Macro Regime Tracker: The Macro Play

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I want to share several words related to the macro regime to explain WHERE we are:

This period of time is NOT normal. As I laid out yesterday, we are seeing a collocation of forces increasing liquidity in the system.

Don’t confuse a positioning unwind with a macro inflection point. We remain ABOVE the FOMC level and could easily have a marginal pullback before another leg higher. My bias continues to be to the upside though.

We have see the DXY rally since FOMC driven by monetary policy differentials.

If you are trying to understand the drivers of the dollar here, see this report:

MAINTAIN RISK MANAGEMENT AND CLARITY OF THOUGHT.

All of the models and strategies are updated below.

Main Developments In Macro

US Macro & Fed Policy

FED GOVERNOR STEPHEN MIRAN SPEAKS AT EVENT IN NEW YORK

MIRAN: FED MANDATES LESS IN TENSION THAN SOME COLLEAGUES THINK

MIRAN: FED POLICY IS MORE RESTRICTIVE AS NEUTRAL RATE CAME DOWN

MIRAN: MY BEST ATTEMPT AT REAL NEUTRAL RATE ESTIMATE IS 0.5%

MIRAN: NEED TO BE HUMBLE ABOUT ESTIMATES OF NEUTRAL RATE

MIRAN: I’M MORE SANGUINE ON INFLATION OUTLOOK THAN MANY OTHERS

MIRAN: ADDITIONAL RESTRICTIVENESS POSES RISK GOING FORWARD

MIRAN: MONETARY POLICY INSULATION FROM S/T POLITICS IS CRITICAL

MIRAN: PRIVATE DATA AREN’T SUFFICIENT REPLACEMENT FOR GOVT DATA

MIRAN: REMAIN OPTIMISTIC WE’LL HAVE DATA BY OCTOBER FED MEETING

MIRAN: US GOVERNMENT DATA ARE GOLD STANDARD AROUND THE WORLD

MIRAN: DECLINING RESPONSE RATES HAVE BEEN SIGNIFICANT PROBLEM

MIRAN: TARIFF INFLATION MAY BE YET TO COME BUT HAVEN’T SEEN YET

MIRAN: I THINK A LOT OF THAT UNCERTAINTY HAS RESOLVED

MIRAN: FED’S MIRAN DOESN’T EXPECT CAPITAL FLOWS TO US TO DECLINE

MIRAN: MY VIEW IS MONETARY POLICY SHOULD BE FORWARD-LOOKING

FED’S MIRAN: UNCERTAINTY WEIGHED ON ECONOMY IN H1 2025

MINNEAPOLIS FED PRESIDENT NEEL KASHKARI COMMENTS IN Q&A

KASHKARI: FOMC COMMITTED TO DATA-BASED, NOT POLITICAL DECISIONS

KASHKARI: DRASTICALLY LOWERING RATES WOULD CAUSE BURST IN INFL.

