Macro Regime Tracker: The Positioning Squeeze

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I want to provide a short summary of all the videos I have recorded over the last couple of days and then explain HOW they tie together.

Most recent video explaining positioning in the dollar (connected reports LINK):

How the error by central banks fits into the macro regime (connected reports LINK)

How everything is truly becoming one trade leveraged to interest rates:

How the current credit cycle is causing a melt-up and WHY it sows the seed for an eventual crash (connected report LINK)

I want to be clear about several things:

First, it is clear that we are still in a melt-up phase of equity markets. I believe ES and BTC remain skewed to the upside on a cyclical basis.

Second, I laid out my view for interest rates here in the report: (link). We continue to see confirmation, and I am providing updates in the chat respectively as things shift:

Third, I believe we are in the process of making a bottom in the dollar. However, this is highly dependent on the signals I have laid out. These are critical to understand when you are betting against momentum like this. See the initial breakdown I provided here: LINK

And then be sure to review the Monetary Fractures report here for the signals on the dollar: LINK

My goal in laying out all of the primers, in depth reports, and views is for them to build on each other. If it feels complicated, it is because markets are complicated. If a lot of these moving parts are new to you, I would strongly encourage you to review all of the models below to continually get a clear picture of WHAT is happening in markets because this sets a foundation for WHERE we are going.

Main Developments In Macro

Macro Policy & Fed Commentary

WARSH ON FED REFORMS: “Plenty of deadwood” at Federal Reserve

WARSH SAYS INTEREST RATES SHOULD BE LOWER

WARSH: SYMPATHY FOR TRUMP’S FRUSTRATION OVER FED POLICY

FORMER FED OFFICIAL WARSH: TARIFFS ARE NOT INFLATIONARY

GOLDMAN SACHS SEES TERMINAL RATE 3–3.25%, WAS 3.5–3.75%

GOLDMAN: EARLY FED CUT POSSIBLE ON TARIFF IMPACT, DISINFLATION

GOLDMAN: FED MAY CUT POLICY RATE IN SEPTEMBER

POWELL’S RATE HOLD IS INFLICTING SERIOUS DAMAGE: NAVARRO

NAVARRO: POWELL IS CAUSING LOST REVENUE, HIGHER INTEREST COSTS

BESSENT: MARKETS MAY BE PRICING IN TRUMP’S VIEW ON RATES

BESSENT: US WILL HAVE GROWTH WITHOUT INFLATION

US Tariff Announcements & Trade Policy

TRUMP TO IMPOSE TARIFFS ON:

Thailand (36%), Cambodia (36%), Bosnia (30%)

Indonesia (32%), Tunisia (25%), Myanmar (40%)

Laos (40%), South Africa (30%), Kazakhstan (25%)

Malaysia (25%), Japan and South Korea (25%) each

TRUMP: ANY COUNTRY ALIGNING WITH BRICS TO FACE ADDED 10% TARIFF

TRUMP: WILL ANNOUNCE TRADE DEALS STARTING 12PM JULY 7

TRUMP: MOST TRADE DEALS/LETTERS TO BE DONE BY JULY 9

TRUMP: TARIFF LETTERS DELIVERED STARTING 12:00 P.M. JULY 7

TRUMP: IF JAPAN RAISES TARIFFS, THEY’LL BE ADDED TO 25% LEVY

TRUMP’S THREATS SHOW BRICS IS NEEDED: LULA ADVISER

EU STILL WORKING TOWARDS JULY 9 DEADLINE FOR US TRADE DEAL

EU SPOKESMAN: PROGRESS IN TALKS WITH US ON TRADE DEAL

EU: NO LETTER RECEIVED FROM US ON HIGHER TARIFFS YET

TRUMP, VON DER LEYEN SPOKE BY PHONE ON SUNDAY

BESSENT: SEVERAL TRADE ANNOUNCEMENTS IN NEXT 48 HOURS

Global Response & Alignment Implications

CHINA: REPEATS THERE IS NO WINNER IN A TARIFF WAR

CHINA FX FIXING: PBOC SURVEY SUGGESTS FOCUS ON DOLLAR WEAKNESS

SINGAPORE, MALAYSIA, THAILAND IN US AI CHIP CURBS SPOTLIGHT

ISRAEL, US MULL 60-DAY TRUCE IN GAZA; TRUMP: “WE COULD HAVE DEAL”

