Macro Regime Tracker: The Bitcoin Drawdown

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I have laid out the full picture for the macro regime, risk assets, and interest rates here:

The connected video is here:

We are seeing risk assets, specifically Bitcoin, move in lockstep with the neutral stance to risk assets I laid out earlier in the week:

The entire question is WHEN will a bottom occur that allows for being bullish (either a DCA for long-term holders or a leverage trade for active traders). For now, I remain neutral.

I would strongly encourage you to review the macro report I linked above and the Bitcoin primer that explains WHY we see outperformance and underperformance of Bitcoin. You can find the Bitcoin primer here:

All of the systematic models are laid out below.

Main Developments In Macro

Fed Commentary – Bostic, Hammack, Waller, Bowman

*ATLANTA FED PRESIDENT RAPHAEL BOSTIC SPEAKS ON CNBC

*FED'S BOSTIC: JOBS NUMBERS TODAY WERE SIGNIFICANT

*BOSTIC: TODAY'S NUMBERS RAISE SALIENCE OF RISKS TO EMPLOYMENT

*BOSTIC: I THINK WE'RE IN A VERY DIFFICULT ENVIRONMENT RIGHT NOW

*BOSTIC: NOT READY TO INCREASE PROJECTION FOR 2025 RATE CUTS

*BOSTIC: IN MANY REGARDS, LABOR MARKET STILL LOOKS GOOD

*BOSTIC: JOBS DATA SHOW RISKS MAY BE COMING MORE INTO BALANCE

*BOSTIC: JOBS DATA SHOW ECONOMY MAY BE WEAKENING MORE BROADLY

*BOSTIC: JOBS DATA REVISIONS SHOW SLOWDOWN IN SIGNIFICANT WAY

*CLEVELAND FED PRESIDENT BETH HAMMACK SPEAKS ON BLOOMBERG TV

*FED'S HAMMACK: I HAVE ENORMOUS RESPECT FOR CHAIR POWELL

*FED'S HAMMACK: MAKES SENSE THAT THERE CAN BE DISAGREEMENT

*FED'S HAMMACK: THIS IS REALLY TRICKY TIME FOR MONETARY POLICY

*FED'S HAMMACK: WILL GET LOT MORE DATA BEFORE SEPTEMBER MEETING

*FED'S HAMMACK: DON'T THINK WE HAVE FAR TO GO TO GET TO NEUTRAL

*FED'S HAMMACK: WE'RE A LITTLE BIT RESTRICTIVE

*FED'S HAMMACK: EXPECT WE'LL SEE LABOR MARKET CONTINUE TO WEAKEN

*FED'S HAMMACK: MY FORECAST IS WE'LL SEE INFLATION TICK UP

*FED'S HAMMACK: COULD SEE SOME WEAKNESS ON LABOR SIDE OF PICTURE

*FED'S HAMMACK: INFLATION MISS HAS BEEN BIGGER, LASTED LONGER

*FED'S HAMMACK: I FEEL CONFIDENT WITH DECISION WE MADE THIS WEEK

*FED'S HAMMACK: LABOR MARKET LOOKS HEALTHY, STILL IN BALANCE

*FED'S HAMMACK: JOBS REPORT WAS DISAPPOINTING TO BE SURE

*FED’S BOWMAN SAYS GRADUAL CUTS APPROPRIATE WITH GROWTH SLOWING

*BOWMAN: GREATER CONFIDENCE TARIFFS WON’T CAUSE PERSISTENT INFL.

*BOWMAN: UPSIDE RISKS TO PRICE STABILITY HAVE DIMINISHED

*WALLER: PRIVATE-SECTOR HIRING NEAR ’STALL SPEED’

*WALLER: FED SHOULDN’T WAIT FOR LABOR MKT DETERIORATION TO CUT

Fed Governance / Personnel

*FED GOVERNOR ADRIANA KUGLER TO RESIGN EFFECTIVE AUG. 8

*FED SAYS KUGLER HAS SUBMITTED RESIGNATION TO PRESIDENT TRUMP

Trump Commentary – Fed, Jobs, Political Pressure

*TRUMP: POWELL 'NO BETTER' THAN 'RIGGED' JOBS NUMBERS

*TRUMP CALLS RECENT BLS REVISIONS A 'TOTAL SCAM'

