Macro Regime Tracker: The next stage of the cycle

Macro regime and risk assets qualified clearly

Macro Regime Tracker:

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning and cross-asset data, it identifies macro changes and their impact on market positioning.

The launch video for the Macro Regime Tracker is here: Link

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth and Inflation Regime Tracker

Fixed Income and Credit Model

Equity Sector Model

Machine Learning Strategies and Models

Macro Regime Context:

I believe we are approaching an inflection point in both risk assets and rates. What TYPE of inflection point? I think it’s one where the Fed is actually going to be constrained to take significant action.

Why is this? When we entered this year, the Fed had the stance that they would pause and wait for developments in underlying growth and inflation data. The problem with this is that in a dynamic system, inaction can be just as costly as action. In a storm at sea, failing to adjust the sails is as dangerous as steering in the wrong direction.

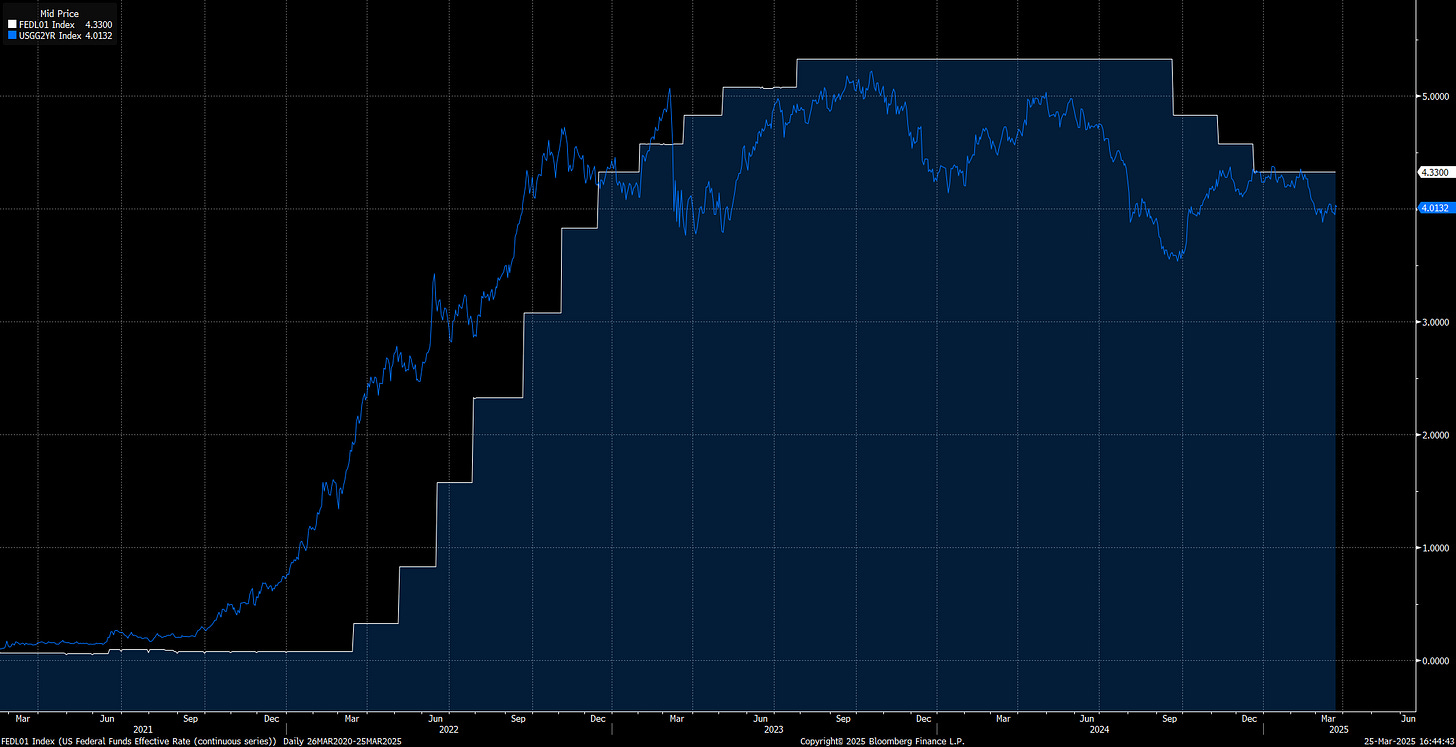

The chart below shows the Fed Funds rate and the 2-year pricing the forward path. The Fed was able to pause in 2023 because real growth was incredibly elevated. 2024 was the year they let the market get way too aggressive and bear steepen even as they cut rates. We are going to retrospectively look at 2025 where they absolutely missed it.