ZELENSKIY AGREES TO WORK WITH TRUMP ON BOOSTING AIR DEFENSE

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

S&P 500 Falls 0.50% as Tariff Shock Halts Rally, Cyclicals and Megacaps Drag

The S&P 500 declined 0.50% on Monday as renewed trade war fears triggered a broad selloff, particularly across megacaps, financials, and rate-sensitive sectors. President Trump’s aggressive tariff schedule including 25%–40% levies on imports from Japan, Korea, and other key partners reignited risk aversion, while a rising dollar and steepening Treasury curve reinforced pressure. Despite recent gains, the move marked a notable break in momentum as investors repriced inflation and growth risks ahead of key CPI data.

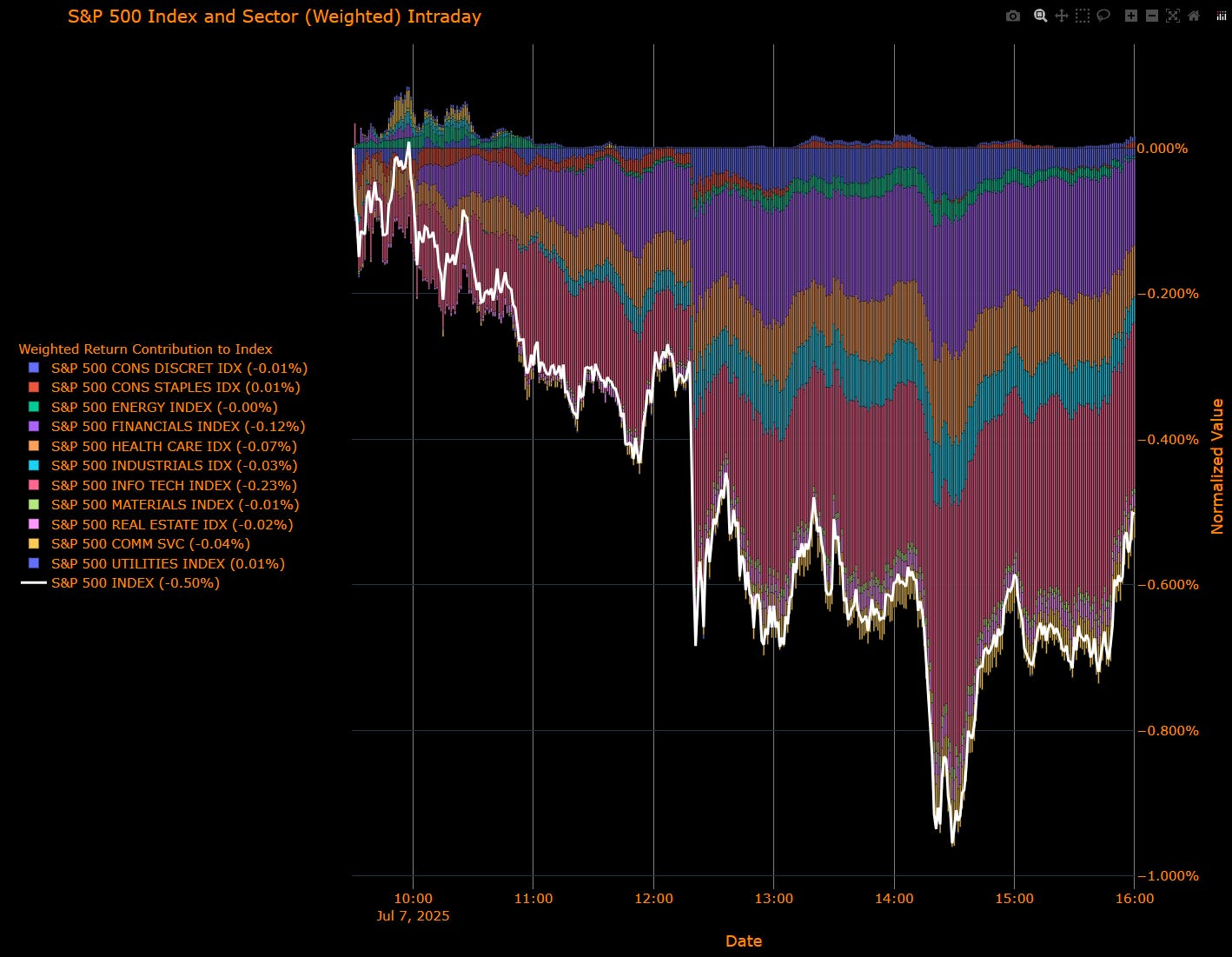

Sector Contribution Breakdown (Weighted Return to Index)

Information Technology (–0.23 pp) – Largest drag as megacaps led the downside; semis and platform names slumped on margin compression fears and overseas exposure.

