Macro Regime Tracker: Post CPI

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

As we move out of the CPI print today, please review the updated view I laid out here on equities and bonds:

Main Developments In Macro

BESSENT: Could even see stablecoin bill demand exceeding $2T.

BESSENT: Removing SLR in past had substantial yield effect.

BESSENT: Administration committed to dollar’s reserve status.

GUNDLACH: Says 'reckoning is coming' for US Treasury debt.

BESSENT: Possible tariff relief for countries negotiating fairly.

LEAVITT: Trump will have bilateral meetings during G-7 summit.

BESSENT: Expect AI spend may accelerate US GDP in 12-24 months.

LEAVITT: Trump acknowledged statement that Musk put out.

LEAVITT: Trump remains receptive to correspondence with N. Korea.

LEAVITT: Trump reviewing details of China trade deal.

LEAVITT: Trump spoke to trade team, liked what he heard.

BESSENT: Expect to meet with Canada's Carney at G-7 with Trump.

BESSENT: 'Would like to stay in my seat' at Treasury to 2029.

BESSENT: If debt limit not sorted, biggest crisis since 2008-09.

BESSENT: US debt ceiling must be raised and extended.

BESSENT: US continues to be the most stable bond market.

BESSENT: April bond volatility never involved stability worries.

BESSENT: US will set a global duty level for de minimis imports.

BESSENT: China pushed back on de minimis tariffs.

BESSENT: Want a deficit ratio under 4% by end of Trump term.

WSJ: Beijing puts six-month limit on rare-earth export easing.

BESSENT: Tax-cut bill is a fiscal bill, 'not a revenge bill.'

BESSENT, pressed on X-date being July or Aug.: It is imprecise.

BESSENT, asked if China is reliable trade partner: We will see.

LUTNICK: This is the execution of the deal reached in Geneva.

LUTNICK: No text on deal, just an agreement after Xi approves.

BESSENT: Greatest debt stability would be raising debt ceiling.

LUTNICK: Europe will probably be at the very, very end.

LUTNICK: Now we're focusing on other deals.

BESSENT: Germany, Japan have higher yields for 2025 but US down.

BESSENT: CPI showed 'yet another fantastic inflation number.'

LUTNICK: Trump, Xi have to approve the final deal.

LUTNICK: We're in a great place with China.

LUTNICK: China will approve all applications for magnets.

LUTNICK: US did countermeasures because of slow-rolling.

BESSENT repeats criticism of global corporate tax framework.

BESSENT: Trump tax bill will bar US profits taxed elsewhere.

