Macro Regime Tracker: The Credit Cycle Playbook

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

You can find the most recent piece of the credit cycle here. This has all of the playbooks and breakdowns in it.

You can find all of the updated systematic models below.

Main Developments In Macro

US Macro & Federal Reserve Commentary

MALPASS: FED HAS BEEN OFF TRACK, CHANGE WILL BE INSTRUMENTAL

MIRAN: MEDIUM-TERM INFLATION EXPECTATIONS ARE 'PRETTY TAME'

MIRAN: THERE'S NO EVIDENCE OF TARIFF-INDUCED INFLATION

BOSTIC: ONE CUT IS PREDICATED ON LABOR MARKET STAYING SOLID

BOSTIC: STILL SEE ONE RATE CUT IN 2025 AS APPROPRIATE

BOSTIC: FIRMS' EXPECTATIONS FOR HIRING, SALES ARE GLOOMIER

BOSTIC: SIGNS OF STRESS ARE MIGRATING UP THE INCOME LADDER

BOSTIC: TRYING TO DETERMINE HOW MUCH LABOR MARKET HAS SOFTENED

BOSTIC: DATA SUGGESTS LABOR MARKETS WEAKENED OVER LAST 3 MONTHS

GOOLSBEE: STATE OF THE LABOR MARKET IS PRETTY STRONG, SOLID

FED'S GOOLSBEE: SERVICES INFLATION IN LATEST CPI REPORT WAS BAD

GOOLSBEE: IDEA OF ONE-TIME TARIFF PRICE IMPACT MAKES ME UNEASY

FED'S GOOLSBEE: DATA REVISIONS SHOULDN'T BE CONTROVERSIAL

TRUMP: FED SHOULD TAKE DOWN INTEREST RATES

BESSSENT: RATE CUTS COULD START WITH 50 BPS IN SEPT.

BESSSENT: COULD GO INTO A SERIES OF RATE CUTS HERE

BESSSENT: IF DATA HAD BEEN ACCURATE, POSSIBLE FED CUTS EARLIER

US Political & Policy Developments

TRUMP ADMINISTRATION NAMES DEMOCRAT ROSNER AS FERC CHAIRMAN

TRUMP WINS COURT FIGHT TO WITHHOLD BILLIONS IN FOREIGN AID

TRUMP ALSO CONSIDERING LARRY LINDSEY FOR FED CHAIR: CNBC

Trade, Tariffs & Geopolitics

US PHARMA TARIFFS LIKELY WEEKS AWAY: REUTERS

BOC: TOO EARLY TO TELL EXTENT, SPEED OF TARIFF PASS-THROUGH

BOC: IMPACT OF TARIFFS ON CONSUMER PRICES APPEARS MODEST SO FAR

BESSSENT: SEE POTENTIAL FOR MORE SECONDARY SANCTIONS ON RUSSIA

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

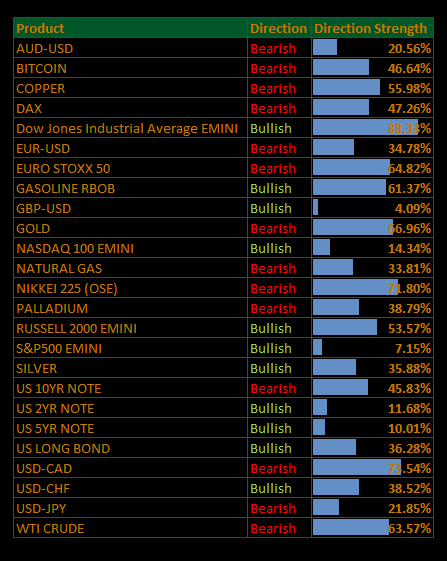

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Energy & Health Care Lift Index Amid Fed Cut Momentum

The S&P 500 eked out a 0.03% gain on Wednesday, with sector rotation masking sizable moves beneath the surface as traders continued to price in aggressive Federal Reserve easing starting in September. Treasury yields fell across maturities, the dollar weakened, and the bond market rally extended after Treasury Secretary Scott Bessent reiterated his call for a potential 50 bp cut next month, alongside a broader cycle totaling up to 150–175 bp.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Top Positive Contributions

Health Care (+0.12 pp) – Broad-based gains led by managed care and biotech strength.

Consumer Discretionary (+0.09 pp) – Auto and travel names advanced on cyclical momentum.

Energy (+0.04 pp) – Higher crude prices supported integrateds and refiners.

Financials (+0.03 pp) – Banks benefited from curve steepening hopes.

Smaller Positive Inputs

Materials (+0.02 pp) – Metals and chemicals tracked higher commodity prices.

Industrials (+0.01 pp) – Gains in transports and aerospace.

Real Estate (+0.01 pp) – REITs edged higher in the rates-friendly environment.

Negative Contributions

Info Tech (–0.19 pp) – Mega-cap weakness weighed, especially in semis.

Communication Services (–0.09 pp) – Pressure in media and streaming names.

Utilities (0.00 pp), Consumer Staples (0.00 pp) – Largely flat.