Financials (–0.12 pp) – Yield curve steepening failed to help banks as risk sentiment soured and credit tightening fears returned.

Health Care (–0.07 pp) – Continued unwind in ACA-related beneficiaries; defensive demand failed to materialize.

Communication Services (–0.04 pp) – Platform consolidation paused; ad tech and media stocks underperformed.

Industrials (–0.03 pp), Real Estate (–0.02 pp), Materials (–0.01 pp) – Cyclicals hit on trade concerns and global growth risks.

Energy / Discretionary / Staples (–0.00 to +0.01 pp) – Mixed; crude held firm but failed to lift energy names meaningfully.

Utilities (+0.01 pp) – Only marginal support from defensives; rate headwinds limited upside.

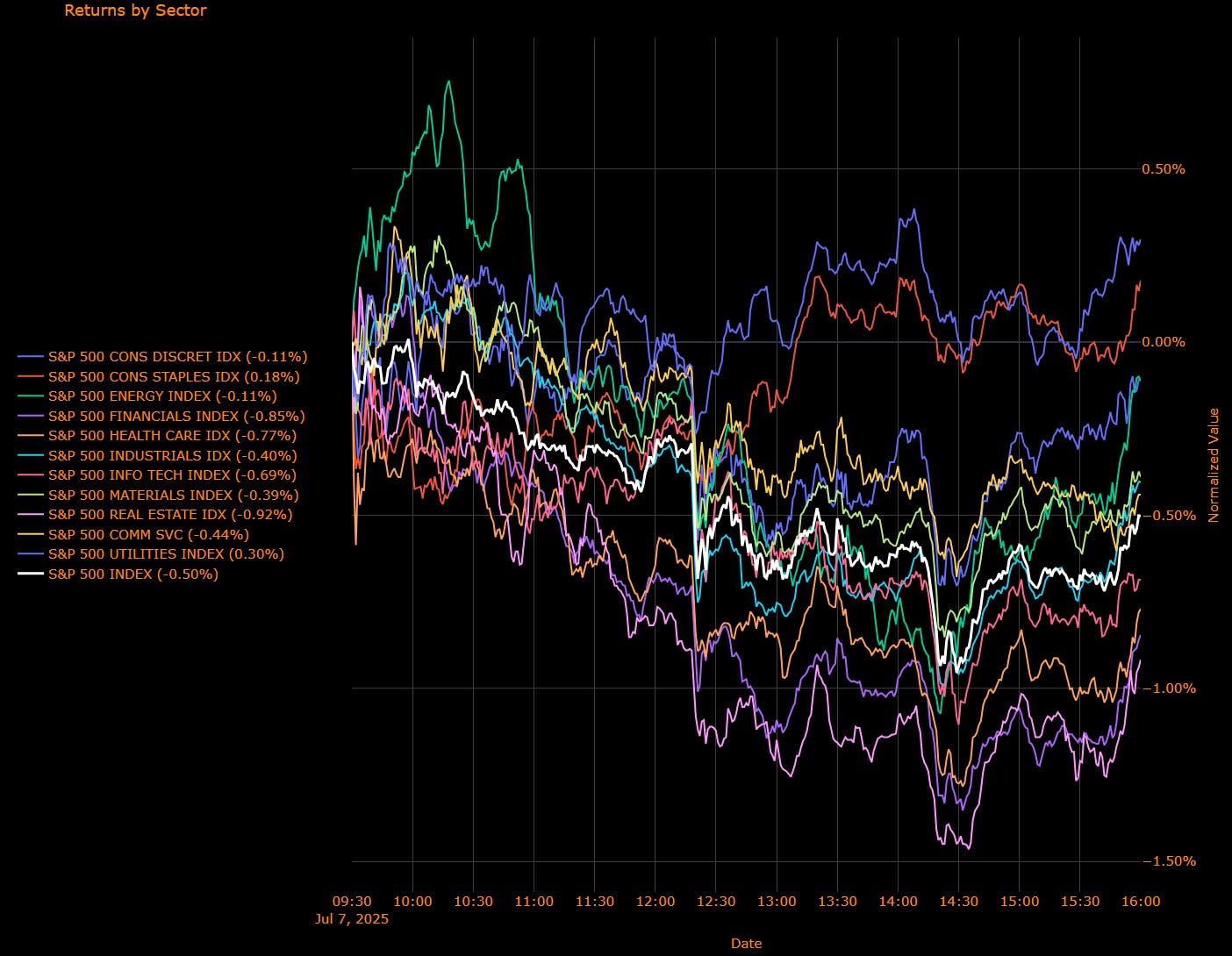

Sector Performance Breakdown (Unweighted Index Returns)

Real Estate (–0.92%) – Worst performer as yields jumped and tariff jitters fed into cap rate concerns.

Financials (–0.85%), Health Care (–0.77%), Tech (–0.69%) – Broad-based megacap and duration-sensitive unwind.

Communication Services (–0.44%), Industrials (–0.40%), Materials (–0.39%) – Cyclical drawdown led by trade exposure.

Consumer Discretionary (–0.11%), Energy (–0.11%) – Minor relative outperformers despite growth scare.

Consumer Staples (+0.18%), Utilities (+0.30%) – Only sectors higher; defensive bid emerged late as volatility spiked.

Macro Overlay: Trade Tensions Snap Risk-On, Fed Expectations Reset

Tariff Reprisal Unleashed

Trump unveiled sweeping new tariffs set for August 1 across a wide range of trade partners, including 25% on Japan and Korea, 30%–40% on BRICS-aligned countries, and a threat of an additional 10% on BRICS affiliates. The dollar rallied sharply, EM FX sold off, and equity leadership reversed — particularly in globally exposed names.Markets Reprice Fed, Inflation, Growth

Treasury yields bear-steepened with the 10y yield up to 4.39%. Traders now price inflation risks higher, while September remains the likely start of Fed easing — though any signs of tariff pass-through into CPI could alter that.Risk Sentiment Breaks, But Not Capitulating Yet