FED’S KASHKARI SAYS DATA SENDING SOME STAGFLATION SIGNALS

ATLANTA FED PRESIDENT RAPHAEL BOSTIC SAYS IN MODERATED Q&A

BOSTIC: TURBULENCE LEADING FIRMS, HOUSEHOLDS TO BE CAUTIOUS

FED’S DALY CAUTIONS AGAINST THINKING ALL BUBBLES ARE FINL:AXIOS

DALY SEES MORE TECH `IN PLACE OF HIRING’ AS ECO SLOWS: AXIOS

DALY: NOT SEEING EVIDENCE OF MASS JOB REPLACEMENT BY AI: AXIOS

NY FED: HOUSEHOLDS’ OUTLOOK FOR LABOR MARKET DETERIORATES

NY FED: MORE HOUSEHOLDS REPORT BEING BETTER OFF THAN YEAR AGO

NY FED: ONE-YEAR INFLATION EXPECTATIONS RISE TO 3.38% VS 3.2%

NY FED: 1Y CONSUMER INFLATION EXPECTATIONS IN SEPT 3.4% VS 3.2%

NY FED: 3Y CONSUMER INFLATION EXPECTATIONS UNCHANGED AT 3%

NY FED: 5Y CONSUMER INFLATION EXPECTATIONS IN SEPT 3% VS 2.9%

Global Macro Links / Trade / Tariffs

LEBLANC: DISCUSSED WAYS TO DEEPEN CANADA-US ENERGY PARTNERSHIP

LEBLANC: CANADA, US HOPE TO REACH DEAL ON STEEL, ALUMINUM

LEBLANC: US, CANADA HOPE TO REACH SECTORAL TARIFF DEAL QUICKLY

TRUMP ON TRADE DEAL: I THINK CANADIANS WILL LOVE US AGAIN

TRUMP: WE WILL HAVE TARIFFS BETWEEN CANADA AND US

TRUMP: WANT TO MAKE OUR CARS HERE, WANT CANADA TO DO WELL

TRUMP: ON USMCA: WE CAN RENEGOTIATE IT OR DO DIFFERENT DEALS

