Macro Regime Tracker: The Equity Rally

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

After going neutral equities on FOMC day, ES sold off marginally, but the positioning unwind was short in nature (it could have been larger). I went long equities Tuesday (noted for paid subscribers here: link), and my view is we are likely to rally from here.

I did a live stream today with Tyler, who is one of the sharpest macro minds out there, breaking down the structural realities we are facing for liquidity:

You can find the connected report from my convo with Tyler here:

My view remains that a recession or significant contraction in growth is unlikely this year. However, market breadth is unlikely to be as strong as it was from April to July. As a result, tactically managing the moves in equities and bonds will be critical over the next 30-90 days.

All of the updated systematic models and strategies are below.

Main Developments In Macro

US Macro Policy & Federal Reserve

DALY: FED HAS MORE WORK TO DO TO BRING INFLATION TO 2%

DALY: FED SEES LIKELY NEED TO ADJUST POLICY IN COMING MONTHS

DALY: TARIFFS TO BOOST INFLATION IN NEAR TERM, NOT PERSISTENTLY

DALY: TARIFFS, IMMIG. CHANGES PUSHING UP INFL, REDUCING WORKERS

DALY: ADDITIONAL SLOWING OF LABOR MARKET WOULD BE UNWELCOME

MIRAN ON ISM SERVICES DATA: NOT UP TO SNUFF

KASHKARI: DON'T KNOW WHETHER TARIFF IMPACT ON PRICES TO PERSIST

MINNEAPOLIS FED PRESIDENT NEEL KASHKARI COMMENTS ON CNBC

MIRAN: FED GOVERNOR SEAT PROCESS IS ONGOING

US Trade Policy / Tariffs

US TO IMPOSE ADDITIONAL 15% TARIFF ON JAPAN IMPORTS: KYODO

US TARIFF ON JAPAN TO COME ON TOP OF EXISTING TARIFFS: KYODO

US TARIFF ON JAPAN REGARDLESS OF EXISTING RATES: KYODO

SWISS PRESIDENT SET TO LEAVE DC WITHOUT REACHING TARIFF DEAL

SWISS FRANC CURBS GAIN AGAINST DOLLAR AS NO TARIFF DEAL WITH US

SWISS KELLER-SUTTER DISCUSSED TARIFFS WITH RUBIO: POST ON X

White House & Trump Comments (US-Focused)