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

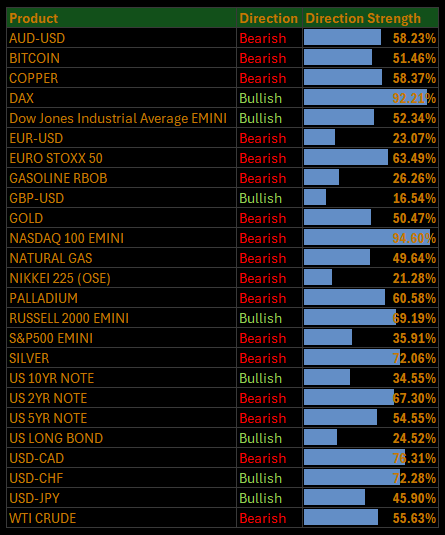

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

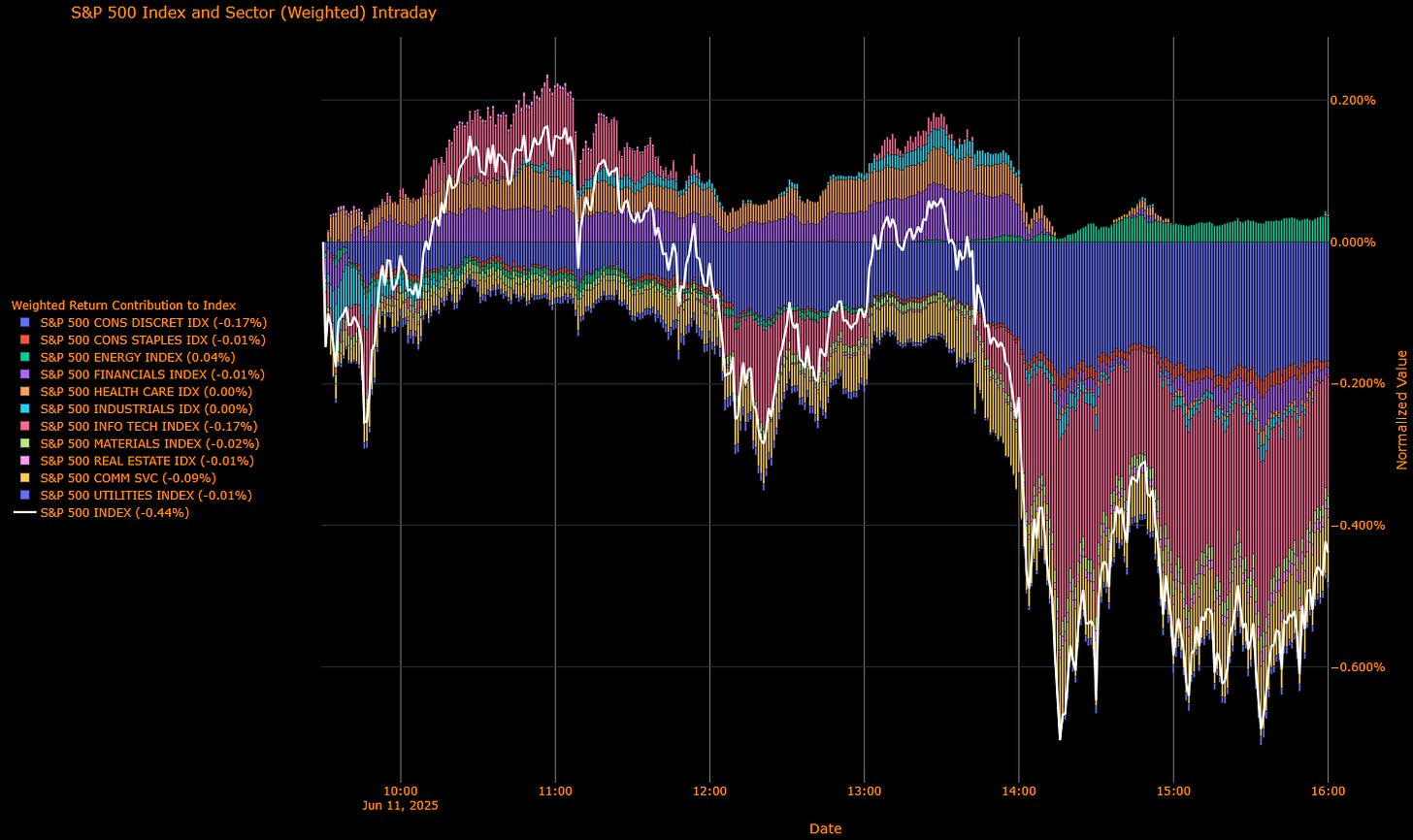

S&P 500 Declines 0.44%, Dragged Lower by Consumer Discretionary and Technology; Energy Sector Bucks Trend

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Consumer Discretionary (-0.17 pp) – Leading negative contributor as consumer optimism cools amid lingering trade uncertainties.

Information Technology (-0.17 pp) – Equally negative, reflecting investor caution despite ongoing US-China trade developments.

Communication Services (-0.09 pp) – Noticeably negative, highlighting diminished investor risk appetite.

Materials (-0.02 pp) – Slightly negative, indicating cautious sentiment amid tariff impacts.

Financials (-0.01 pp) – Marginally negative, signaling moderate concerns over economic growth prospects.

Utilities (-0.01 pp) – Slightly negative impact, pointing to minor defensive shifts.

Health Care (0.00 pp) – Neutral contribution, showing investor ambivalence amid broader market uncertainties.