*TRUMP: TODAY’S JOBS NUMBERS WERE RIGGED TO MAKE ME LOOK BAD

*TRUMP TO FIRE LABOR STATISTICS CHIEF AFTER WEAK JOBS DATA

*TRUMP: DIRECTED TEAM TO FIRE COMMISSIONER OF LABOR STATISTICS

*TRUMP: WE NEED ACCURATE JOBS NUMBERS

*TRUMP: STRONG DISSENTS ON FED BOARD WILL ONLY GET STRONGER

*TRUMP: FED BOARD SHOULD TAKE CONTROL IF RATES AREN'T LOWERED

*TRUMP: POWELL MUST `SUBSTANTIALLY' LOWER INTEREST RATES, NOW

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

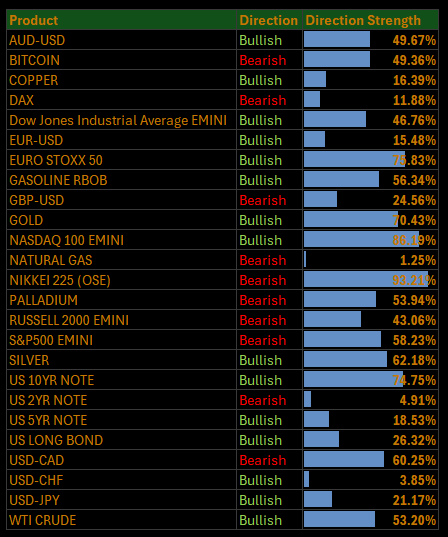

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Jobs Jolt, Trump Turmoil, and a Fragile Fade in Leadership

Markets unraveled sharply Friday, with the S&P 500 shedding 0.56%, marking its worst session since May. Beneath the surface, the damage was more telling: every major sector bar Health Care and Utilities closed in the red, volatility spiked, and short-end yields plunged in the biggest daily move since 2023.

This wasn’t just a tactical pullback it was a macro reset. A softer-than-expected payrolls print, large downward revisions to prior months, and rising unemployment triggered a wholesale rethink of the labor market narrative. Toss in Trump’s escalating pressure campaign on the Fed, a political sacking at the BLS, and the surprise resignation of Fed Governor Kugler, and markets were left spinning.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Top Positive Contributors:

Health Care (+0.05 pp) — The only sector offering real ballast, thanks to pharma and services. Possibly a defensive rotation bid, or early speculation around Medicare expansion for weight-loss coverage.

Utilities (+0.01 pp) — Modest but consistent. Yield proxies saw demand even as the curve bull steepened sharply.

Top Negative Contributors:

Info Tech (–0.35 pp) — Megacaps finally cracked. Amazon’s guidance miss wiped out recent resilience, and even the AI story took a breather.

Financials (–0.13 pp) — Hit hard by the curve. With 2s down nearly 30 bps and easing expectations surging, the macro backdrop turned sharply bearish for banks.

Comm Services (–0.08 pp) — Meta held up reasonably well, but the rest of the space sagged with Tech.

Consumer Discretionary (–0.07 pp) — High-beta retailers and autos buckled under macro weight.

Energy (–0.05 pp) — WTI’s retracement and geopolitical jitters spooked flows.

Staples, Industrials, Real Estate, Materials — Minor drags across the board as broad de-risking took hold.

Sector Performance Breakdown

(Unweighted Daily Returns)

Leaders:

Health Care (+0.55%) — A rare bright spot amid the carnage. Driven by both fundamental rotation and a potential policy tailwind.

Utilities (+0.28%) — Quiet resilience despite volatility spike and bond rally possibly flow-driven into low-beta havens.

Laggards:

Energy (–1.69%) — Crude weakness and copper’s ongoing slump weighed. Tariff fear renewed pressure.

Real Estate (–1.25%) — Duration whiplash hit hard. A classic beta unwind on a macro curve move.

Info Tech (–1.03%) — The biggest weight on the index. Amazon’s stumble marked a broader shift in sentiment.

Financials (–0.92%) — Flattening repriced bank earnings outlook in real time.

Comm Services (–0.86%) — Choppy internals, but overall weak.

Consumer Discretionary (–0.70%), Staples (–0.38%), Industrials (–0.16%), Materials (–0.20%) — Weakness across cyclical and defensive sectors alike. The tape had nowhere to hide.

Macro Overlay: Jobs Miss Sparks Fed Shift, Political Pressure Escalates

Friday’s jobs report was a game-changer.

Headline payrolls came in at just +73K, nearly 30K below consensus, while the prior two months were revised lower by a staggering –258K. Unemployment ticked up to 4.2%, and average job growth over the past three months now sits below 35K a steep slide from earlier in the year.

The labor market long the last line of defense for hawks is showing cracks. Markets responded in force: 2-year yields collapsed 28 bps to 3.68%, the VIX jumped above 20, and traders moved to price in nearly two full cuts by year-end, with September odds rising to 90%.

Trump, never one to let a narrative go to waste, fired the BLS Commissioner within hours of the release and renewed calls for Fed Chair Powell to step aside. Meanwhile, Fed Governor Kugler resigned, handing Trump another opportunity to reshape the Fed board. This all comes amid a wave of revised inflation data, collapsing response rates at the BLS, and rising skepticism about data integrity especially in light of political interference.

