Macro Regime Tracker: The Bitcoin Play

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I laid out the entire thesis and strategy for interest rates here:

With the connected video here:

I also published a report explaining my views on Bitcoin and MSTR here:

As always, you can find all the systematic models and strategies updated below. Thanks

Main Developments In Macro

US Macro & Policy

US JULY CONSUMER CREDIT RISES $16.010B M/M; EST. +$10.350B

SENATE BANKING PANEL TO VOTE ON MIRAN FED NOMINATION SEPT. 10

STATES LOSE APPEALS COURT CHALLENGE TO FEDERAL WORKER FIRINGS

SUPREME COURT LIFTS RACIAL-PROFILING BAN ON DHS IN LOS ANGELES

NY FED: 5Y CONSUMER INFLATION EXPECTATIONS UNCHANGED AT 2.9%

NY FED: 3Y CONSUMER INFLATION EXPECTATIONS UNCHANGED AT 3%

NY FED: ONE-YEAR INFLATION EXPECTATIONS RISE TO 3.2% VS 3.09%

WARREN QUERIES WALL STREET BANKS OVER STOCK BUYBACKS, DIVIDENDS

FANNIE MAE STOCK IN LONGEST WIN STREAK SINCE FEBRUARY 2020

FANNIE MAE SHARES GAIN 11% FOR NINTH STRAIGHT ADVANCE

Goldman’s Kostin Sees S&P 500 Rising 6% on Fed Cuts By Mid-2026

Global Macro Developments

MEXICO AFFIRMED AT BBB BY S&P; OUTLOOK STABLE

EURO AREA SEPT. SENTIX INVESTOR CONFIDENCE -9.2; EST. -2.0

ECB CURBS BLACK BOX MODELS TO END LEVERAGED LOANS STANDOFF

EU WEIGHS NEW SANCTIONS ON RUSSIA TO HIT BANKS AND OIL TRADE

US WEIGHS ANNUAL CHINA CHIP SUPPLY PERMITS FOR SAMSUNG, HYNIX

GERMANY JULY IMPORTS FALL 0.1% M/M; EST. -1.0%

GERMANY JULY EXPORTS FALL 0.6% M/M; EST. +0.1%

GERMANY JULY INDUSTRIAL PRODUCTION RISES 1.3% M/M; EST. +1.0%

CHINA'S AUG. TRADE BALANCE $102.33B

CHINA AUG. IMPORTS IN USD TERMS RISE 1.3% Y/Y; EST. +3.4%

CHINA AUG. EXPORTS IN USD TERMS RISE 4.4% Y/Y; EST. +5.5%

CHINA AUG. TRADE SURPLUS CNY0.73T

CHINA AUG. IMPORTS IN YUAN TERMS RISE 1.7% Y/Y

CHINA AUG. EXPORTS IN YUAN TERMS RISE 4.8% Y/Y

Yuan Reference Rate at 7.1029 Per USD; Estimate 7.1323

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

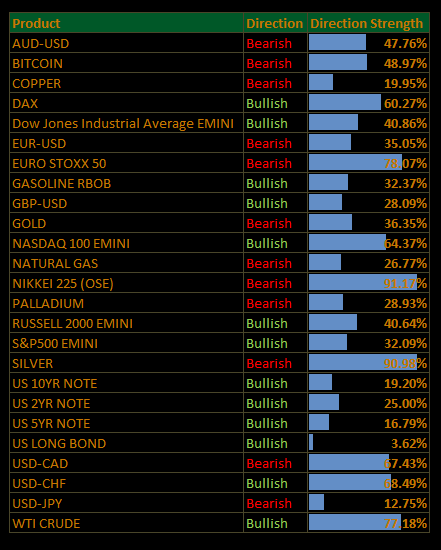

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.