Industrials (0.00 pp) – Flat impact, reflecting ongoing uncertainty linked to trade.

Consumer Staples (-0.01 pp) – Minor negative, indicating slight defensive pullback.

Real Estate (-0.01 pp) – Marginal negative contribution, suggesting cautious outlooks on interest rate trends.

Energy (+0.04 pp) – Sole positive contributor, benefiting from optimism in commodity markets.

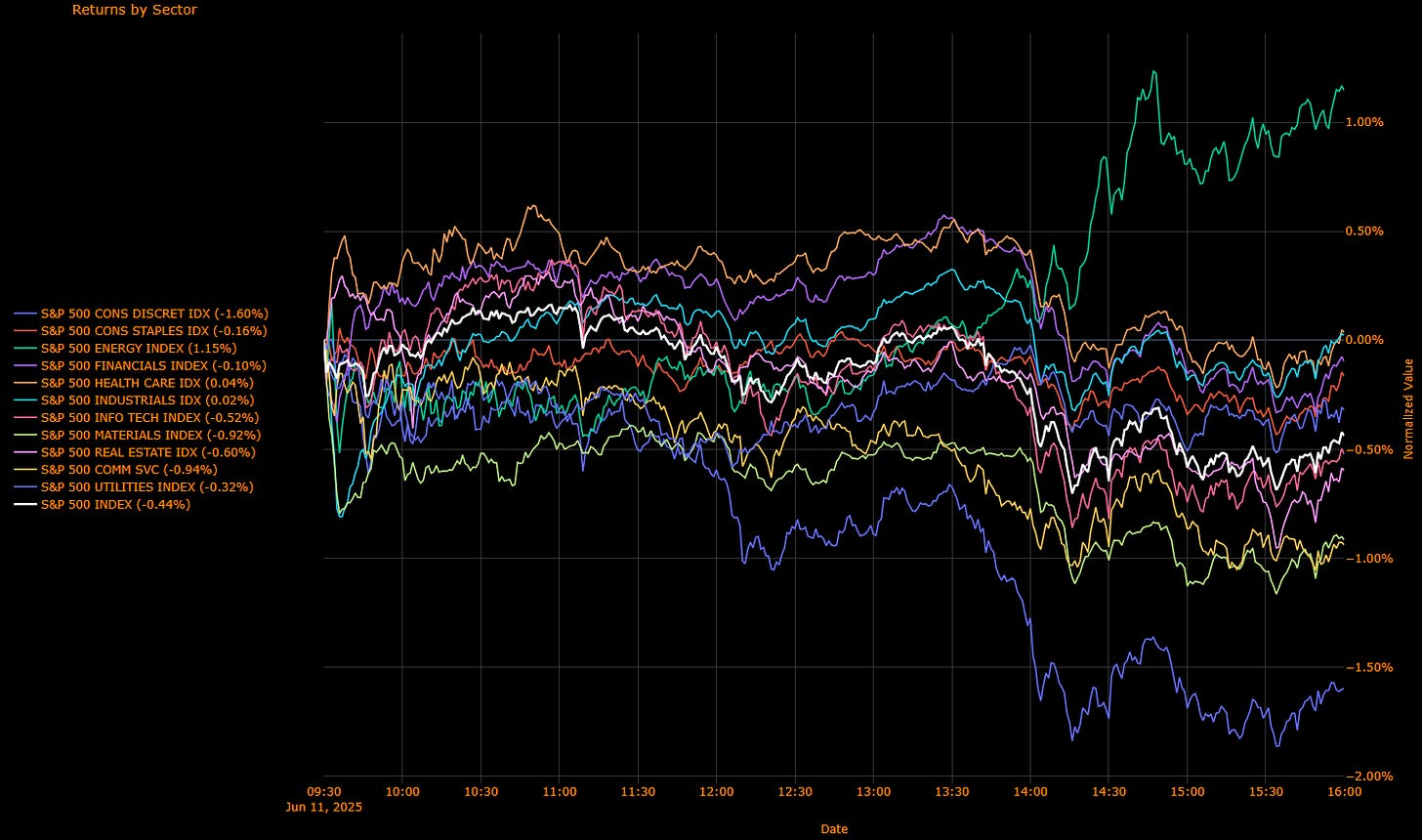

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Energy (+1.15%) – Standout sector, benefiting from improving sentiment around trade clarity.