TRUMP: WILL MEET XI IN A FEW WEEKS IN SOUTH KOREA

WTO SAYS ‘FULL IMPACT’ OF TRUMP TARIFFS MAY HIT NEXT YEAR

WTO: GOODS TRADE GROWTH SEEN AT 2.4% THIS YR, 0.5% IN 2026

SEFCOVIC: WILL DISCUSS STEEL RINGFENCING, DERIVATES WITH US

EU PROPOSES TO LIMIT TARIFF-FREE STEEL IMPORTS: SEJOURNE

Europe/ECB – Relevant for US Macro Context

ECB’S LAGARDE SAYS EU INSTITUTIONS WATCHING FRANCE SITUATION

LAGARDE: EU INSTITUTIONS HOPE FRANCE FINDS PATH TO BUDGET

EU TRADE COMMISSIONER MAROS SEFCOVIC COMMENTS IN STRASBOURG

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

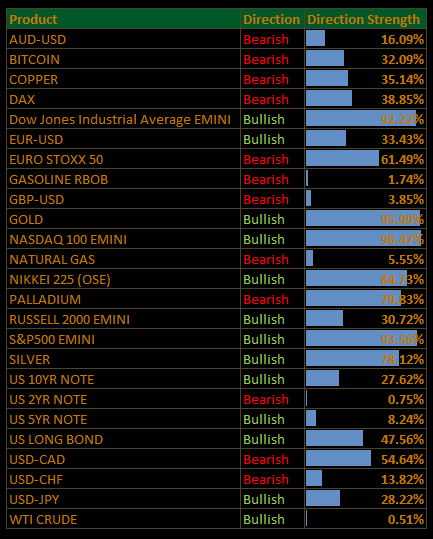

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

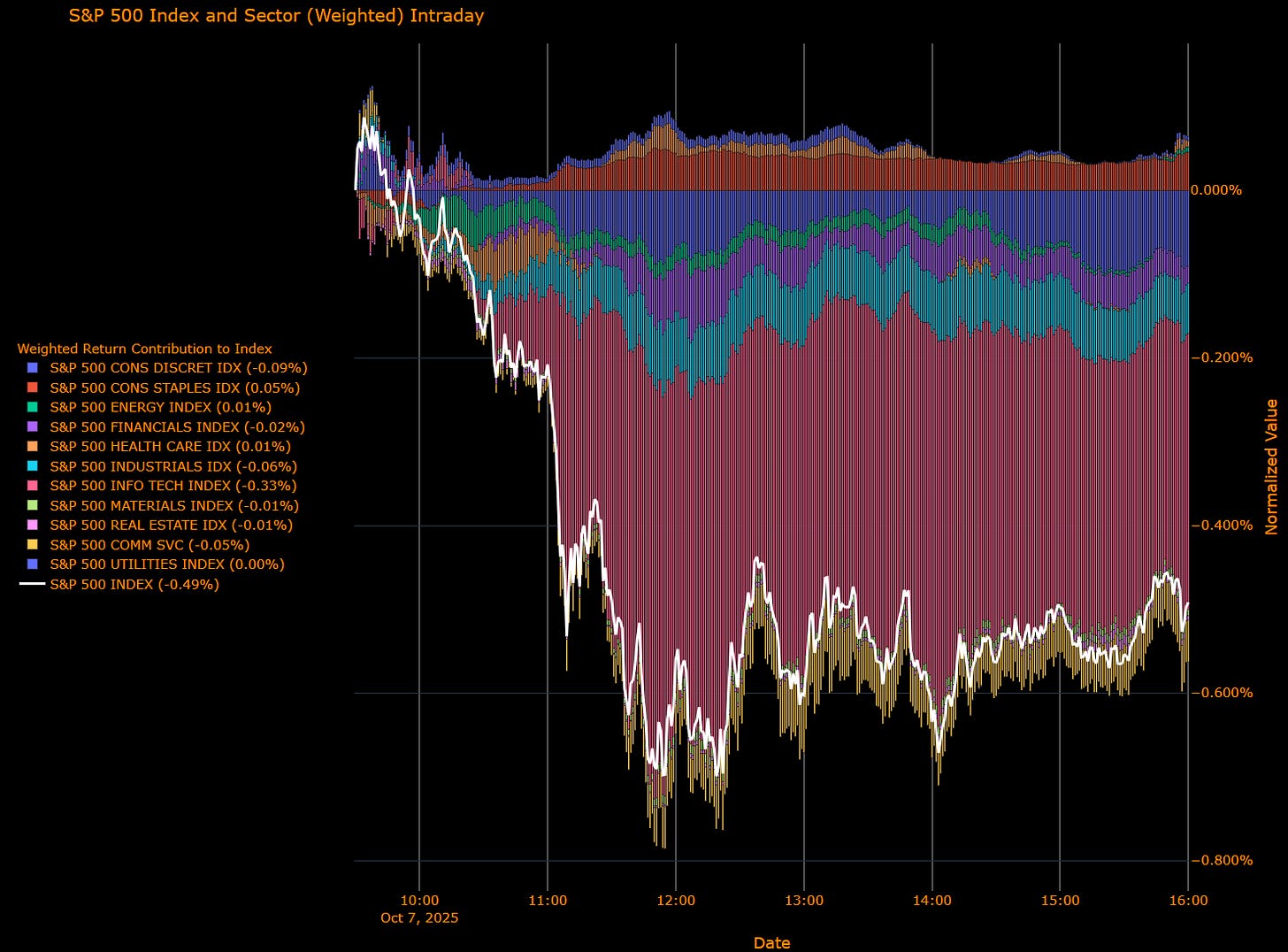

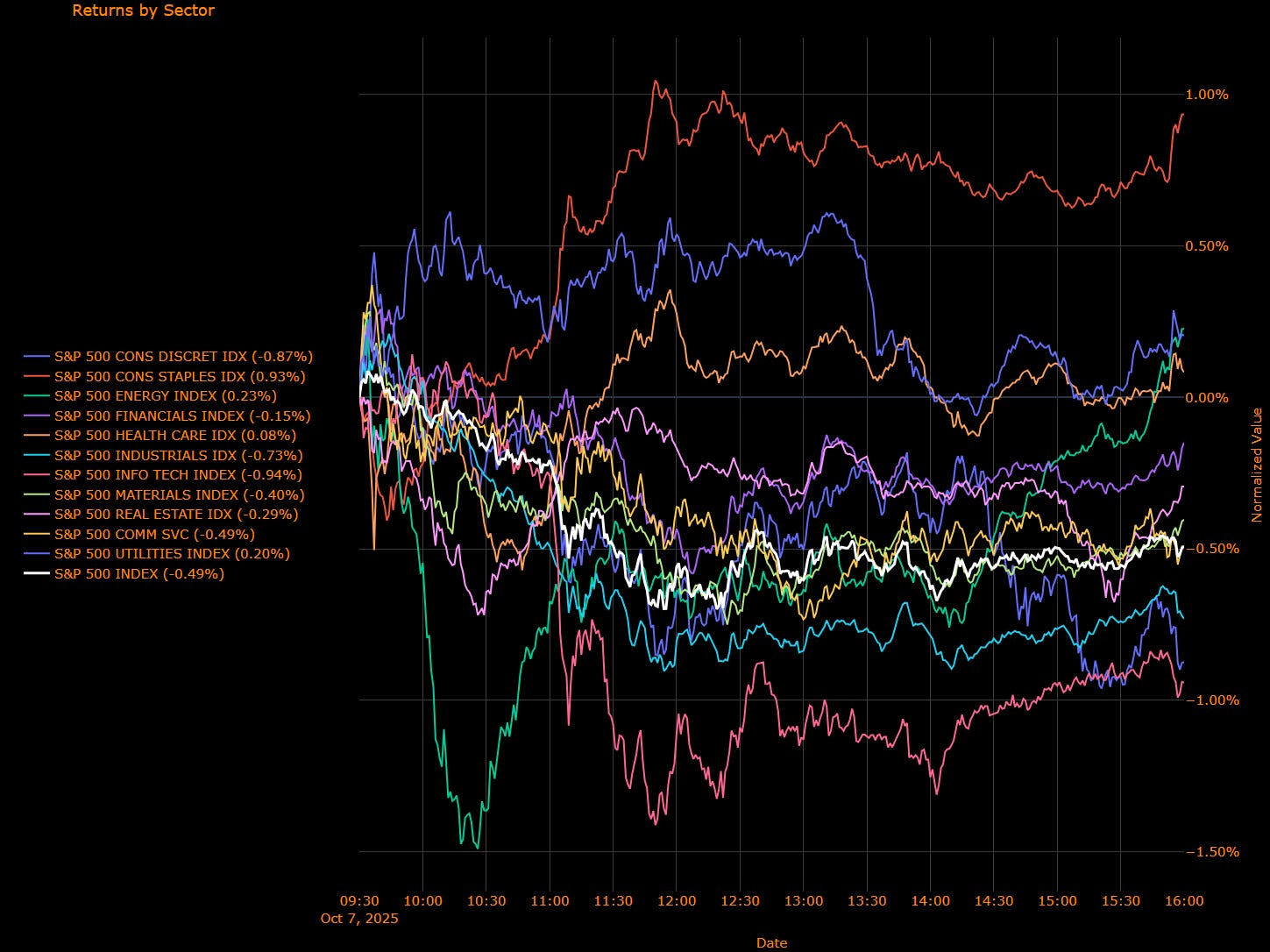

US Market Wrap: Tech and Discretionary Lead Pullback Amid Buyer Fatigue (S&P –0.49%)

After a relentless rally that added over $16 trillion in market cap since April, the S&P 500 finally took a breather (–0.49%), with mega-caps and tech leading the retreat. Oracle’s softer-than-expected cloud margins and Tesla’s price cuts triggered profit-taking across the AI complex, while investors digested a crowded sentiment backdrop and over-extended valuations. Bonds found a bid as a $58 billion 3-year Treasury auction cleared smoothly, nudging yields lower.

Sector Attribution

Weighted Return Contribution to Index

Leaders: Consumer Staples (+0.05%), Energy (+0.01%), Health Care (+0.01%)

Drags: Info Tech (–0.33%), Discretionary (–0.09%), Industrials (–0.06%), Comm Services (–0.05%)

Net: S&P 500 –0.49%

Sector Performance (Unweighted Breadth)

Winners: Consumer Staples (+0.93%), Utilities (+0.20%), Energy (+0.23%), Health Care (+0.08%)

Losers: Info Tech (–0.94%), Discretionary (–0.87%), Industrials (–0.73%), Materials (–0.40%), Comm Services (–0.49%)

Net: S&P 500 –0.49%

Macro Overlay

Exhaustion After Euphoria

The AI trade that’s powered this year’s melt-up finally paused with some “buyer fatigue” after a historic run. Oracle’s margin disappointment and Tesla’s price-cut headline sparked rotation out of high-multiple tech and into defensives and energy. Wall St client sentiment index remains at its most bullish since December, and another IB’s exuberance gauge still flirts with “manic” territory, a sign the pullback may be as much about positioning as macro.