Sector Performance Breakdown

(Unweighted Daily Returns)

Leaders

Energy (+1.34%) – Crude’s modest uptick fueled broad gains across the sector.

Health Care (+1.32%) – Outperformance from biotech and pharmaceuticals.

Materials (+1.31%) – Commodity-linked names rallied in line with metals strength.

Consumer Discretionary (+0.87%) – Leisure, retail, and travel sub-groups gained.

Real Estate (+0.32%), Financials (+0.22%), Industrials (+0.17%) – All in positive territory.

Laggards

Communication Services (–0.87%) – Weakness in social media and content platforms.

Info Tech (–0.55%) – Semiconductor underperformance led declines.

Consumer Staples (+0.08%), Utilities (+0.01%) – Defensive sectors muted.

Macro Overlay: Fed Cut Debate, Rates Markets in Focus

Policy Expectations – Rate futures now fully price a 25 bp September cut, with a growing camp leaning toward 50 bp. Bessent reinforced his view that the Fed is “150–175 bp too high” and could begin a series of cuts next month.

Market Reaction – Treasuries rallied, with yields down at least 5 bps intraday, and the dollar extended losses.

Corporate Context – Equities showed pronounced dispersion, with cyclicals and rate-sensitive sectors outperforming while tech lagged.

Energy and health care leadership helped the S&P 500 tread water as tech and communications pulled back. With the Fed narrative turning decisively dovish and bonds staging their strongest rally in two weeks, sector rotation reflects positioning ahead of key catalysts, notably Thursday’s PPI and Friday’s retail sales which will determine if the momentum behind a larger September cut continues to build.

US IG Credit Wrap: OAS Edges Lower as Fed Cut Bets Solidify

IG OAS: 49.72 bp • 5-yr avg: 62.66 bp • Cycle low: 43.75 bp • COVID high: 151.80 bp

10y UST: rally extended, yields ~5 bp lower • Equities: mixed rotation • Dollar: softer

Investment-grade spreads narrowed ~0.4 bp to 49.72 bp, holding just off the tightest levels of the post-COVID era as markets leaned further into aggressive Fed easing expectations. The tone stayed carry-positive, with duration demand buoyed by falling yields and a rates narrative that has shifted decisively toward “how much” to cut in September rather than “if.”

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay That Matters for IG

Policy:

Treasury Secretary Scott Bessent again floated the possibility of a 50 bp September cut, with total easing over the cycle of 150–175 bp. The rates market now fully prices 25 bp and leans toward the larger move. Chicago Fed’s Goolsbee signaled September will be a “live” meeting.

Rates:

Front-end relief outweighs credit-specific risk; 10y yields are lower year-to-date despite overseas term premium pressures from Japan and Germany. The belly of the curve remains the favored duration point for many IG buyers.

Inflation/Labor:

PPI and retail sales this week are the next key tests. Softer labor data keeps the Fed biased toward cuts a dynamic that keeps IG OAS anchored unless consumption surprises strongly on the upside.

Calm:

IG credit is priced for a “Goldilocks” mix of slowing growth, anchored inflation expectations, and an easing Fed. With OAS inside 50 bp, the risk/reward remains skewed toward carry and roll until either consumer data re-prices growth risk or the Fed under-delivers relative to the market’s dovish tilt in September.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

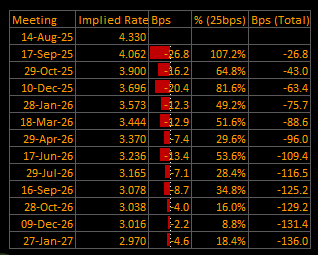

Short-End Rates Wrap: September Cut Locked; Path Deepens to –136 bp, Terminal ~2.97%

Cumulative Implied Easing (to Jan 2027): –136.0 bp

Terminal Rate (Jan 2027): 2.970%

September OIS Cut Probability: effectively certain — Implied Rate: 4.062% | Implied Move: –26.8 bp (~107% of a 25 bp cut)

The front end nudged dovisher again. Pricing now embeds ~27 bp for September (i.e., more than a full 25), with the glidepath extending to a ~3.0% terminal by early 2027. The market’s question set remains “how much in September and how fast thereafter,” not “if.”

OIS-Implied Policy Path

Macro Overlay: Easing Mode, With a 50 bp Tail

Policy rhetoric: Treasury Sec. Bessent continues to float a 50 bp opener and 150–175 bp total easing over the cycle, while Goolsbee calls fall meetings “live.”

Rates & risk tone: Treasuries rallied, yields fell ~5 bp across the curve, dollar softer; options flow in SOFR continues to express the 50 bp tail.

Next catalysts: PPI → PCE inputs, Retail Sales, and Jackson Hole for any pushback if the Fed wants to cap 50 bp expectations.

More...

The market has inched from “September is likely” to “September is done,” with a deeper, smoother glidepath to a ~3% terminal. Until data say otherwise, carry remains in charge and the debate is 25 vs. 50 at liftoff.

Tactical Portfolio

Morning Trade(s) and Market thread

Tactical Trade Tracker:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.