Industrials (+0.02%) – Slightly positive, displaying resilience despite broader concerns.

Health Care (+0.04%) – Mildly positive, indicating cautious investor sentiment.

Consumer Staples (-0.16%) – Minor losses, reflecting cautious defensive positioning.

Utilities (-0.32%) – Moderate decline, suggesting limited appeal as defensive shifts occur.

Financials (-0.10%) – Slightly negative amid tempered growth expectations.

Information Technology (-0.52%) – Notable decline, highlighting investor concerns despite positive trade signals.

Real Estate (-0.60%) – Moderate decline, reflecting cautious interest rate outlook.

Materials (-0.92%) – Substantial drop driven by trade and tariff-related anxieties.

Communication Services (-0.94%) – Heavily impacted, reflecting cautious investor risk-taking.

Consumer Discretionary (-1.60%) – Significant underperformance, driven by cooling consumer confidence and trade uncertainties.

Macro Overlay

The S&P 500 declined by 0.44%, pressured primarily by significant weakness in Consumer Discretionary and Information Technology sectors. The session saw cautious trading despite Commerce Secretary Howard Lutnick signaling continued progress in US-China negotiations. Markets were tempered by softer-than-expected inflation data, suggesting companies continue to absorb tariff costs without significant consumer pass-through, maintaining investor caution.

Bottom Line

Market sentiment dipped, predominantly driven by sector-specific concerns in technology and consumer-oriented sectors. Despite optimism in energy, broader caution prevails as investors weigh ongoing trade developments and key economic data releases.