The S&P 500 halted a record-breaking run, with participation notably weak. The Bloomberg Magnificent 7 Index dropped 1.4%, Tesla fell 7%, and ADRs from Japan/Korea tumbled. But credit spreads remain anchored, and no major volatility triggers fired — indicating a reprice, not panic.

Final Word: Tariff Uncertainty Snaps Momentum, Inflation Now Key

The market has transitioned into a tactically cautious phase: risk assets are no longer in melt-up mode, but the underlying growth narrative isn’t dead either. With Trump’s tariff clock restarted and July CPI due July 15. Until then, volatility may rise, participation will remain narrow, and defensives could start to outperform cyclicals if yields stay firm.

US IG Credit Wrap — Spreads Drift to 50.89 bp as Tariff Turbulence Caps Conviction

Current Spread: 50.89 bp | 5-Year Average: 64.77 bp

Investment-grade credit spreads ticked wider Friday to 50.89 bp, snapping a three-day tightening streak as tariff jitters re-entered the narrative and long-end Treasuries came under renewed pressure. While carry remains attractive and rate volatility contained, Trump’s sweeping August tariff slate introduced a macro overhang that kept investors defensive into the weekend. Spreads remain anchored near post-COVID lows, but with conviction softening, risk appetite is increasingly selective.

Credit Context

< 60 bp: Duration-friendly, carry-positive zone for insurers, pensions, and liability-driven buyers.

60–70 bp: Macro noise threshold, where volatility or inflation threats prompt positioning cuts.

> 90 bp: Systemic stress unlikely unless global macro or geopolitical shocks return.

Macro Overlay: Trade Surprises, Fed Patience, and a Shift in Tone

1. Trump Unveils Sweeping Tariff Schedule, Rattles Global Risk

President Trump began issuing formal tariff notices to over a dozen nations, with duties ranging from 25% to 40% on imports from Japan, Korea, South Africa, and others. The levies take effect August 1, and an additional 10% surcharge threatens BRICS-aligned nations.

Credit took note of the uncertainty window: implementation lag buys time, but positioning turned cautious.