Fed Tone and Rates

Yields drifted lower (10-yr 4.13%, –3 bp) as a solid Treasury auction offset hawkish comments from Minneapolis Fed’s Kashkari and a sanguine read from Governor Miran. Miran reiterated that tariffs pose limited inflation risk and that policy remains overly restrictive, implying scope for continued easing. Markets still price October as a live meeting for a 25 bp cut, but Fed messaging suggests incremental moves will stay data-dependent, especially given the risk of a government data blackout if the shutdown persists.

Macro Narrative Shift

The day marked a turn from euphoria to evaluation. Markets are starting to ask whether AI profitability timelines justify current multiples and how fragile sentiment has become after months of uninterrupted gains. Some Wall St firms flagged that a short, shallow pullback would be constructive if earnings momentum holds. In contrast, some warn that profit-taking risk has risen materially, especially in the Nasdaq.

Cross-Asset Moves

The dollar strengthened (+0.4%) as yen slid past 151.9 per dollar. Gold continued toward $4,000/oz (+0.5%), oil rose (+0.6%) to $62/bbl, and Bitcoin dropped (–2.6%). Credit and rates markets stayed orderly, signaling that this was a position-driven pause, not a risk-off rotation.

The Read-Through

The market’s excess is finally meeting resistance. Tech’s drag underscores how narrow the advance had become, a few AI heavyweights propped up indices while cyclicals and defensives lagged. This correction looks like a healthy reset within a broader bullish trend, provided yields stay contained and earnings deliver.

Takeaway: After a $16 trillion run, momentum finally blinked. Wider market nthusiasm remains high, but it needs proof that AI profits can justify valuation. The Fed’s measured tone offers support, yet positioning is crowded and breadth is thin, a setup for choppy consolidation rather than capitulation.