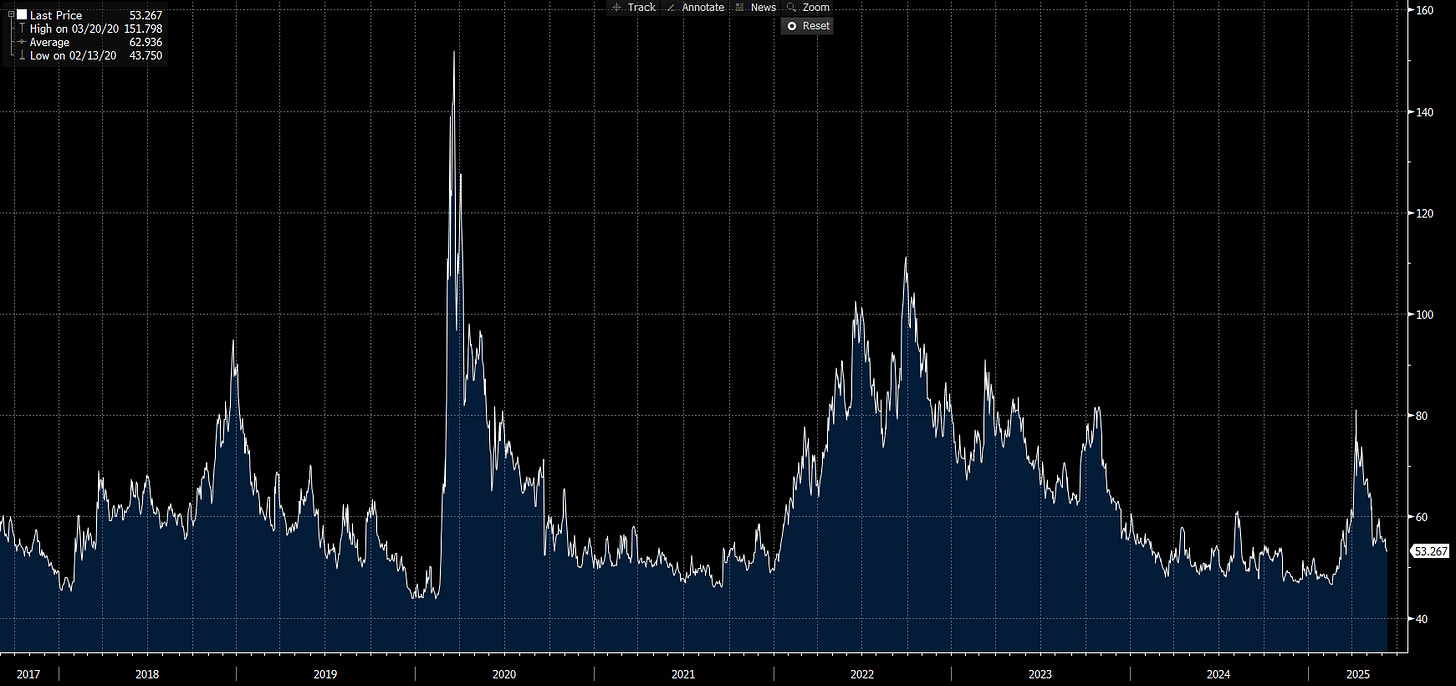

US IG Credit Wrap — Spreads Narrow Slightly to 53.27 bp Amid Easing Market Volatility

Current Spread: 53.27 bp (▼ modest tightening), below the 5-year historical average (~62.94 bp). Current spread indicates sustained investor comfort despite broader macroeconomic uncertainty.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay:

The narrowing of US IG credit spreads to 53.27 bp points toward a stable market environment underpinned by recent constructive trade negotiations between the US and China. Treasury market volatility remains subdued, aligning with tempered expectations for Federal Reserve rate actions amidst modest inflation figures.

Remain watchful for ongoing developments from trade talks, forthcoming inflation data, and Fed communications, ensuring balanced risk management.

Bottom Line:

Credit spreads continue to reflect a cautiously optimistic market stance, tightening slightly to 53.27 bp. Vigilance remains essential given ongoing uncertainties tied to macroeconomic developments and central bank policies.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

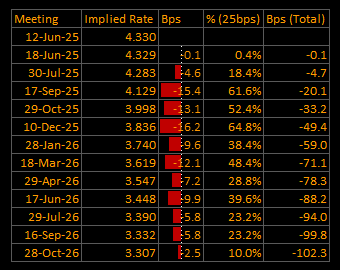

Short-End Rates Wrap — Cumulative Easing Deepens to ≈ –102.3 bp; Increased Conviction for December Rate Cut

Key Takeaways (Latest OIS-Implied Pricing)

First-Cut Timing:

30-Jul-25: Probability modest at 18.4% for a 25 bps rate cut, signaling cautious market expectations.

18-Jun-25: Remains highly unlikely at just 0.4%, reflecting persistent caution.

17-Sep-25: Rising conviction, currently at 61.6% probability for at least one rate cut, indicating robust market sentiment.

Front-Loaded Easing Path:

10-Dec-25: Implied rate now at 3.836%, highlighting cumulative easing of approximately –49.4 bp (~2 cuts) by year-end 2025.

Longer-term Easing Expectations:

28-Oct-26: Projected implied rate of 3.307%, suggesting cumulative easing of around –102.3 bp from the current effective rate of 4.330%.

Macro Context:

Sentiment remains cautiously optimistic amid encouraging progress in US-China trade discussions led by Commerce Secretary Howard Lutnick. Recent softer-than-anticipated US inflation readings further bolster market expectations for moderate Federal Reserve easing. Core inflation's subdued growth suggests limited immediate pressure on the Fed to become hawkish, aligning market sentiment toward potential rate cuts later in the year.

Treasury yields continue reflecting subdued volatility, consistent with cautiously optimistic market conditions supported by recent constructive trade developments and tempered inflation expectations.

Bottom Line:

Market expectations for rate cuts have notably strengthened, particularly for December 2025, supported by sustained optimism from trade discussions and easing inflation pressures. Continued vigilance remains necessary around future inflation data and central bank communications to effectively manage evolving market positioning.

Tactical Portfolio

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.