TRUMP: GAS WILL SOON BE UNDER $2 A GALLON

TRUMP: BUILDING RARE EARTH RECYCLING LINE IN CALIFORNIA

FRASER, MOYNIHAN HELD MEETINGS W/ TRUMP ON FANNIE/FREDDIE: CNBC

CITI CEO FRASER MEETS TRUMP ON FANNIE, FREDDIE PUBLIC OFFERINGS

HASSETT: TRUMP'S TOP PRIORITY TO MAKE ECO DATA RELIABLE

HASSETT: TRUMP NOT AIMING TO HIRE PEOPLE TO GIVE DATA HE LIKES

Geopolitical/US Foreign Policy Tie-In

TRUMP: WORKING TOWARDS UKRAINE-RUSSIA WAR'S END

TRUMP TELLS EUROPEANS HE INTENDS TO MEET PUTIN, ZELENSKIY: NYT

TRUMP `PATIENCE RUN OUT' WITH HAMAS OVER CEASEFIRE: HUCKABEE

KREMLIN: RUSSIA RECEIVED SIGNALS FROM TRUMP ON UKRAINE: IFX

KREMLIN: RUSSIA ALSO SUBMITTED OWN SIGNALS TO US: IFX

SEN. GRAHAM TO EUROPE: BUYING RUSSIA OIL FROM INDIA MUST STOP

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

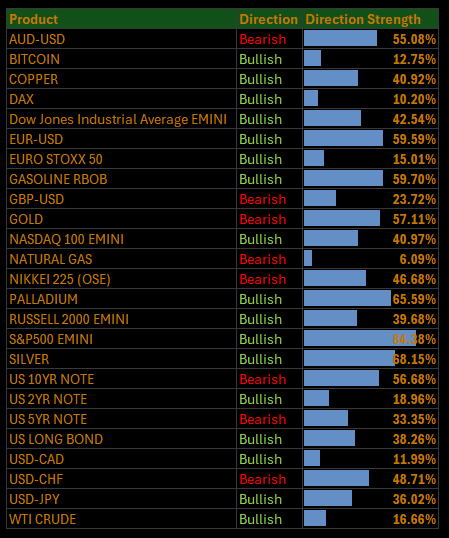

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

US Market Wrap: Apple’s $100B Boost Masks Fragile Breadth as Tariff Clock Ticks

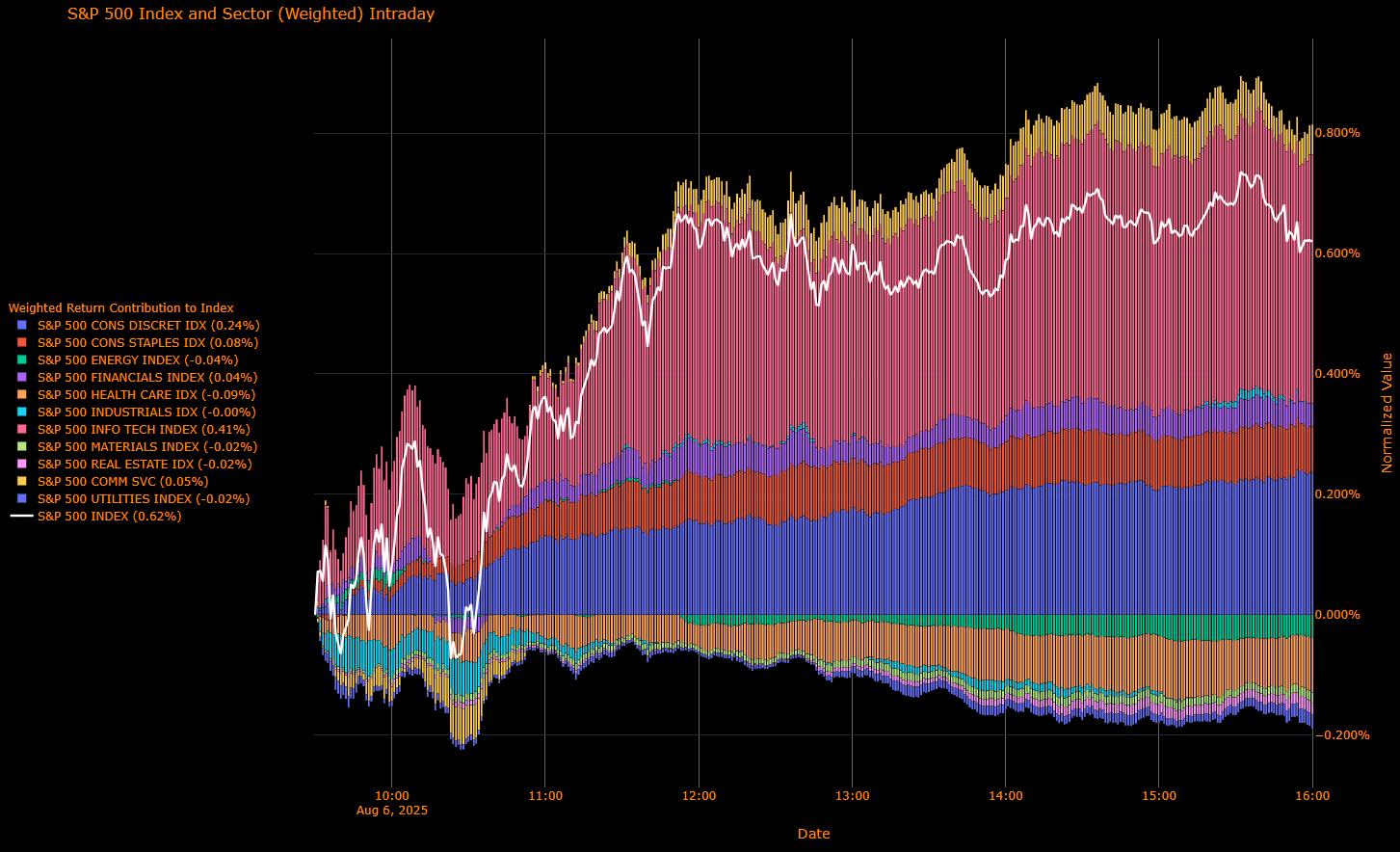

The S&P 500 climbed 0.62% on Wednesday, snapping back from recent softness as a surge in Apple shares powered the index higher. While the headline index posted a respectable gain, the move was narrow and dominated by just a few megacaps. Beneath the surface, sector breadth remained weak, and macro uncertainty continued to build.

