jackson Hole Ahead

Retail sales stayed firm (control group +0.5%), but sentiment slipped and inflation expectations ticked up—keeping the Fed biased to a measured start rather than a shock-and-awe cut. Daly reinforced a “two cuts this year” baseline and pushed back on a 50 bp opener. With Alaska headlines adding headline risk and long-end rates bear-steepening, Powell’s Jackson Hole remarks are the next volatility node more for rates than for the path.

Takeaway

Debate remains “how dovish,” not “if.” The market is comfortable with a 25 bp September followed by a step-down cadence into 2026, holding terminal near 3.0–3.1%. Until growth softens decisively or inflation re-heats, expect the front-end to oscillate around this track: shallower, data-contingent easing, with risks skewed to rates volatility rather than a wholesale repricing of cuts.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.