My view is drastically different than what the market is pricing right now. Everyone is focused on tariffs and news, but in actuality the Peso continues to put up consecutive weeks of positive returns.

The structural thesis I laid out for Mexico remains. They are a massive opportunity over the next decade, and small speed bumps arent going to change the course.

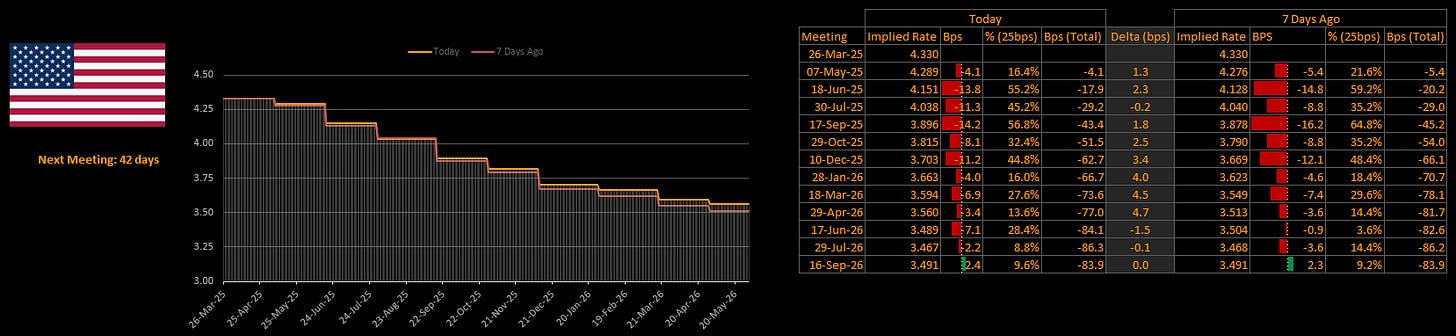

Right now, every PM is front-running April 2nd catalysts in equities because they think equities will rally into it. On top of this, we are operating in the tension between the Z5 and Z6 SOFR contract risk reward I noted in the recent article (link).

So what does this all mean? It means we are in a short-term tension with the forward curve, and equities are likely to rally marginally into the April 2nd news but the bigger question will be if this sets a lower high in equities and we have another leg down as the forward curve prices MORE cuts.

One of the most important relationships I am watching in this context is the low quality financial sector of the Russell (white). The index below takes all of the lowest quality financial stocks in the Russell and aggregates them together. Overlayed (in green and red) is the 3m2y spread, which represents HOW AGGRESSIVELY the forward curve is pricing cuts.

As I laid out in the report on banking (link) if the highest risk banks are rallying, it means the spigot is turned on for credit. If this is true and the Fed tries to cut, then we’re in for a ton of inflationary risk. Inversely, if the rotation out of US financials continues and rotations into foreign equities persist, then there’s a reasonable amount of downside for equities and more cuts to be priced in 2026.

The important point of knowing the scenario analysis is that we are currently compressing the macro factors for one of these tails to take place. Once it does, the next leg up in volatility will ensue. See the logic in the video I laid out here:

Main Developments In Macro Today:

*BOJ MEMBER: THERE IS RISK PRICE EXPECTATIONS MAY EXCEED 2%

*TRUMP CONSIDERS TWO-STEP TARIFF REGIME ON APRIL 2: FT

*TRUMP: MEXICO, CANADA HAVE STEPPED IT UP A LOT

*TRUMP ON APRIL 2 TARIFFS: I HAVE THEM SET

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth and Inflation Regime Tracker:

The Macro Regime Model first provides a real-time view of growth and inflation dynamics, then directly connects these insights to upcoming catalysts and the statistical measures that gauge their impact on asset prices.

(If you are new and would like to do a free trial to review the full macro regime tracker with the connected ES strategy, a link to a free trial is available here: Link).

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.