Dip-buying returned in force, but the catalyst was specific not broad: Apple’s 5.1% rally, fueled by a $100 billion domestic investment pledge, helped soothe tariff jitters and sparked renewed optimism in the AI complex. Still, defensives and trade-sensitive sectors struggled, suggesting fragility beneath the tech-led bounce.

Sector Contribution Breakdown

(Weighted Return Contribution to S&P 500)

Top Positive Contributors

Info Tech (+0.41 pp) – Apple’s surge did the heavy lifting, buoyed by news of its domestic expansion push to preempt new tariffs. Other AI-adjacent names followed suit.

Consumer Discretionary (+0.24 pp) – Retail and e-commerce caught a tailwind from renewed risk-on flows.

Comm Services (+0.05 pp) – Modest gains, helped by a rebound in select media and social names.

Consumer Staples (+0.08 pp) – Defensive, but stable. Some rotation here as a hedge against policy noise.

Financials (+0.04 pp) – Slight support from stable yields, though regional banks remain tentative.

Flat to Negative Contributors

Energy (–0.04 pp) – Crude slipped, and tariff risks around commodities weighed.

Health Care (–0.09 pp) – Policy risk building. Trump’s pharma tariff plan is a clear overhang.

Utilities, Real Estate, Materials (each –0.02 pp) – Rate-sensitive sectors failed to catch a bid, highlighting defensive underperformance.

Industrials (~0.00 pp) – Flat on the day, despite macro rotation narratives.

Sector Performance Breakdown

(Unweighted Daily Returns)

Leaders

Consumer Discretionary (+2.28%) – Led by Apple and strength in retail/auto names. Classic risk-on rotation.

Consumer Staples (+1.43%) – Somewhat surprising outperformance. Possibly driven by positioning.

Info Tech (+1.21%) – Strong bounce led by Apple; chips were mixed amid continued export concerns.

Comm Services (+0.50%) – Stable session with slight gains across major platforms.

Financials (+0.28%) – Supported by flat yields and improved credit sentiment.

Laggards

Energy (–1.30%) – Oil weakness and tariff risk on commodity exports hit the space hard.

Health Care (–1.03%) – Dragged by Trump’s planned pharma tariffs and investor rotation out of defensives.

Real Estate (–1.03%) – Duration sensitivity hurting sentiment despite flat long-end yields.

Utilities (–0.93%) – Yield proxies remained under pressure. No haven flows despite macro jitters.

Materials (–0.88%) – Tariff fallout and demand concerns weighed.

Industrials (–0.02%) – Sideways, despite some relative macro tailwinds.

Macro Overlay: Apple Lifts Spirits, but Trade and Fed Uncertainty Linger

The market pop may feel bullish, but the broader macro landscape remains tricky.

Apple’s $100B domestic investment pledge not only boosted shares but helped calm trade-related anxieties at least temporarily. Trump’s tariff offensive continues, with new levies on Indian pharmaceuticals and semiconductors set to roll out, and secondary sanctions now looming for Russian oil buyers.

Meanwhile, Fed dynamics remain highly political. Trump is considering appointing a short-term governor to replace Kugler and is openly weighing Fed chair candidates ahead of Powell’s term expiry. Names floated include Kevin Warsh and Kevin Hassett both seen as more dovish and politically aligned.

At the same time, economic data continues to flash mixed signals. Soft ISM Services data and elevated inflation readings have left the Fed in a bind: September cuts remain priced, but conviction is fading.

A Top-Heavy Rally in a Foggy Policy Regime

Wednesday’s session was less a broad rally and more a single-stock surge. Apple’s news catalyzed sentiment, but underneath, defensive sectors cracked and macro risks deepened.

The Fed remains in a politically charged holding pattern. Trump is turning up the heat on the Fed, on India, and on global trade norms. If tariffs materialize as planned, margin pressure and sector rotation could intensify.

Markets want to look past the noise. But the noise from policy, politics, protectionism is starting to shape the path forward.