From Fragility to Repricing

Friday’s session was less about valuation and more about narrative collapse. A softening labor market, rising political pressure on the Fed, and the erosion of confidence in economic institutions have sparked a genuine repricing not just of rates, but of leadership, breadth, and macro trajectory.

The S&P 500 is once again leaning heavily on narrow tech leadership, but even that crumbled under the weight of Amazon’s miss and a more cautious AI tone. Breadth is deteriorating, macro risk premia are expanding, and the once-durable soft-landing thesis is beginning to fray.

US IG Credit Wrap: Spreads Drift to 53.94 bp as Labor Cracks, Fed Credibility Wanes, and Trump Pressure Builds

Current IG Spread: 53.94 bp | 5-Year Avg: 62.70 bp | COVID High: 151.80 bp | Cycle Low: 43.75 bp

Investment-grade credit spreads widened modestly on Friday, closing at 53.94 bp, still within their historically tight range but now inching higher after an extended period of remarkable stability. While far from a disorderly repricing, the tone has shifted: macro volatility is back, politics are bleeding into policy, and the “durable carry” thesis is starting to wobble under the weight of accumulating uncertainty.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: From Quiet Confidence to Defensive Drift

Jobs Data Breaks the Spell

July’s jobs report was the weakest in over three years, with just +73K payrolls added, and a two-month revision cutting 258K. Unemployment ticked up to 4.2%, and average job gains have collapsed to just 35K over the past quarter.

That’s a sharp shift from the “Teflon labor market” narrative and it’s exactly the kind of fundamental deterioration that begins to matter for credit, particularly when paired with rising policy risk.

Trump’s BLS Purge and Fed Pressure

Within hours of the jobs release, Trump fired the head of the Bureau of Labor Statistics, publicly questioning the integrity of US labor data. Simultaneously, Fed Governor Kugler resigned, opening the door for a more dovish Trump-aligned replacement just as the Fed faces rising dissent from within.

This isn’t just headline risk. It raises questions about institutional credibility and the Fed’s ability to maintain independence, both of which are vital pillars of market confidence especially in credit markets that thrive on stability.

A Market That’s Priced for Smooth Sailing… In Rougher Waters

Spreads below 55 bp are not a problem but they are a statement of confidence. Confidence in Fed stability, in economic durability, in earnings resilience, and in political restraint. All of which are now, arguably, under pressure.

We're not in crisis territory. But we are in a transition phase and credit markets, always the last to panic but also the slowest to react, are now in a spot where even small macro tremors could have a disproportionate impact.

With Powell's grip loosening, Trump reshaping the board, and economic data showing signs of real stress

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap: Total Implied Easing Widens to –139.0 bp as Jobs Data Breaks Fed’s Grip and September Cut Becomes Baseline

Cumulative Implied Easing (to Jan 2027): –139.0 bp

Terminal Rate (Jan 2027): 2.940%

September OIS Cut Probability: 91.6% | Implied Rate: 4.101%

The market has moved. Decisively. A week after Powell stood pat and tried to push back on near-term easing bets, Friday’s labor data shattered the illusion of a durable jobs market and forced traders to recalibrate. The implied path now prices more than 5.5 cuts by January 2027, with a September cut nearly a done deal.

Front-end risk has gone from drift to drop. And not because of panic because of hard data.

OIS-Implied Policy Path

Macro Overlay: Job Growth Falters, Narrative Shifts

Labor Market Shows Cracks

July payrolls rose just +73K, while prior months were revised lower by –258K. Unemployment rose to 4.2%, and the 3-month average of job gains has plunged to 35K the weakest since the post-pandemic reopening period.

This isn’t “softening at the margin.” It’s a trend break. And it's happening just as internal Fed dissent grows louder and Trump intensifies his campaign to shake up the board.

Kugler’s Resignation and Political Risk Surge

Fed Governor Adriana Kugler’s resignation opens the door for a Trump-aligned pick, further complicating the Fed’s ability to project independence. Powell is now isolated, caught between a weakening macro backdrop and intensifying political heat.

Trump fired the BLS Commissioner, questioned the data’s integrity, and called on the board to “take control.” Markets may be pricing in more cuts but they’re also beginning to price institutional fragility.

This Is No Longer a “Glidepath” Market

Just one week ago, traders assumed the Fed would wait until the data forced its hand. That moment may already be here.

The front end is pricing urgency (91.6% chance in September).

The mid-curve is extending the easing (five cuts by Oct 2026).

The terminal rate has collapsed to 2.94% the lowest since before Powell’s June hawkish pivot.

Narrative Break Confirmed

This isn’t about positioning or sentiment. This is about data. And the data no longer supports holding.

The market is no longer giving Powell the benefit of the doubt. It's giving him a schedule.

Tariffs, political risk, labor softness… the glue that held the "resilient expansion" story together is coming undone.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.