2. Risk-Off Undercurrents Emerge in Rates and FX

Long-end Treasuries underperformed as term premium widened amid tariff-driven inflation concerns. The 10-year yield rose 4 bp to 4.39%, while the dollar strengthened broadly — with the yen, won, and rand all falling >1%.

Risk metrics like EMFX and vol-of-vol rose modestly — IG investors leaned into quality and stayed light on peripherals.

3. Powell’s Patience Reinforced, Even as Warsh Joins Critics

Chair Powell reiterated the “wait-and-see” stance on rates, warning that tariff effects on inflation are still to come. Meanwhile, former Fed governor Kevin Warsh criticized the current FOMC, calling for “regime change” and claiming rates are too high.

Market pricing: July cut odds flat near 0%, September still ~70%. But confidence in the Fed’s internal cohesion may be slipping.

4. Credit Steady, but Not Immune

Despite the widening, IG spreads are still 14 bp inside the 5-year average. Friday’s move reflects more a pause in momentum than broad de-risking. High-grade buyers remain duration-neutral, focused on carry and liquidity, not tactical compression.

Final Word: Stable But Shaken

At 50.89 bp, spreads remain anchored in a historically favorable zone — but the Trump tariff salvo has clearly introduced an element of uncertainty that markets can’t fade. With the July 9 deadline approaching, headline risk is back in play.

Mag7 Model:

See the intro published for how to use the Mag7 models here: Link

Short-End Rates Wrap… Easing Path Holds at –118.6 bp Despite Tariff Jitters, Market Clings to Lower-for-Longer Bias

Markets continued to cling to a dovish glidepath even as geopolitical risks resurfaced, with cumulative cuts through December 2026 now totaling –118.6 basis points, a slight moderation from the post-payrolls high of –120.7 bp. The shift reflects reduced conviction in back-end cuts rather than a change to the broader easing thesis. September remains the expected pivot point, with July fully priced out and terminal expectations hovering just above 3.10%.

OIS-Implied Easing Path

Front-End Meetings

08-Jul-25: 4.330% → No cut risk

30-Jul-25: 4.318% (–1.2 bp) → ~5% probability → July risk completely priced out

17-Sep-25: 4.157% (–16.1 bp) → ~64% cut probability → Still base case

29-Oct-25: 4.008% (–14.9 bp) → ~60% probability → Path moderates post-September

2025 Year-End Outlook

10-Dec-25: 3.825% → –50.5 bp total easing → Two cuts priced firmly

Full Cycle Trajectory

09-Dec-26: 3.144% → –118.6 bp → Lower terminal remains intact, but back-end compression slows

Macro Overlay: Tariffs, Labor, and the Fed's Calculus

1. Tariff Risk Back in Focus, but Not Yet in the Curve

President Trump’s tariff barrage targeting over a dozen countries with duties of 25–40% triggered risk-off flows, dollar strength, and curve steepening. However, because implementation starts August 1 and most nations are still negotiating, markets are treating this as a headline, not a base case for inflation re-acceleration.

Markets remain cautious but unconvinced tariffs will derail the cut path.

2. Labor Market Remains Decently Soft Below the Surface

While June NFP (+147k) surprised to the upside, internals remain fragile:

Private hiring was +74k → weakest since Oct

Participation fell to 62.4% → second monthly drop

Wage growth slowed to +0.2% m/m

Workweek slipped to 34.2 hours

→ Supports the view that the labor market is resilient but cooling. The Fed has no reason to rush, but no reason to hold indefinitely either.

3. Powell Sticks to the Script, Warsh Enters the Fray

Chair Powell reiterated data dependence and stressed uncertainty over the inflation pass-through from tariffs. Former Fed official Kevin Warsh, in contrast, blasted the Fed’s stance, calling for lower rates and criticizing institutional “deadwood.”

The Fed isn’t in a hurry, but political pressure is rising especially as tariffs add fiscal uncertainty.

Final Word: Still a Soft Bias, but Terminal Slippage Slows

At –118.6 bp, the easing cycle remains historic in scale, but the pace of repricing is slowing. The market has now settled on a September cut as the anchor, with softening inflation, deteriorating labor quality, and geopolitical volatility all offering cover. What’s clear is this: without a clear inflation shock, the Fed has permission to drift and markets are pricing exactly that.

Tactical Portfolio

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.