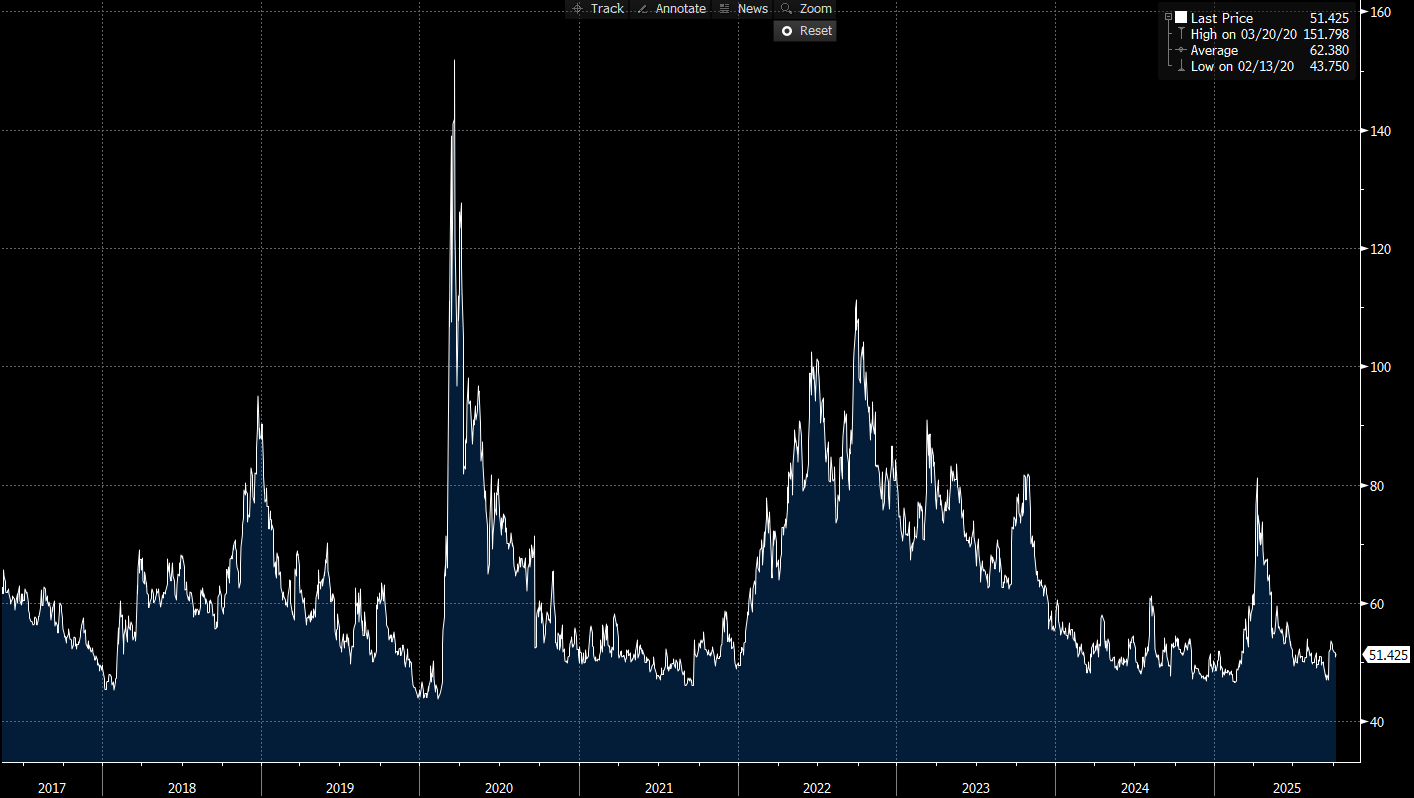

US IG Credit Wrap: Low-50s Hold as Equities Exhale; Bid for Duration Returns (IG OAS ~51.4 bp)

IG spreads stayed inside the carry channel despite a tech-led equity pullback and a firmer dollar. A well-received $58bn 3-year auction helped nudge UST yields lower, cushioning credit beta. Bloomberg US IG OAS sits ~51.4 bp (chart last: 51.425), basically unchanged to a touch wider vs yesterday.

Where we sit (from the chart)

IG OAS: ~51.4 bp

5-yr avg: ~62.4 bp → ~11 bp inside

Cycle tights: 43.8 bp → ~7–8 bp off

Pandemic wides: 151.8 bp → ~100 bp tighter

(Chart stats: Last 51.425 | High 151.798 on 03/20/20 | Avg 62.380 | Low 43.750 on 02/13/20.)

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro

Equities: Momentum pause after a $16T run; mega-cap/AI complex led the drag as Oracle margin chatter and Tesla price cuts hit sentiment.

Rates: UST 10y ~4.13% (–3 bp) as the 3-yr auction cleared cleanly; curve stable.

USD/Commods/Crypto: Dollar firmer; gold +0.5% toward $4,000/oz; WTI ~+$0.6; Bitcoin lower.

Fed tone: Gov. Miran sees limited tariff pass-through and room to keep easing; Kashkari warns against drastic cuts—net read = measured, data-dependent easing path with shutdown-driven data gaps still a risk.

How this maps to credit

Carry over convexity: Low-50s OAS keeps the asset class in “clip-the-coupon” mode; the small equity wobble wasn’t enough to force spread beta wider.

Rates cushion: A mild rally in duration offsets equity softness—supportive for long-duration A/AA demand.

Quality skew / dispersion: Index stability masks idiosyncratic spread moves; high-beta BBB cyclicals remain most sensitive if profit-taking extends or if reals back up.

Correlation check: Stronger USD + softer tech normally lean wider, but auction strength and still-benign macro kept IG pinned.

The read-through

Base case remains a sideways grind in the low-50s: equities consolidate, rates contained, and policy guidance steady. Without a clear macro break (labor crack vs. inflation re-accel), IG is carry-led with selective dispersion.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Capital Flows Interest Rate Sensitivity Model:

All of the interest rate sensitivity models are now reserved exclusively for paid subscribers. If you would like to do a free trial, you can with this LINK.

Launch video for these models is here: LINK

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.