US IG Credit Wrap: Complacency Creeps In as Spreads Hold at 52.03 bp Despite Policy Noise

Current IG Spread: 52.03 bp

5-Year Avg: 62.69 bp

COVID High: 151.80 bp

Cycle Low: 43.75 bp

Credit markets continue to shrug off macro and policy landmines. IG spreads are holding steady at 52.03 bp, well inside the 5-year average, even as the backdrop grows noisier and more inflation-prone. With Fed credibility under question, a fresh tariff blitz unfolding, and political pressure mounting across the board, credit risk seems oddly underpriced.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Apple Soars, But Credit Ignores Fed Turbulence and Tariff Chaos

Apple’s $100B domestic investment surge lifted risk sentiment and dominated the narrative, but credit is overlooking several key destabilizers:

Tariff Volatility Rises: Trump confirmed sweeping new tariffs are imminent. Pharma and semiconductor imports will face escalating levies, starting small but moving to 250% within 18 months. India faces sharp increases tied to its Russian oil purchases. The average tariff rate is poised to rise above 15%—and secondary sanctions are now being openly discussed.

Fed Board in Flux: Trump is set to appoint a short-term Fed governor following Kugler’s early exit. He’s openly weighing names like Warsh and Hassett for Chair. The politicization of the Fed risks unanchoring expectations particularly if a dovish short-term appointee shapes September rate messaging.

Economic Deceleration: ISM Services sits just above contraction at 50.1. Employment has now contracted in four of the past five months. Prices paid are re-accelerating. This isn’t a soft landing… it’s a stagflation flirt.

Despite this, credit spreads are treading water. Equity volatility is modest, and Treasury yields remain rangebound. But this apparent calm feels less like confidence and more like inertia.

Calm for Now… But Edges Are Fraying

The chart says "stable." The macro says "not for long."

IG credit has shown resilience throughout this cycle but that resilience may now be turning into complacency. With spreads hugging 52 bp and macro headwinds swirling, the asymmetric risk is skewing wider.

Spreads don’t need to blow out to reflect stress. But a reversion toward the 60–70 bp range wouldn’t require a recession just acknowledgement of a murky, politicized, inflation-laced environment.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap: September Cut Locked, But Terminal Drifts Higher as Markets React to Fed Tension and Trade Shocks

Cumulative Implied Easing (to Jan 2027): –135.5 bp

Terminal Rate (Jan 2027): 2.977%

September OIS Cut Probability: 96.8% | Implied Rate: 4.088%

The September rate cut is now nearly a lock, with 96.8% probability priced and a full 34.2 bp of easing implied for the meeting. But the market’s longer-term outlook subtly shifted: the terminal rate edged higher to 2.977%, and cumulative cuts through January 2027 expanded modestly to –135.5 bp.

It’s a small move in notional terms, but a telling one in tone. Traders are acknowledging the political tightrope the Fed now walks between a weakening economy and a politicized policy environment, between sticky inflation and fading institutional independence.

OIS-Implied Policy Path

Macro Overlay: Cuts in Motion, But the Environment Is Shifting Fast

Markets remain committed to the easing narrative but the composition of that easing is evolving. The September cut is locked, December looks live, and five full cuts are still priced over the next 12 months. But the Fed’s credibility and flexibility are increasingly under strain:

Fed Politics Intensify: Trump is poised to nominate a short-term governor to replace Kugler likely someone already vetted and willing to toe the line. Names floated for Powell’s replacement include Kevin Warsh and Kevin Hassett. This politicization could un-anchor the long end if markets perceive the Fed as an instrument of the White House.

Tariff Acceleration: Trump confirmed new pharma and semiconductor tariffs are coming, and India will face “very substantial” hikes imminently. The average tariff rate will exceed 15%, with secondary sanctions on Russian oil buyers now on the table. This will hit supply chains, input costs, and inflation metrics.

Stalling Services, Sticky Prices: The ISM Services Index barely held above contraction, and employment within services continues to decline. Yet prices paid just hit the highest level since October 2022, painting a stagflation-like scenario that muddies the Fed’s mandate.

From Glidepath to Guesswork

The rate path isn’t just a reflection of economic data it’s now entangled in a credibility tug-of-war. The September cut is a done deal. But after that, it’s less a glidepath and more a minefield.

The terminal rate slipping below 3% remains the signal. But if politics dictate appointments and tariffs push inflation metrics higher, the Fed’s room to maneuver narrows considerably.

The market is still pricing a regime shift. But the path is no longer clean. It’s conditional, noisy, and increasingly political.

Tactical Portfolio

Morning Trade(s) and Market thread

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.